Chart Industries’ Acquisition Of Howden: A Deep Dive Into A Strategic Powerhouse

By admin / July 20, 2024 / No Comments / 2025

Chart Industries’ Acquisition of Howden: A Deep Dive right into a Strategic Powerhouse

Associated Articles: Chart Industries’ Acquisition of Howden: A Deep Dive right into a Strategic Powerhouse

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Industries’ Acquisition of Howden: A Deep Dive right into a Strategic Powerhouse. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Chart Industries’ Acquisition of Howden: A Deep Dive right into a Strategic Powerhouse

Chart Industries, a number one supplier of engineered tools and providers for the cryogenic and vitality sectors, made a big transfer in its enlargement technique with the acquisition of Howden, a worldwide chief in rotating tools for varied industrial functions. This acquisition, finalized in [Insert Date of Finalization], represents a transformative occasion in each corporations’ histories, making a formidable power within the world industrial panorama. This text delves deep into the main points of the acquisition, analyzing its strategic implications, the challenges confronted, and the potential for future progress and innovation.

The Rationale Behind the Acquisition:

Chart Industries’ pursuit of Howden wasn’t a spontaneous choice; it was a calculated transfer pushed by a number of strategic goals. The first rationale centered round increasing Chart’s product portfolio and market attain. Whereas Chart held a robust place in cryogenic applied sciences, significantly inside the liquefied pure gasoline (LNG) and hydrogen sectors, Howden introduced experience and market dominance in rotating tools, together with compressors, followers, and blowers, throughout a broader vary of industries. This diversification considerably lowered Chart’s reliance on a single sector, mitigating dangers related to market fluctuations.

The synergy between the 2 corporations’ applied sciences was one other essential issue. Howden’s experience in compression and air flow applied sciences straight complemented Chart’s cryogenic experience. This mix supplied alternatives for creating built-in options for numerous functions, significantly within the burgeoning renewable vitality sector, particularly inexperienced hydrogen manufacturing and carbon seize, utilization, and storage (CCUS). The mixing of Howden’s expertise enabled Chart to supply extra complete and environment friendly options to its shoppers, enhancing its worth proposition.

Moreover, the acquisition offered entry to Howden’s intensive world buyer base and distribution community. Howden operates in numerous geographic areas, offering Chart with rapid entry to new markets and alternatives for progress. This enlargement past Chart’s current footprint considerably broadened its market attain and strengthened its world presence.

Monetary Points of the Deal:

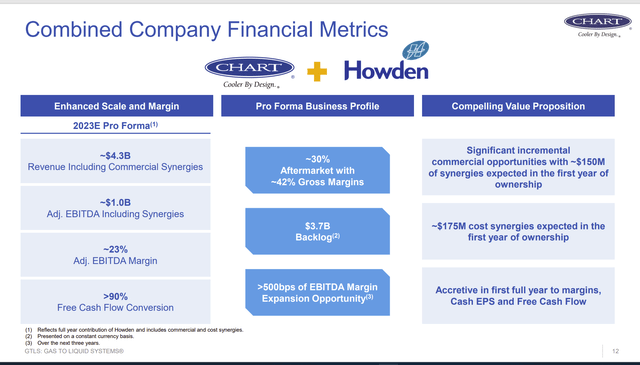

The acquisition of Howden concerned a big monetary dedication from Chart Industries. The deal’s worth was [Insert Deal Value], reflecting the strategic significance and market worth of Howden. The financing was doubtless a mixture of debt and fairness, with particulars outlined in regulatory filings. The acquisition was structured to leverage Chart’s current monetary power and safe favorable financing phrases to facilitate a easy integration course of.

The valuation of Howden mirrored its sturdy monetary efficiency and future progress potential. Howden’s constant income era and profitability made it a sexy acquisition goal, offering Chart with rapid returns on funding and a stable basis for future enlargement. The deal’s phrases have been doubtless topic to regulatory approvals and due diligence processes, making certain compliance with related legal guidelines and laws.

Challenges and Integration Methods:

Integrating two massive corporations with distinct cultures and operational constructions introduced important challenges. Cultural variations, differing administration kinds, and the necessity to harmonize operational processes required cautious planning and execution. Chart Industries doubtless employed a phased integration strategy, prioritizing key areas corresponding to buyer relationship administration, provide chain optimization, and expertise integration.

The mixing course of required addressing potential redundancies in personnel and streamlining operations to maximise effectivity. This concerned cautious consideration of worker welfare and minimizing disruption to ongoing tasks. Efficient communication and collaboration between groups from each corporations have been essential for a easy transition. Chart doubtless carried out sturdy change administration applications to information staff by way of the combination course of and guarantee a profitable final result.

One other problem was the necessity to keep the momentum of each corporations’ operations in the course of the integration course of. Chart had to make sure that ongoing tasks and buyer commitments weren’t compromised. Sustaining buyer relationships and making certain a seamless transition for Howden’s shoppers was a prime precedence.

Strategic Implications and Future Outlook:

The Chart-Howden merger creates a robust participant within the world industrial tools market. The mixed entity possesses a considerably expanded product portfolio, a broader geographic attain, and enhanced technological capabilities. This stronger market place permits Chart to higher serve its current clients and appeal to new shoppers.

The acquisition considerably strengthens Chart’s place within the quickly rising renewable vitality sector. The mixture of Chart’s cryogenic experience and Howden’s rotating tools expertise creates a novel benefit in offering built-in options for inexperienced hydrogen manufacturing and CCUS. This strategic alignment positions Chart as a key participant within the transition in direction of a extra sustainable vitality future.

The long-term implications of the acquisition are promising. The mixed entity is predicted to attain important synergies by way of economies of scale, improved effectivity, and enhanced innovation. The mixing of Howden’s expertise and experience is predicted to drive progress in current markets and open new alternatives in rising sectors.

Conclusion:

The Chart Industries acquisition of Howden represents a daring strategic transfer with far-reaching implications. Whereas challenges associated to integration have been inevitable, the strategic rationale, monetary power, and dedication to a easy transition recommend a constructive outlook for the mixed entity. The acquisition positions Chart Industries as a number one supplier of essential tools and providers for a variety of industries, significantly within the burgeoning renewable vitality sector. The long-term success of the merger will rely on the efficient execution of integration methods, sustaining sturdy buyer relationships, and fostering a tradition of innovation and collaboration. The approaching years shall be essential in assessing the total affect of this transformative acquisition on the worldwide industrial panorama.

.jpg?ext=.jpg)

Closure

Thus, we hope this text has offered helpful insights into Chart Industries’ Acquisition of Howden: A Deep Dive right into a Strategic Powerhouse. We hope you discover this text informative and helpful. See you in our subsequent article!