Decoding The KLSE Screener Chart: A Complete Information For Malaysian Traders

By admin / September 25, 2024 / No Comments / 2025

Decoding the KLSE Screener Chart: A Complete Information for Malaysian Traders

Associated Articles: Decoding the KLSE Screener Chart: A Complete Information for Malaysian Traders

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the KLSE Screener Chart: A Complete Information for Malaysian Traders. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the KLSE Screener Chart: A Complete Information for Malaysian Traders

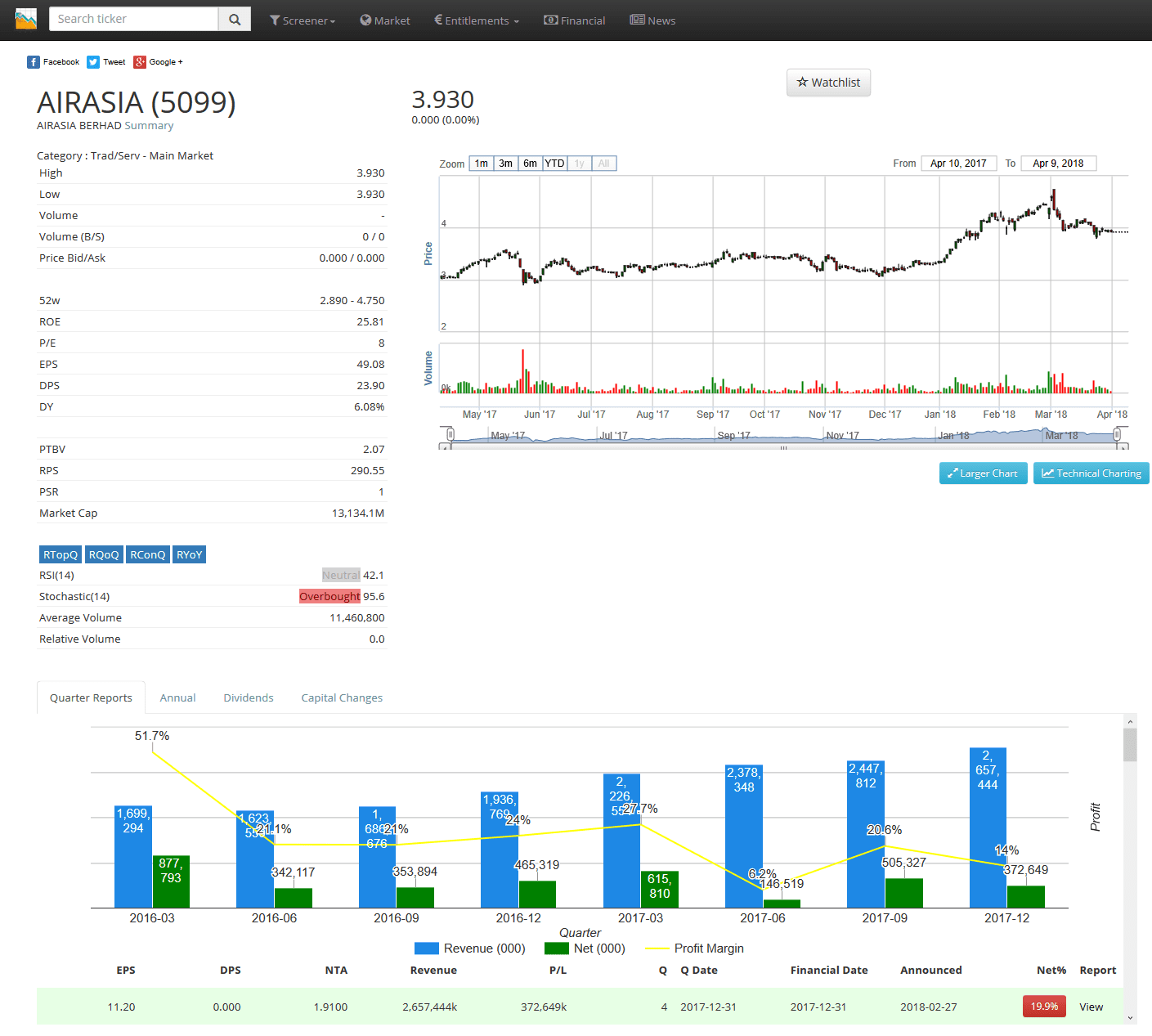

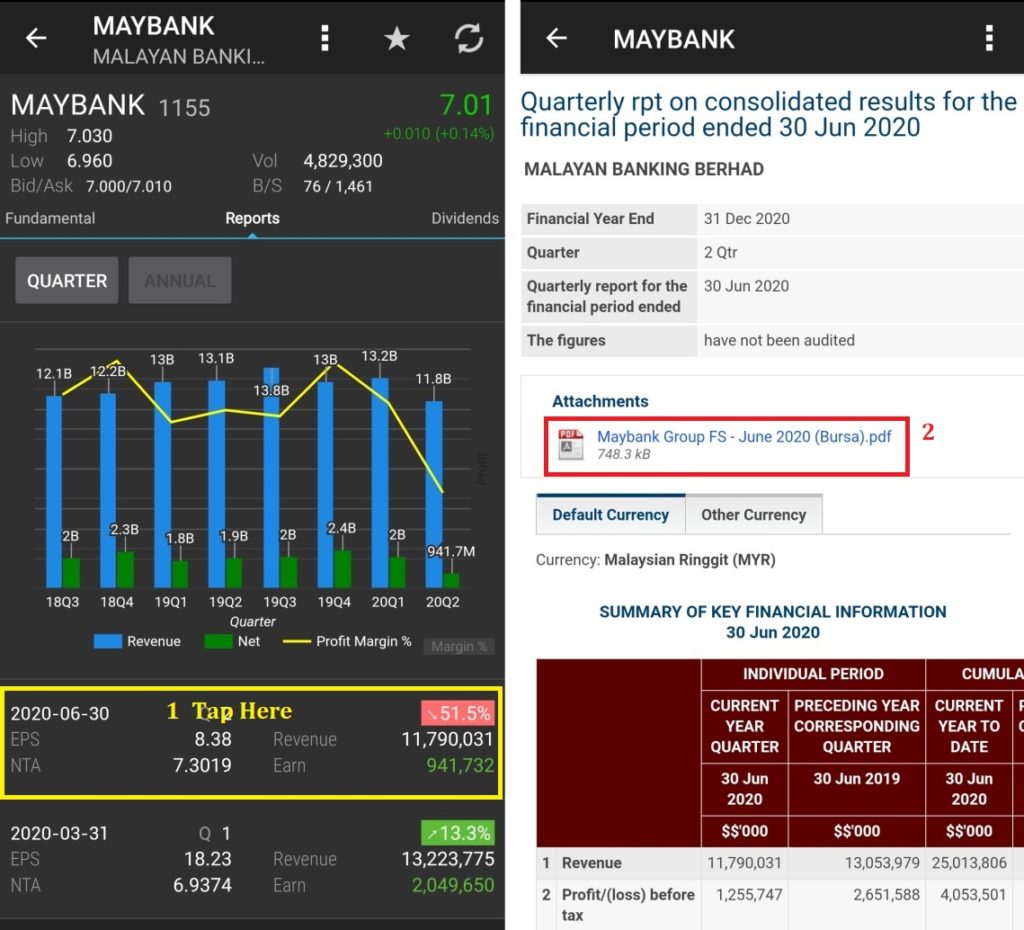

The Kuala Lumpur Inventory Change (KLSE), now often known as Bursa Malaysia, affords a dynamic and numerous funding panorama. For buyers navigating this market, efficient screening instruments are essential for figuring out potential funding alternatives that align with their particular person methods and danger tolerance. The KLSE screener chart, a robust analytical device, gives a visible illustration of quite a few inventory parameters, permitting buyers to rapidly filter and examine firms based mostly on their efficiency and traits. This text delves into the intricacies of the KLSE screener chart, explaining its functionalities, key parameters, and tips on how to successfully put it to use for knowledgeable funding choices.

Understanding the Fundamentals of the KLSE Screener Chart

The KLSE screener chart sometimes presents information in a tabular format, though some platforms could supply interactive graphical representations. The core perform is to permit customers to filter a big dataset of listed firms based mostly on pre-defined standards or custom-built parameters. This permits buyers to considerably cut back the variety of firms they should individually analyze, focusing their efforts on essentially the most promising candidates.

The chart itself normally shows a number of key metrics, various barely relying on the platform used. Nevertheless, widespread parameters embody:

- Inventory Title and Code: The fundamental identifier for every listed firm.

- Value: The present market value of the inventory.

- Change: The share change in value in comparison with the earlier buying and selling day.

- Quantity: The variety of shares traded in the course of the day.

- Market Capitalization: The whole worth of all excellent shares.

- Value-to-Earnings Ratio (P/E): A valuation metric indicating the market’s expectation of an organization’s future earnings.

- Value-to-Ebook Ratio (P/B): A valuation metric evaluating an organization’s market worth to its ebook worth.

- Dividend Yield: The annual dividend fee expressed as a proportion of the inventory value.

- Earnings Per Share (EPS): The portion of an organization’s revenue allotted to every excellent share.

- Return on Fairness (ROE): A measure of an organization’s profitability relative to its shareholders’ fairness.

- Beta: A measure of a inventory’s volatility relative to the general market.

Using the Screener Chart for Efficient Inventory Choice

The ability of the KLSE screener chart lies in its capacity to mix a number of standards to isolate particular funding alternatives. For instance, an investor looking for high-growth potential may filter for firms with:

- Excessive P/E ratios: Suggesting sturdy future earnings expectations.

- Excessive ROE: Indicating sturdy profitability and environment friendly use of capital.

- Excessive quantity: Suggesting important buying and selling exercise and liquidity.

Conversely, a price investor may concentrate on:

- Low P/E ratios: Suggesting undervalued firms.

- Low P/B ratios: Indicating that the market is undervaluing the corporate’s property.

- Excessive dividend yields: Offering a constant earnings stream.

Superior Screening Strategies:

Past the fundamental parameters, many KLSE screener platforms supply superior filtering choices, enabling extra refined evaluation:

- Trade Sector: Filter firms based mostly on their business classification (e.g., finance, know-how, shopper items). This permits buyers to concentrate on particular sectors they perceive or imagine have sturdy progress potential.

- Market Capitalization Vary: Filter by market cap to focus on firms of a particular dimension (e.g., large-cap, mid-cap, small-cap). This influences danger and potential return.

- Monetary Ratios: Make the most of a variety of monetary ratios past P/E and P/B, comparable to debt-to-equity ratio, present ratio, and gross revenue margin, to evaluate an organization’s monetary well being and stability.

- Technical Indicators: Some superior platforms combine technical indicators like shifting averages, RSI (Relative Power Index), and MACD (Transferring Common Convergence Divergence) straight into the screener. This permits buyers to mix basic and technical evaluation for a extra complete method.

- Customizable Alerts: Arrange alerts to inform you when a inventory meets particular standards, permitting you to react promptly to potential funding alternatives.

Decoding the Knowledge and Avoiding Widespread Pitfalls

Whereas the KLSE screener chart is a worthwhile device, it is essential to grasp its limitations and keep away from widespread pitfalls:

- Over-reliance on Screeners: The screener must be used as a place to begin, not the only real foundation for funding choices. Thorough basic evaluation, together with reviewing monetary statements, understanding the corporate’s enterprise mannequin, and assessing administration high quality, is crucial.

- Ignoring Qualitative Elements: Monetary information alone is inadequate. Take into account qualitative elements comparable to aggressive panorama, regulatory atmosphere, and administration competence.

- Knowledge Lag: The information displayed on the screener won’t be fully up-to-date, particularly for quickly altering market situations.

- Misinterpretation of Ratios: Understanding the context and limitations of monetary ratios is essential. A low P/E ratio does not routinely imply a inventory is undervalued; it may point out underlying issues.

- Backtesting Bias: Be cautious when backtesting methods utilizing historic screener information. Previous efficiency isn’t indicative of future outcomes.

Selecting the Proper KLSE Screener Platform:

A number of on-line brokerage platforms and monetary information suppliers supply KLSE screeners. When selecting a platform, take into account the next elements:

- Ease of Use: The platform must be intuitive and user-friendly.

- Knowledge Accuracy and Reliability: Guarantee the info is correct and up-to-date.

- Vary of Parameters: The platform ought to supply a variety of screening parameters to go well with numerous funding methods.

- Price: Take into account the subscription charges and any transaction prices related to the platform.

- Buyer Help: Dependable buyer assist is crucial when you encounter any issues.

Conclusion:

The KLSE screener chart is an indispensable device for Malaysian buyers looking for to effectively determine potential funding alternatives throughout the Bursa Malaysia market. By understanding its functionalities, using superior screening methods, and decoding the info fastidiously, buyers can considerably improve their funding course of. Nevertheless, it is essential to keep in mind that the screener is only one piece of the puzzle. A complete funding technique requires thorough due diligence, a balanced method combining basic and technical evaluation, and a transparent understanding of 1’s personal danger tolerance and funding targets. Utilizing the KLSE screener chart successfully, alongside different analytical instruments and sound funding ideas, can pave the way in which for profitable investing within the Malaysian inventory market.

![]()

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the KLSE Screener Chart: A Complete Information for Malaysian Traders. We admire your consideration to our article. See you in our subsequent article!