Depreciation Charts Below The Earnings Tax Act, 1961: A Complete Information

By admin / September 9, 2024 / No Comments / 2025

Depreciation Charts underneath the Earnings Tax Act, 1961: A Complete Information

Associated Articles: Depreciation Charts underneath the Earnings Tax Act, 1961: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Depreciation Charts underneath the Earnings Tax Act, 1961: A Complete Information. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Depreciation Charts underneath the Earnings Tax Act, 1961: A Complete Information

The Earnings Tax Act, 1961, permits companies to assert depreciation on their property as a deductible expense, lowering their taxable revenue. Depreciation accounts for the wear and tear and tear, obsolescence, and different components that diminish an asset’s worth over time. Understanding depreciation calculations is essential for correct tax submitting and efficient monetary planning. This text delves into the intricacies of depreciation charts as per the Earnings Tax Act, 1961, offering a complete overview for taxpayers.

The Significance of Depreciation in Tax Computation:

Depreciation is just not merely an accounting entry; it is a very important element of tax planning. By permitting depreciation deductions, the Earnings Tax Act acknowledges the gradual decline in an asset’s worth and prevents the overestimation of earnings. This finally results in a discount in tax legal responsibility, bettering the money circulate of companies. Correct depreciation calculation is due to this fact important for compliance and minimizing tax burden.

Strategies of Depreciation underneath the Earnings Tax Act, 1961:

The Earnings Tax Act offers flexibility in selecting the depreciation technique, primarily providing two choices:

-

Written Down Worth (WDV) Technique: That is probably the most generally used technique. Below this technique, depreciation is calculated on the written down worth (WDV) of the asset every year. The WDV is the unique price of the asset much less amassed depreciation. The depreciation price is utilized to the WDV, leading to a declining depreciation quantity every year.

-

Straight-Line Technique: This technique calculates depreciation uniformly over the asset’s helpful life. The annual depreciation is a hard and fast quantity, calculated by dividing the asset’s price minus its salvage worth by its helpful life. Whereas easier, it is much less generally used in comparison with the WDV technique.

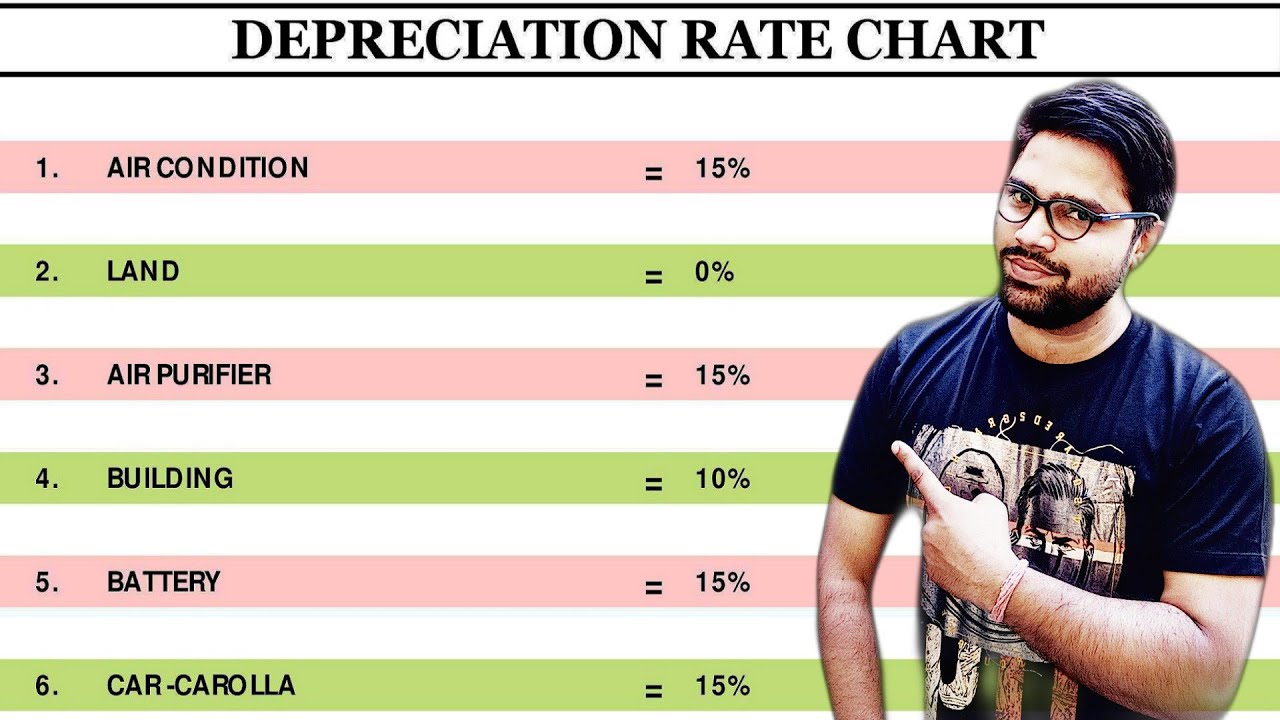

Depreciation Charges and Asset Classification:

The Earnings Tax Act specifies completely different depreciation charges for varied classes of property. These charges are essential for correct depreciation calculations. The charges are usually prescribed as a proportion of the WDV. The Act categorizes property primarily based on their nature and utilization. These classes and their related charges are topic to vary by means of amendments to the Act, so all the time confer with the most recent official notifications. Whereas an in depth itemizing of all charges is past the scope of this text, we are able to spotlight some key classes:

-

Buildings: Buildings usually have decrease depreciation charges, reflecting their longer helpful life. The speed varies primarily based on the kind of constructing and its development.

-

Plant and Equipment: These property sometimes have greater depreciation charges attributable to quicker technological obsolescence and put on and tear. Charges range considerably relying on the precise sort of equipment.

-

Furnishings and Fittings: These property even have comparatively greater depreciation charges in comparison with buildings.

-

Computer systems and Software program: These property have exceptionally excessive depreciation charges attributable to fast technological developments and quick helpful lives.

-

Intangible Belongings: The depreciation of intangible property like patents and copyrights can also be ruled by particular guidelines and charges underneath the Earnings Tax Act.

Depreciation Chart Creation:

Making a depreciation chart includes systematically making use of the chosen depreciation technique and the related price to every asset. This chart sometimes consists of the next info:

- Asset Identify and Description: A transparent identification of the asset.

- Date of Acquisition: The date when the asset was acquired.

- Authentic Price: The preliminary price of the asset, together with any set up prices.

- Helpful Life: The estimated interval over which the asset will probably be used.

- Salvage Worth (if relevant): The estimated worth of the asset on the finish of its helpful life.

- Depreciation Fee: The prescribed price for the asset class.

- Annual Depreciation: The depreciation quantity calculated for every year.

- Collected Depreciation: The whole depreciation claimed as much as a particular date.

- Written Down Worth (WDV): The remaining worth of the asset after deducting amassed depreciation.

Instance of a Depreciation Chart (WDV Technique):

Let’s illustrate with a hypothetical instance:

| Yr | Asset: Machine A | Authentic Price (₹) | Depreciation Fee (%) | Annual Depreciation (₹) | Collected Depreciation (₹) | Written Down Worth (WDV) (₹) |

|---|---|---|---|---|---|---|

| 1 | 100,000 | 15 | 15,000 | 15,000 | 85,000 | |

| 2 | 15 | 12,750 | 27,750 | 72,250 | ||

| 3 | 15 | 10,837.50 | 38,587.50 | 61,412.50 | ||

| 4 | 15 | 9,211.88 | 47,799.38 | 52,200.62 | ||

| 5 | 15 | 7,830.09 | 55,629.47 | 44,370.53 |

Observe: This can be a simplified instance. Precise depreciation calculations could contain extra complicated components, equivalent to changes for additions, disposals, and adjustments in depreciation charges.

Amendments and Updates:

The Earnings Tax Act is periodically amended, resulting in adjustments in depreciation charges and guidelines. It is essential to remain up to date with the most recent amendments to make sure correct depreciation calculations. Taxpayers ought to confer with the official notifications and circulars issued by the Earnings Tax Division.

Software program and Instruments:

A number of software program functions and on-line instruments can be found to simplify depreciation calculations. These instruments automate the method, lowering the probabilities of errors and saving time. Selecting a dependable software program is essential for correct and environment friendly tax compliance.

Looking for Skilled Recommendation:

Depreciation calculations may be complicated, significantly for companies with numerous property or these coping with specialised asset classes. Looking for recommendation from a professional chartered accountant or tax skilled is very really helpful to make sure correct compliance and optimize tax advantages. They’ll present steerage on selecting the suitable depreciation technique, making use of the proper charges, and dealing with any particular circumstances.

Conclusion:

Depreciation charts are an integral a part of tax compliance underneath the Earnings Tax Act, 1961. Correct depreciation calculations are important for lowering tax liabilities and bettering monetary reporting. Understanding the completely different strategies, charges, and related laws is significant for companies of all sizes. Whereas this text offers a complete overview, in search of skilled recommendation is all the time really helpful to make sure correct compliance and maximize tax advantages. Repeatedly reviewing and updating depreciation charts primarily based on adjustments within the Act and asset acquisitions/disposals is essential for sustaining correct monetary data and complying with tax laws.

Closure

Thus, we hope this text has offered helpful insights into Depreciation Charts underneath the Earnings Tax Act, 1961: A Complete Information. We respect your consideration to our article. See you in our subsequent article!