Chart Sample Alerts: Your Early Warning System In The Markets

By admin / August 6, 2024 / No Comments / 2025

Chart Sample Alerts: Your Early Warning System within the Markets

Associated Articles: Chart Sample Alerts: Your Early Warning System within the Markets

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart Sample Alerts: Your Early Warning System within the Markets. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Chart Sample Alerts: Your Early Warning System within the Markets

The monetary markets are a fancy ecosystem, pushed by a confluence of financial indicators, investor sentiment, and unpredictable occasions. Navigating this panorama efficiently requires a eager eye for element and the flexibility to anticipate market actions. Whereas no system ensures revenue, chart sample alerts can present a big benefit, appearing as an early warning system for potential buying and selling alternatives or impending dangers. This text delves into the world of chart sample alerts, exploring their significance, numerous sorts, limitations, and the best way to successfully make the most of them in your buying and selling technique.

Understanding Chart Patterns: The Language of the Market

Chart patterns symbolize visually identifiable formations on value charts that, traditionally, have proven a statistically important likelihood of resulting in particular value actions. These patterns are shaped by the collective actions of consumers and sellers, reflecting the underlying market sentiment and momentum. Recognizing these patterns may help merchants anticipate future value route, doubtlessly resulting in extra knowledgeable and well timed buying and selling selections. The patterns themselves are sometimes categorized into two broad teams: continuation patterns and reversal patterns.

Continuation Patterns: Using the Wave

Continuation patterns counsel that the prevailing pattern will seemingly proceed after a brief pause or consolidation. These patterns symbolize durations of relaxation earlier than the dominant pattern resumes its course. Widespread continuation patterns embody:

-

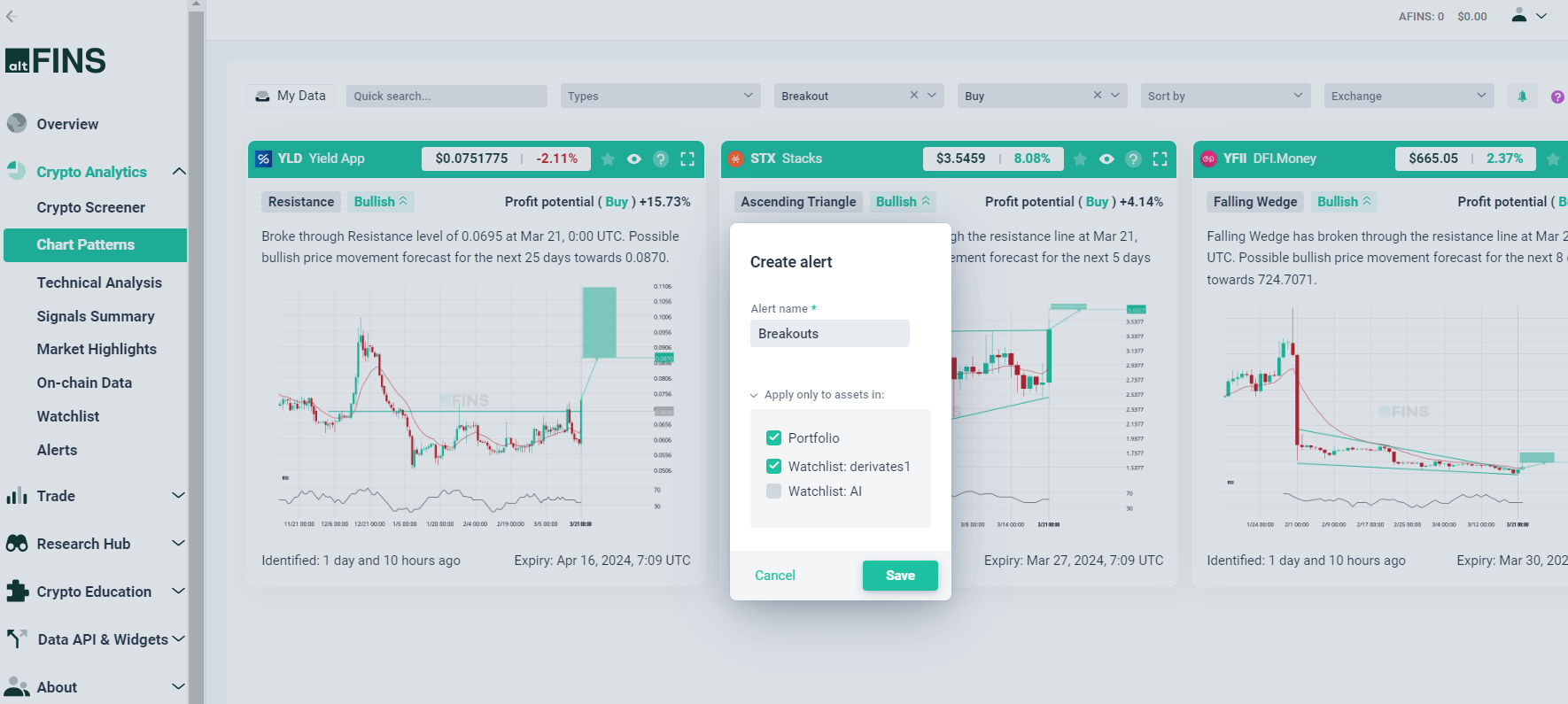

Triangles: Triangles are characterised by converging trendlines, indicating a interval of indecision between consumers and sellers. There are three fundamental sorts: symmetrical, ascending, and descending. Symmetrical triangles counsel a continuation of the earlier pattern, whereas ascending triangles counsel a bullish continuation and descending triangles counsel a bearish continuation. Alerts primarily based on triangle breakouts can sign a resumption of the underlying pattern.

-

Flags and Pennants: These patterns resemble small flags or pennants connected to a flagpole representing the prevailing pattern. Flags are characterised by parallel trendlines, whereas pennants have converging trendlines. Breakouts from these patterns usually sign a continuation of the previous pattern with elevated momentum. Alerts triggered by flagpole breakouts can point out a powerful directional transfer.

-

Rectangles: Rectangles are characterised by horizontal help and resistance ranges. Value consolidates inside these ranges earlier than ultimately breaking out, normally persevering with within the route of the previous pattern. Alerts primarily based on rectangle breakouts can signify a resumption of the dominant pattern.

Reversal Patterns: Turning the Tide

Reversal patterns counsel a possible shift within the prevailing pattern. These patterns point out a change in market sentiment, with consumers or sellers gaining the higher hand. Figuring out these patterns could be essential for avoiding losses or capitalizing on new tendencies. Some frequent reversal patterns embody:

-

Head and Shoulders: This traditional reversal sample consists of three peaks, with the center peak (the top) being the very best. A neckline connects the troughs of the 2 outer peaks. A break beneath the neckline usually alerts a bearish reversal. Alerts primarily based on neckline breakouts can present early warnings of a possible pattern reversal.

-

Inverse Head and Shoulders: That is the mirror picture of the top and shoulders sample, indicating a possible bullish reversal. A break above the neckline usually alerts a bullish pattern resumption. Alerts primarily based on neckline breakouts can sign the start of an upward pattern.

-

Double Tops and Double Bottoms: These patterns encompass two comparable peaks (double prime) or troughs (double backside). A break beneath the help degree of a double prime or above the resistance degree of a double backside usually alerts a reversal. Alerts primarily based on these breakouts can present well timed alerts for pattern reversals.

-

Wedges: Wedges are characterised by converging trendlines, however in contrast to triangles, they slope in the other way of the previous pattern. Ascending wedges counsel a bearish reversal, whereas descending wedges counsel a bullish reversal. Alerts primarily based on wedge breakouts can signify a pattern change.

Using Chart Sample Alerts Successfully

Whereas chart patterns supply helpful insights, they aren’t foolproof predictors. Efficient utilization requires a multi-faceted strategy:

-

Affirmation is Key: Relying solely on chart sample alerts is dangerous. At all times affirm the sign with different technical indicators (e.g., RSI, MACD, quantity) and elementary evaluation to extend the likelihood of a profitable commerce.

-

Danger Administration: Implement strict threat administration methods, together with stop-loss orders and place sizing, to restrict potential losses. By no means threat greater than you may afford to lose.

-

Context Issues: Think about the broader market context and the particular asset’s traits earlier than appearing on an alert. Financial information, geopolitical occasions, and company-specific elements can considerably influence value actions.

-

False Alerts: Be ready for false alerts. Not each sample will result in the expected value motion. Study to distinguish between dependable and unreliable patterns by way of expertise and backtesting.

-

Automation and Software program: Many buying and selling platforms supply automated chart sample recognition and alert techniques. These instruments can considerably improve effectivity, however they need to be used judiciously and at the side of guide evaluation.

Limitations of Chart Sample Alerts

It is essential to acknowledge the inherent limitations of chart sample alerts:

-

Subjectivity: Figuring out chart patterns could be subjective, with completely different merchants decoding the identical sample otherwise. This may result in inconsistencies in sign era.

-

Lagging Indicator: Chart patterns are lagging indicators, which means they establish tendencies after they’ve already begun. This may restrict the potential for maximizing income.

-

Market Noise: Market noise can obscure true patterns, making identification tough. That is very true in risky markets.

-

Over-reliance: Over-reliance on chart patterns can result in missed alternatives and poor decision-making. A holistic strategy that integrates a number of analytical strategies is essential.

Conclusion: A Helpful Device, Not a Crystal Ball

Chart sample alerts are a helpful instrument in a dealer’s arsenal, offering early warnings of potential market actions. Nevertheless, they aren’t a crystal ball. Efficient utilization requires an intensive understanding of varied patterns, affirmation by way of different analytical strategies, strong threat administration, and a practical evaluation of their limitations. By combining chart sample alerts with sound buying and selling rules and disciplined threat administration, merchants can considerably improve their decision-making course of and enhance their possibilities of success within the dynamic world of economic markets. Keep in mind, constant studying, adaptation, and disciplined execution are key to long-term success in buying and selling.

.png.jpg?itok=418Ci-co)

Closure

Thus, we hope this text has supplied helpful insights into Chart Sample Alerts: Your Early Warning System within the Markets. We respect your consideration to our article. See you in our subsequent article!