Chart Patterns: A Complete Information With Photos (PDF Downloadable)

By admin / August 31, 2024 / No Comments / 2025

Chart Patterns: A Complete Information with Photos (PDF Downloadable)

Associated Articles: Chart Patterns: A Complete Information with Photos (PDF Downloadable)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Patterns: A Complete Information with Photos (PDF Downloadable). Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Chart Patterns: A Complete Information with Photos (PDF Downloadable)

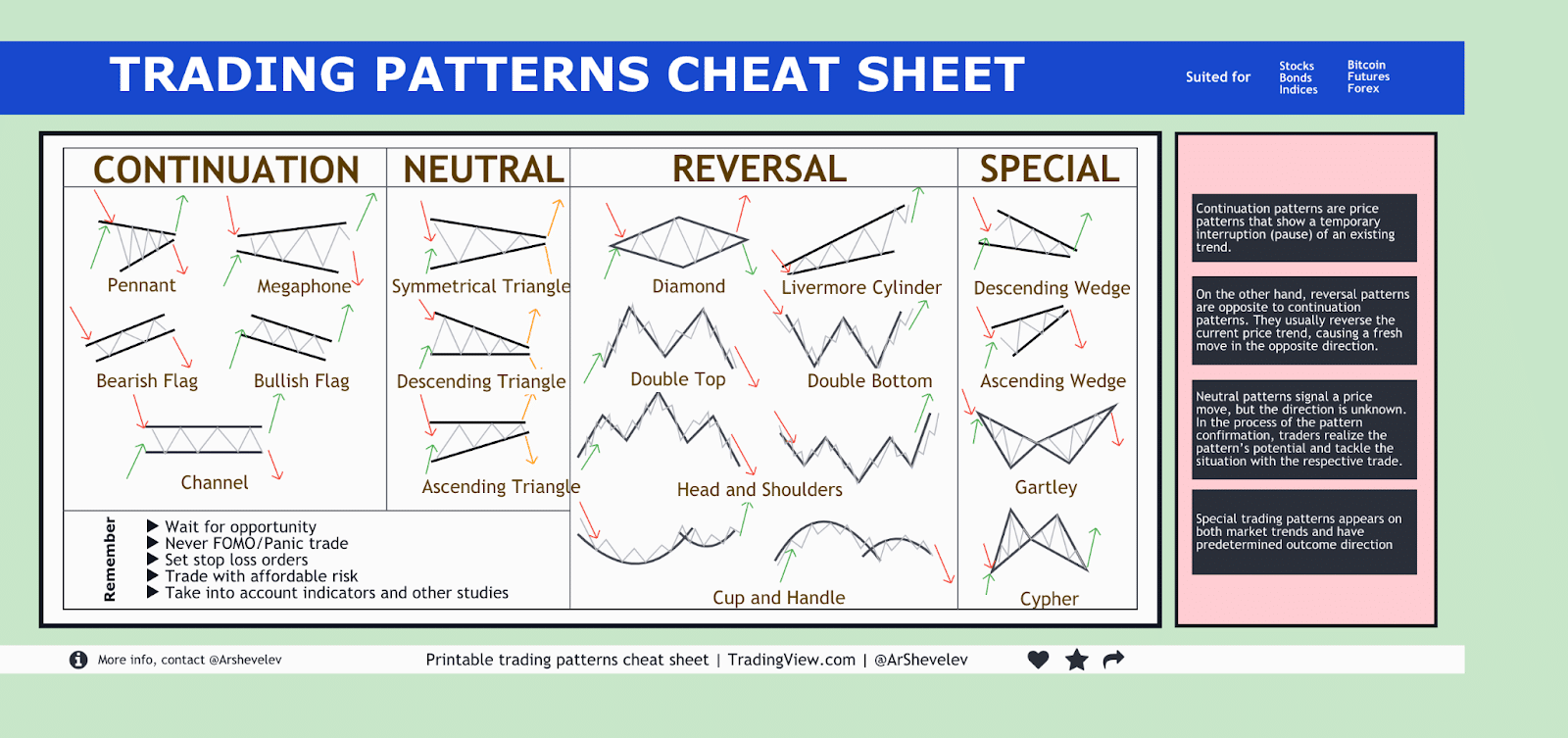

Technical evaluation, a cornerstone of profitable buying and selling, depends closely on figuring out recurring chart patterns. These patterns, fashioned by value actions over time, provide worthwhile insights into potential future value path and volatility. Whereas indicators present numerical information, chart patterns provide a visible illustration of market sentiment and momentum, permitting merchants to anticipate shifts out there. This text delves into the world of chart patterns, offering an in depth overview of varied formations, their interpretations, and sensible purposes, complemented by illustrative photographs downloadable as a PDF. (Obtain hyperlink on the finish of the article)

Understanding Chart Patterns:

Chart patterns are graphical representations of value motion on a chart, sometimes candlestick or bar charts. They emerge from the collective habits of consumers and sellers, reflecting the interaction of provide and demand. Recognizing these patterns permits merchants to anticipate potential breakouts, reversals, or continuations of current developments. Their effectiveness depends upon a number of elements together with the timeframe, quantity affirmation, and the general market context.

Categorizing Chart Patterns:

Chart patterns are broadly labeled into two foremost classes:

-

Continuation Patterns: These patterns recommend a short lived pause in an current pattern earlier than its resumption. The pattern’s path stays unchanged after the sample completes. Examples embody triangles, flags, pennants, and rectangles.

-

Reversal Patterns: These patterns point out a possible shift within the prevailing pattern. They sign a possible change from an uptrend to a downtrend (or vice versa). Examples embody head and shoulders, double tops/bottoms, and inverse head and shoulders.

Continuation Patterns: A Detailed Look:

1. Triangles: Triangles are characterised by converging trendlines, indicating a interval of consolidation. There are three foremost sorts:

-

Symmetrical Triangle: The trendlines converge, forming a symmetrical form. Breakouts can happen in both path, making it essential to think about quantity and different confirming indicators. (Picture included in PDF)

-

Ascending Triangle: The higher trendline is horizontal, whereas the decrease trendline slopes upward. This sample suggests bullish continuation, with a breakout anticipated above the higher trendline. (Picture included in PDF)

-

Descending Triangle: The decrease trendline is horizontal, whereas the higher trendline slopes downward. This sample suggests bearish continuation, with a breakout anticipated beneath the decrease trendline. (Picture included in PDF)

2. Flags and Pennants: These patterns resemble flags or pennants hooked up to a flagpole (the previous pattern). They’re characterised by a quick interval of consolidation inside a channel, adopted by a continuation of the unique pattern.

-

Flags: These patterns exhibit a comparatively parallel channel, suggesting a interval of sideways buying and selling. (Picture included in PDF)

-

Pennants: These patterns show a converging channel, much like a triangle however on a smaller scale and inside a extra outlined pattern. (Picture included in PDF)

3. Rectangles: Rectangles are characterised by horizontal assist and resistance ranges, forming an oblong form. Breakouts can happen above the resistance or beneath the assist, persevering with the prevailing pattern. (Picture included in PDF)

Reversal Patterns: A Detailed Exploration:

1. Head and Shoulders: It is a basic reversal sample indicating a possible pattern shift. It consists of three peaks, with the center peak (the "head") being considerably increased than the opposite two ("shoulders"). A neckline connects the troughs of the sample. A break beneath the neckline confirms the bearish reversal. (Picture included in PDF)

2. Inverse Head and Shoulders: That is the mirror picture of the top and shoulders sample, indicating a possible bullish reversal. The center trough is considerably decrease than the opposite two, and a break above the neckline confirms the bullish reversal. (Picture included in PDF)

3. Double Tops/Bottoms: These patterns encompass two consecutive peaks (double high) or troughs (double backside) at roughly the identical value degree. A neckline connects the intervening trough (double high) or peak (double backside). A break beneath the neckline in a double high or above the neckline in a double backside confirms the reversal. (Picture included in PDF)

4. Triple Tops/Bottoms: Much like double tops/bottoms, however with three peaks (triple high) or troughs (triple backside) at roughly the identical value degree. These patterns usually signify stronger reversal indicators than double tops/bottoms. (Picture included in PDF)

Different Notable Patterns:

Past the patterns mentioned above, a number of different chart patterns exist, together with:

-

Rounded Tops/Bottoms: These patterns point out gradual reversals over an extended interval. (Picture included in PDF)

-

Wedges: Wedges are converging trendlines, much like triangles, however with a steeper slope. They are often ascending (bullish) or descending (bearish). (Picture included in PDF)

-

Diamonds: These patterns are characterised by converging trendlines, making a diamond form. They usually sign a big value change. (Picture included in PDF)

Affirmation and Danger Administration:

Figuring out a chart sample is simply step one. Affirmation is essential earlier than getting into a commerce. This will embody:

- Quantity Affirmation: Elevated quantity throughout a breakout is a robust confirming sign.

- Indicator Affirmation: Utilizing indicators like RSI, MACD, or transferring averages will help verify the sample’s sign.

- Help and Resistance Ranges: The sample’s breakout ought to ideally happen at or close to important assist or resistance ranges.

Danger administration is paramount. All the time use stop-loss orders to restrict potential losses, and place sizing ought to replicate your threat tolerance.

Conclusion:

Chart patterns present worthwhile insights into market dynamics and potential value actions. By understanding the totally different patterns, their interpretations, and the significance of affirmation and threat administration, merchants can considerably improve their buying and selling methods. This information offers a strong basis for figuring out and using chart patterns successfully. Nevertheless, keep in mind that no sample ensures success, and thorough evaluation and threat administration are essential for constant profitability.

(Downloadable PDF Hyperlink: [Insert PDF download link here]) The PDF contains all the photographs talked about within the article, offering a visible assist for higher understanding and future reference. Keep in mind to all the time observe accountable buying and selling and seek the advice of with a monetary advisor earlier than making any funding selections.

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Closure

Thus, we hope this text has supplied worthwhile insights into Chart Patterns: A Complete Information with Photos (PDF Downloadable). We thanks for taking the time to learn this text. See you in our subsequent article!