Chart Sample Indicators In MT4: A Complete Information

By admin / October 28, 2024 / No Comments / 2025

Chart Sample Indicators in MT4: A Complete Information

Associated Articles: Chart Sample Indicators in MT4: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Sample Indicators in MT4: A Complete Information. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Chart Sample Indicators in MT4: A Complete Information

MetaTrader 4 (MT4) is a well-liked foreign currency trading platform famend for its intensive library of technical indicators. Amongst these, chart sample indicators maintain a major place, helping merchants in figuring out potential buying and selling alternatives based mostly on recurring value formations. Whereas MT4 would not supply built-in indicators particularly designed to determine all chart patterns, many customized indicators can be found, every specializing in particular patterns. This text delves into the world of chart sample indicators in MT4, exploring their performance, limitations, and the way to successfully combine them right into a buying and selling technique.

Understanding Chart Patterns:

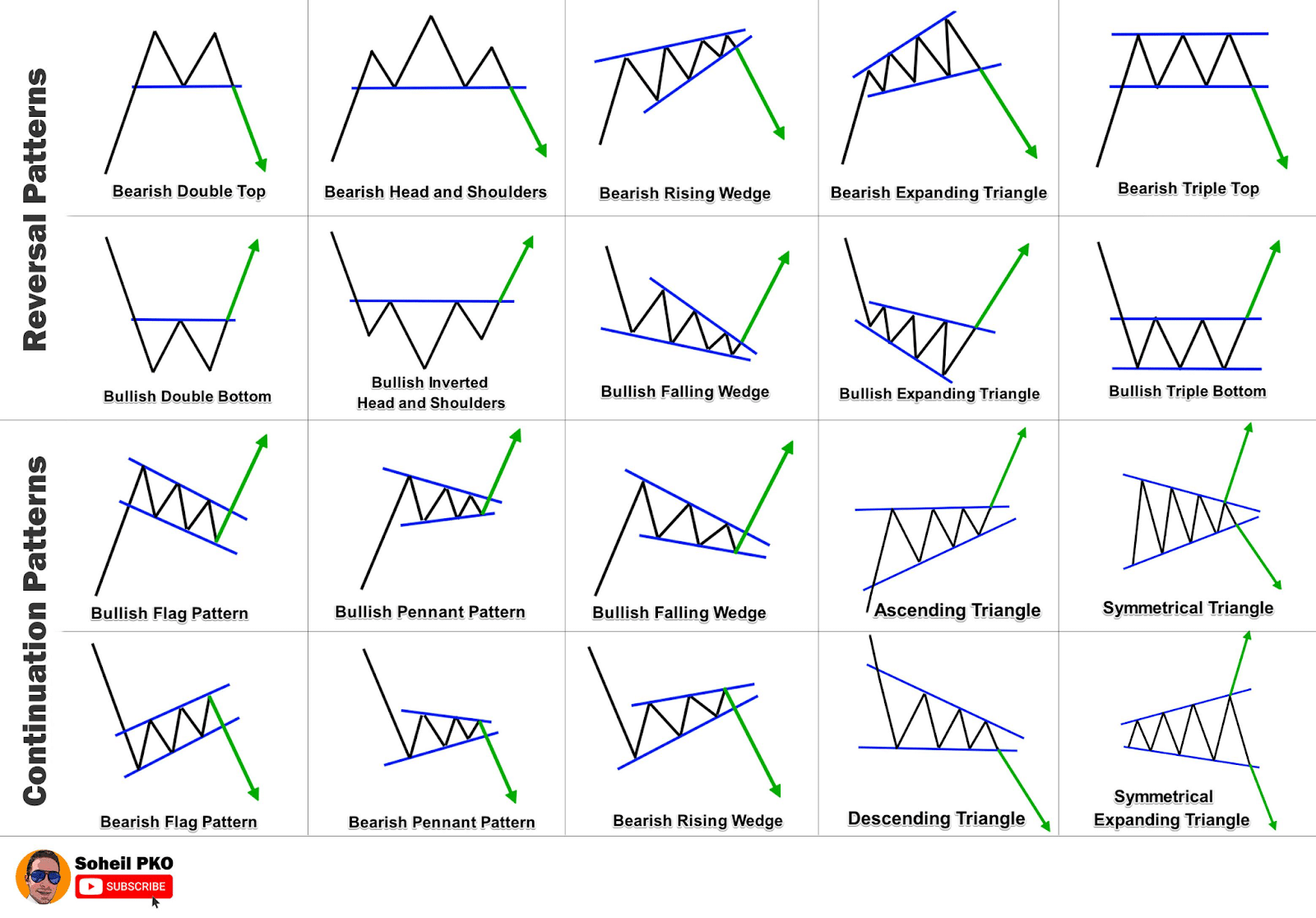

Chart patterns are visually identifiable formations on value charts that counsel future value actions. They’re based mostly on the precept of market psychology and the tendency for value motion to repeat itself. Recognizing these patterns can present merchants with potential entry and exit factors, stop-loss ranges, and revenue targets. Frequent chart patterns embody:

- Head and Shoulders: A reversal sample indicating a possible shift from an uptrend to a downtrend (or vice-versa for an inverse head and shoulders).

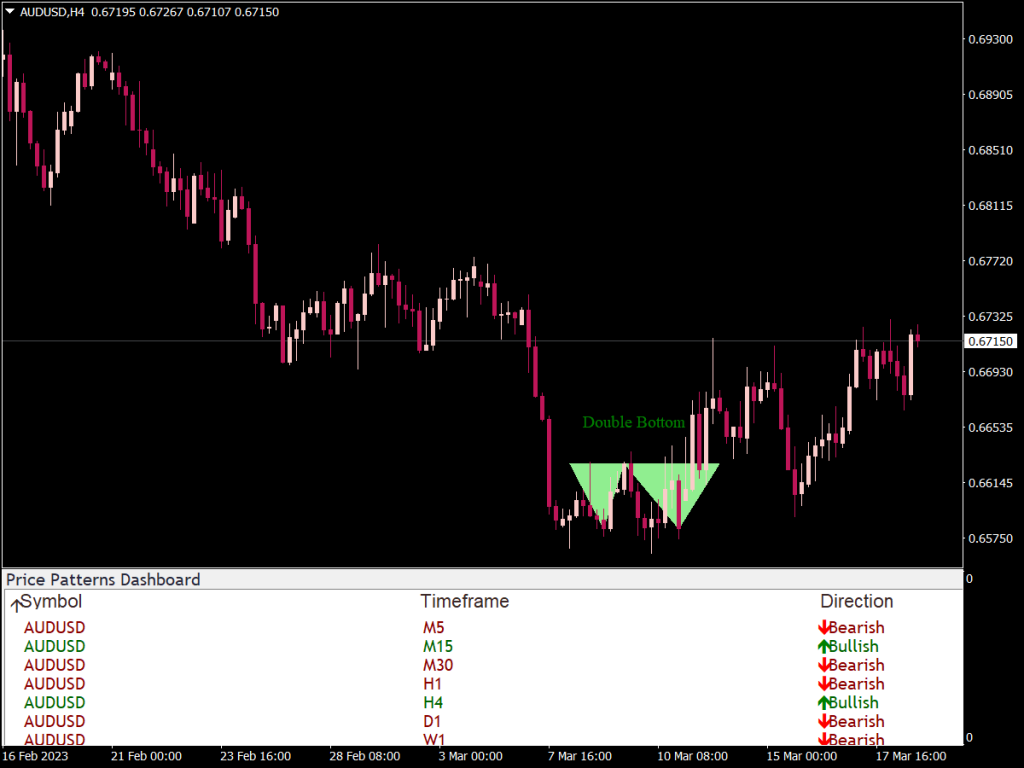

- Double Tops/Bottoms: Reversal patterns signaling a attainable change in pattern path after two comparable value peaks (tops) or troughs (bottoms).

- Triangles: Continuation patterns suggesting a interval of consolidation earlier than a breakout within the path of the prevailing pattern. A number of sorts exist, together with symmetrical, ascending, and descending triangles.

- Rectangles: Continuation patterns just like triangles, indicating a interval of sideways value motion earlier than a breakout.

- Flags and Pennants: Continuation patterns characterised by temporary intervals of consolidation inside a powerful pattern.

- Wedges: These may be both rising or falling and normally point out a continuation or a reversal, relying on the path of the wedge.

- Cup and Deal with: A bullish continuation sample suggesting a continuation of the uptrend after a interval of consolidation.

Forms of MT4 Chart Sample Indicators:

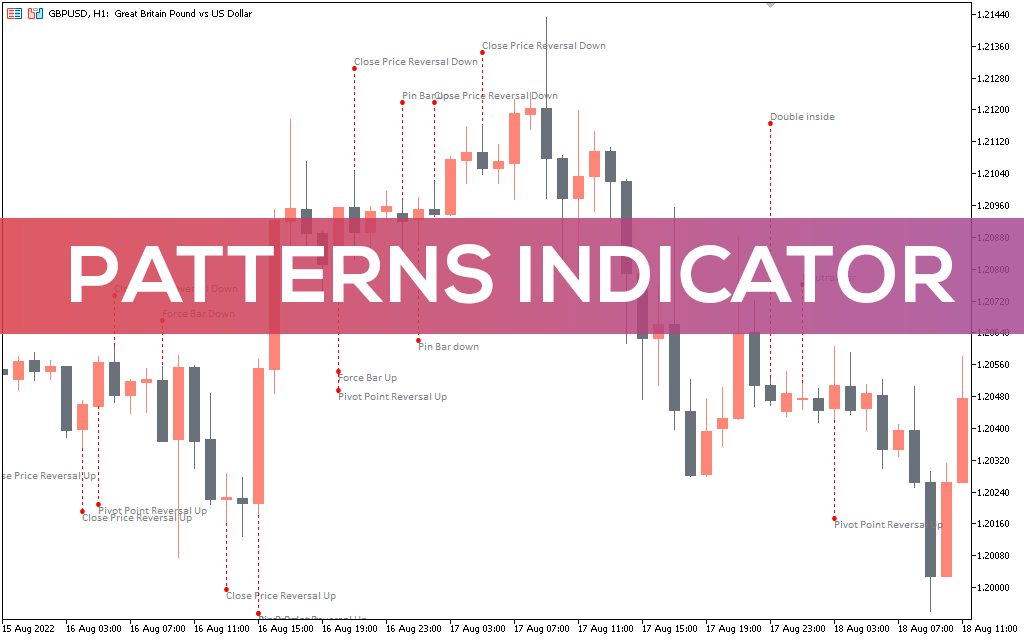

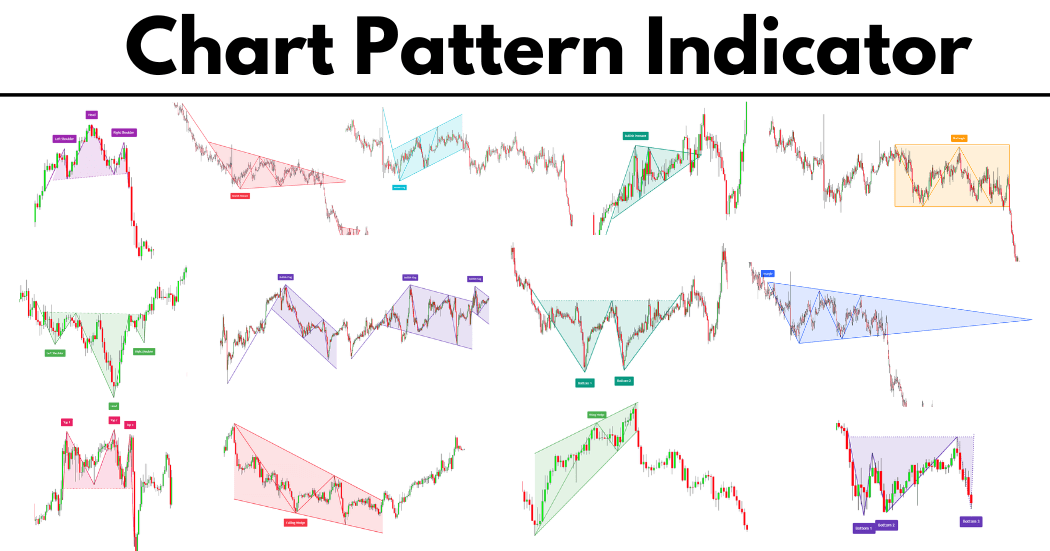

Whereas MT4 would not have built-in indicators for all these patterns, quite a few customized indicators can be found for obtain from varied sources. These indicators sometimes operate by:

-

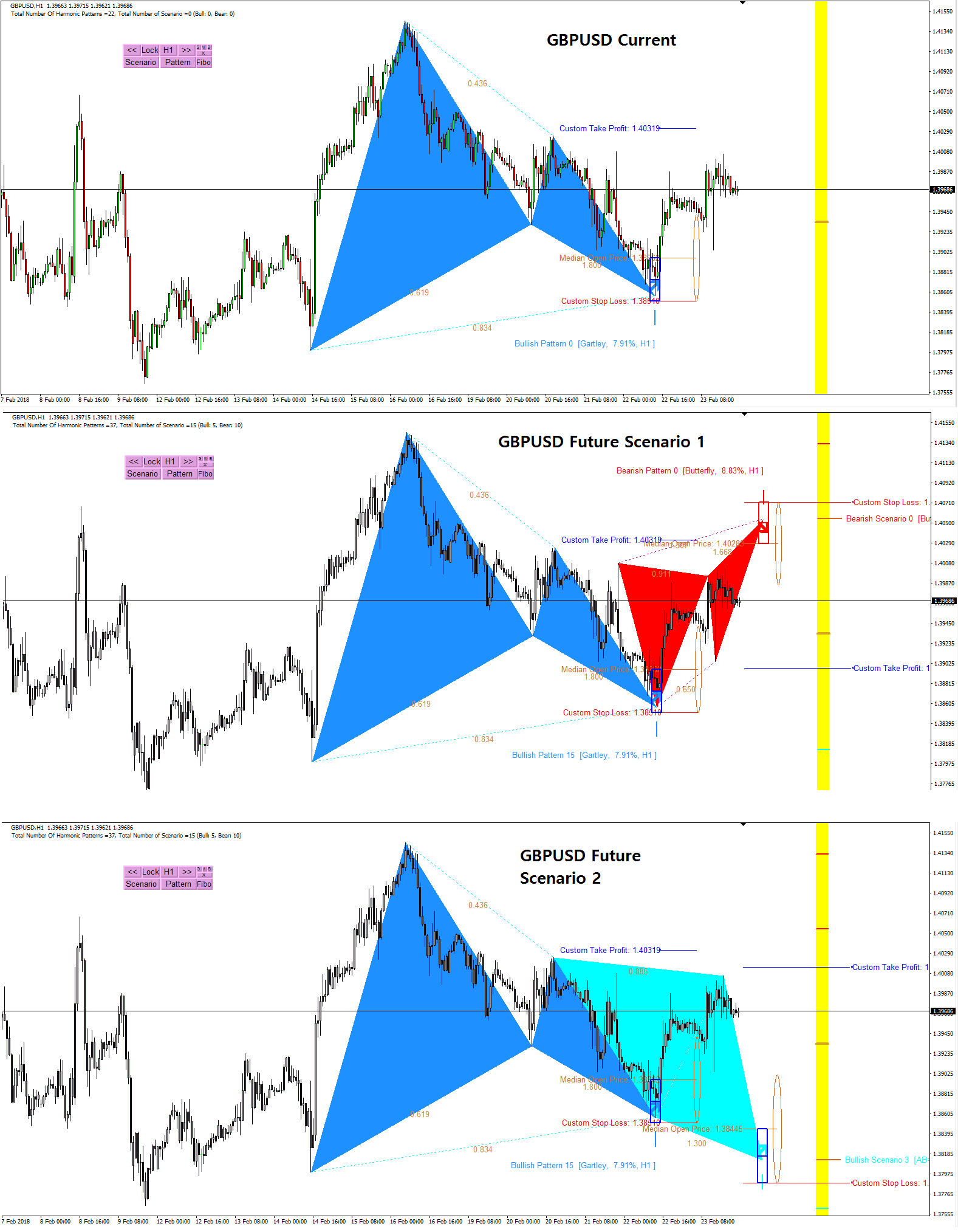

Algorithmic Sample Recognition: These indicators use algorithms to scan value information and determine patterns based mostly on predefined standards. The factors may embody value ranges, angles, and quantity. The accuracy of those algorithms varies significantly relying on the sophistication of the code and the parameters used.

-

Visible Sample Highlighting: Some indicators merely spotlight potential patterns on the chart, leaving the ultimate affirmation to the dealer’s judgment. This method reduces false alerts however requires extra handbook interpretation.

-

Mixed Method: Extra superior indicators mix algorithmic recognition with visible highlighting, offering each automated alerts and visible affirmation.

Utilizing Chart Sample Indicators in MT4:

Successfully utilizing chart sample indicators requires a multi-faceted method:

-

Indicator Choice: Select indicators that align along with your buying and selling model and the patterns you are most comfy figuring out. Contemplate the indicator’s accuracy, reliability, and the extent of handbook interpretation required. Assessment consumer opinions and check the indicator on historic information earlier than reside buying and selling.

-

Parameter Optimization: Many chart sample indicators have adjustable parameters. Experiment with completely different settings to search out the optimum configuration to your chosen market and timeframe. Over-optimization needs to be prevented, as it might result in unreliable leads to reside buying and selling. Backtesting on historic information is essential for this step.

-

Affirmation with Different Indicators: Relying solely on a chart sample indicator is dangerous. All the time verify the recognized sample utilizing different technical indicators, akin to transferring averages, RSI, MACD, or quantity indicators. This helps to filter out false alerts and improve the chance of profitable trades.

-

Danger Administration: Implement sturdy threat administration methods, together with stop-loss orders and place sizing. Even with correct sample identification, losses are inevitable. Correct threat administration minimizes potential losses and protects your buying and selling capital.

-

Timeframe Concerns: The effectiveness of chart sample indicators can fluctuate considerably relying on the timeframe used. Patterns that work nicely on every day charts is probably not dependable on hourly or minute charts. Experiment with completely different timeframes to find out the optimum setting to your chosen indicator and buying and selling technique.

-

Contextual Evaluation: Do not simply depend on the indicator’s alerts in isolation. Contemplate the broader market context, together with information occasions, financial information, and total market sentiment. A sample that is perhaps bullish in a powerful bull market could possibly be bearish in a weakening market.

-

False Indicators: Remember that chart sample indicators usually are not excellent and might generate false alerts. Study to determine traits of false alerts and develop a system to filter them out. This usually entails combining the indicator with different types of evaluation.

Limitations of Chart Sample Indicators:

Regardless of their usefulness, chart sample indicators have limitations:

- Subjectivity: Figuring out chart patterns may be subjective, particularly for much less outlined patterns. Totally different merchants might interpret the identical value motion in a different way.

- Lagging Indicators: Most chart sample indicators are lagging indicators, which means they determine patterns after they’ve shaped. This will result in missed entry alternatives or late exits.

- False Indicators: As talked about, false alerts are widespread, resulting in probably shedding trades.

- Market Noise: Market noise can obscure real patterns, making identification difficult.

- Dependence on Particular Parameters: The accuracy of an indicator is very depending on its parameters, and discovering the optimum settings requires intensive testing and optimization.

Conclusion:

Chart sample indicators in MT4 may be invaluable instruments for merchants, providing visible cues and potential buying and selling alerts. Nonetheless, they shouldn’t be utilized in isolation. Profitable integration requires an intensive understanding of chart patterns, cautious indicator choice, affirmation with different technical indicators, sturdy threat administration, and a eager consciousness of the restrictions of those instruments. Deal with them as one piece of the puzzle in your total buying and selling technique, not the only determinant of your buying and selling choices. By combining the insights from chart sample indicators with different types of technical and basic evaluation, merchants can considerably enhance their buying and selling decision-making course of and probably improve their buying and selling efficiency. Do not forget that constant studying, observe, and disciplined threat administration are essential for fulfillment in foreign currency trading, whatever the instruments employed.

Closure

Thus, we hope this text has offered invaluable insights into Chart Sample Indicators in MT4: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!