Decoding The Language Of The Market: A Complete Information To Inventory Market Chart Patterns (PDF-Prepared)

By admin / October 17, 2024 / No Comments / 2025

Decoding the Language of the Market: A Complete Information to Inventory Market Chart Patterns (PDF-Prepared)

Associated Articles: Decoding the Language of the Market: A Complete Information to Inventory Market Chart Patterns (PDF-Prepared)

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the Language of the Market: A Complete Information to Inventory Market Chart Patterns (PDF-Prepared). Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Language of the Market: A Complete Information to Inventory Market Chart Patterns (PDF-Prepared)

Introduction:

The inventory market, a posh ecosystem pushed by human emotion and financial forces, typically reveals its future intentions by recurring patterns on worth charts. These chart patterns, fashioned by the interaction of provide and demand, provide invaluable insights for merchants and buyers looking for to anticipate worth actions. Whereas not foolproof predictors, understanding and appropriately decoding these patterns can considerably improve buying and selling methods and threat administration. This complete information will delve into varied outstanding chart patterns, explaining their formation, significance, and sensible purposes, equipping you with the data to decipher the market’s visible language. This info is meant for academic functions and shouldn’t be thought-about monetary recommendation. All the time conduct thorough analysis and seek the advice of with a monetary skilled earlier than making any funding choices.

I. Understanding Chart Sorts and Timeframes:

Earlier than exploring particular chart patterns, it is essential to know the completely different chart sorts and timeframes utilized in technical evaluation. The commonest chart sorts are:

- Line Charts: These charts join the closing costs of a safety over a specified interval, offering a easy visible illustration of worth developments.

- Bar Charts: Every bar represents a selected interval (e.g., every day, weekly), exhibiting the excessive, low, open, and shutting costs. This gives a extra detailed view than line charts.

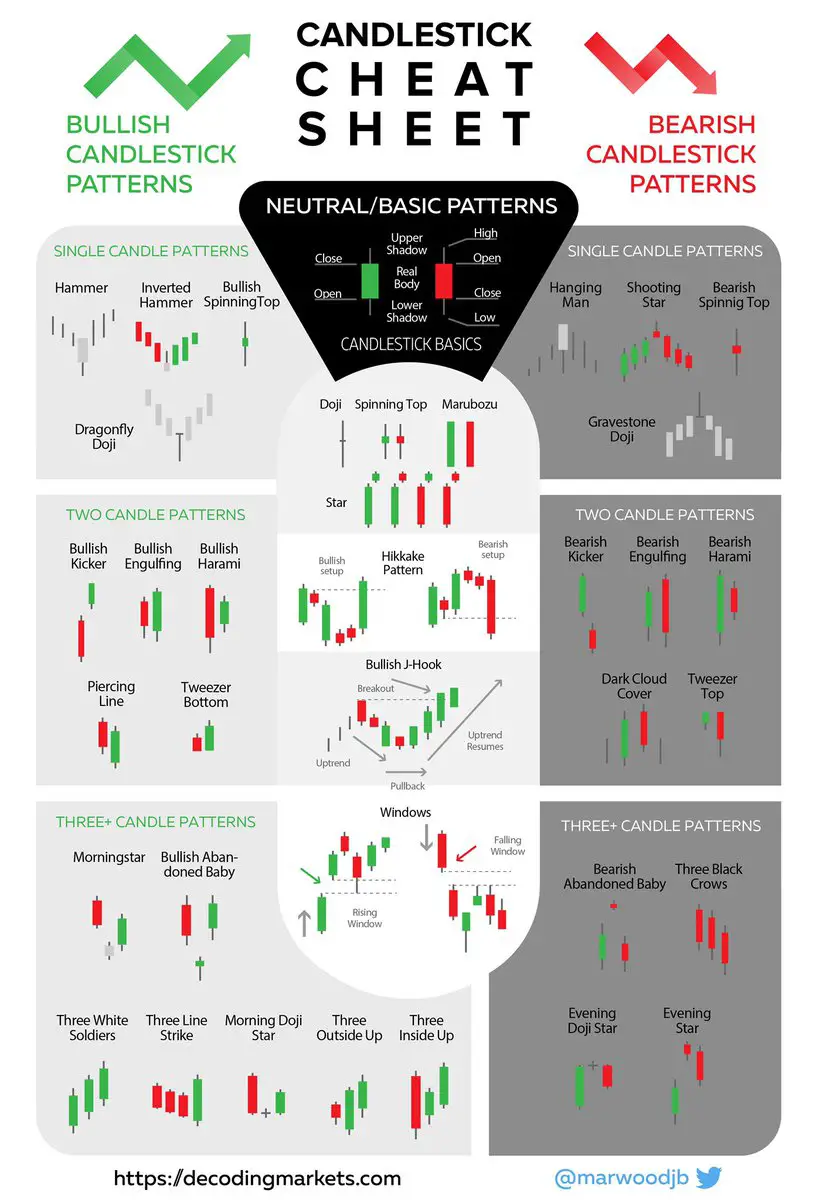

- Candlestick Charts: Just like bar charts, candlestick charts present the identical worth info however use visually distinct "candles" to signify worth motion. The physique of the candle signifies the vary between the open and shut, whereas the "wicks" (higher and decrease shadows) present the excessive and low costs. Candlestick charts are significantly helpful for figuring out patterns and reversals.

The timeframe chosen considerably influences the patterns noticed. Quick-term timeframes (e.g., 5-minute, hourly) reveal short-term worth fluctuations, whereas long-term timeframes (e.g., weekly, month-to-month) spotlight broader developments. The selection of timeframe is dependent upon the dealer’s funding horizon and technique.

II. Main Chart Patterns: Continuation and Reversal

Chart patterns are broadly categorized into continuation and reversal patterns. Continuation patterns counsel a continuation of the present pattern, whereas reversal patterns point out a possible shift within the prevailing pattern.

A. Continuation Patterns:

These patterns usually seem throughout a trending market, suggesting a short lived pause earlier than the pattern resumes in the identical route. Widespread continuation patterns embrace:

-

Triangles: Triangles are characterised by converging trendlines, forming a triangular form. There are three principal sorts: symmetrical, ascending, and descending. Symmetrical triangles counsel a continuation of the previous pattern, whereas ascending triangles sign a bullish continuation, and descending triangles a bearish continuation. The breakout from the triangle normally happens within the route of the prevailing pattern.

-

Flags and Pennants: These patterns resemble flags or pennants connected to a flagpole (the previous pattern). They’re characterised by a short interval of consolidation inside a channel, adopted by a breakout within the route of the unique pattern. Flags are usually characterised by parallel trendlines, whereas pennants have converging trendlines.

-

Rectangles: Rectangles are characterised by horizontal help and resistance ranges, forming an oblong form. The value consolidates inside this vary earlier than breaking out within the route of the prevailing pattern.

-

Head and Shoulders Sample (Continuation): Whereas usually a reversal sample, a head and shoulders sample can typically be a continuation sample if it happens inside a robust and established pattern. The breakout ought to then happen within the route of that pattern.

B. Reversal Patterns:

These patterns sign a possible change within the route of the prevailing pattern. Key reversal patterns embrace:

-

Head and Shoulders: This is without doubt one of the most dependable reversal patterns. It consists of three peaks, with the center peak (the "head") being the best. A neckline connects the troughs on both facet of the top. A break under the neckline confirms a bearish reversal. The inverse, an "inverted head and shoulders," alerts a bullish reversal.

-

Double Tops and Double Bottoms: These patterns encompass two related worth peaks (double prime) or troughs (double backside). A break under the neckline of a double prime confirms a bearish reversal, whereas a break above the neckline of a double backside confirms a bullish reversal.

-

Triple Tops and Triple Bottoms: Just like double tops and bottoms, however with three peaks or troughs. These patterns are typically thought-about stronger reversal alerts because of the elevated affirmation.

-

Wedges: Wedges are characterised by converging trendlines, just like triangles, however not like triangles, the breakout tends to happen in the other way of the previous pattern. Rising wedges are bearish, whereas falling wedges are bullish.

III. Utilizing Chart Patterns in Buying and selling Methods:

Chart patterns present invaluable info, however they should not be utilized in isolation. Profitable buying and selling requires integrating chart patterns with different technical indicators and basic evaluation.

-

Affirmation: All the time search affirmation from different indicators earlier than coming into a commerce primarily based on a chart sample. This might embrace quantity evaluation, shifting averages, or oscillators (RSI, MACD). A robust quantity surge accompanying a breakout is a optimistic signal.

-

Threat Administration: All the time use stop-loss orders to restrict potential losses. Place your stop-loss order under the neckline in a head and shoulders sample or under the help stage in different patterns.

-

Goal Costs: Estimate potential revenue targets primarily based on the sample’s dimensions. For instance, in a head and shoulders sample, the goal worth may be calculated by measuring the space between the top and the neckline and projecting that distance downward from the neckline’s breakout level.

IV. Limitations of Chart Patterns:

It is essential to acknowledge the constraints of chart patterns:

-

Subjectivity: Figuring out chart patterns may be subjective, with completely different merchants decoding the identical chart otherwise.

-

False Breakouts: Generally, the value breaks out of a sample solely to revert again to the unique pattern, resulting in false alerts.

-

Context is Key: Chart patterns ought to be analyzed throughout the broader market context. A sample that may sign a reversal in a sideways market is perhaps a continuation sample in a robust trending market.

V. Superior Chart Patterns and Ideas:

Past the fundamental patterns, extra advanced patterns and ideas exist, together with:

-

Harmonic Patterns: These patterns are primarily based on Fibonacci ratios and are thought-about extra superior.

-

Elliott Wave Concept: This idea means that market costs transfer in particular wave patterns, offering insights into potential future actions.

-

Cypher Patterns, Gartley Patterns, Butterfly Patterns: These are particular harmonic patterns that depend on exact Fibonacci retracements and extensions.

Conclusion:

Chart patterns provide a invaluable software for technical evaluation, offering insights into potential worth actions. Nevertheless, they need to be used along with different analytical instruments and a sound threat administration technique. By understanding the varied chart patterns, their formation, and their limitations, merchants and buyers can improve their decision-making course of and navigate the complexities of the inventory market extra successfully. Do not forget that constant studying, apply, and a disciplined method are important for profitable buying and selling. This information gives a basis for understanding chart patterns; continued examine and expertise are essential for mastering this facet of technical evaluation. All the time keep in mind to seek the advice of with a monetary skilled earlier than making any funding choices. This doc is for academic functions solely and doesn’t represent monetary recommendation.

![Chart Patterns PDF Free Download [11 MB] – (हिंदी में डाउनलोड करें)](https://stockmarkethindi.in/wp-content/uploads/2023/08/20230815_013123_2996.webp)

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Language of the Market: A Complete Information to Inventory Market Chart Patterns (PDF-Prepared). We hope you discover this text informative and helpful. See you in our subsequent article!