401 Ok Vs 403 B Comparability Chart

By admin / June 5, 2024 / No Comments / 2025

401 ok vs 403 b comparability chart

Associated Articles: 401 ok vs 403 b comparability chart

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to 401 ok vs 403 b comparability chart. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

401(ok) vs. 403(b): A Complete Comparability Chart and Information

Retirement planning is a vital facet of economic safety, and understanding the totally different retirement financial savings automobiles out there is paramount. Two of the most typical employer-sponsored retirement plans are the 401(ok) and the 403(b). Whereas each supply tax-advantaged methods to avoid wasting for retirement, they’ve key variations that may considerably impression your financial savings technique. This text offers an in depth comparability of 401(ok) and 403(b) plans, offered in a transparent chart format, adopted by an in-depth clarification of every characteristic.

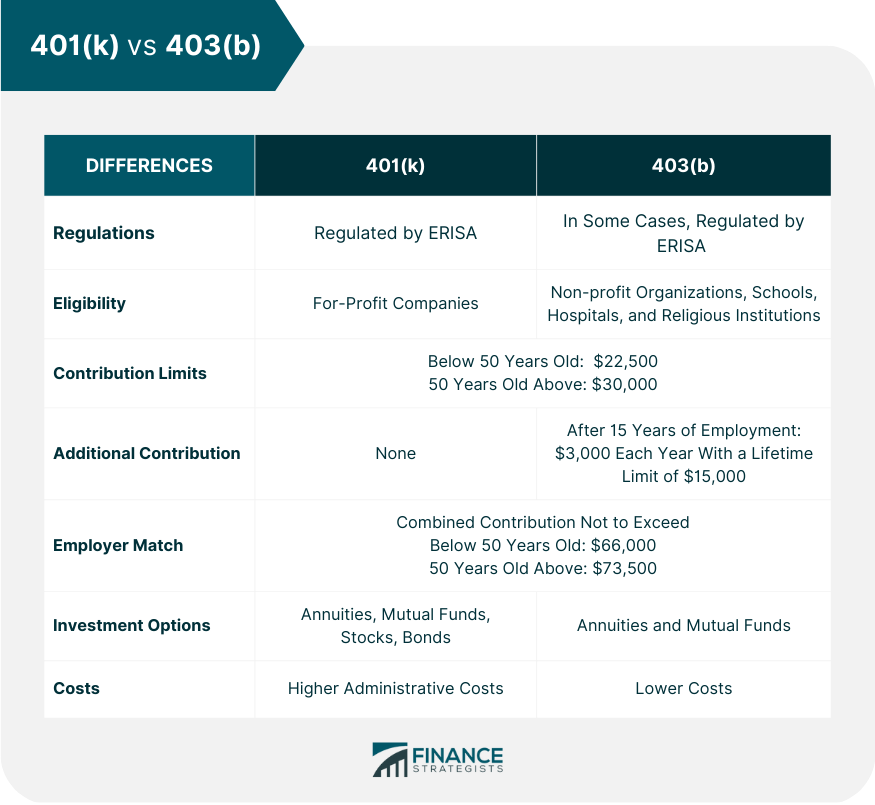

Comparability Chart: 401(ok) vs. 403(b)

| Characteristic | 401(ok) | 403(b) |

|---|---|---|

| Provided By | For-profit corporations, some non-profits | Public faculties, hospitals, non-profit orgs |

| Funding Choices | Big selection of mutual funds, shares, bonds, ETFs | Usually extra restricted, usually mutual funds and annuities |

| Funding Charges | Can range considerably, usually greater | Can range, however probably decrease in some plans |

| Employer Matching | Widespread, varies by employer | Much less widespread, varies by employer |

| Mortgage Provisions | Often allowed | Often allowed, however restrictions could apply |

| Early Withdrawal Penalties | Usually applies earlier than age 59 1/2 | Usually applies earlier than age 59 1/2 |

| Tax Benefits | Contributions pre-tax, taxes deferred till retirement | Contributions pre-tax, taxes deferred till retirement |

| Rollover Choices | Straightforward to rollover to different 401(ok)s or IRAs | Straightforward to rollover to different 403(b)s or IRAs |

| Plan Administration | Usually dealt with by a third-party administrator | Will be dealt with by a third-party administrator or the employer |

| Funding Management | Extra management over investments | Much less management, relying on plan choices |

| Account Portability | Usually simpler to switch | Will be extra advanced to switch |

Detailed Clarification of Key Variations:

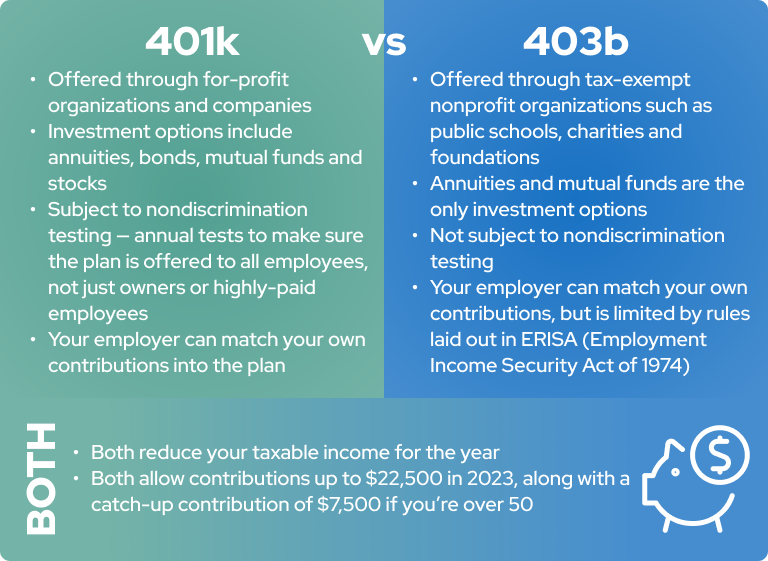

1. Provided By:

- 401(ok): Primarily provided by for-profit corporations however can be present in some non-profit organizations. The supply and specifics of the plan rely completely on the employer.

- 403(b): Primarily provided by public faculties, hospitals, and different tax-exempt organizations. These plans are ruled by totally different laws than 401(ok)s.

2. Funding Choices:

- 401(ok): Provides a wider vary of funding choices, together with mutual funds, shares, bonds, exchange-traded funds (ETFs), and generally even actual property funding trusts (REITs). This offers better flexibility and diversification alternatives.

- 403(b): Usually provides a extra restricted collection of funding choices, usually specializing in mutual funds and annuities. The supply and kinds of annuities can range considerably relying on the plan supplier. Annuities, whereas providing assured revenue, usually include greater charges and fewer flexibility.

3. Funding Charges:

- 401(ok): Funding charges can range considerably relying on the plan supplier and the chosen funding choices. Some plans could have greater expense ratios than others, impacting long-term returns.

- 403(b): Charges also can range, however some 403(b) plans may supply decrease charges than comparable 401(ok) plans. Nevertheless, this is not all the time the case, and cautious comparability is essential. Annuities inside a 403(b) usually have greater charges than different funding choices.

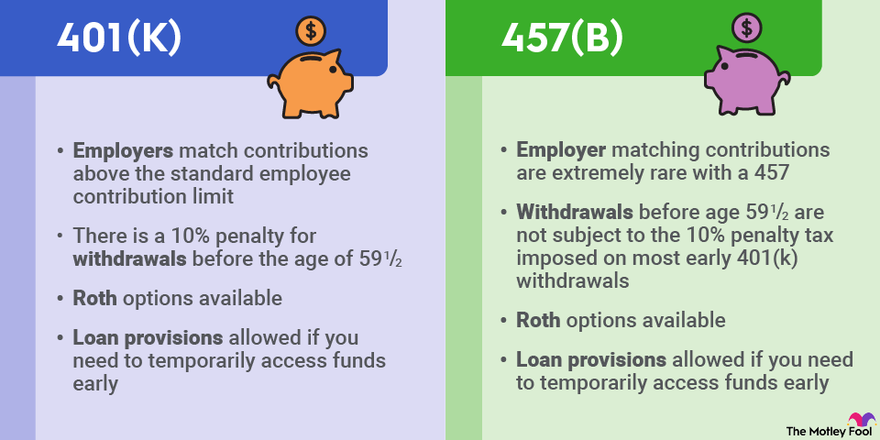

4. Employer Matching:

- 401(ok): Employer matching contributions are widespread in 401(ok) plans. This implies the employer will contribute a sure proportion of your contributions, usually matching a portion as much as a particular restrict. It is a vital profit that may considerably enhance your retirement financial savings.

- 403(b): Employer matching is much less widespread in 403(b) plans. Whereas some employers do supply matching contributions, it isn’t as prevalent as in 401(ok) plans.

5. Mortgage Provisions:

- 401(ok): Most 401(ok) plans enable contributors to borrow cash from their account. This could be a useful gizmo in emergencies, but it surely’s essential to know the compensation phrases and potential tax implications.

- 403(b): Mortgage provisions are often out there however could have stricter limitations in comparison with 401(ok) plans. The supply and phrases of loans rely upon the particular plan.

6. Early Withdrawal Penalties:

- 401(ok) & 403(b): Each plans usually impose penalties for early withdrawals earlier than age 59 1/2. Exceptions exist for sure circumstances, comparable to monetary hardship or demise. These penalties can considerably scale back the quantity you obtain.

7. Tax Benefits:

- 401(ok) & 403(b): Each plans supply vital tax benefits. Contributions are made pre-tax, decreasing your taxable revenue within the current. Taxes are deferred till retirement, if you start withdrawing funds. This permits your investments to develop tax-deferred, resulting in probably bigger retirement financial savings.

8. Rollover Choices:

- 401(ok) & 403(b): Each plans enable for straightforward rollover to different 401(ok)s, 403(b)s, or conventional IRAs. This offers flexibility when you change employers or need to consolidate your retirement financial savings.

9. Plan Administration:

- 401(ok): Usually administered by a third-party administrator, which handles record-keeping, funding administration, and different administrative duties.

- 403(b): Will be administered by a third-party administrator or straight by the employer. This could impression the extent of service and help out there to contributors.

10. Funding Management & Account Portability:

- 401(ok): Usually provides extra management over funding decisions and simpler portability when altering jobs.

- 403(b): Might supply much less management over investments, relying on the plan choices, and transferring the account can generally be extra advanced.

Conclusion:

Selecting between a 401(ok) and a 403(b) relies upon largely on the particular plan provided by your employer and your particular person circumstances. Whereas each supply tax-advantaged retirement financial savings, the variations in funding choices, charges, employer matching, and plan administration can considerably impression your long-term retirement outcomes. Rigorously evaluation the main points of your employer’s plan, evaluate charges, and think about your funding objectives earlier than making a call. Consulting with a monetary advisor can present useful steering in navigating the complexities of retirement planning and choosing the right plan in your wants. Keep in mind, maximizing your contributions to both plan, whatever the particular sort, is essential for constructing a safe monetary future.

_and_403(b)_Plans_Work_(1).png?width=960u0026height=520u0026name=How_Do_401(a)_and_403(b)_Plans_Work_(1).png)

Closure

Thus, we hope this text has offered useful insights into 401 ok vs 403 b comparability chart. We hope you discover this text informative and useful. See you in our subsequent article!