Chart Patterns Screeners: Your Free Information To Recognizing Market Alternatives

By admin / July 8, 2024 / No Comments / 2025

Chart Patterns Screeners: Your Free Information to Recognizing Market Alternatives

Associated Articles: Chart Patterns Screeners: Your Free Information to Recognizing Market Alternatives

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Patterns Screeners: Your Free Information to Recognizing Market Alternatives. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Chart Patterns Screeners: Your Free Information to Recognizing Market Alternatives

The inventory market can really feel like a chaotic sea of fluctuating costs, making it difficult for even seasoned buyers to navigate. Nonetheless, inside this obvious randomness, lie recurring patterns – chart patterns – that may provide useful insights into potential market actions. Figuring out these patterns manually is time-consuming and susceptible to human error. That is the place chart patterns screeners are available, providing a strong instrument to sift by way of huge quantities of information and pinpoint shares exhibiting particular formations, all with out breaking the financial institution. This text explores the world of free chart patterns screeners, their functionalities, limitations, and how one can successfully make the most of them to your funding technique.

Understanding Chart Patterns:

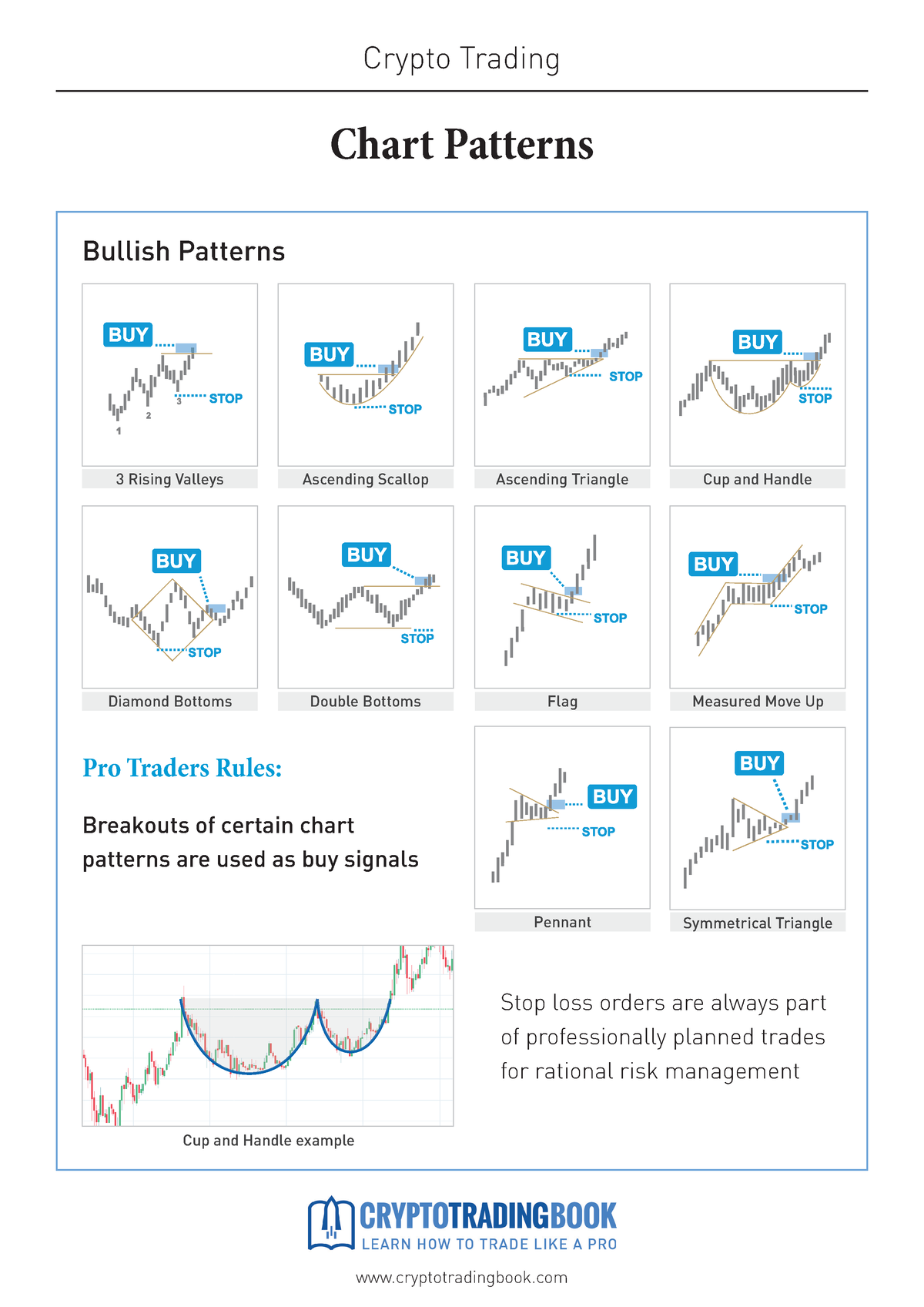

Earlier than diving into the world of screeners, it is essential to understand the basic ideas behind chart patterns. These patterns characterize visually identifiable formations on worth charts, usually indicating potential future worth actions. Frequent patterns embrace:

- Head and Shoulders: A bearish reversal sample suggesting a worth decline.

- Inverse Head and Shoulders: A bullish reversal sample signaling a worth improve.

- Triangles (Symmetrical, Ascending, Descending): Continuation patterns indicating a possible breakout within the route of the prevailing pattern.

- Flags and Pennants: Continuation patterns suggesting a short lived pause in a robust pattern.

- Double Tops and Double Bottoms: Reversal patterns indicating a possible change in route.

- Cup and Deal with: A bullish continuation sample.

- Wedges (Ascending and Descending): Point out a possible pattern reversal or continuation, relying on the sort.

These patterns are usually not foolproof predictors, and their accuracy is dependent upon varied components like quantity, market context, and general pattern. Nonetheless, they will considerably improve your buying and selling technique when used along side different technical indicators and elementary evaluation.

The Energy of Free Chart Patterns Screeners:

Manually figuring out chart patterns throughout quite a few shares is a tedious and impractical process. Free chart patterns screeners automate this course of, permitting you to:

- Display for particular patterns: Specify the precise chart sample you are on the lookout for, filtering out irrelevant information.

- Analyze a number of shares concurrently: Look at a whole bunch and even 1000’s of shares inside minutes, figuring out potential alternatives you would possibly in any other case miss.

- Set customized parameters: Refine your search primarily based on components like quantity, worth vary, timeframes (every day, weekly, month-to-month), and different related metrics.

- Backtest your methods: Some superior free screeners mean you can take a look at your chosen patterns towards historic information, evaluating their effectiveness earlier than implementing them in dwell buying and selling.

- Save time and sources: Free screeners remove the necessity for handbook chart evaluation, liberating up useful time for different features of your funding technique.

Discovering and Using Free Chart Patterns Screeners:

A number of platforms provide free chart patterns screening capabilities, albeit usually with limitations in comparison with their paid counterparts. These limitations would possibly embrace:

- Restricted variety of shares: Some free screeners would possibly limit the variety of shares you may analyze concurrently.

- Fewer sample recognition algorithms: Free variations might not determine as many chart patterns as paid companies.

- Restricted historic information: Entry to historic worth information may be restricted by way of timeframe or decision.

- Fundamental charting instruments: The charting capabilities may be much less subtle than these provided by premium platforms.

- Ads: Count on to come across commercials on free platforms.

Regardless of these limitations, free screeners can nonetheless be extremely useful for newcomers and people on a price range. Search for platforms that supply:

- Consumer-friendly interface: A clear and intuitive interface is essential for environment friendly navigation and evaluation.

- Customizable parameters: The power to tailor your search standards is important for exact outcomes.

- Dependable information sources: Make sure the platform makes use of respected sources for its worth and quantity information.

- Group help: Entry to boards or assist documentation may be invaluable when encountering points.

Examples of Free (or Fremium) Choices:

Whereas devoted free chart sample screeners are uncommon, many buying and selling platforms provide primary screening functionalities inside their free plans. These usually embrace:

- TradingView: Whereas primarily recognized for its superior charting instruments, TradingView provides some free options that enable for primary screening primarily based on indicators, which may not directly assist determine some chart patterns. You will want to mix indicators and handbook statement for extra complete sample identification.

- Finviz: Finviz provides a free inventory screener with varied technical indicators, which can be utilized along side handbook chart evaluation to determine potential chart patterns.

- Different Brokerage Platforms: Some on-line brokerage platforms provide primary screening instruments as a part of their free accounts, though the particular options fluctuate vastly relying on the dealer.

Vital Issues When Utilizing Free Screeners:

- Do not rely solely on screeners: Chart patterns are only one piece of the funding puzzle. All the time mix screener outcomes with elementary evaluation, threat administration methods, and different technical indicators.

- Perceive the constraints: Pay attention to the constraints of free screeners, resembling restricted information or performance.

- Confirm the outcomes: Manually confirm the recognized patterns on the precise charts to make sure accuracy. Screeners are instruments; human judgment stays essential.

- Backtest totally: If the screener permits backtesting, use it to judge the efficiency of your chosen patterns earlier than risking actual capital.

- Handle your expectations: No screener ensures income. Chart patterns are probabilistic, not deterministic, instruments.

Conclusion:

Free chart patterns screeners, regardless of their limitations, provide a strong and accessible entry level into the world of technical evaluation. By combining the insights gained from these instruments with sound funding rules and diligent analysis, you may considerably enhance your potential to determine potential buying and selling alternatives. Keep in mind that these are instruments to help, not exchange, your personal judgment and complete funding technique. All the time apply accountable threat administration and by no means make investments greater than you may afford to lose.

Closure

Thus, we hope this text has supplied useful insights into Chart Patterns Screeners: Your Free Information to Recognizing Market Alternatives. We recognize your consideration to our article. See you in our subsequent article!