Decoding The 30-Yr Mortgage Price Chart: A Complete Information

By admin / November 14, 2024 / No Comments / 2025

Decoding the 30-Yr Mortgage Price Chart: A Complete Information

Associated Articles: Decoding the 30-Yr Mortgage Price Chart: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the 30-Yr Mortgage Price Chart: A Complete Information. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the 30-Yr Mortgage Price Chart: A Complete Information

The 30-year fixed-rate mortgage is a cornerstone of the American Dream, providing a predictable path to homeownership. Understanding the fluctuations in its rate of interest is essential for each potential consumers and seasoned owners. This text delves deep into the intricacies of the common 30-year mortgage price chart, analyzing historic tendencies, influencing components, and the implications for debtors. We’ll discover how you can interpret the info, predict future tendencies (with the required caveats), and finally, how you can leverage this data to make knowledgeable monetary selections.

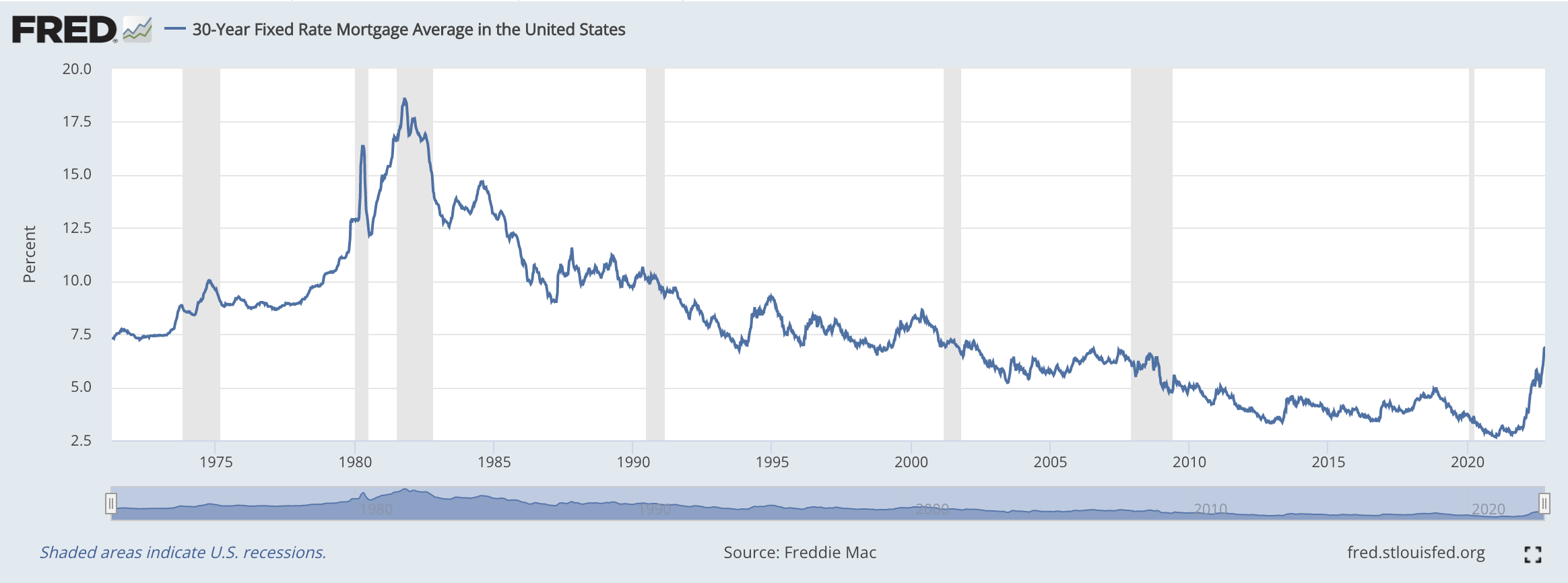

Historic Context: A Rollercoaster Experience

A complete 30-year mortgage price chart reveals an enchanting story of financial booms and busts, reflecting the broader well being of the financial system. Whereas exact historic information varies barely relying on the supply (Freddie Mac, Fannie Mae, and many others.), the general pattern is evident: charges have fluctuated considerably over the previous few many years.

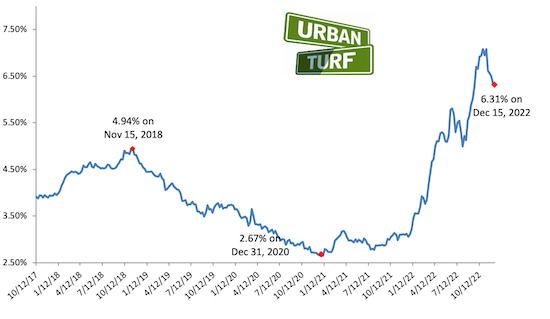

The early 2000s witnessed a interval of comparatively low charges, dipping beneath 6% at instances. This spurred a housing increase, fueled by available credit score. Nevertheless, this era culminated within the 2008 monetary disaster, which triggered a dramatic spike in mortgage charges as lenders tightened their lending requirements and the general financial system faltered. Charges climbed effectively above 6%, making homeownership considerably more difficult for a lot of.

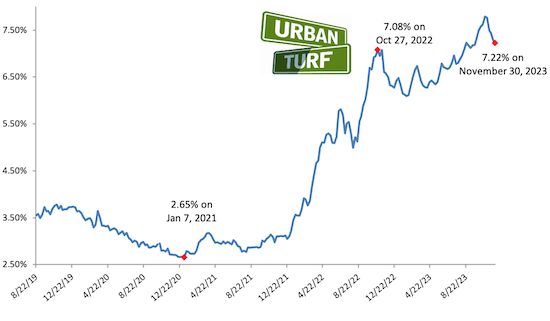

The years following the disaster noticed a gradual decline in charges, reaching historic lows in 2020 and 2021, dipping beneath 3% in some situations. This unprecedented low was largely a response to the Federal Reserve’s actions to stimulate the financial system through the COVID-19 pandemic. Nevertheless, this era additionally noticed a surge in residence costs, creating a special sort of affordability problem.

Extra lately, we have noticed a big upward pattern in mortgage charges. Inflationary pressures and the Federal Reserve’s efforts to fight inflation by rate of interest hikes have pushed mortgage charges significantly increased. This has cooled the beforehand red-hot housing market, making homeownership dearer for a lot of potential consumers.

Elements Influencing 30-Yr Mortgage Charges

Quite a few components contribute to the fluctuations depicted within the common 30-year mortgage price chart. Understanding these components is vital to deciphering the info and anticipating future tendencies, though exact prediction stays inherently troublesome. A number of the most important influences embrace:

-

Federal Reserve Coverage: The Federal Reserve (the Fed) performs a pivotal position in setting the general rate of interest surroundings. The Fed’s goal federal funds price – the speed at which banks lend cash to one another – immediately influences different rates of interest, together with mortgage charges. When the Fed raises charges to fight inflation, mortgage charges typically rise; conversely, price cuts are inclined to result in decrease mortgage charges.

-

Inflation: Inflation, the speed at which the overall degree of costs for items and companies is rising, is a big driver of rates of interest. Excessive inflation erodes the buying energy of cash, prompting the Fed to boost rates of interest to chill down the financial system and curb inflation. This, in flip, results in increased mortgage charges.

-

Financial Progress: Sturdy financial progress can result in elevated demand for loans, together with mortgages, which may put upward strain on charges. Conversely, weak financial progress can dampen demand and probably result in decrease charges.

-

Authorities Insurance policies: Authorities insurance policies associated to housing and the mortgage market may also affect charges. Adjustments in laws, tax insurance policies affecting mortgage curiosity deductions, and government-sponsored enterprise (GSE) actions (like Fannie Mae and Freddie Mac) can all impression the general provide and demand for mortgages.

-

Investor Sentiment and Market Circumstances: Investor confidence and general market circumstances play a task. Uncertainty within the monetary markets can result in increased charges as lenders demand increased returns to compensate for elevated threat.

-

Provide and Demand for Mortgages: Like another commodity, the availability and demand for mortgages affect charges. Excessive demand with restricted provide can push charges upward, whereas the alternative can result in decrease charges.

Decoding the Chart: Traits and Patterns

Decoding a 30-year mortgage price chart requires cautious consideration of the historic context and the assorted components talked about above. Trying on the chart, you must observe:

-

Lengthy-term tendencies: Whereas short-term fluctuations are frequent, the chart usually reveals long-term tendencies, akin to intervals of typically rising or falling charges.

-

Cyclical patterns: Mortgage charges are inclined to exhibit cyclical patterns, mirroring the broader financial cycles of growth and contraction.

-

Correlation with different financial indicators: Analyzing the chart alongside different financial indicators, akin to inflation charges, unemployment charges, and GDP progress, can present beneficial insights into the relationships between these components and mortgage charges.

-

Affect of main occasions: Important financial occasions, akin to recessions, monetary crises, and geopolitical instability, usually go away a noticeable mark on the chart, illustrating their impression on mortgage charges.

Predicting Future Charges: A Cautious Method

Predicting future mortgage charges with certainty is inconceivable. Nevertheless, by rigorously analyzing the present financial panorama and contemplating the components mentioned above, you’ll be able to kind an inexpensive expectation of potential future tendencies. Think about:

-

The Fed’s future actions: Monitoring the Fed’s pronouncements on financial coverage and its projected path for rates of interest offers beneficial perception into the potential course of mortgage charges.

-

Inflation outlook: Analyzing inflation forecasts and the effectiveness of the Fed’s efforts to manage inflation will help gauge the potential for future price modifications.

-

Financial progress projections: Forecasts for financial progress can present clues in regards to the potential demand for mortgages and the ensuing strain on charges.

Keep in mind, any prediction carries inherent uncertainty. A number of components can affect mortgage charges, and unexpected occasions can considerably alter the trajectory.

Implications for Debtors and Homebuyers:

Understanding the common 30-year mortgage price chart has vital implications for each potential homebuyers and present owners with adjustable-rate mortgages:

-

Homebuyers: Decrease charges make homeownership extra inexpensive, whereas increased charges improve the price of borrowing and cut back buying energy. Understanding price tendencies will help consumers time their buy strategically.

-

Refinancing: Householders with present mortgages can use the chart to determine alternatives for refinancing at decrease charges, probably saving vital quantities of cash over the lifetime of their mortgage.

-

Adjustable-rate mortgages (ARMs): Householders with ARMs ought to rigorously monitor price fluctuations, as their month-to-month funds can change considerably primarily based on market circumstances.

Conclusion:

The common 30-year mortgage price chart is a strong software for understanding the dynamics of the housing market and the broader financial system. By finding out historic tendencies, analyzing influencing components, and deciphering the info cautiously, each potential homebuyers and present owners could make extra knowledgeable monetary selections. Whereas predicting future charges with precision is inconceivable, understanding the underlying components permits for a extra knowledgeable strategy to navigating the complexities of the mortgage market. Keep in mind to seek the advice of with monetary professionals for customized recommendation tailor-made to your particular circumstances.

:max_bytes(150000):strip_icc()/BgXcd-average-mortgage-rates-over-the-last-year-feb-29-2024-0875eb9980bb4ece94169bb78b670b86.png)

Closure

Thus, we hope this text has offered beneficial insights into Decoding the 30-Yr Mortgage Price Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!