Decoding The Dhan Financial institution Nifty Chart: A Complete Evaluation

By admin / November 14, 2024 / No Comments / 2025

Decoding the Dhan Financial institution Nifty Chart: A Complete Evaluation

Associated Articles: Decoding the Dhan Financial institution Nifty Chart: A Complete Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Dhan Financial institution Nifty Chart: A Complete Evaluation. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Dhan Financial institution Nifty Chart: A Complete Evaluation

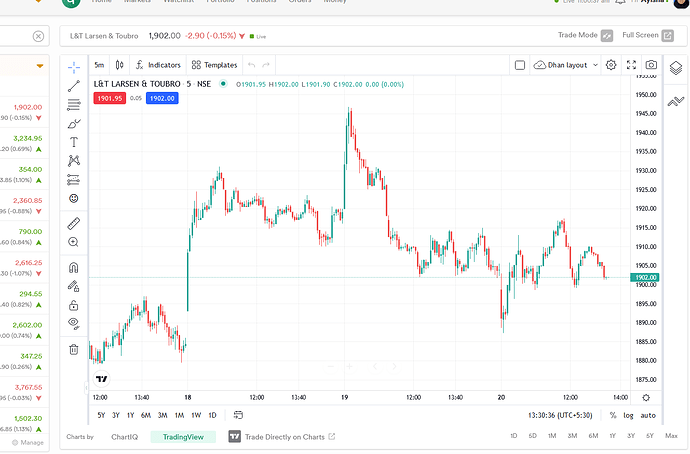

The Dhan Financial institution Nifty chart, whereas seemingly a easy illustration of the Nifty 50 index’s efficiency throughout the Dhan platform, presents a wealth of knowledge for seasoned merchants and newbies alike. Understanding its nuances requires a multifaceted method, encompassing technical evaluation, elementary understanding of the Nifty 50, and consciousness of the platform’s particular options. This text delves deep into deciphering the Dhan Financial institution Nifty chart, exploring its numerous elements, potential buying and selling methods, and the essential elements influencing its actions.

Understanding the Fundamentals: The Nifty 50 and Dhan Platform

Earlier than diving into chart evaluation, it is essential to grasp the underlying asset: the Nifty 50 index. This benchmark index represents the 50 largest and most liquid firms listed on the Nationwide Inventory Alternate of India (NSE). Its actions mirror the general well being and route of the Indian financial system. Investing within the Nifty 50, both instantly or via derivatives, supplies publicity to a diversified portfolio of blue-chip firms.

Dhan, a preferred on-line buying and selling platform, presents its customers entry to real-time knowledge and charting instruments for numerous monetary devices, together with the Nifty 50. The Dhan Financial institution Nifty chart supplies a visible illustration of the index’s value fluctuations over a selected timeframe, permitting merchants to establish developments, help and resistance ranges, and potential buying and selling alternatives.

Parts of the Dhan Financial institution Nifty Chart:

A typical Dhan Financial institution Nifty chart includes a number of key elements:

-

Worth Axis (Y-axis): Shows the Nifty 50 index’s value at totally different time limits. This may be displayed in numerous codecs, together with absolute value, share change, or logarithmic scale.

-

Time Axis (X-axis): Represents the time interval coated by the chart. This will vary from intraday (minutes, hours) to long-term (weeks, months, years). The chosen timeframe considerably impacts the chart’s look and interpretation.

-

Candlesticks/Bars: These symbolize value actions over a particular interval. Every candlestick or bar exhibits the opening value, closing value, excessive, and low for that interval. The colour of the candlestick usually signifies whether or not the closing value was greater (inexperienced/bullish) or decrease (crimson/bearish) than the opening value.

-

Transferring Averages (MAs): These are calculated by averaging the value over a particular interval (e.g., 50-day MA, 200-day MA). MAs easy out value fluctuations and assist establish developments. Generally used MAs embody easy transferring common (SMA) and exponential transferring common (EMA).

-

Technical Indicators: An unlimited array of technical indicators will be overlaid on the chart to supply extra insights. These embody Relative Power Index (RSI), Transferring Common Convergence Divergence (MACD), Bollinger Bands, Stochastic Oscillator, and lots of others. Every indicator supplies a unique perspective on value momentum, volatility, and potential reversals.

-

Quantity: The amount of Nifty 50 futures or choices traded throughout every interval is commonly displayed alongside the value chart. Quantity confirms value actions and may sign potential breakouts or reversals. Excessive quantity accompanying a value transfer strengthens the sign, whereas low quantity suggests a weaker pattern.

-

Help and Resistance Ranges: These are value ranges the place the index has traditionally proven issue breaking via. Help ranges symbolize costs the place shopping for strain is robust, whereas resistance ranges point out the place promoting strain is dominant. Breaks above resistance or beneath help can sign important value actions.

Deciphering the Dhan Financial institution Nifty Chart: Technical Evaluation

Technical evaluation includes finding out previous value actions and quantity to foretell future value route. A number of strategies will be utilized to the Dhan Financial institution Nifty chart:

-

Development Evaluation: Figuring out the general route of the index (uptrend, downtrend, or sideways). This includes observing the slope of transferring averages, candlestick patterns, and help/resistance ranges.

-

Help and Resistance Identification: Pinpointing key value ranges the place the index is prone to discover help or face resistance. Breaks above resistance or beneath help usually sign important value actions.

-

Candlestick Sample Recognition: Figuring out particular candlestick patterns that counsel potential value reversals or continuations. Examples embody hammer, hanging man, engulfing patterns, and doji.

-

Indicator Evaluation: Utilizing technical indicators to substantiate developments, establish overbought/oversold circumstances, and predict potential value reversals. As an example, an RSI above 70 may counsel an overbought situation, whereas an RSI beneath 30 might sign an oversold situation.

-

Quantity Evaluation: Analyzing buying and selling quantity to substantiate value actions. Excessive quantity accompanying a value break confirms the energy of the transfer, whereas low quantity suggests weak point.

Elementary Evaluation and its Affect on the Dhan Financial institution Nifty Chart

Whereas technical evaluation focuses on value charts, elementary evaluation examines the underlying financial elements influencing the Nifty 50’s efficiency. These elements embody:

-

Financial Progress: Sturdy financial progress usually results in greater company earnings and elevated investor confidence, pushing the Nifty 50 greater.

-

Inflation: Excessive inflation can erode company income and enhance rates of interest, doubtlessly resulting in a decline within the Nifty 50.

-

Curiosity Charges: Adjustments in rates of interest have an effect on borrowing prices for firms and buyers. Larger rates of interest can dampen financial exercise and result in decrease inventory costs.

-

International Market Situations: International occasions, comparable to geopolitical instability or financial downturns in main economies, can considerably affect the Nifty 50.

-

Authorities Insurance policies: Authorities insurance policies, comparable to fiscal and financial insurance policies, can affect the general financial atmosphere and affect inventory costs.

Understanding these elementary elements is essential for deciphering the Dhan Financial institution Nifty chart’s long-term actions. Whereas technical evaluation will help establish short-term buying and selling alternatives, elementary evaluation supplies a broader context for long-term funding selections.

Buying and selling Methods utilizing the Dhan Financial institution Nifty Chart:

The Dhan Financial institution Nifty chart can be utilized to implement numerous buying and selling methods:

-

Development Following: Figuring out a transparent pattern (uptrend or downtrend) and buying and selling within the route of the pattern. This includes utilizing transferring averages, trendlines, and different technical indicators to substantiate the pattern.

-

Imply Reversion: Buying and selling on the belief that costs will revert to their common. This technique usually includes utilizing indicators like RSI or Bollinger Bands to establish overbought or oversold circumstances.

-

Breakout Buying and selling: Figuring out and buying and selling on value breakouts above resistance ranges or beneath help ranges. This technique requires cautious threat administration, as breakouts can typically fail.

-

Scalping: Quick-term buying and selling technique that goals to revenue from small value actions inside a brief interval. This requires fast decision-making and shut monitoring of the chart.

-

Swing Buying and selling: Holding positions for a couple of days to a number of weeks, aiming to revenue from intermediate-term value swings. This technique requires understanding of technical evaluation and threat administration.

Threat Administration and Dhan Platform Options:

Whatever the chosen buying and selling technique, threat administration is paramount. Dhan presents numerous options to assist handle threat:

-

Cease-Loss Orders: These robotically exit a place when the value reaches a predetermined degree, limiting potential losses.

-

Take-Revenue Orders: These robotically exit a place when the value reaches a predetermined revenue goal, securing income.

-

Margin Buying and selling: Dhan permits margin buying and selling, enabling merchants to leverage their capital and doubtlessly amplify income (and losses). Nevertheless, margin buying and selling carries important threat and needs to be used cautiously.

-

Paper Buying and selling: Dhan possible presents a paper buying and selling account, permitting customers to apply their methods with out risking actual cash. That is essential for newbies to develop their abilities earlier than buying and selling with actual capital.

Conclusion:

The Dhan Financial institution Nifty chart is a robust device for understanding and buying and selling the Nifty 50 index. By combining technical evaluation, elementary evaluation, and a stable understanding of threat administration rules, merchants can leverage the data introduced within the chart to make knowledgeable buying and selling selections. Nevertheless, it is essential to keep in mind that no buying and selling technique ensures income, and losses are an inherent a part of buying and selling. Steady studying, disciplined method, and correct threat administration are important for fulfillment within the dynamic world of monetary markets. Using the assorted options supplied by the Dhan platform, together with instructional sources and threat administration instruments, can considerably improve a dealer’s capability to navigate the complexities of the Dhan Financial institution Nifty chart and obtain their monetary objectives.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Dhan Financial institution Nifty Chart: A Complete Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!