Chart Patterns Vs Candlestick

By admin / October 11, 2024 / No Comments / 2025

chart patterns vs candlestick

Associated Articles: chart patterns vs candlestick

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to chart patterns vs candlestick. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Chart Patterns vs. Candlesticks: A Complete Comparability for Technical Merchants

Technical evaluation is a cornerstone of profitable buying and selling, offering merchants with helpful insights into market sentiment and potential worth actions. Two elementary instruments inside technical evaluation are chart patterns and candlestick patterns. Whereas each supply helpful data, they differ considerably of their scope, interpretation, and software. Understanding their particular person strengths and weaknesses, and the way they can be utilized in conjunction, is essential for efficient buying and selling methods.

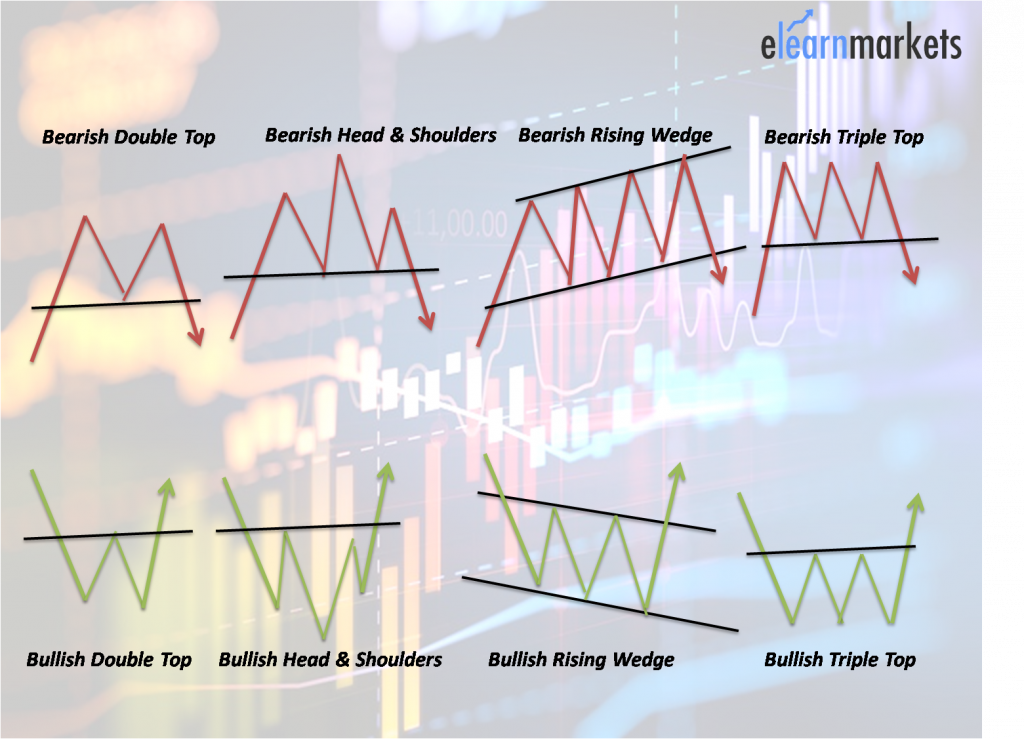

Chart Patterns: The Huge Image Perspective

Chart patterns signify the broader pattern of worth motion over an extended interval. They’re shaped by connecting vital highs and lows on a worth chart, creating visually recognizable shapes that counsel potential future worth actions. These patterns are usually recognized on every day, weekly, and even month-to-month charts, providing a macro perspective in the marketplace’s route. Their major focus is on figuring out potential reversals or continuations of present developments.

A number of key chart patterns exist, every with its personal distinctive traits and implications:

-

Head and Shoulders (H&S): A traditional reversal sample indicating a possible pattern shift. It is characterised by three peaks, with the center peak (the "head") being the very best, adopted by decrease peaks on both aspect ("shoulders"). A neckline connects the troughs between the peaks. A break under the neckline usually indicators a bearish reversal.

-

Inverse Head and Shoulders (IH&S): The mirror picture of the H&S sample, indicating a possible bullish reversal. It options three troughs, with the center trough being the bottom. A break above the neckline suggests a bullish reversal.

-

Triangles: These patterns signify durations of consolidation, the place shopping for and promoting pressures are comparatively balanced. There are a number of sorts, together with symmetrical, ascending, and descending triangles, every with its personal implications for future worth motion. Breakouts from triangles usually point out a continuation of the previous pattern.

-

Rectangles: Much like triangles, rectangles signify durations of consolidation. They’re characterised by parallel horizontal strains representing help and resistance ranges. Breakouts above or under the rectangle usually sign a continuation of the pattern.

-

Flags and Pennants: These patterns are continuation patterns, indicating a brief pause in a powerful pattern. They’re characterised by a quick interval of consolidation inside a channel, adopted by a breakout within the route of the unique pattern.

The interpretation of chart patterns usually includes contemplating elements resembling:

-

Quantity: The amount accompanying a breakout from a chart sample can verify its validity. Excessive quantity breakouts are usually thought of stronger indicators than low-volume breakouts.

-

Pattern: The general pattern previous the sample formation is essential. A reversal sample in an uptrend would possibly point out a brief correction, whereas a reversal sample in a downtrend may sign a big change in market sentiment.

-

Timeframe: The timeframe on which the sample is recognized impacts its significance. Patterns on longer timeframes usually carry extra weight than these on shorter timeframes.

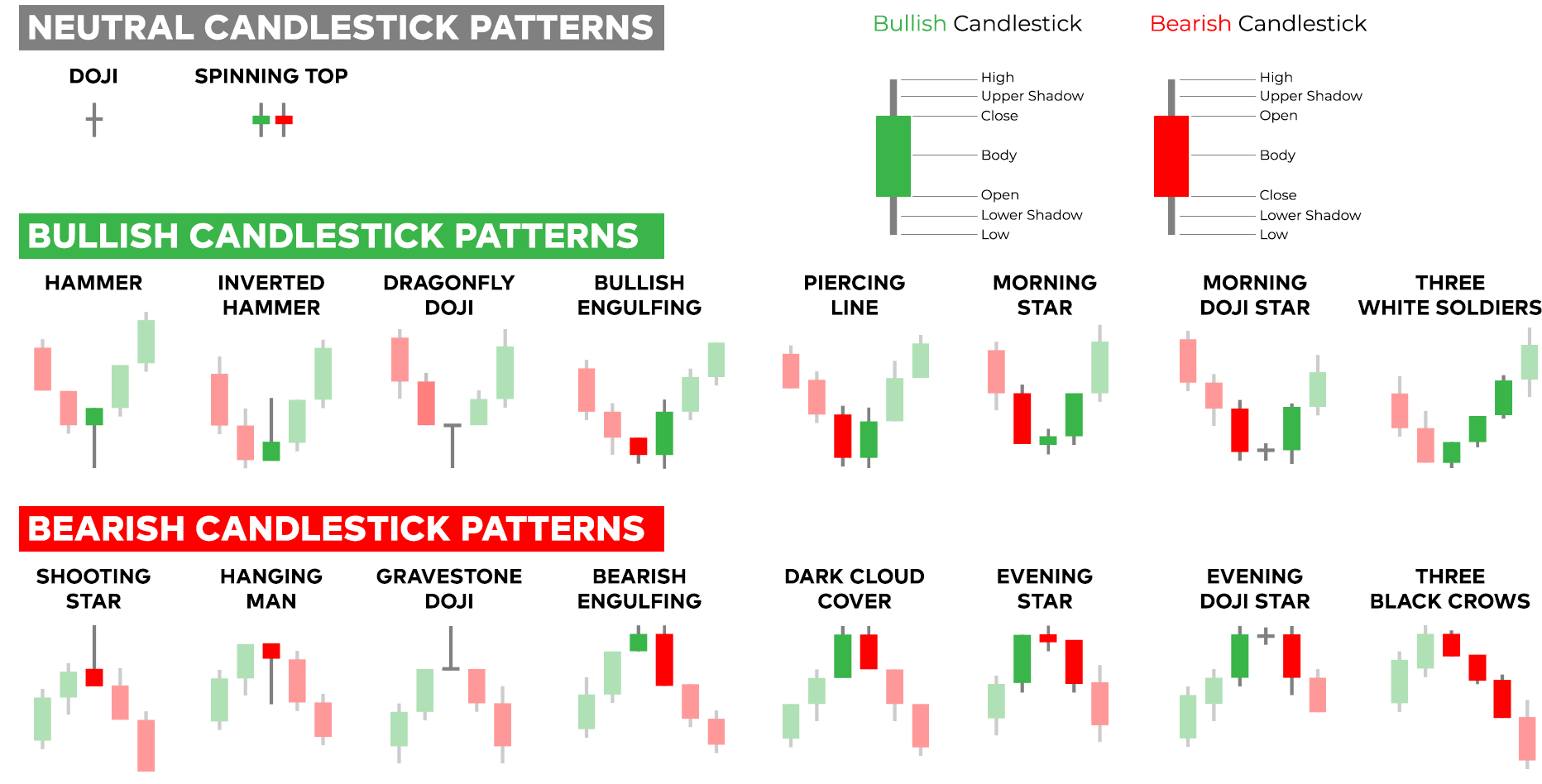

Candlesticks: The Microcosm of Market Sentiment

Candlesticks present a extra granular view of worth motion, specializing in the intraday or every day worth fluctuations. Every candlestick represents a selected time interval (e.g., in the future, one hour), exhibiting the opening, closing, excessive, and low costs. The physique of the candlestick represents the distinction between the opening and shutting costs, whereas the wicks (shadows) signify the excessive and low costs.

The interpretation of candlestick patterns depends on understanding the connection between the opening, closing, excessive, and low costs, in addition to the context of surrounding candlesticks. A number of widespread candlestick patterns exist, every conveying a selected message about market sentiment:

-

Doji: A candlestick with just about equal opening and shutting costs, indicating indecision or a possible reversal.

-

Hammer and Hanging Man: These are single-candlestick reversal patterns. A hammer is a bullish reversal sample showing on the backside of a downtrend, whereas a dangling man is a bearish reversal sample showing on the high of an uptrend.

-

Engulfing Patterns: These patterns encompass two candlesticks, the place the second candlestick fully engulfs the physique of the primary candlestick. A bullish engulfing sample suggests a possible bullish reversal, whereas a bearish engulfing sample suggests a bearish reversal.

-

Taking pictures Star and Inverted Hammer: These are single-candlestick reversal patterns much like hammers and hanging males however with longer higher or decrease wicks respectively.

-

Piercing Line and Darkish Cloud Cowl: These are two-candlestick reversal patterns indicating potential reversals in the other way of the previous pattern.

The effectiveness of candlestick patterns is commonly enhanced by contemplating:

-

Affirmation: A single candlestick sample may not be adequate for making a buying and selling choice. Affirmation from different candlestick patterns or indicators is commonly needed.

-

Context: The context of the candlestick sample throughout the broader market pattern is essential. A bullish reversal sample in a powerful downtrend is perhaps a brief bounce reasonably than a big reversal.

-

Quantity: Excessive quantity accompanying a candlestick sample usually strengthens its significance.

Chart Patterns vs. Candlesticks: Synergistic Use

Whereas chart patterns and candlestick patterns supply distinct views, their mixed use can considerably improve buying and selling accuracy. Chart patterns present the broader context, outlining the general pattern and potential reversal factors, whereas candlestick patterns supply detailed insights into the short-term market sentiment and potential affirmation of chart sample breakouts.

As an illustration, a dealer would possibly determine a head and shoulders sample on a every day chart, suggesting a possible bearish reversal. They may then use candlestick patterns, resembling bearish engulfing patterns or taking pictures stars, to substantiate the breakout under the neckline and to time their entry into a brief place.

Conclusion:

Chart patterns and candlestick patterns are highly effective instruments for technical evaluation, every providing distinctive benefits. Chart patterns present a macro view of worth motion, figuring out long-term developments and potential reversals, whereas candlestick patterns supply a micro view, offering insights into short-term market sentiment and confirming chart sample breakouts. By understanding the strengths and limitations of every approach and using them synergistically, merchants can considerably enhance their decision-making course of and improve their buying and selling efficiency. Nonetheless, it is essential to keep in mind that no technical evaluation device ensures success, and danger administration stays paramount in any buying and selling technique. Thorough analysis, backtesting, and disciplined danger administration are important for profitable buying and selling whatever the chosen analytical strategy.

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://f.hubspotusercontent10.net/hubfs/20705417/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Closure

Thus, we hope this text has offered helpful insights into chart patterns vs candlestick. We recognize your consideration to our article. See you in our subsequent article!