A Decade Of Gold: Analyzing The Value Chart (2014-2024)

By admin / August 20, 2024 / No Comments / 2025

A Decade of Gold: Analyzing the Value Chart (2014-2024)

Associated Articles: A Decade of Gold: Analyzing the Value Chart (2014-2024)

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to A Decade of Gold: Analyzing the Value Chart (2014-2024). Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

A Decade of Gold: Analyzing the Value Chart (2014-2024)

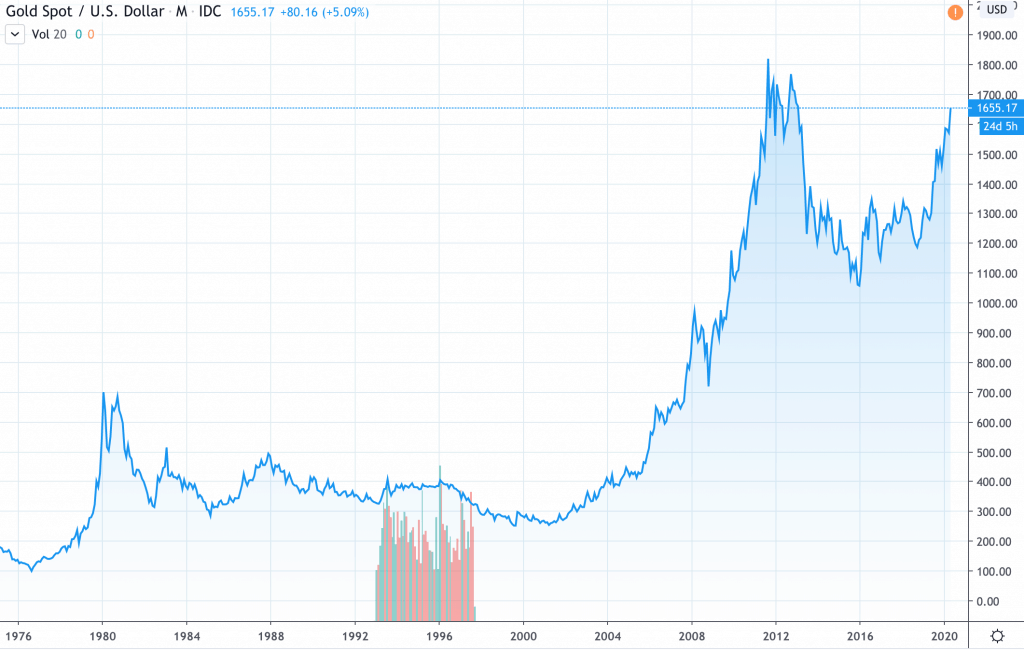

Gold, a timeless image of wealth and stability, has captivated traders and merchants for millennia. Its worth, nonetheless, is way from static, fluctuating in response to a posh interaction of financial, geopolitical, and market forces. Analyzing a ten-year chart of gold costs (let’s assume we’re wanting on the interval from 2014 to 2024 – a hypothetical chart as real-time knowledge continuously adjustments) supplies helpful insights into these dynamics and provides a glimpse into potential future developments. This text will delve right into a hypothetical ten-year gold worth chart, analyzing key developments, influential components, and potential implications for traders.

Hypothetical Chart Overview (2014-2024): A Narrative

As an example the evaluation, we’ll assemble a hypothetical chart showcasing key worth actions and important occasions. This isn’t a prediction of future costs, however a framework for understanding how varied components affect gold’s worth.

(Observe: The next is a hypothetical narrative primarily based on typical gold worth habits. Particular numbers are illustrative and never reflective of precise market knowledge.)

-

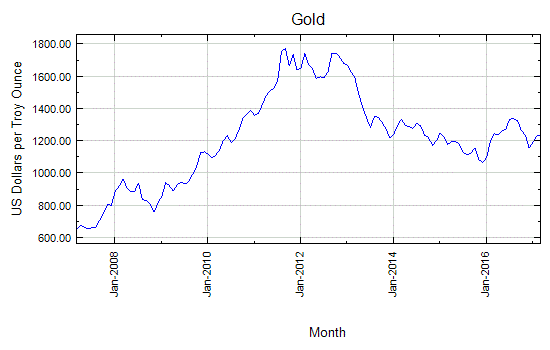

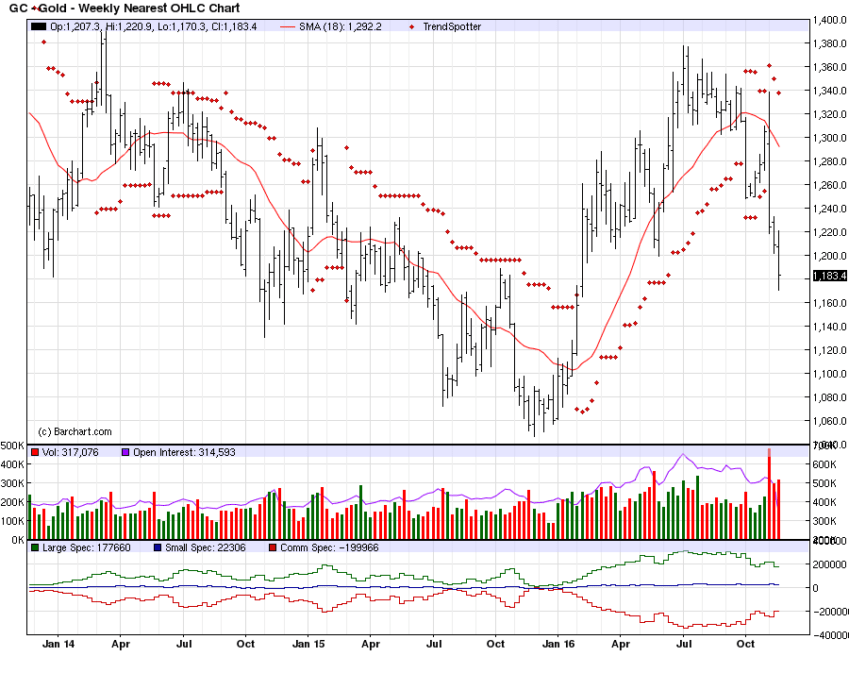

2014-2015: A Interval of Consolidation: The chart begins with gold costs hovering round $1,200-$1,300 per ounce. This era displays a comparatively steady international economic system, with average development and low inflation. The US Federal Reserve is step by step tapering its quantitative easing program, resulting in some upward stress on rates of interest, which negatively impacts gold’s enchantment as a non-yielding asset.

-

2016-2017: The Brexit Bump and Trump’s Election: A big spike happens following the UK’s vote to go away the European Union (Brexit), reflecting elevated uncertainty in international markets. Buyers flock to gold as a protected haven asset. This upward pattern continues briefly after Donald Trump’s election, fueled by issues about his protectionist commerce insurance policies and potential geopolitical instability. Costs peak round $1,400-$1,500.

-

2018-2019: A Correction and Rising Curiosity Charges: Gold costs expertise a correction, falling again to the $1,200 degree. This decline is attributed to a strengthening US greenback and rising rates of interest, making gold much less engaging in comparison with higher-yielding investments. Geopolitical tensions, nonetheless, present some help, stopping a sharper drop.

-

2020: The COVID-19 Pandemic and Protected Haven Demand: The COVID-19 pandemic dramatically alters the panorama. World markets plunge, and traders rush into gold, driving costs to report highs above $2,000 per ounce. This displays the acute uncertainty surrounding the pandemic’s financial affect and the unprecedented financial stimulus measures applied by central banks worldwide.

-

2021-2022: Inflationary Pressures and Financial Restoration: Gold costs stay elevated, fluctuating between $1,800 and $2,000. This era is characterised by rising inflation, pushed by provide chain disruptions and elevated demand. Whereas the worldwide economic system recovers, issues about persistent inflation and potential stagflation maintain gold’s enchantment robust.

-

2023-2024: Geopolitical Uncertainty and Market Volatility: The chart reveals continued volatility. Geopolitical occasions, akin to escalating tensions between main powers or regional conflicts, trigger periodic spikes in gold costs. Fluctuations are influenced by rate of interest selections by central banks, inflation charges, and the general efficiency of the worldwide economic system. Costs could consolidate round $1,700-$2,000, reflecting a posh interaction of things.

Components Influencing Gold Costs:

A number of key components affect gold’s worth actions, creating the dynamic patterns noticed within the hypothetical chart:

-

US Greenback Energy: An inverse relationship exists between the US greenback and gold costs. A stronger greenback usually places downward stress on gold, because it turns into costlier for holders of different currencies to purchase gold.

-

Curiosity Charges: Greater rates of interest usually cut back gold’s enchantment, as traders can earn increased returns on interest-bearing belongings. Conversely, decrease rates of interest can increase gold’s attractiveness.

-

Inflation: Gold is commonly thought of a hedge towards inflation. Rising inflation usually drives up gold costs, as traders search to guard their buying energy.

-

Geopolitical Uncertainty: Instances of geopolitical instability or uncertainty typically result in elevated demand for gold as a protected haven asset. Buyers search refuge in gold in periods of financial or political turmoil.

-

Provide and Demand: Like several commodity, gold’s worth is influenced by the steadiness between provide and demand. Modifications in mining manufacturing, jewellery demand, and central financial institution purchases can all affect the value.

-

Funding Demand: The extent of funding demand for gold, notably from exchange-traded funds (ETFs) and different institutional traders, considerably influences worth actions.

Implications for Buyers:

The hypothetical chart highlights the significance of contemplating varied components when investing in gold. Gold’s worth just isn’t merely pushed by a single issue however by a posh interaction of financial, geopolitical, and market forces. Buyers ought to:

-

Diversify their portfolio: Gold can function a helpful diversification device, providing a hedge towards inflation and market volatility. Nonetheless, it should not be the only real funding.

-

Think about long-term funding: Gold’s worth fluctuates considerably within the brief time period. An extended-term funding horizon permits traders to experience out these fluctuations and doubtlessly profit from long-term worth appreciation.

-

Keep knowledgeable about macroeconomic developments: Understanding international financial circumstances, inflation charges, rate of interest insurance policies, and geopolitical occasions is essential for making knowledgeable funding selections.

-

Monitor market sentiment: Investor sentiment performs an important function in gold worth actions. Staying knowledgeable about market sentiment will help traders anticipate potential worth adjustments.

Conclusion:

Analyzing a ten-year gold worth chart reveals the advanced dynamics influencing this valuable metallic’s worth. Whereas predicting future costs with certainty is not possible, understanding the interaction of financial, geopolitical, and market forces supplies helpful insights for traders. A well-diversified portfolio that comes with gold, together with a radical understanding of macroeconomic developments and market sentiment, will help traders navigate the challenges and alternatives introduced by this timeless asset. Keep in mind that this text makes use of a hypothetical chart; real-world knowledge will range, {and professional} monetary recommendation ought to at all times be sought earlier than making any funding selections.

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

Closure

Thus, we hope this text has offered helpful insights into A Decade of Gold: Analyzing the Value Chart (2014-2024). We thanks for taking the time to learn this text. See you in our subsequent article!