Decoding The Silver Worth Chart On Yahoo Finance: A Complete Information

By admin / October 2, 2024 / No Comments / 2025

Decoding the Silver Worth Chart on Yahoo Finance: A Complete Information

Associated Articles: Decoding the Silver Worth Chart on Yahoo Finance: A Complete Information

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the Silver Worth Chart on Yahoo Finance: A Complete Information. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Silver Worth Chart on Yahoo Finance: A Complete Information

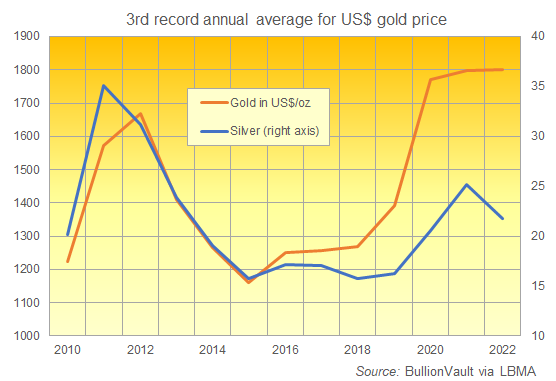

The silver worth chart on Yahoo Finance, like every commodity worth chart, is a dynamic snapshot of market sentiment, financial indicators, and international occasions. Understanding tips on how to interpret this chart successfully is essential for buyers, merchants, and anybody within the valuable metals market. This text will delve into the intricacies of the Yahoo Finance silver worth chart, exploring its options, decoding its actions, and contemplating the components that affect its fluctuations.

Understanding the Fundamentals of the Yahoo Finance Silver Worth Chart

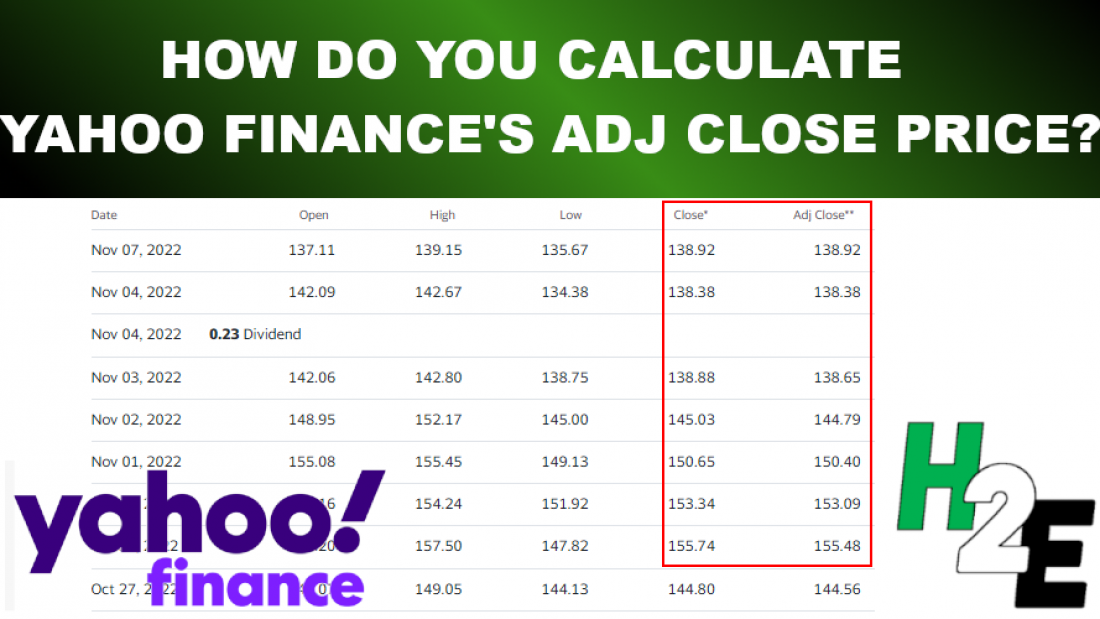

The Yahoo Finance silver worth chart offers a visible illustration of the silver worth over a selected time interval. Usually, it shows the value in US {dollars} per troy ounce. The chart itself might be personalized, permitting customers to pick numerous timeframes (from minutes to years), chart varieties (line, candlestick, bar), and indicators (shifting averages, RSI, MACD, and so on.). These customizable options permit for a tailor-made evaluation primarily based on particular person funding methods and time horizons.

Key components displayed on the chart normally embody:

- Worth Axis (Y-axis): Exhibits the value of silver in USD per troy ounce.

- Time Axis (X-axis): Represents the time interval chosen, starting from minutes to years.

- Worth Information Factors: These characterize the silver worth at particular time limits, typically marked as candlesticks (representing the open, excessive, low, and shutting costs for a given interval) or easy line factors.

- Quantity (Typically a separate chart): Exhibits the buying and selling quantity of silver contracts for every interval, offering insights into market exercise.

- Technical Indicators (Elective): Customers can add numerous technical indicators to the chart, offering extra alerts for potential worth actions. Widespread examples embody shifting averages (e.g., 50-day, 200-day), Relative Energy Index (RSI), and Shifting Common Convergence Divergence (MACD).

Deciphering Worth Actions on the Yahoo Finance Silver Chart

Understanding worth actions requires analyzing each short-term and long-term traits. Quick-term fluctuations might be extremely risky, influenced by day by day information and buying and selling exercise. Lengthy-term traits, nonetheless, typically mirror broader financial circumstances and market sentiment.

- Uptrends: A sustained enhance in silver costs over a interval, typically indicated by larger highs and better lows on the chart. This sometimes alerts bullish sentiment, with buyers anticipating additional worth appreciation.

- Downtrends: A sustained lower in silver costs, characterised by decrease highs and decrease lows. This signifies bearish sentiment, with buyers anticipating additional worth declines.

- Consolidation: A interval of sideways buying and selling, the place the value fluctuates inside an outlined vary. This typically represents indecision available in the market earlier than a major worth transfer in both route.

- Breakouts: A major worth transfer past a consolidation vary or a key assist/resistance degree. Breakouts can affirm a change in development and infrequently result in substantial worth actions.

- Assist and Resistance Ranges: Horizontal traces on the chart representing worth ranges the place the value has traditionally struggled to interrupt by. Assist ranges characterize worth flooring, whereas resistance ranges characterize worth ceilings. A break above resistance or under assist can sign a major worth motion.

Components Influencing Silver Costs: A Deeper Dive

The silver worth is influenced by a fancy interaction of things, making it a dynamic and infrequently unpredictable market. Understanding these components is essential for decoding the Yahoo Finance silver worth chart successfully.

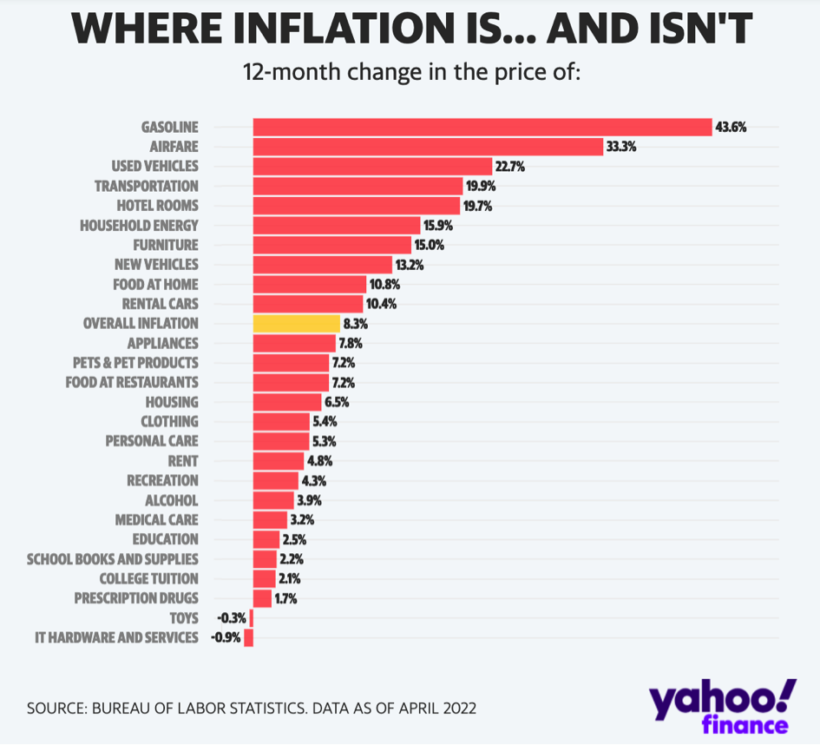

- Industrial Demand: Silver is an important industrial metallic utilized in numerous functions, together with electronics, photo voltaic panels, and cars. Elevated industrial demand can drive up silver costs. Financial progress and technological developments typically correlate with larger industrial demand.

- Funding Demand: Silver is taken into account a safe-haven asset, which means buyers typically purchase it throughout instances of financial uncertainty or geopolitical instability. Elevated funding demand can considerably influence silver costs. That is very true in periods of inflation or forex devaluation.

- Speculative Buying and selling: The silver market is vulnerable to speculative buying and selling, the place buyers purchase or promote primarily based on anticipated worth actions relatively than elementary components. This may result in important worth volatility.

- Foreign money Fluctuations: The US greenback is the first forex utilized in silver buying and selling. A weakening US greenback could make silver extra engaging to worldwide buyers, resulting in larger costs. Conversely, a strengthening greenback can put downward strain on silver costs.

- Inflation: Silver is usually seen as an inflation hedge, which means its worth tends to rise in periods of excessive inflation. It’s because silver’s worth will not be instantly tied to a fiat forex.

- Authorities Insurance policies: Authorities laws and insurance policies, resembling mining restrictions or adjustments in financial coverage, can influence silver provide and demand, thereby affecting its worth.

- Provide and Demand: Like all commodity, the elemental precept of provide and demand performs an important position in figuring out silver costs. A scarcity of silver as a result of restricted mining manufacturing or elevated demand can result in worth will increase.

- Geopolitical Occasions: World occasions, resembling wars, political instability, or pure disasters, can influence investor sentiment and considerably affect silver costs.

Using Technical Indicators on the Yahoo Finance Silver Chart

Yahoo Finance permits customers so as to add numerous technical indicators to their silver worth chart, offering extra insights into potential worth actions. These indicators are mathematical calculations primarily based on historic worth information and quantity. Nevertheless, it is essential to do not forget that technical indicators should not foolproof and must be used along side elementary evaluation.

Some generally used indicators embody:

- Shifting Averages: Calculate the common worth over a particular interval (e.g., 50-day, 200-day). Shifting averages will help determine traits and potential assist/resistance ranges.

- Relative Energy Index (RSI): Measures the magnitude of latest worth adjustments to judge overbought or oversold circumstances. RSI values above 70 are usually thought of overbought, whereas values under 30 are thought of oversold.

- Shifting Common Convergence Divergence (MACD): Identifies adjustments in momentum by evaluating two shifting averages. MACD crossovers can sign potential development reversals.

- Bollinger Bands: Plot customary deviations round a shifting common, indicating volatility and potential worth reversals.

Disclaimer: Technical evaluation is a fancy area, and relying solely on technical indicators might be dangerous. It is essential to conduct thorough analysis and take into account elementary components earlier than making any funding choices.

Conclusion:

The Yahoo Finance silver worth chart provides a helpful instrument for understanding the dynamics of the silver market. By understanding the chart’s options, decoding worth actions, and contemplating the varied components influencing silver costs, buyers can acquire a extra complete view of the market and make knowledgeable choices. Nevertheless, do not forget that the silver market is inherently risky, and no evaluation can assure future worth actions. Cautious analysis, threat administration, and a diversified funding technique are essential for achievement on this dynamic market. At all times seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Silver Worth Chart on Yahoo Finance: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!