Decoding The Tata Motors Share Value Chart: A 20-Yr Journey

By admin / September 10, 2024 / No Comments / 2025

Decoding the Tata Motors Share Value Chart: A 20-Yr Journey

Associated Articles: Decoding the Tata Motors Share Value Chart: A 20-Yr Journey

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding the Tata Motors Share Value Chart: A 20-Yr Journey. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the Tata Motors Share Value Chart: A 20-Yr Journey

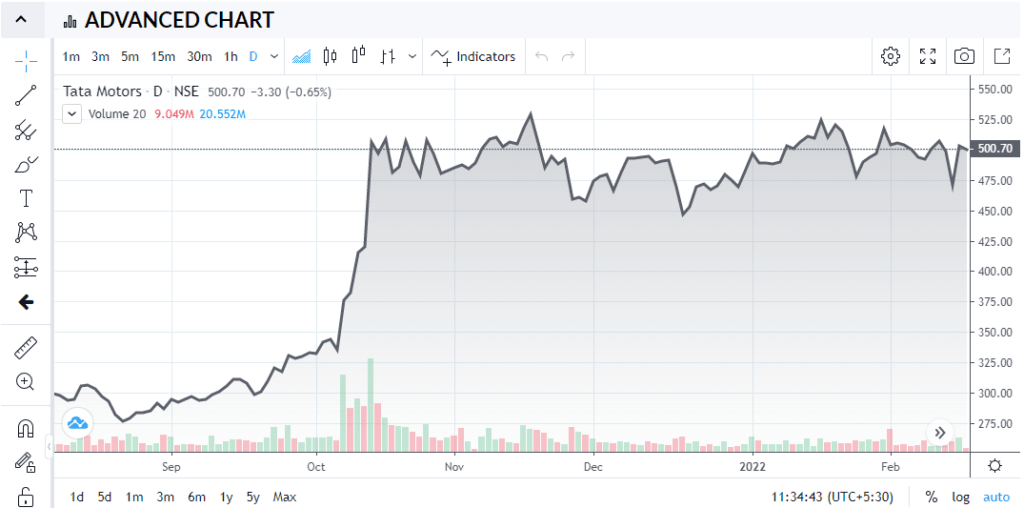

Tata Motors, a behemoth within the Indian automotive trade, has witnessed a rollercoaster journey in its share worth over the previous 20 years. Analyzing its share worth chart presents worthwhile insights into the corporate’s efficiency, the impression of macroeconomic elements, and the evolving investor sentiment. This text delves deep into the Tata Motors share worth chart, inspecting key traits, vital occasions, and potential future implications.

The Early 2000s: A Interval of Consolidation and Development:

The early 2000s noticed Tata Motors navigate a comparatively secure, albeit slow-growing, market. The share worth, whereas not experiencing explosive progress, demonstrated gradual upward motion, reflecting the corporate’s regular growth inside India and its preliminary forays into worldwide markets. This era was characterised by constant profitability and a deal with strengthening its home presence, notably within the industrial car section. The chart throughout this time exhibits a comparatively mild incline, punctuated by minor corrections mirroring broader market fluctuations. Elements influencing the worth included home financial progress, authorities insurance policies associated to the auto sector, and the growing demand for industrial autos pushed by infrastructure improvement.

The Jaguar Land Rover Acquisition and its Impression:

The acquisition of Jaguar Land Rover (JLR) in 2008 marked a pivotal second in Tata Motors’ historical past, dramatically reshaping its trajectory. Whereas the acquisition initially boosted investor confidence and led to a surge within the share worth, the next years introduced vital challenges. The worldwide monetary disaster of 2008-09 severely impacted the automotive trade worldwide, and JLR, closely reliant on European and North American markets, felt the brunt of the downturn. The share worth chart displays this volatility, displaying a pointy decline mirroring the worldwide financial disaster, adopted by a chronic interval of consolidation and gradual restoration. This era highlights the inherent dangers related to large-scale acquisitions and the impression of worldwide macroeconomic occasions on even established corporations.

Navigating the International Recession and Subsequent Restoration:

The post-2009 interval noticed Tata Motors grapple with the aftermath of the worldwide monetary disaster. The corporate carried out cost-cutting measures and targeted on streamlining operations to enhance profitability. The share worth chart throughout this section reveals a gradual, gradual upward pattern, interspersed with intervals of stagnation and minor corrections. The restoration was not uniform, with the efficiency of JLR enjoying a big position in influencing the general share worth. Elements resembling fluctuating foreign money alternate charges, commodity costs (notably metal and aluminum), and evolving shopper preferences in several markets all contributed to the share worth fluctuations.

The Rise of Electrical Automobiles and the Shift in Technique:

The emergence of electrical autos (EVs) within the final decade has considerably impacted the automotive trade globally, and Tata Motors is not any exception. The corporate has strategically positioned itself to capitalize on the rising demand for EVs, investing closely in analysis and improvement and launching a number of profitable EV fashions within the Indian market. The share worth chart displays this strategic shift, exhibiting a extra pronounced upward pattern lately, pushed by investor optimism surrounding the corporate’s EV initiatives and the rising reputation of its EV choices. This era showcases the significance of adapting to technological developments and the potential for vital returns from strategic investments in rising applied sciences.

Latest Efficiency and Future Outlook:

In recent times, Tata Motors has demonstrated a robust resurgence, pushed by sturdy gross sales in each its home and worldwide markets. The corporate’s deal with EVs, together with its sturdy efficiency within the industrial car section, has contributed considerably to its improved monetary well being. The share worth chart displays this constructive momentum, displaying a constant upward trajectory, though topic to market-wide fluctuations. Nonetheless, challenges stay, together with the extreme competitors within the EV market, the volatility of commodity costs, and the potential impression of geopolitical occasions.

Analyzing Key Chart Patterns:

An in depth evaluation of the Tata Motors share worth chart reveals a number of key patterns:

- Help and Resistance Ranges: Figuring out key help and resistance ranges on the chart can assist predict potential worth actions. These ranges signify worth factors the place shopping for or promoting stress is powerful.

- Trendlines: Drawing trendlines on the chart can assist establish the general path of the worth motion – whether or not it is an uptrend, downtrend, or sideways pattern.

- Transferring Averages: Utilizing transferring averages (e.g., 50-day, 200-day) can assist easy out short-term worth fluctuations and establish long-term traits.

- Candlestick Patterns: Analyzing candlestick patterns can present insights into potential worth reversals or continuations.

Elements Influencing the Share Value:

Quite a few elements affect the Tata Motors share worth, together with:

- Home Financial Development: The general well being of the Indian financial system instantly impacts the demand for cars.

- Authorities Insurance policies: Authorities laws and incentives associated to the auto sector play an important position.

- International Financial Circumstances: International financial downturns or upturns can considerably impression the corporate’s efficiency, particularly JLR’s.

- Commodity Costs: Fluctuations within the costs of uncooked supplies like metal and aluminum have an effect on manufacturing prices.

- Competitors: Competitors from each home and worldwide gamers influences market share and profitability.

- Technological Developments: The tempo of technological innovation, notably within the EV sector, shapes the corporate’s future prospects.

- Investor Sentiment: General investor confidence within the firm and the broader market considerably influences the share worth.

Conclusion:

The Tata Motors share worth chart tells a compelling story of resilience, adaptation, and strategic imaginative and prescient. Whereas the journey has been marked by intervals of volatility and challenges, the corporate has demonstrated a outstanding capability to navigate troublesome instances and capitalize on rising alternatives. The way forward for Tata Motors, and consequently its share worth, will depend upon its capability to proceed innovating, adapting to altering market dynamics, and sustaining a robust monetary place. A radical understanding of the historic traits, coupled with an evaluation of present market situations and future prospects, is essential for buyers in search of to make knowledgeable choices relating to Tata Motors shares. Nonetheless, it is essential to do not forget that previous efficiency will not be indicative of future outcomes, and investing within the inventory market inherently entails threat. Thorough analysis and diversification are important for any funding technique.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Tata Motors Share Value Chart: A 20-Yr Journey. We admire your consideration to our article. See you in our subsequent article!