Decoding Silver’s Dance: A Complete Information To TradingView Charts For Silver

By admin / October 31, 2024 / No Comments / 2025

Decoding Silver’s Dance: A Complete Information to TradingView Charts for Silver

Associated Articles: Decoding Silver’s Dance: A Complete Information to TradingView Charts for Silver

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding Silver’s Dance: A Complete Information to TradingView Charts for Silver. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding Silver’s Dance: A Complete Information to TradingView Charts for Silver

Silver, a valuable steel with a wealthy historical past and various functions, has captivated buyers for hundreds of years. Its value, influenced by a posh interaction of business demand, funding sentiment, and macroeconomic components, presents each alternatives and challenges for merchants. Mastering the artwork of silver buying and selling requires a deep understanding of market dynamics and the flexibility to interpret value motion successfully. TradingView, a well-liked charting platform, gives a strong suite of instruments to investigate silver’s value actions and inform buying and selling selections. This text serves as a complete information to using TradingView charts for silver buying and selling, masking elementary evaluation, technical evaluation, and threat administration methods.

I. Understanding the Silver Market: A Basis for Chart Evaluation

Earlier than diving into the technical elements of chart evaluation on TradingView, it is essential to know the elemental drivers of silver’s value. These components present context for decoding value actions and anticipating future traits.

-

Industrial Demand: Silver’s main use lies in industrial functions, together with electronics, photo voltaic panels, and cars. Robust world financial development, notably in creating nations, sometimes interprets to elevated industrial demand and better silver costs. Conversely, financial slowdowns can result in diminished demand and value declines. Monitoring manufacturing PMI (Buying Managers’ Index) and industrial manufacturing knowledge can supply worthwhile insights into this facet.

-

Funding Demand: Silver is taken into account a safe-haven asset, very like gold. Throughout instances of financial uncertainty, geopolitical instability, or inflation fears, buyers usually flock to valuable metals, boosting demand and costs. Monitoring investor sentiment by information headlines, ETF flows (e.g., SLV – iShares Silver Belief), and gold-silver ratio can present worthwhile clues.

-

Foreign money Fluctuations: The worth of silver is usually quoted in US {dollars}. A weakening greenback typically makes dollar-denominated commodities, together with silver, extra engaging to worldwide buyers, pushing costs increased. Conversely, a strengthening greenback can put downward stress on silver costs. Monitoring the US Greenback Index (DXY) is important for understanding this dynamic.

-

Provide and Demand Dynamics: Like all commodity, the interaction of provide and demand considerably influences silver’s value. Mining manufacturing, recycling charges, and geopolitical occasions affecting main silver-producing international locations can all influence the general provide. Understanding these dynamics requires monitoring trade experiences and information associated to silver mining.

-

Inflationary Pressures: Silver, like different valuable metals, is usually seen as a hedge in opposition to inflation. In periods of excessive inflation, buyers might enhance their holdings of silver as a retailer of worth, driving up costs. Monitoring inflation indicators just like the Shopper Worth Index (CPI) and Producer Worth Index (PPI) is significant.

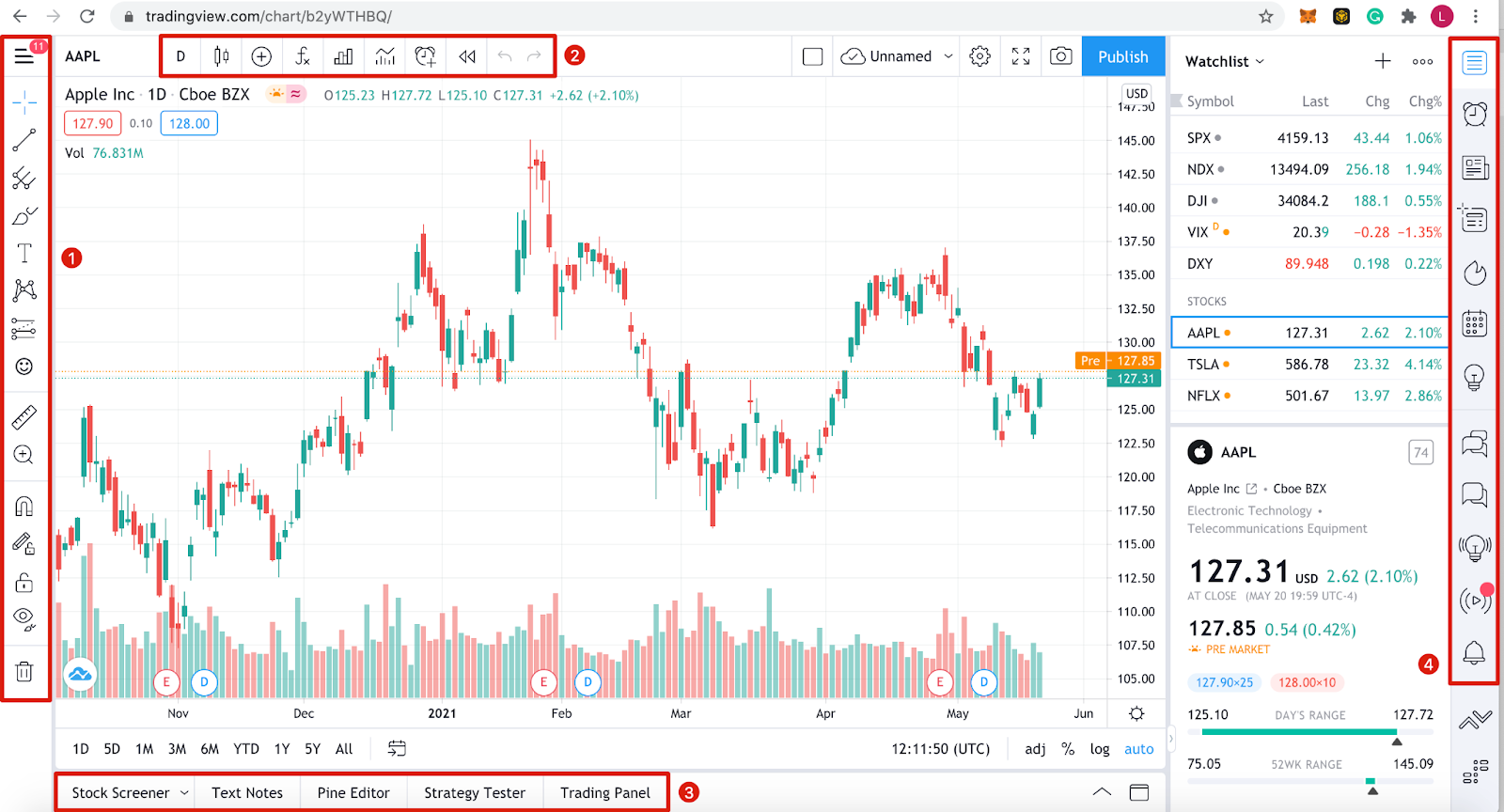

II. Leveraging TradingView for Silver Chart Evaluation

TradingView offers a wealth of instruments for technical evaluation, permitting merchants to establish potential entry and exit factors primarily based on value patterns and indicators.

-

Selecting the Proper Chart Kind: TradingView gives numerous chart varieties, together with candlestick, bar, and line charts. Candlestick charts are notably widespread for his or her skill to visually signify value motion over a particular interval, together with open, excessive, low, and shutting costs.

-

Timeframes: Deciding on the suitable timeframe is important. Brief-term merchants may give attention to intraday charts (e.g., 1-minute, 5-minute, 15-minute), whereas long-term buyers may want every day, weekly, or month-to-month charts. Analyzing a number of timeframes concurrently can present a extra complete perspective.

-

Technical Indicators: TradingView gives an enormous library of technical indicators, together with shifting averages (MA), Relative Power Index (RSI), MACD (Shifting Common Convergence Divergence), Bollinger Bands, and Stochastic Oscillator. These indicators will help establish traits, momentum shifts, and potential overbought or oversold circumstances. Experimenting with totally different indicators and combos is important to search out what works greatest in your buying and selling fashion.

-

Drawing Instruments: TradingView’s drawing instruments permit merchants to establish assist and resistance ranges, trendlines, channels, and different important value patterns. These instruments will help verify traits, establish potential reversal factors, and set stop-loss and take-profit orders.

-

Backtesting Methods: TradingView permits for backtesting buying and selling methods utilizing historic knowledge. This characteristic is invaluable for evaluating the effectiveness of various indicators and buying and selling methods earlier than risking actual capital. Nevertheless, it is essential to keep in mind that previous efficiency is just not indicative of future outcomes.

-

Alert System: TradingView’s alert system permits merchants to arrange notifications for particular value ranges, technical indicator crossovers, or different occasions. This characteristic will help merchants keep knowledgeable about potential buying and selling alternatives with out consistently monitoring the charts.

III. Particular Silver Chart Evaluation Examples on TradingView

Let’s illustrate some sensible functions of TradingView for silver chart evaluation:

-

Figuring out Development Reversals utilizing RSI and MACD: A bearish divergence between the worth and RSI, coupled with a MACD bearish crossover, may sign a possible development reversal from an uptrend to a downtrend. Merchants may take into account brief positions at this level, putting stop-loss orders above the latest swing excessive.

-

Using Assist and Resistance Ranges: Figuring out key assist and resistance ranges on the chart will help merchants decide potential entry and exit factors. A breakout above a major resistance degree might be a bullish sign, whereas a break under a assist degree might be bearish.

-

Analyzing Shifting Averages: A bullish crossover of a short-term shifting common (e.g., 50-day MA) above a long-term shifting common (e.g., 200-day MA) could be a sturdy bullish sign, suggesting an upward development. The other situation may point out a bearish development.

-

Decoding Candlestick Patterns: Candlestick patterns, corresponding to engulfing patterns, hammer, and taking pictures stars, can present worthwhile insights into potential development reversals or continuations. Understanding these patterns can improve the accuracy of buying and selling selections.

IV. Threat Administration in Silver Buying and selling on TradingView

Threat administration is paramount in any buying and selling endeavor, and silver buying and selling is not any exception. TradingView facilitates efficient threat administration by a number of options:

-

Setting Cease-Loss Orders: Cease-loss orders routinely exit a commerce when the worth reaches a predetermined degree, limiting potential losses. Inserting stop-loss orders primarily based on technical evaluation, corresponding to assist ranges or latest swing lows, is essential.

-

Figuring out Place Sizing: Correct place sizing ensures that losses are manageable even when a commerce goes in opposition to the anticipated path. By no means threat greater than a small proportion of your buying and selling capital on any single commerce.

-

Using Take-Revenue Orders: Take-profit orders routinely exit a commerce when the worth reaches a predetermined revenue goal. Setting take-profit orders primarily based on technical evaluation, corresponding to resistance ranges or Fibonacci retracements, will help lock in earnings.

-

Diversification: Diversifying throughout totally different asset lessons, together with different valuable metals or different commodities, can cut back general portfolio threat.

-

Backtesting and Paper Buying and selling: Earlier than risking actual capital, it is important to backtest buying and selling methods and follow paper buying and selling on TradingView to realize expertise and refine your method.

V. Conclusion:

TradingView offers a useful toolset for analyzing silver value actions and making knowledgeable buying and selling selections. By combining elementary evaluation with technical evaluation, using TradingView’s charting instruments and indicators, and implementing strong threat administration methods, merchants can considerably enhance their possibilities of success within the dynamic silver market. Do not forget that constant studying, disciplined execution, and adaptableness are essential for long-term success in any market. The knowledge offered on this article is for academic functions solely and shouldn’t be thought-about monetary recommendation. At all times conduct thorough analysis and take into account looking for recommendation from a professional monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding Silver’s Dance: A Complete Information to TradingView Charts for Silver. We respect your consideration to our article. See you in our subsequent article!