Decoding The 30-12 months Mortgage Price Chart: A Complete Information

By admin / September 1, 2024 / No Comments / 2025

Decoding the 30-12 months Mortgage Price Chart: A Complete Information

Associated Articles: Decoding the 30-12 months Mortgage Price Chart: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the 30-12 months Mortgage Price Chart: A Complete Information. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the 30-12 months Mortgage Price Chart: A Complete Information

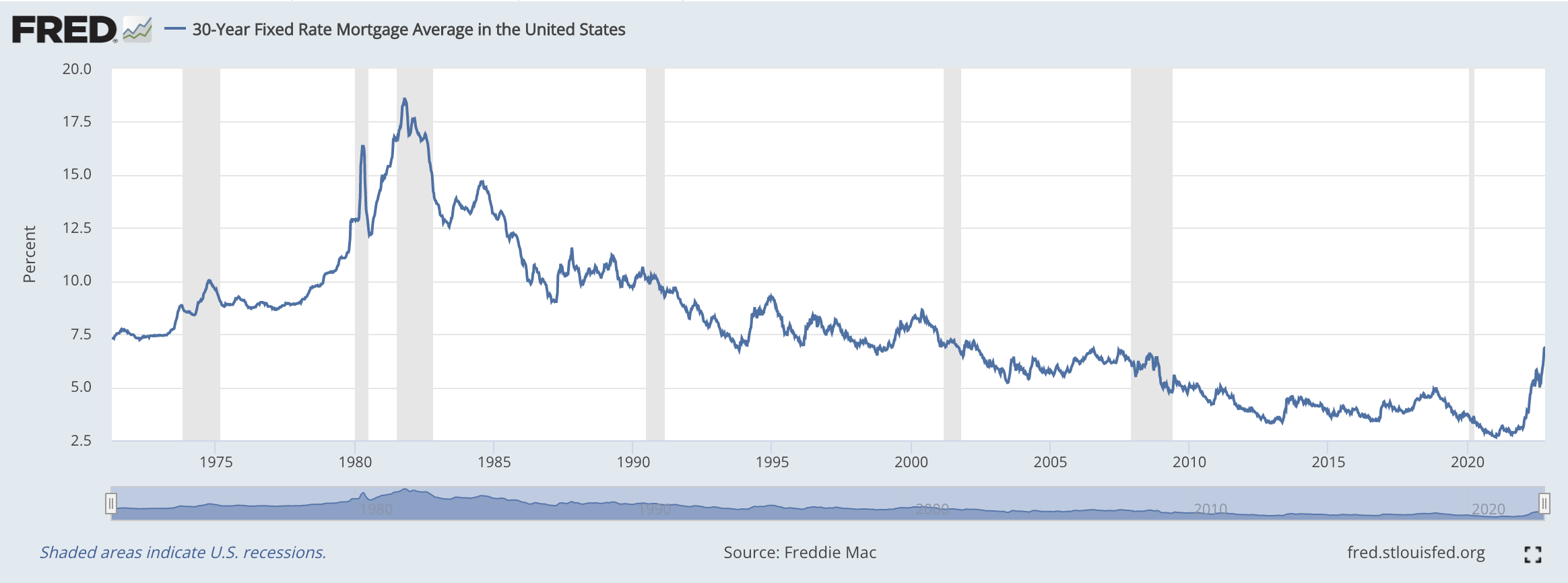

The 30-year fixed-rate mortgage is the cornerstone of the American Dream, providing householders predictable month-to-month funds and long-term stability. Nonetheless, navigating the complexities of mortgage charges, notably understanding their historic tendencies and future projections, can really feel overwhelming. This text delves deep into the intricacies of a 30-year mortgage fee chart, explaining its significance, deciphering its fluctuations, and providing insights into the elements that affect its trajectory.

Understanding the Chart: A Visible Illustration of Market Forces

A 30-year mortgage fee chart usually shows the common rate of interest for a 30-year fixed-rate mortgage over a particular interval, often starting from a number of months to a number of many years. The chart’s horizontal axis represents time (e.g., years or months), whereas the vertical axis represents the rate of interest (often expressed as a proportion). The road connecting the info factors illustrates the speed’s development over time, offering a visible illustration of its volatility and general pattern.

The chart’s information is often sourced from respected monetary establishments, authorities companies (like Freddie Mac or the Federal Housing Finance Company), or mortgage business trackers. These sources collect information from a big pattern of lenders to supply a dependable common that displays the broader market. It is essential to keep in mind that the chart displays common charges; particular person charges provided by lenders can range based mostly on a number of elements (mentioned later).

Decoding the Fluctuations: Deciphering the Ups and Downs

The 30-year mortgage fee chart hardly ever reveals a easy, regular line. As a substitute, it displays vital fluctuations, reflecting the dynamic nature of the monetary markets. Understanding these fluctuations requires contemplating numerous financial indicators and market forces:

-

Federal Reserve Coverage: The Federal Reserve (the Fed), the central financial institution of america, performs a pivotal function in influencing rates of interest. The Fed makes use of financial coverage instruments, primarily the federal funds fee (the goal fee for in a single day lending between banks), to handle inflation and financial development. When the Fed raises the federal funds fee to fight inflation, it usually results in larger mortgage charges. Conversely, reducing the federal funds fee to stimulate financial exercise often ends in decrease mortgage charges.

-

Inflation: Inflation, the speed at which the final degree of costs for items and companies is rising, is a big issue impacting mortgage charges. Excessive inflation erodes the buying energy of cash, prompting the Fed to lift rates of interest to curb inflation. This, in flip, results in larger mortgage charges. Conversely, low inflation permits for decrease rates of interest.

-

Financial Development: Sturdy financial development typically results in larger demand for loans, together with mortgages, placing upward strain on rates of interest. Conversely, slower financial development or recessionary intervals can result in decrease demand and consequently decrease mortgage charges.

-

Authorities Rules and Insurance policies: Authorities insurance policies and laws associated to the housing market also can have an effect on mortgage charges. As an illustration, adjustments in government-sponsored enterprise (GSE) tips, resembling these for Fannie Mae and Freddie Mac, can affect the provision and price of mortgages.

-

Investor Sentiment and Market Hypothesis: Investor confidence and hypothesis within the bond market considerably impression mortgage charges. Mortgage-backed securities (MBS) are carefully tied to the bond market, and adjustments in investor sentiment may cause fluctuations in MBS costs, which instantly have an effect on mortgage charges.

-

World Financial Circumstances: World financial occasions, resembling geopolitical instability, worldwide commerce disputes, or international recessions, also can affect mortgage charges within the US. These occasions can have an effect on investor confidence, inflation, and financial development, not directly impacting mortgage charges.

Historic Context: Studying from the Previous

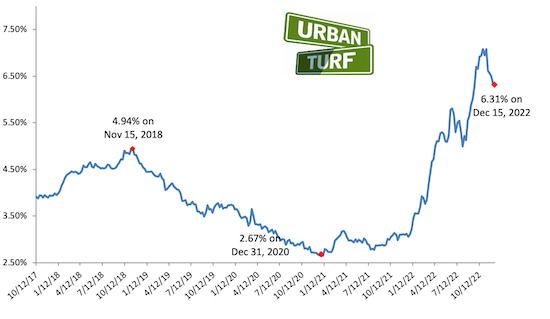

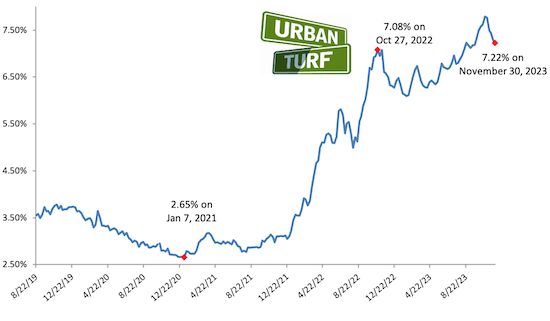

Analyzing a long-term 30-year mortgage fee chart reveals fascinating historic patterns. For instance, the chart clearly reveals the numerous impression of the 2008 monetary disaster, which led to a dramatic spike in mortgage charges adopted by a interval of traditionally low charges. Inspecting historic information helps us perceive the cyclical nature of mortgage charges and the interaction of assorted financial elements. This historic context gives worthwhile perspective when deciphering present fee actions and making knowledgeable predictions about future tendencies.

Predicting Future Tendencies: A Advanced Endeavor

Predicting future mortgage charges is a difficult process, because it includes forecasting quite a few interconnected financial variables. Whereas nobody can definitively predict future charges, analyzing present financial indicators and historic tendencies can provide some insights. Components to contemplate embrace:

- Present Inflation Price: The persistence and severity of inflation will considerably affect the Fed’s actions and consequently mortgage charges.

- Financial Development Projections: Forecasts of financial development will impression the demand for mortgages and due to this fact charges.

- Federal Reserve Communication: The Fed’s statements and projections about future rate of interest hikes or cuts present worthwhile clues in regards to the route of mortgage charges.

- Geopolitical Occasions: Unexpected international occasions can considerably impression market sentiment and subsequently mortgage charges.

Past the Chart: Particular person Components Affecting Your Price

Whereas the chart gives a common overview of common mortgage charges, your particular person fee will rely upon a number of elements:

- Credit score Rating: A better credit score rating usually qualifies you for a decrease rate of interest.

- Down Cost: A bigger down fee often interprets to a decrease fee.

- Mortgage-to-Worth Ratio (LTV): A decrease LTV (the ratio of the mortgage quantity to the property worth) usually ends in a greater fee.

- Debt-to-Revenue Ratio (DTI): A decrease DTI (the ratio of your month-to-month debt funds to your gross month-to-month earnings) improves your probabilities of securing a positive fee.

- Mortgage Sort: Various kinds of mortgages (e.g., FHA, VA, standard) include various rates of interest.

- Lender: Completely different lenders provide totally different charges based mostly on their pricing methods and threat assessments.

Conclusion: A Highly effective Device for Knowledgeable Resolution-Making

The 30-year mortgage fee chart is a strong device for understanding the dynamics of the mortgage market. By fastidiously analyzing the chart’s historic tendencies and contemplating the assorted financial and market forces that affect charges, potential homebuyers and householders could make extra knowledgeable selections about financing their properties. Whereas predicting the long run is unattainable, understanding the elements that drive mortgage fee fluctuations empowers people to navigate the complexities of the housing market and safe the absolute best financing phrases. Bear in mind to seek the advice of with a professional mortgage skilled to acquire customized recommendation and discover the choices out there to you based mostly in your particular monetary state of affairs. The chart gives a worthwhile context, but it surely’s only one piece of the puzzle within the bigger means of securing a mortgage.

:max_bytes(150000):strip_icc()/BgXcd-average-mortgage-rates-over-the-last-year-feb-29-2024-0875eb9980bb4ece94169bb78b670b86.png)

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the 30-12 months Mortgage Price Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!