The Mounting Burden: Visualizing US Debt By 12 months Due By Bar Charts

By admin / July 18, 2024 / No Comments / 2025

The Mounting Burden: Visualizing US Debt by 12 months Due By Bar Charts

Associated Articles: The Mounting Burden: Visualizing US Debt by 12 months Due By Bar Charts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to The Mounting Burden: Visualizing US Debt by 12 months Due By Bar Charts. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

The Mounting Burden: Visualizing US Debt by 12 months Due By Bar Charts

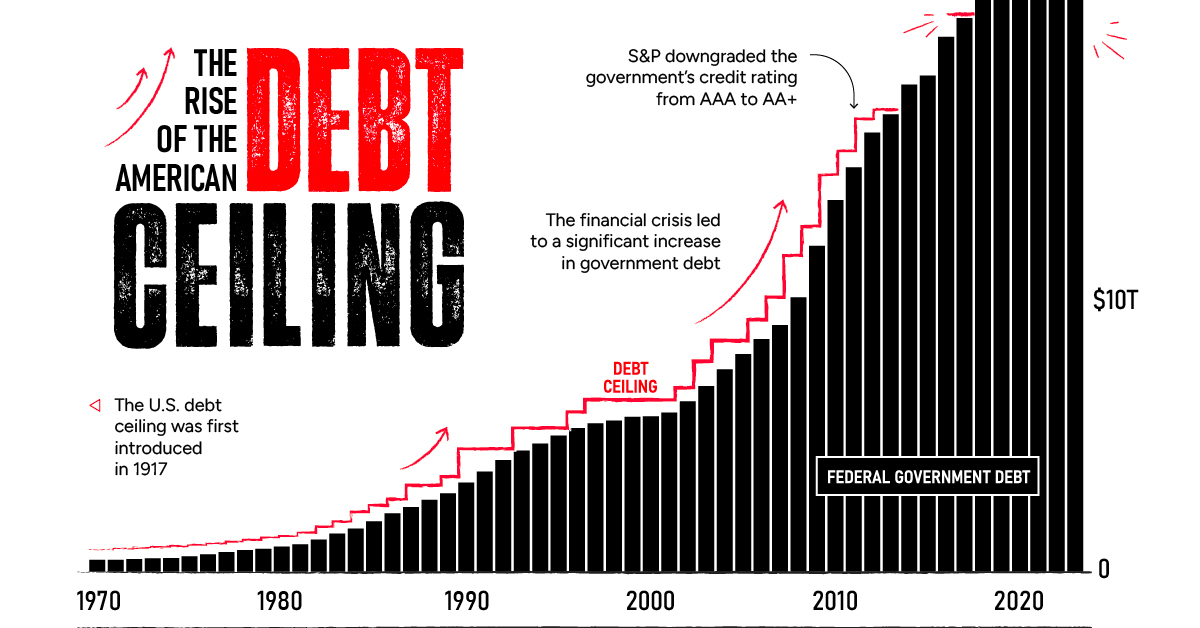

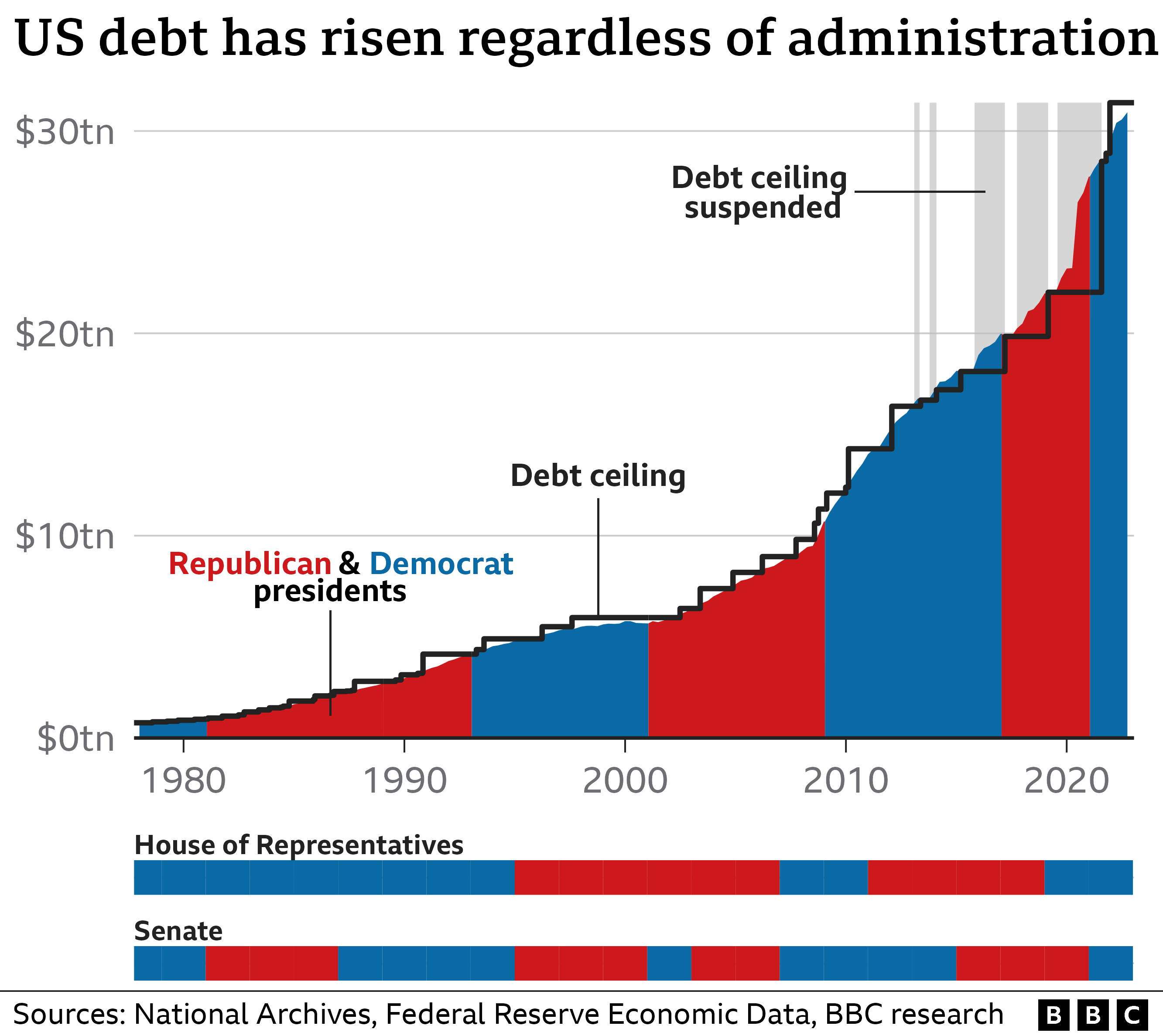

The US nationwide debt, a determine representing the full amount of cash the federal authorities owes to its collectors, is a topic of intense political and financial debate. Understanding its composition and trajectory is essential for assessing the nation’s fiscal well being and long-term stability. Whereas advanced tables and spreadsheets can convey this data, a visible illustration, equivalent to a bar chart illustrating US debt by yr due, provides a robust and accessible approach to grasp the magnitude and implications of this accumulating legal responsibility.

This text will delve into the creation and interpretation of bar charts depicting US debt by yr due, exploring the info sources, methodological issues, and the insights they supply into the nation’s borrowing patterns and future fiscal challenges. We will even talk about the constraints of such visualizations and the significance of contemplating further financial indicators for an entire understanding of the debt scenario.

Knowledge Sources and Methodology:

The first supply for information on US debt is the Treasury Division’s web site. The Treasury publishes detailed studies on the federal debt, together with breakdowns by sort of debt (e.g., Treasury payments, notes, bonds) and maturity dates. This data is important for setting up a bar chart exhibiting the debt due by yr.

The method of making such a chart includes a number of steps:

-

Knowledge Acquisition: Obtain the related information from the Treasury’s web site. This sometimes includes accessing spreadsheets or databases containing data on excellent debt devices and their maturity dates.

-

Knowledge Cleansing and Processing: The uncooked information might require cleansing and processing. This may occasionally contain dealing with lacking values, correcting inconsistencies, and aggregating information to the specified stage of granularity (e.g., grouping debt by yr).

-

Knowledge Aggregation: The information must be aggregated to indicate the full debt due in annually. This includes summing the worth of all debt devices maturing in a particular yr.

-

Chart Creation: Utilizing information visualization software program (e.g., Microsoft Excel, Tableau, R), create a bar chart. The horizontal axis (x-axis) will symbolize the yr, and the vertical axis (y-axis) will symbolize the quantity of debt due in billions or trillions of {dollars}. Every bar represents the full debt maturing in a given yr.

-

Chart Enhancement: Improve the chart with a transparent title, axis labels, and a legend (if a number of debt classes are included). Think about including information labels to every bar to show the precise quantity of debt. Select acceptable scales for the axes to make sure the chart is well readable and avoids distortion.

Deciphering the Bar Chart:

A well-constructed bar chart of US debt by yr due gives a number of key insights:

-

Debt Maturity Profile: The chart reveals the distribution of debt maturities over time. A focus of debt maturing in a selected yr signifies a doubtlessly larger refinancing threat in that yr. A extra evenly distributed maturity profile usually suggests a decrease threat.

-

Debt Progress Developments: The chart visually demonstrates the expansion of the US debt over time. By evaluating the peak of the bars throughout totally different years, one can simply observe the speed at which the debt is rising or lowering.

-

Fiscal Coverage Implications: The chart can be utilized to investigate the affect of presidency fiscal insurance policies on the debt. For instance, durations of elevated authorities spending or tax cuts could also be mirrored in a steeper improve within the peak of the bars.

-

Potential for Refinancing Challenges: A sudden surge within the quantity of debt maturing in a particular yr can point out a possible problem for the federal government in refinancing that debt, notably if rates of interest are rising.

-

Lengthy-Time period Sustainability: The general development displayed by the chart gives a visible illustration of the long-term sustainability of the US debt. A persistently upward trending chart suggests a rising concern relating to the nation’s fiscal well being.

Limitations of Bar Charts:

Whereas bar charts are efficient for visualizing debt by yr due, they’ve limitations:

-

Simplified Illustration: Bar charts simplify a posh phenomenon. They don’t seize the nuances of various kinds of debt, rates of interest, or the affect of inflation.

-

Lack of Context: The chart alone doesn’t present adequate context for decoding the info. It’s essential to think about different financial indicators, equivalent to GDP development, inflation charges, and rates of interest, to completely perceive the implications of the debt ranges.

-

Potential for Misinterpretation: Improperly scaled axes or deceptive labels can distort the interpretation of the info. It’s essential to make sure the chart is precisely and clearly introduced.

Past the Bar Chart: A Holistic Perspective:

To achieve a complete understanding of the US nationwide debt, it’s important to transcend easy bar charts. Analyzing the debt-to-GDP ratio, inspecting the composition of the debt by holder (e.g., international governments, home establishments), and contemplating the affect of rate of interest adjustments are all essential parts of a radical evaluation. Moreover, incorporating projections of future debt ranges primarily based on varied financial eventualities gives a extra nuanced understanding of the long-term fiscal outlook.

Conclusion:

A bar chart illustrating US debt by yr due provides a helpful visible software for understanding the maturity profile and development trajectory of the nation’s debt. Nonetheless, it’s essential to interpret this visualization inside a broader financial context. By combining the insights gleaned from bar charts with different financial indicators and complicated analytical fashions, policymakers and residents alike can achieve a extra full and nuanced understanding of the challenges and alternatives introduced by the US nationwide debt. The visible readability of a bar chart can function a robust start line for knowledgeable discussions and efficient coverage selections associated to the nation’s fiscal future. The continued monitoring and evaluation of this information, introduced by means of clear and accessible visualizations like bar charts, stay essential for accountable fiscal administration and the long-term financial well-being of america.

Closure

Thus, we hope this text has supplied helpful insights into The Mounting Burden: Visualizing US Debt by 12 months Due By Bar Charts. We thanks for taking the time to learn this text. See you in our subsequent article!