Decoding The Lengthy-Time period Copper Value Chart: A Century Of Tendencies, Cycles, And Future Implications

By admin / October 29, 2024 / No Comments / 2025

Decoding the Lengthy-Time period Copper Value Chart: A Century of Tendencies, Cycles, and Future Implications

Associated Articles: Decoding the Lengthy-Time period Copper Value Chart: A Century of Tendencies, Cycles, and Future Implications

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Lengthy-Time period Copper Value Chart: A Century of Tendencies, Cycles, and Future Implications. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Lengthy-Time period Copper Value Chart: A Century of Tendencies, Cycles, and Future Implications

Copper, typically dubbed "Dr. Copper" for its uncanny means to mirror the general well being of the worldwide economic system, boasts a value historical past as fascinating as it’s complicated. Analyzing its long-term chart reveals not solely the ebb and stream of financial cycles but in addition the impression of technological developments, geopolitical shifts, and evolving supply-demand dynamics. This text delves right into a complete evaluation of the long-term copper value chart, exploring its historic traits, cyclical patterns, and potential future implications.

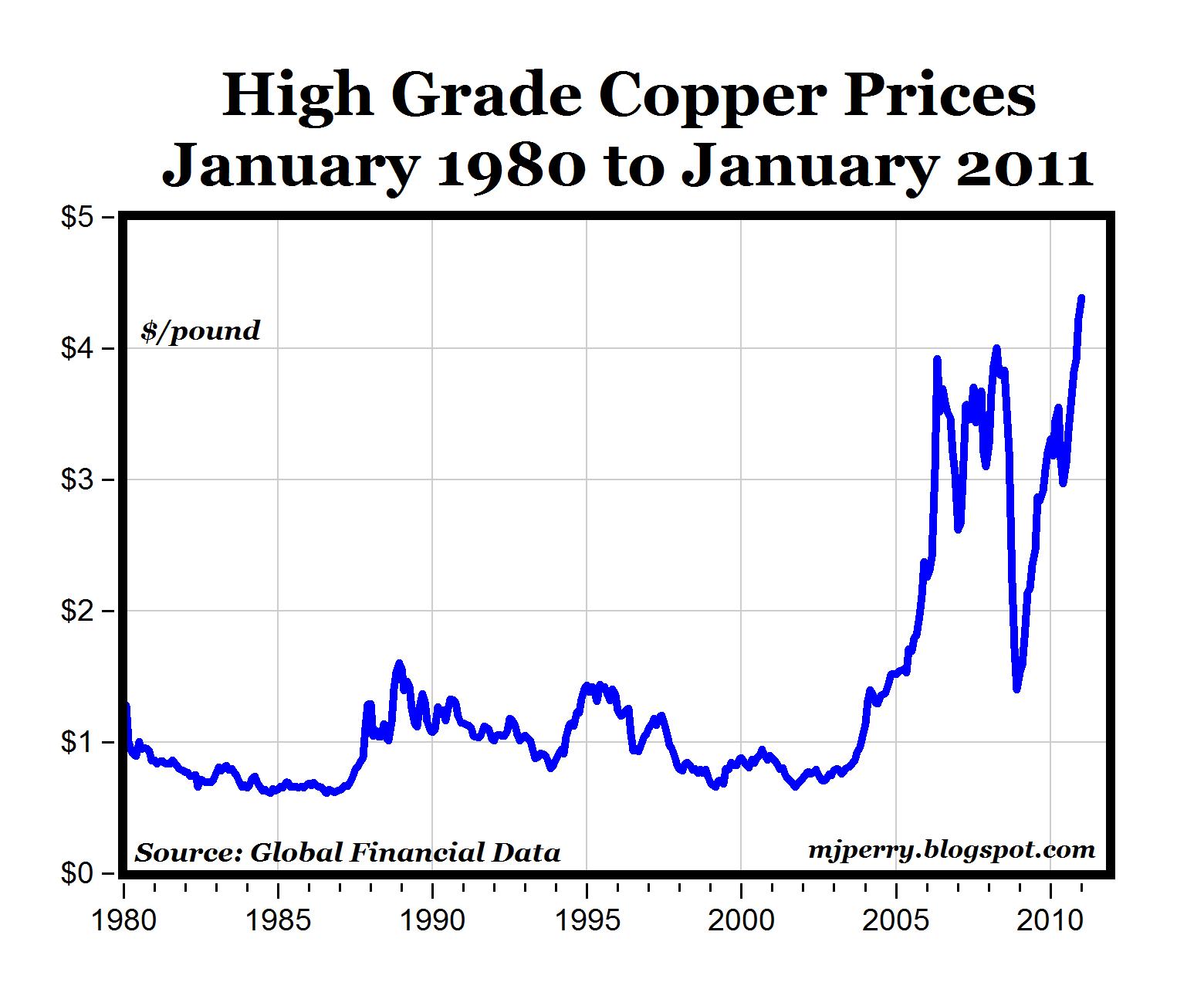

A Century of Fluctuations: From Penny Steel to Commodity King

Analyzing a century-long copper value chart, a number of distinct phases emerge. The early twentieth century noticed comparatively secure, albeit low, costs, reflecting a slower-paced world economic system and fewer intensive industrialization. The post-World Battle II period witnessed a interval of sustained development, pushed by speedy industrialization in developed and rising economies. This era noticed a big improve in copper demand, fueling value appreciation. The Seventies caused a interval of volatility, influenced by the oil disaster, inflation, and geopolitical instability. The next many years noticed intervals of each growth and bust, reflecting the cyclical nature of the worldwide economic system and the sensitivity of copper costs to macroeconomic components.

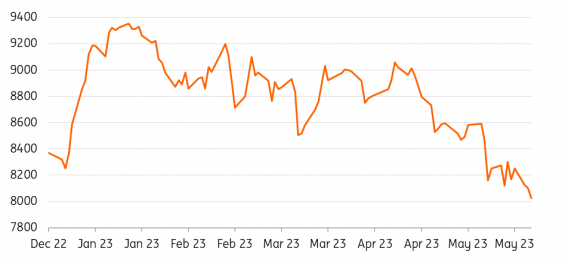

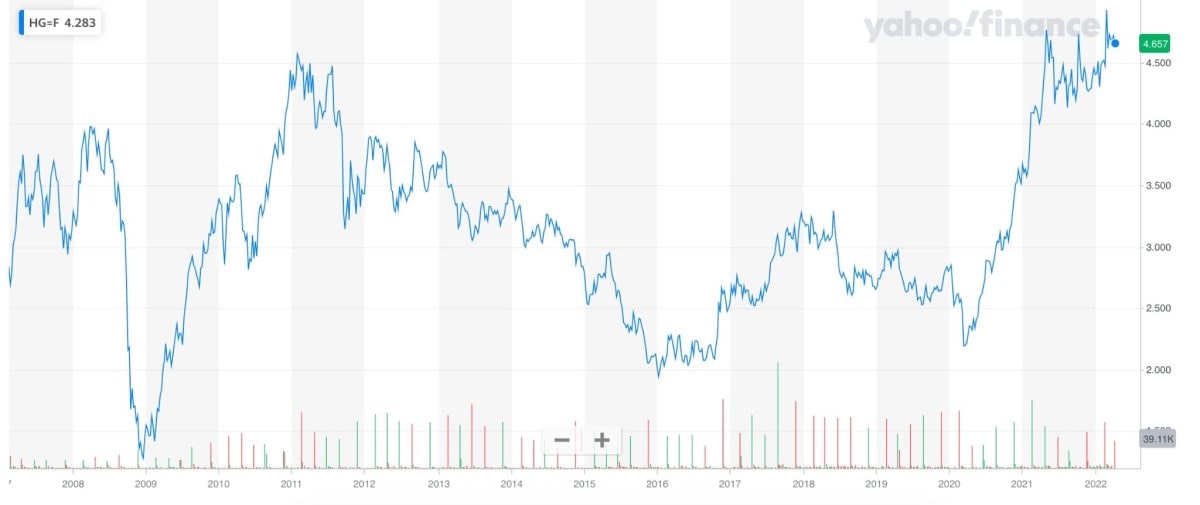

The late twentieth and early twenty first centuries noticed a extra pronounced affect of globalization and rising markets. The speedy industrialization of China, specifically, considerably boosted copper demand, driving costs to file highs within the mid-2000s. Nevertheless, the 2008 world monetary disaster led to a pointy correction, highlighting the vulnerability of copper to financial downturns. The next restoration was punctuated by intervals of each development and stagnation, reflecting the complexities of the worldwide financial panorama.

Key Elements Influencing Lengthy-Time period Copper Costs:

A number of interconnected components have traditionally formed the long-term trajectory of copper costs:

-

World Financial Development: Copper is an important enter in quite a few industrial purposes, making its demand extremely correlated with world GDP development. Intervals of sturdy financial enlargement usually translate to elevated copper consumption and better costs, whereas recessions or financial slowdowns result in decreased demand and decrease costs.

-

Technological Developments: Technological innovation has each boosted and probably dampened copper demand. The electrification of transportation, the enlargement of renewable vitality infrastructure (photo voltaic panels, wind generators), and the expansion of knowledge facilities all require vital quantities of copper. Nevertheless, developments in materials science and the event of other conductors may probably impression future copper demand.

-

Provide-Demand Dynamics: The steadiness between copper provide and demand is a important determinant of value. Provide disruptions, resembling mine closures, labor disputes, or geopolitical instability in main producing nations, can result in value spikes. Conversely, elevated mining capability or the event of recent copper deposits can exert downward strain on costs.

-

Geopolitical Elements: Political instability, commerce wars, and sanctions in main copper-producing or consuming areas can considerably impression costs. The danger of provide disruptions attributable to political turmoil typically results in value volatility.

-

Forex Fluctuations: The worth of copper, usually quoted in US {dollars}, is influenced by fluctuations in trade charges. A weakening US greenback could make copper extra engaging to worldwide consumers, probably pushing costs increased.

-

Hypothesis and Funding: The copper market is inclined to speculative buying and selling and funding flows. Massive-scale investments in copper futures contracts can amplify value swings, significantly within the brief time period.

Cyclical Patterns and Lengthy-Time period Tendencies:

Whereas the long-term copper value chart displays appreciable volatility, sure cyclical patterns are discernible:

-

Commodity Supercycles: Copper costs have traditionally adopted long-term cyclical patterns, also known as commodity supercycles. These cycles usually span a number of many years and are pushed by long-term shifts in world financial development, technological innovation, and supply-demand dynamics.

-

Enterprise Cycles: Copper costs are strongly correlated with enterprise cycles. Intervals of financial enlargement usually coincide with increased copper costs, whereas recessions or financial slowdowns typically result in value declines.

-

Stock Cycles: Modifications in copper inventories may also affect costs. Excessive stock ranges can exert downward strain on costs, whereas low stock ranges can contribute to cost will increase.

Future Implications and Predictions:

Predicting future copper costs with certainty is inconceivable, however analyzing historic traits and present market dynamics gives insights into potential future eventualities:

-

The Electrification Push: The worldwide push in the direction of electrification throughout numerous sectors is more likely to considerably improve copper demand within the coming many years. The transition to electrical autos, renewable vitality sources, and superior grid infrastructure would require huge quantities of copper.

-

Provide Constraints: The invention and improvement of recent copper mines is lagging behind the projected improve in demand. This potential provide deficit may result in sustained value will increase in the long run.

-

Technological Disruption: The potential for technological breakthroughs in supplies science may disrupt the copper market. The event of other conductors with comparable or superior properties may probably cut back copper demand in the long term.

-

Geopolitical Dangers: Geopolitical instability and potential provide disruptions stay vital dangers. The focus of copper manufacturing in a comparatively small variety of nations will increase the vulnerability of the market to political occasions.

-

Sustainability Issues: Rising issues in regards to the environmental impression of copper mining are more likely to affect future market dynamics. The demand for sustainably sourced copper is anticipated to extend, probably affecting costs.

Conclusion:

The long-term copper value chart reveals a fancy interaction of financial, technological, geopolitical, and environmental components. Whereas predicting future costs with precision is difficult, the continuing world push for electrification, potential provide constraints, and geopolitical dangers counsel that copper may stay a useful and risky commodity for the foreseeable future. Understanding the historic traits and cyclical patterns of copper costs is essential for traders, companies, and policymakers navigating this dynamic market. Continued monitoring of worldwide financial development, technological developments, and geopolitical developments is crucial for knowledgeable decision-making within the copper market. The story of copper is way from over, and its future value trajectory will proceed to mirror the evolving dynamics of the worldwide economic system.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Lengthy-Time period Copper Value Chart: A Century of Tendencies, Cycles, and Future Implications. We recognize your consideration to our article. See you in our subsequent article!