Decoding The QQQ Inventory Value: A Deep Dive Into Yahoo Finance’s Chart And Its Implications

By admin / June 20, 2024 / No Comments / 2025

Decoding the QQQ Inventory Value: A Deep Dive into Yahoo Finance’s Chart and its Implications

Associated Articles: Decoding the QQQ Inventory Value: A Deep Dive into Yahoo Finance’s Chart and its Implications

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the QQQ Inventory Value: A Deep Dive into Yahoo Finance’s Chart and its Implications. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the QQQ Inventory Value: A Deep Dive into Yahoo Finance’s Chart and its Implications

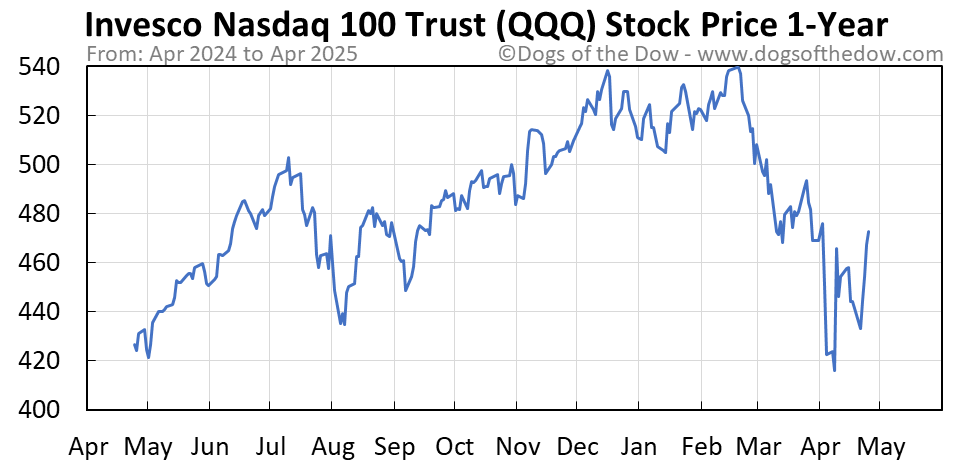

The Invesco QQQ Belief (QQQ) is a well-liked exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. Its worth actions, readily seen on Yahoo Finance and different monetary platforms, function a strong barometer of the know-how sector and, to a bigger extent, the general US inventory market. Analyzing the QQQ inventory worth chart on Yahoo Finance, subsequently, affords beneficial insights into market traits, investor sentiment, and potential funding alternatives. This text will delve into the intricacies of deciphering the QQQ chart on Yahoo Finance, exploring numerous technical indicators, basic components, and their mixed affect on worth fluctuations.

Understanding the Yahoo Finance QQQ Chart:

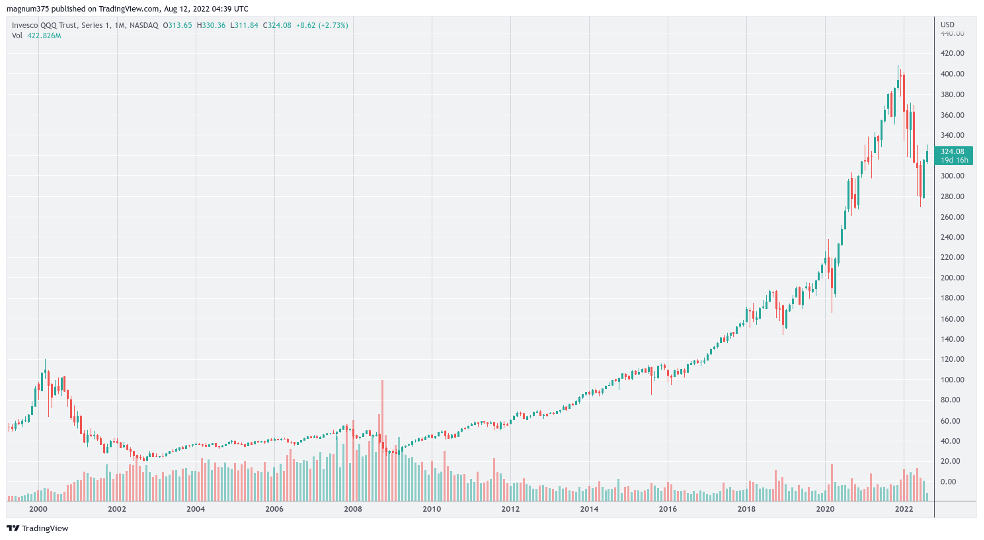

Yahoo Finance supplies a complete charting software for QQQ, permitting customers to visualise the ETF’s worth historical past throughout numerous timeframes, from intraday to a long time. The essential chart shows the worth (normally closing worth) over the chosen interval, sometimes represented as a candlestick or line graph. Crucially, Yahoo Finance permits customers to overlay quite a few technical indicators, drawing instruments, and basic knowledge factors, enhancing analytical capabilities.

Key Parts of the Yahoo Finance QQQ Chart:

- Value Axis (Y-axis): Represents the QQQ worth, normally in USD.

- Time Axis (X-axis): Represents the time interval chosen, starting from minutes to years.

- Candlesticks/Line Graph: Candlesticks visually signify the opening, closing, excessive, and low costs for a given interval. Line graphs join closing costs, providing a less complicated visible illustration.

- Quantity: A vital indicator displayed alongside the worth chart, representing the variety of QQQ shares traded throughout every interval. Excessive quantity typically accompanies important worth actions.

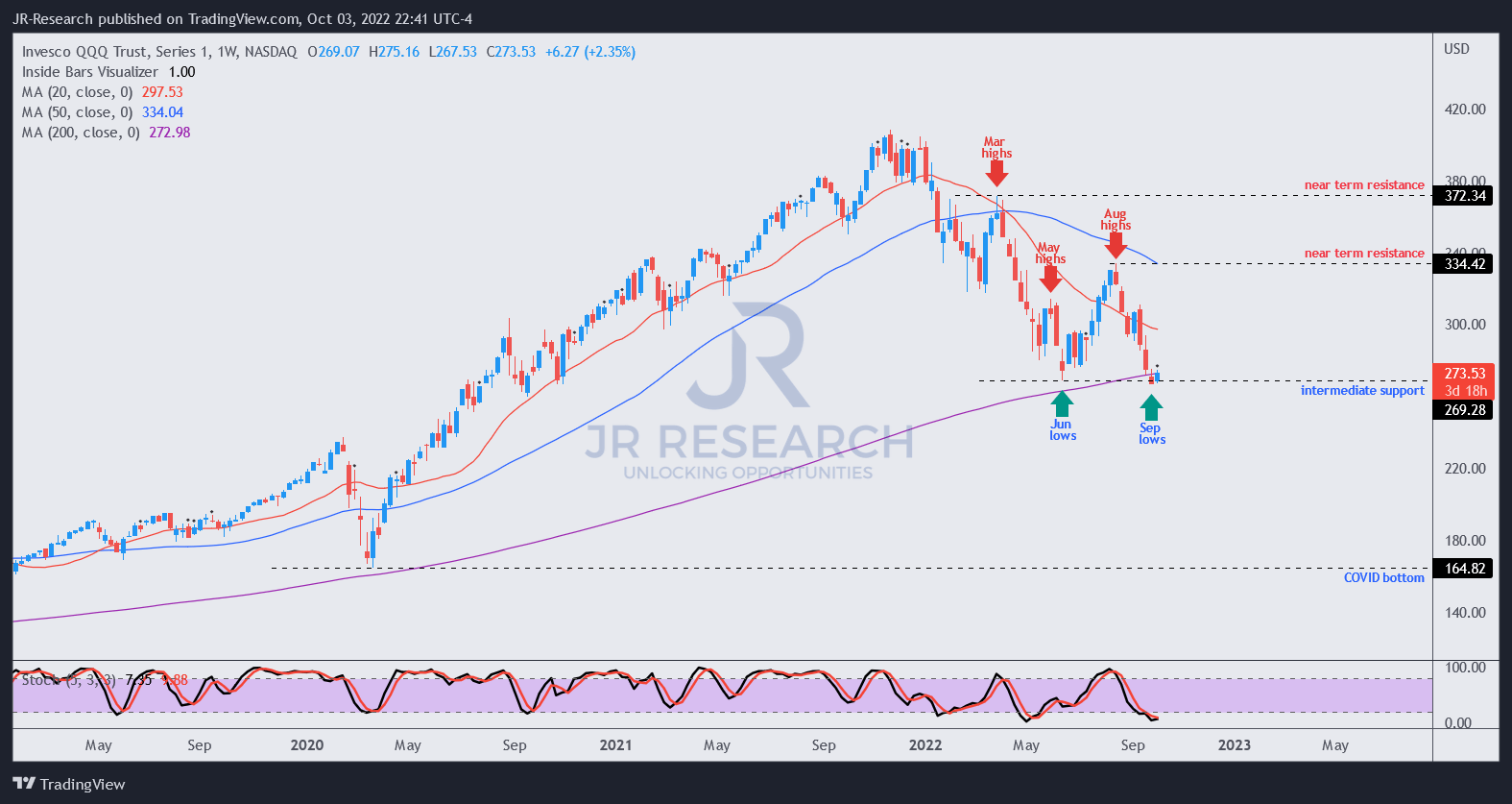

- Technical Indicators: Yahoo Finance permits customers so as to add numerous technical indicators, equivalent to transferring averages (MA), Relative Power Index (RSI), MACD (Shifting Common Convergence Divergence), Bollinger Bands, and others. These indicators present alerts about potential worth traits, momentum, and overbought/oversold circumstances.

- Drawing Instruments: Instruments like development traces, Fibonacci retracements, and help/resistance ranges enable customers to determine potential worth targets and reversal factors.

Deciphering Value Motion and Technical Indicators:

Analyzing the QQQ chart includes deciphering worth motion at the side of technical indicators. For example:

- Shifting Averages: Shifting averages clean out worth fluctuations, highlighting underlying traits. A 50-day MA crossing above a 200-day MA (a "golden cross") is usually thought of a bullish sign, suggesting a possible uptrend. The reverse ("dying cross") can point out a bearish development.

- Relative Power Index (RSI): RSI measures the magnitude of latest worth adjustments to judge overbought (above 70) and oversold (under 30) circumstances. These ranges typically sign potential worth reversals.

- MACD: MACD identifies adjustments in momentum by evaluating two transferring averages. Crossovers of the MACD line above its sign line can recommend bullish momentum, whereas the other can sign bearish momentum.

- Bollinger Bands: Bollinger Bands present worth volatility by plotting customary deviations round a transferring common. Costs touching the higher band may recommend an overbought situation, whereas touching the decrease band might sign an oversold situation.

- Assist and Resistance Ranges: These are worth ranges the place the worth has traditionally struggled to interrupt by means of. Assist ranges signify potential shopping for alternatives, whereas resistance ranges could point out potential promoting strain.

Basic Elements Influencing QQQ Value:

Whereas technical evaluation supplies insights into worth actions, understanding the underlying basic components is essential for a complete evaluation. Key components influencing QQQ’s worth embrace:

- Nasdaq-100 Efficiency: QQQ straight tracks the Nasdaq-100 Index, which is closely weighted in direction of large-cap know-how corporations. The efficiency of those corporations considerably impacts QQQ’s worth. Sturdy earnings reviews, revolutionary product launches, and constructive trade traits typically enhance QQQ’s worth.

- Curiosity Charges: Rising rates of interest can negatively affect know-how corporations, as they typically depend on debt financing and future progress projections. Greater rates of interest enhance borrowing prices and may depress valuations, probably resulting in a decline in QQQ’s worth.

- Financial Progress: Sturdy financial progress typically advantages know-how corporations, resulting in elevated demand for his or her services and products. Conversely, financial slowdowns or recessions can negatively affect QQQ’s worth.

- Geopolitical Occasions: International occasions, equivalent to commerce wars, political instability, or pandemics, can create uncertainty available in the market and considerably affect QQQ’s worth.

- Regulatory Adjustments: Adjustments in rules affecting the know-how sector can affect the efficiency of particular person corporations inside the Nasdaq-100 and, consequently, QQQ’s worth.

Combining Technical and Basic Evaluation:

Efficient QQQ worth evaluation requires integrating technical and basic evaluation. Technical indicators can present short-term buying and selling alerts, whereas basic evaluation helps assess the long-term prospects of the underlying corporations and the general market surroundings. For instance, a bullish technical setup is perhaps strengthened by constructive earnings reviews from main know-how corporations, indicating a better likelihood of sustained worth appreciation.

Dangers and Issues:

Investing in QQQ, like several funding, carries dangers. The ETF’s heavy weighting within the know-how sector makes it vulnerable to sector-specific dangers. Moreover, the Nasdaq-100 is understood for its volatility, which means QQQ’s worth can expertise important fluctuations. Traders ought to fastidiously contemplate their threat tolerance and funding targets earlier than investing in QQQ.

Conclusion:

The Yahoo Finance QQQ inventory worth chart supplies a wealth of knowledge for traders looking for to grasp the know-how sector and the broader market. By combining technical evaluation of worth motion and indicators with an understanding of basic components, traders can develop a extra complete view of QQQ’s worth actions and make knowledgeable funding selections. Nevertheless, it is essential to do not forget that no analytical technique ensures success, and threat administration stays paramount in any funding technique. Steady monitoring of the chart, alongside staying abreast of related information and financial developments, is significant for navigating the dynamic panorama of the know-how sector and making sound funding decisions. Keep in mind to at all times seek the advice of with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the QQQ Inventory Value: A Deep Dive into Yahoo Finance’s Chart and its Implications. We thanks for taking the time to learn this text. See you in our subsequent article!