Decoding The Sensex Chart On TradingView: A Complete Information

By admin / October 25, 2024 / No Comments / 2025

Decoding the Sensex Chart on TradingView: A Complete Information

Associated Articles: Decoding the Sensex Chart on TradingView: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Sensex Chart on TradingView: A Complete Information. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the Sensex Chart on TradingView: A Complete Information

The Sensex, or the S&P BSE Sensex, is India’s benchmark inventory market index, monitoring the efficiency of 30 of the biggest and most actively traded corporations listed on the Bombay Inventory Trade (BSE). Understanding its actions is essential for anybody concerned in Indian equities, whether or not a seasoned investor or a novice dealer. TradingView, a preferred charting platform, supplies a robust toolset to investigate the Sensex and make knowledgeable buying and selling choices. This text delves into using TradingView to successfully interpret the Sensex chart, masking numerous technical indicators, chart patterns, and threat administration methods.

Understanding the Fundamentals: Navigating the TradingView Sensex Chart

Earlier than diving into superior evaluation, it is essential to know the basic components of the TradingView Sensex chart. Upon accessing the Sensex chart on TradingView (usually by looking out "^BSESN"), you may encounter numerous elements:

-

Value Chart: This shows the Sensex’s worth actions over a selected timeframe (e.g., 1-minute, every day, weekly, month-to-month). You possibly can choose candlestick, line, bar, or space charts primarily based in your desire. Candlesticks are usually most well-liked for his or her capability to visually signify worth motion (open, excessive, low, shut).

-

Timeframe Choice: This lets you regulate the chart’s granularity, from intraday ticks to long-term yearly views. Completely different timeframes reveal totally different traits and patterns. Brief-term charts (e.g., 5-minute, 1-hour) present worth fluctuations ultimate for day buying and selling, whereas longer-term charts (e.g., weekly, month-to-month) present a broader perspective for swing buying and selling or investing.

-

Indicators: TradingView provides an unlimited library of technical indicators, that are mathematical calculations utilized to cost information to determine potential buying and selling alerts. These embrace shifting averages (MA), relative energy index (RSI), MACD, Bollinger Bands, and lots of extra. Including related indicators enhances the chart’s analytical capabilities.

-

Drawing Instruments: These instruments mean you can mark assist and resistance ranges, trendlines, Fibonacci retracements, and different chart patterns to visually determine potential buying and selling alternatives and threat administration factors.

-

Research: TradingView’s "Research" part supplies entry to a complete library of pre-built indicators and scripts. Customers can add, customise, and handle these research to tailor their chart evaluation.

Technical Evaluation on TradingView: Deciphering the Sensex’s Indicators

Efficient Sensex buying and selling on TradingView depends closely on technical evaluation. Here is a take a look at some key strategies:

-

Pattern Identification: Figuring out the general pattern (uptrend, downtrend, or sideways) is paramount. Trendlines, shifting averages (e.g., 20-day, 50-day, 200-day MA), and the general worth motion may also help decide the dominant pattern. A rising trendline signifies an uptrend, whereas a falling trendline suggests a downtrend.

-

Help and Resistance Ranges: These are worth ranges the place the value has traditionally struggled to interrupt by way of. Help ranges signify potential shopping for alternatives, whereas resistance ranges point out potential promoting alternatives. Breaks above resistance or under assist typically sign important worth actions.

-

Transferring Averages: Transferring averages clean out worth fluctuations, making it simpler to determine traits. The crossover of various shifting averages (e.g., a 50-day MA crossing above a 200-day MA) can generate purchase alerts, whereas the other can sign promote alerts.

-

Relative Energy Index (RSI): The RSI measures the magnitude of latest worth modifications to guage overbought or oversold circumstances. RSI values above 70 are usually thought-about overbought, suggesting potential worth corrections, whereas values under 30 point out oversold circumstances, doubtlessly signaling a worth bounce.

-

MACD (Transferring Common Convergence Divergence): MACD is a momentum indicator that identifies modifications within the energy, route, momentum, and period of a pattern. Crossovers of the MACD line above the sign line can generate purchase alerts, whereas crossovers under the sign line can counsel promote alerts.

-

Bollinger Bands: Bollinger Bands show worth volatility utilizing normal deviations. Value touches close to the higher band can counsel overbought circumstances, whereas touches close to the decrease band can counsel oversold circumstances. Breakouts above the higher band or under the decrease band typically signify robust worth actions.

Chart Patterns on TradingView: Recognizing Potential Alternatives

TradingView’s drawing instruments allow the identification of varied chart patterns that may predict future worth actions. Some frequent patterns embrace:

-

Head and Shoulders: This reversal sample suggests a possible pattern change. It consists of three peaks, with the center peak (the pinnacle) being the very best.

-

Double Tops/Bottoms: These patterns point out potential pattern reversals, with two related worth peaks (double high) or troughs (double backside).

-

Triangles: Triangles are consolidation patterns that may precede both a breakout or a breakdown. Symmetrical triangles are impartial, whereas ascending triangles counsel bullish continuation, and descending triangles counsel bearish continuation.

-

Flags and Pennants: These continuation patterns point out a brief pause in a powerful pattern, adopted by a continuation of the pattern.

Threat Administration and Buying and selling Methods on TradingView

Efficient buying and selling includes meticulous threat administration. TradingView facilitates this by way of:

-

Cease-Loss Orders: These orders mechanically promote an asset when it reaches a predetermined worth, limiting potential losses.

-

Take-Revenue Orders: These orders mechanically promote an asset when it reaches a predetermined worth, securing income.

-

Place Sizing: This includes figuring out the suitable quantity of capital to allocate to every commerce, limiting general threat.

-

Backtesting: TradingView permits backtesting of buying and selling methods utilizing historic information, enabling analysis of their effectiveness earlier than implementing them with actual capital.

Past the Fundamentals: Superior Strategies and Issues

TradingView’s capabilities lengthen past the basics. Superior customers can discover:

-

Customized Indicators: Create and make the most of customized indicators tailor-made to particular buying and selling methods.

-

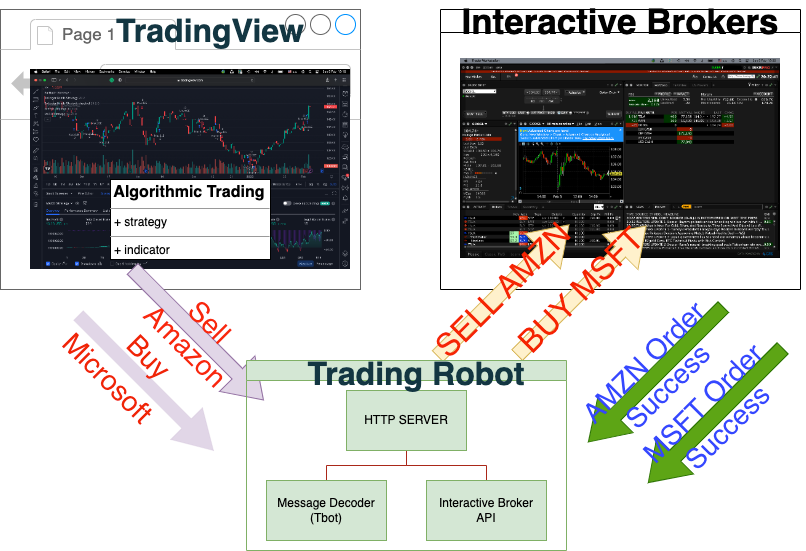

Automated Buying and selling: Combine TradingView with brokerage platforms to execute trades mechanically primarily based on pre-defined guidelines.

-

Group Interplay: Interact with different merchants, share concepts, and be taught from skilled customers throughout the TradingView group.

-

Elementary Evaluation Integration: Whereas TradingView primarily focuses on technical evaluation, integrating elementary information (e.g., firm earnings, financial indicators) can present a extra holistic view of the Sensex’s efficiency.

Conclusion:

TradingView provides a strong platform for analyzing the Sensex chart and making knowledgeable buying and selling choices. By mastering its options, together with technical indicators, chart patterns, and threat administration instruments, merchants can considerably enhance their understanding of market dynamics and improve their buying and selling efficiency. Nonetheless, it is essential to do not forget that no buying and selling technique ensures success, and thorough analysis, threat administration, and steady studying are important for navigating the complexities of the inventory market. The data offered on this article serves as a information and shouldn’t be thought-about monetary recommendation. At all times conduct your individual analysis and seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered useful insights into Decoding the Sensex Chart on TradingView: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!