Navigating The Yen-Greenback Trade Price: A Complete Information With Conversion Chart

By admin / October 16, 2024 / No Comments / 2025

Navigating the Yen-Greenback Trade Price: A Complete Information with Conversion Chart

Associated Articles: Navigating the Yen-Greenback Trade Price: A Complete Information with Conversion Chart

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Navigating the Yen-Greenback Trade Price: A Complete Information with Conversion Chart. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Navigating the Yen-Greenback Trade Price: A Complete Information with Conversion Chart

The Japanese yen (JPY) and the US greenback (USD) are two of the world’s most closely traded currencies. Understanding their trade price is essential for anybody concerned in worldwide enterprise, journey, or funding involving Japan and the US. This text gives a complete information to changing yen to {dollars}, together with an in depth conversion chart, a proof of things influencing the trade price, and ideas for getting the perfect trade charges.

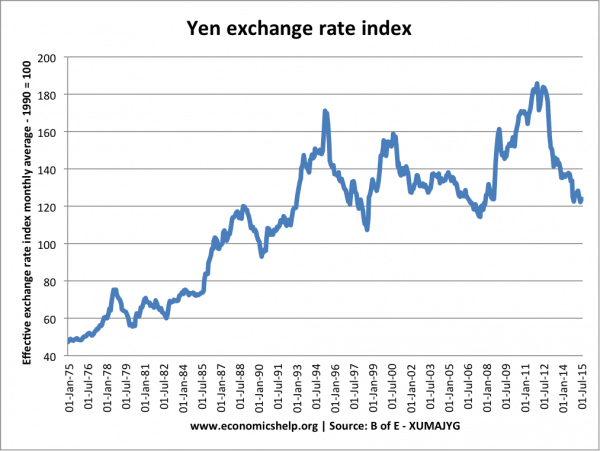

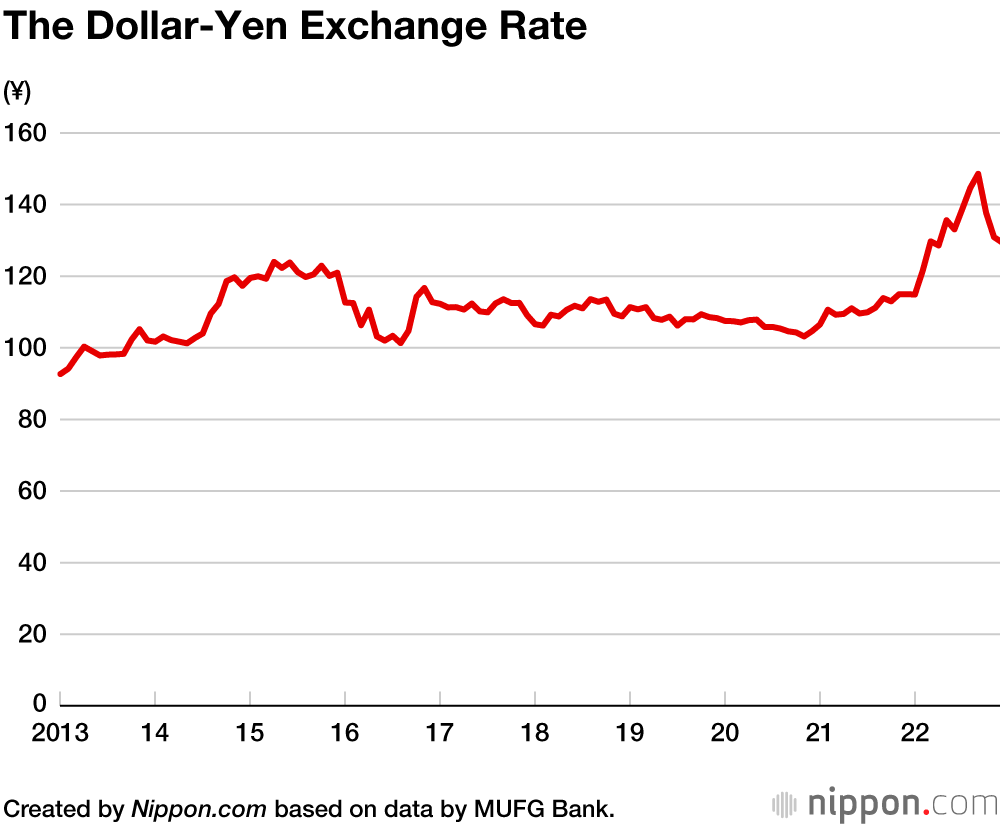

Understanding the Yen-Greenback Trade Price

The yen-dollar trade price, represented as JPY/USD or USD/JPY, signifies what number of yen are wanted to buy one US greenback (JPY/USD) or vice-versa (USD/JPY). For instance, a price of 130 JPY/USD implies that 1 US greenback could be exchanged for 130 Japanese yen. Conversely, a price of 0.0077 USD/JPY signifies that 1 Japanese yen could be exchanged for about 0.0077 US {dollars}. These charges continuously fluctuate primarily based on numerous financial and political components.

Components Influencing the Yen-Greenback Trade Price

A number of components contribute to the volatility of the yen-dollar trade price:

-

Curiosity Price Differentials: Variations in rates of interest between the US and Japan considerably influence the trade price. Increased rates of interest within the US typically appeal to international funding, growing demand for the greenback and strengthening it in opposition to the yen. Conversely, increased rates of interest in Japan would strengthen the yen. The Federal Reserve’s financial coverage choices and the Financial institution of Japan’s actions are key drivers right here.

-

Financial Development: Sturdy financial development within the US relative to Japan tends to extend demand for the greenback, strengthening it in opposition to the yen. Components like GDP development, inflation, employment figures, and client confidence all play a task. Equally, constructive financial information from Japan can strengthen the yen.

-

Political Stability and Geopolitical Occasions: Political uncertainty or instability in both nation can negatively have an effect on its foreign money. International geopolitical occasions, similar to worldwide conflicts or commerce wars, can even considerably influence trade charges. For instance, heightened world tensions may lead traders to hunt secure haven belongings just like the yen, strengthening it briefly.

-

Authorities Intervention: Central banks can intervene within the international trade market to affect the trade price. For instance, the Financial institution of Japan may promote yen to weaken it if it believes a robust yen is harming exports. Such interventions are normally rare and thoroughly thought-about.

-

Market Sentiment and Hypothesis: Investor sentiment and hypothesis play a major function in short-term fluctuations. Information reviews, analyst predictions, and market rumors can all affect the trade price, resulting in short-term volatility.

-

Commerce Balances: A big commerce surplus for Japan (exporting greater than importing) can strengthen the yen, whereas a commerce deficit would weaken it. The other holds true for the US.

-

Commodity Costs: Modifications within the value of key commodities, similar to oil, can affect each the US and Japanese economies, thereby affecting the trade price. A surge in oil costs, for instance, can weaken each currencies, however the influence is perhaps totally different relying on every nation’s dependence on imported oil.

Yen to USD Conversion Chart (Illustrative)

The next chart gives an illustrative instance of yen to USD conversion at totally different trade charges. It’s essential to grasp that these are pattern charges and the precise trade price will differ continuously. All the time verify a stay foreign money converter for essentially the most up-to-date data earlier than making any transactions.

| Yen (JPY) | USD (at 130 JPY/USD) | USD (at 135 JPY/USD) | USD (at 140 JPY/USD) |

|---|---|---|---|

| 10,000 | $76.92 | $74.07 | $71.43 |

| 20,000 | $153.85 | $148.15 | $142.86 |

| 50,000 | $384.62 | $370.37 | $357.14 |

| 100,000 | $769.23 | $740.74 | $714.29 |

| 500,000 | $3,846.15 | $3,703.70 | $3,571.43 |

| 1,000,000 | $7,692.31 | $7,407.41 | $7,142.86 |

Utilizing a Foreign money Converter

Quite a few on-line foreign money converters can be found to offer real-time trade charges. These converters are typically dependable and handy for fast conversions. Nevertheless, do not forget that the charges displayed are normally indicative and should not mirror the precise price you may get from a financial institution or trade service.

Getting the Finest Trade Charges

To acquire essentially the most favorable trade charges, think about the next:

-

Evaluate Charges: Verify a number of banks, foreign money trade bureaus, and on-line companies earlier than making a transaction. Charges can differ considerably between suppliers.

-

Use a Debit or Credit score Card with Favorable Trade Charges: Some banks and bank card firms supply higher trade charges than others. Verify your card’s phrases and circumstances.

-

Keep away from Airport Trade Bureaus: Airport trade bureaus typically cost increased charges and supply much less favorable charges.

-

Switch Sensible or Related Providers: Providers like TransferWise (now Sensible) typically present aggressive trade charges and clear charges for worldwide cash transfers.

-

Timing: The trade price fluctuates continuously, so timing your transaction could be essential. Monitoring the speed and performing when it is favorable can prevent cash.

Conclusion

Understanding the yen-dollar trade price is crucial for anybody coping with monetary transactions between Japan and the US. Whereas this text gives a complete overview, the dynamic nature of the trade price necessitates steady monitoring and knowledgeable decision-making. By understanding the components influencing the trade price and using the out there assets, people and companies can successfully handle their foreign money conversions and decrease potential losses. Bear in mind to at all times use a dependable, up-to-date foreign money converter and examine charges from totally different suppliers earlier than making any transactions. This proactive method will make sure you safe the very best trade price on your wants.

![Yen/Dollar exchange rate Source: Bank of Japan [1] Download](https://www.researchgate.net/publication/334522957/figure/download/fig3/AS:781724711665666@1563389103434/Yen-Dollar-exchange-rate-Source-Bank-of-Japan-1.png)

Closure

Thus, we hope this text has supplied precious insights into Navigating the Yen-Greenback Trade Price: A Complete Information with Conversion Chart. We admire your consideration to our article. See you in our subsequent article!