Mastering The Chart Of Accounts In QuickBooks On-line: A Complete Information

By admin / August 3, 2024 / No Comments / 2025

Mastering the Chart of Accounts in QuickBooks On-line: A Complete Information

Associated Articles: Mastering the Chart of Accounts in QuickBooks On-line: A Complete Information

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Mastering the Chart of Accounts in QuickBooks On-line: A Complete Information. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Mastering the Chart of Accounts in QuickBooks On-line: A Complete Information

QuickBooks On-line (QBO) is a strong instrument for managing your corporation funds, however its effectiveness hinges on a correctly configured Chart of Accounts. This important component acts because the spine of your monetary record-keeping, categorizing each transaction and offering the muse for correct monetary reporting. Understanding and successfully managing your Chart of Accounts in QBO is important for sustaining monetary readability, simplifying tax preparation, and making knowledgeable enterprise choices.

This complete information will delve into the intricacies of the QBO Chart of Accounts, masking its construction, customization choices, finest practices for setup and upkeep, and the implications of incorrect configuration. We’ll discover how to decide on the best account sorts, manage your accounts successfully, and troubleshoot frequent points.

Understanding the Construction of the Chart of Accounts

The Chart of Accounts is basically a hierarchical record of all of the accounts used to document your organization’s monetary transactions. Every account represents a particular class, permitting you to trace revenue, bills, property, liabilities, and fairness. QBO makes use of a double-entry bookkeeping system, which means each transaction impacts at the least two accounts, sustaining the basic accounting equation (Property = Liabilities + Fairness).

The accounts are organized into numerous account sorts, every serving a particular goal:

-

Property: These symbolize what your corporation owns, together with money, accounts receivable (cash owed to you), stock, gear, and property. Property enhance with debits and reduce with credit.

-

Liabilities: These symbolize what your corporation owes to others, together with accounts payable (cash you owe to suppliers), loans, and bank card balances. Liabilities enhance with credit and reduce with debits.

-

Fairness: This represents the proprietor’s funding within the enterprise, together with preliminary contributions, retained earnings (income reinvested), and withdrawals. Fairness will increase with credit and reduces with debits.

-

Earnings (Income): This represents cash earned from your corporation operations, together with gross sales income, service income, and different revenue sources. Earnings will increase with credit and reduces with debits.

-

Bills: These symbolize the prices incurred in working your corporation, together with price of products bought (COGS), salaries, hire, utilities, and advertising and marketing bills. Bills enhance with debits and reduce with credit.

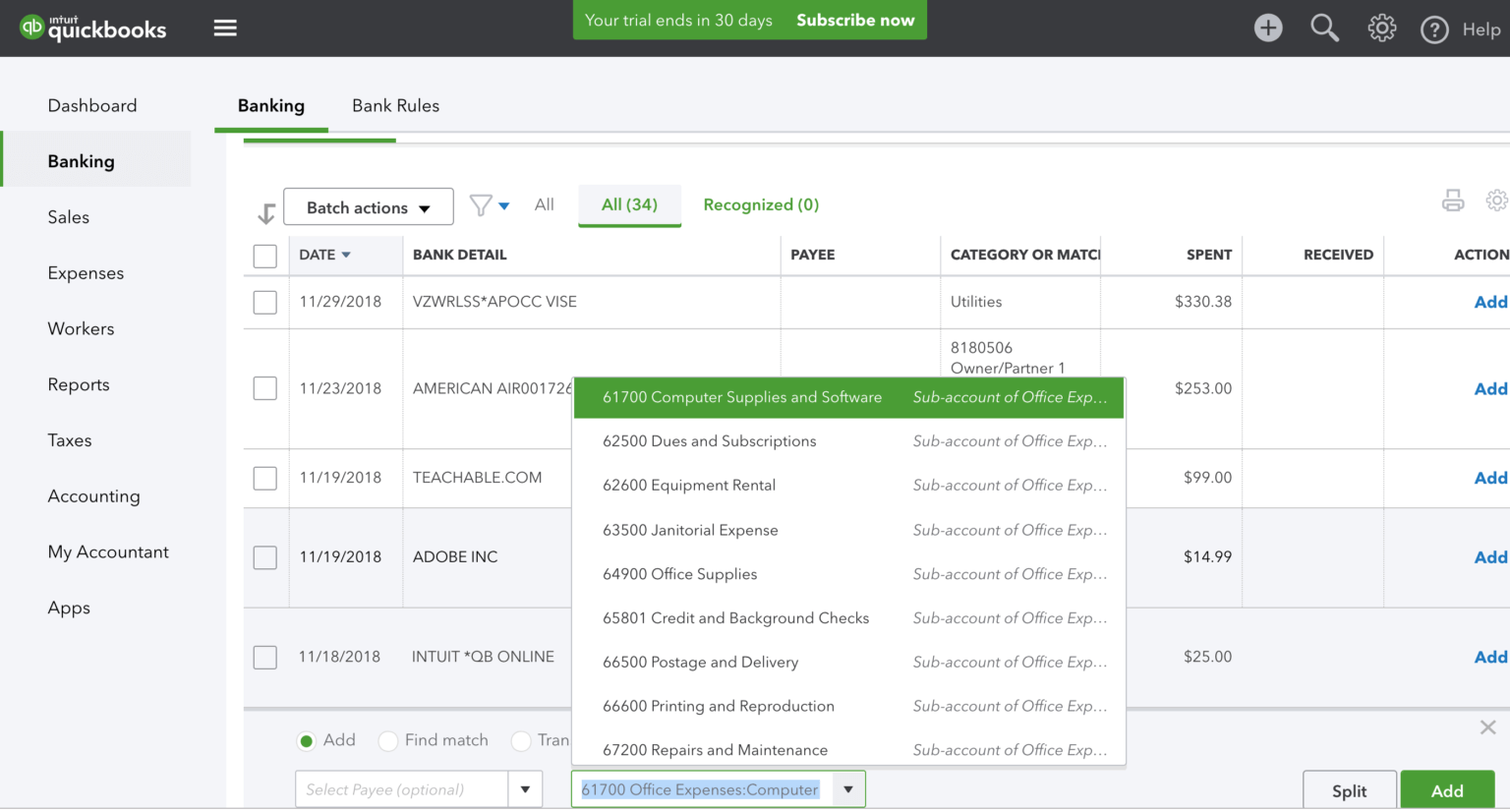

Customizing Your Chart of Accounts in QuickBooks On-line

QBO provides a level of customization to tailor your Chart of Accounts to your particular enterprise wants. Whereas it gives a pre-populated chart, you’ll be able to add, modify, or delete accounts to replicate your distinctive monetary construction. This customization is essential for correct monetary reporting and insightful evaluation.

Including Accounts:

Navigating to the "Chart of Accounts" part in QBO permits you to add new accounts. You may want to pick the suitable account kind (Asset, Legal responsibility, Fairness, Earnings, or Expense) and supply an in depth account title. Correct and descriptive account names are essential for readability and environment friendly reporting. For instance, as a substitute of a generic "Bills" account, take into account extra particular accounts like "Hire Expense," "Utilities Expense," or "Advertising Expense."

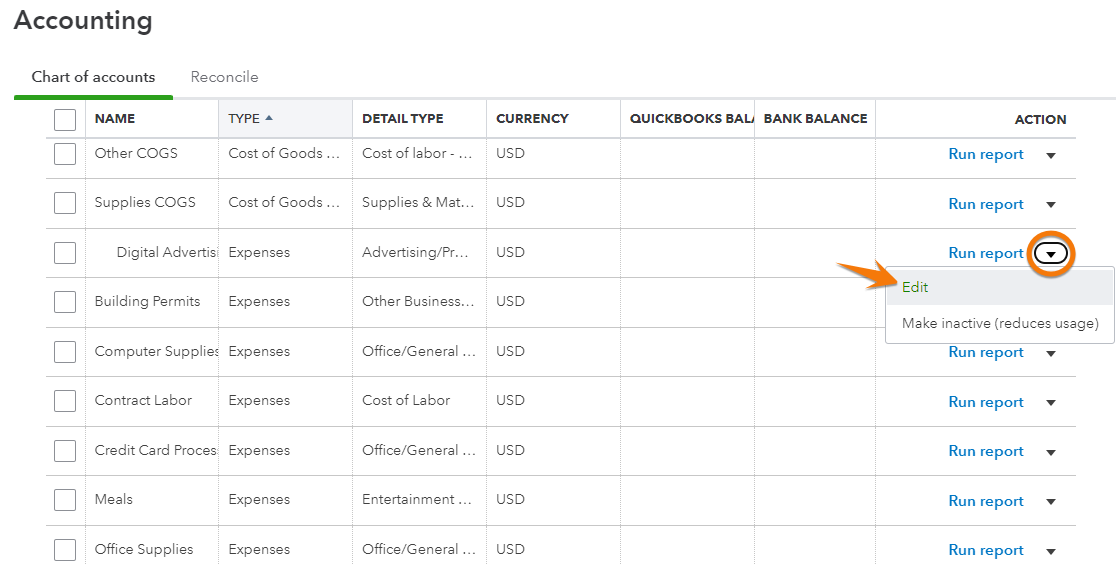

Modifying Accounts:

Current accounts could be modified to right errors or replicate modifications in your corporation construction. This would possibly contain renaming an account, altering its kind, or updating its particulars. Nonetheless, be cautious when making modifications, as it could impression previous transactions and studies. Take into account the implications earlier than making any modifications, and all the time again up your knowledge earlier than making important modifications.

Deleting Accounts:

Deleting accounts must be finished cautiously, because it completely removes the account and its related transactions out of your QBO knowledge. Earlier than deleting an account, guarantee you don’t have any excellent transactions related to it. If you could take away an account, take into account archiving it as a substitute of deleting it, permitting you to retain the historic knowledge whereas stopping it from being utilized in future transactions.

Greatest Practices for Setting Up and Sustaining Your Chart of Accounts

A well-organized Chart of Accounts is important for correct monetary reporting and environment friendly enterprise administration. Listed below are some finest practices to observe:

-

Use a Constant Chart of Accounts: Keep a constant naming conference on your accounts. This ensures readability and simplifies reporting.

-

Use Detailed Account Names: Keep away from generic account names. As a substitute, use descriptive names that clearly establish the aim of every account.

-

Usually Evaluation and Replace: Periodically assessment your Chart of Accounts to make sure it precisely displays your corporation actions. Add or modify accounts as wanted to accommodate modifications in your corporation operations.

-

Section Your Accounts: Use sub-accounts to categorize bills and revenue additional. This gives better element and permits for extra in-depth evaluation. For instance, you might have a "Advertising Expense" account with sub-accounts for "Promoting," "Public Relations," and "Social Media."

-

Use a Chart of Accounts Template: Think about using a pre-built chart of accounts template related to your trade. This may save time and guarantee your chart is structured appropriately. Nonetheless, guarantee it aligns together with your particular enterprise wants and adapt it accordingly.

-

Doc Your Chart of Accounts: Keep a written document of your Chart of Accounts, together with account names, descriptions, and account numbers. That is useful for reference and coaching functions.

-

Take into account Business-Particular Accounts: Relying in your trade, you might want particular accounts to trace distinctive bills or income streams. Analysis trade finest practices to make sure your Chart of Accounts is complete.

Implications of an Incorrectly Configured Chart of Accounts

An incorrectly configured Chart of Accounts can have important implications for your corporation:

-

Inaccurate Monetary Studies: Incorrect account assignments will result in inaccurate monetary studies, making it troublesome to make knowledgeable enterprise choices.

-

Tax Reporting Errors: Incorrect categorization of transactions can result in errors in your tax returns, probably leading to penalties and audits.

-

Issue in Monitoring Bills and Income: A poorly structured Chart of Accounts makes it troublesome to trace bills and income successfully, hindering your capability to handle your funds effectively.

-

Elevated Time and Effort for Reconciliation: Reconciling your financial institution statements and different monetary data turns into considerably more difficult with an improperly configured Chart of Accounts.

Troubleshooting Widespread Chart of Accounts Points

A number of frequent points come up when managing the Chart of Accounts in QBO:

-

Duplicate Accounts: Guarantee you do not have duplicate accounts. This may result in inaccurate monetary reporting.

-

Lacking Accounts: Guarantee you will have all the required accounts to categorize your transactions appropriately.

-

Incorrect Account Varieties: Guarantee every account is assigned to the right account kind (Asset, Legal responsibility, Fairness, Earnings, or Expense).

-

Inconsistent Naming Conventions: Keep constant naming conventions all through your Chart of Accounts.

Conclusion

The Chart of Accounts in QuickBooks On-line is a basic side of your monetary administration system. By understanding its construction, customizing it appropriately, and following finest practices for setup and upkeep, you’ll be able to guarantee correct monetary reporting, environment friendly tax preparation, and knowledgeable enterprise decision-making. Keep in mind that a well-organized and meticulously maintained Chart of Accounts is an funding within the long-term well being and success of your corporation. Common assessment and updates are essential to adapt to your corporation’s evolving wants and keep monetary readability. Do not hesitate to hunt skilled assist when you’re uncertain about any side of your Chart of Accounts configuration. A small funding in skilled steering can save important time, effort, and potential monetary complications in the long term.

Closure

Thus, we hope this text has supplied precious insights into Mastering the Chart of Accounts in QuickBooks On-line: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!