Mastering Multi-Chart Evaluation: Unleashing The Energy Of Two Charts In One TradingView Format

By admin / October 28, 2024 / No Comments / 2025

Mastering Multi-Chart Evaluation: Unleashing the Energy of Two Charts in One TradingView Format

Associated Articles: Mastering Multi-Chart Evaluation: Unleashing the Energy of Two Charts in One TradingView Format

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Mastering Multi-Chart Evaluation: Unleashing the Energy of Two Charts in One TradingView Format. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Mastering Multi-Chart Evaluation: Unleashing the Energy of Two Charts in One TradingView Format

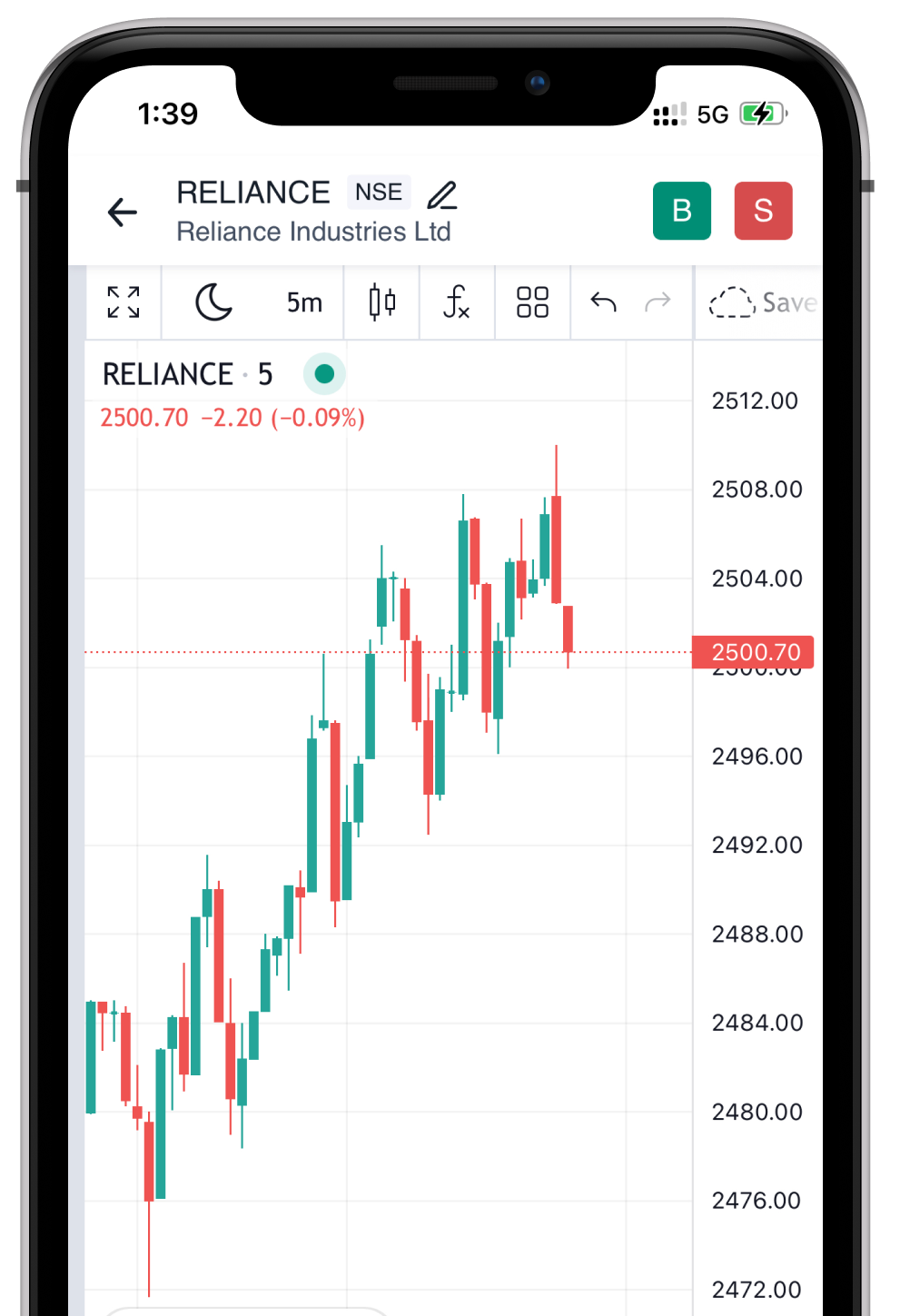

TradingView’s energy lies not simply in its particular person charting capabilities, however in its flexibility to rearrange a number of charts for complete market evaluation. Whereas many merchants make the most of single-chart setups, leveraging the facility of two charts concurrently inside a single structure considerably enhances buying and selling technique improvement and execution. This text explores the strategic benefits of using a dual-chart structure on TradingView, providing sensible examples and configurations to maximise your analytical prowess.

Why Two Charts are Higher Than One:

The human mind thrives on visible comparisons. A single chart, whereas informative, can usually lack the contextual depth wanted for assured decision-making. Incorporating a second chart permits for a richer, extra nuanced understanding of value motion, indicator alerts, and total market dynamics. This dual-perspective strategy allows merchants to:

- Verify Alerts: A major chart may present a bullish breakout, however a secondary chart, maybe specializing in a distinct timeframe or indicator, can present affirmation or disconfirmation, mitigating false alerts.

- Determine Divergences: Observing discrepancies between value motion and indicator momentum throughout two charts can reveal potential reversals or continuation patterns.

- Analyze Correlation: Evaluating the worth actions of associated property (e.g., a inventory and its ETF) on separate charts inside the similar structure facilitates the identification of correlated or inversely correlated behaviors.

- Enhance Threat Administration: A second chart, probably displaying a broader timeframe or a distinct asset class, can present a macro perspective, aiding within the evaluation of total market danger and the positioning of trades inside a bigger context.

- Improve Entry and Exit Methods: Combining charts with totally different timeframes permits for exact entry and exit factors, leveraging short-term momentum whereas sustaining alignment with long-term traits.

Optimum Chart Combos and Configurations:

The simplest dual-chart setup relies upon closely on particular person buying and selling methods and most popular indicators. Nonetheless, some common and extremely efficient combos embody:

1. Multi-Timeframe Evaluation:

That is arguably the most typical and versatile strategy. One chart shows the next timeframe (e.g., each day or weekly) to determine the overarching pattern, whereas the second chart reveals a decrease timeframe (e.g., hourly or 15-minute) to pinpoint exact entry and exit factors.

-

Instance: The first chart shows the each day chart of Apple (AAPL) with a 200-day shifting common. The secondary chart reveals the 1-hour chart of AAPL, specializing in figuring out breakouts or pullbacks inside the context of the each day pattern. This enables the dealer to determine an extended place on the each day uptrend, confirmed by a bullish breakout on the hourly chart.

-

TradingView Implementation: Simply achieved by including a brand new chart panel under or beside the prevailing one. Alter the timeframe selector for every chart independently.

2. Complementary Indicator Evaluation:

This strategy makes use of two charts displaying the identical asset and timeframe however with totally different indicators. This helps to cross-validate alerts and determine potential divergences.

-

Instance: Each charts show the each day chart of Bitcoin (BTC). The first chart makes use of a Relative Power Index (RSI) to determine overbought and oversold situations. The secondary chart employs a Transferring Common Convergence Divergence (MACD) to substantiate momentum shifts. A bearish divergence between value and RSI, coupled with a bearish MACD crossover, may sign a possible brief alternative.

-

TradingView Implementation: Create two an identical charts of the identical asset and timeframe. Modify the indicator settings for every chart to show the specified indicators (RSI on one, MACD on the opposite).

3. Correlation Evaluation:

This technique entails evaluating the worth actions of two associated property.

-

Instance: One chart shows the worth of the S&P 500 index (SPY), whereas the second chart reveals the worth of a particular sector ETF (e.g., Expertise Choose Sector SPDR Fund (XLK)). This enables the dealer to look at how the sector’s efficiency correlates with the broader market. A robust optimistic correlation may counsel {that a} bullish transfer in SPY is prone to be accompanied by a bullish transfer in XLK.

-

TradingView Implementation: Add two separate charts, one for SPY and one for XLK. Think about using synchronized timeframes for straightforward comparability.

4. Totally different Asset Class Evaluation:

This strategy presents a macro perspective by evaluating the efficiency of various asset lessons.

-

Instance: One chart shows the worth of gold (XAUUSD), whereas the second chart reveals the worth of the US Greenback Index (DXY). This enables the dealer to evaluate the connection between the safe-haven asset (gold) and the US greenback. A weakening greenback (falling DXY) usually correlates with a strengthening gold value, providing potential buying and selling alternatives.

-

TradingView Implementation: Much like correlation evaluation, add two separate charts, one for every asset. Think about using comparable timeframes for higher comparability.

Optimizing Your TradingView Format:

- Display Actual Property: Maximize your display actual property by adjusting the scale and place of every chart panel. TradingView permits for versatile customization.

- Shade Coordination: Keep constant colour schemes throughout each charts to keep away from visible litter and enhance readability.

- Indicator Readability: Keep away from overcrowding your charts with too many indicators. Concentrate on a choose few that present probably the most related info.

- Time Synchronization: Whereas not at all times crucial, synchronizing the timeframes on each charts can simplify comparability and evaluation.

- Labeling and Annotation: Use TradingView’s annotation instruments to obviously label vital value ranges, help/resistance areas, and key indicator alerts.

Conclusion:

Using a dual-chart structure in TradingView is a robust approach to reinforce your buying and selling evaluation. By rigorously choosing the suitable chart combos and optimizing your structure, you possibly can acquire a deeper understanding of market dynamics, enhance sign affirmation, and refine your danger administration methods. Experiment with totally different chart configurations and indicator combos to find the setup that most accurately fits your particular person buying and selling type and preferences. Do not forget that constant observe and disciplined evaluation are key to mastering the artwork of multi-chart buying and selling. The facility of two charts is not only about seeing extra information; it is about gaining a extra complete and nuanced perspective, resulting in extra knowledgeable and worthwhile buying and selling selections.

Closure

Thus, we hope this text has supplied useful insights into Mastering Multi-Chart Evaluation: Unleashing the Energy of Two Charts in One TradingView Format. We hope you discover this text informative and useful. See you in our subsequent article!