The Chart Of Accounts: Spine Of Monetary Administration For Your Enterprise

By admin / August 21, 2024 / No Comments / 2025

The Chart of Accounts: Spine of Monetary Administration for Your Enterprise

Associated Articles: The Chart of Accounts: Spine of Monetary Administration for Your Enterprise

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to The Chart of Accounts: Spine of Monetary Administration for Your Enterprise. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

The Chart of Accounts: Spine of Monetary Administration for Your Enterprise

:max_bytes(150000):strip_icc()/chart-accounts.asp_final-438b76f8e6e444dd8f4cd8736b0baa6a.png)

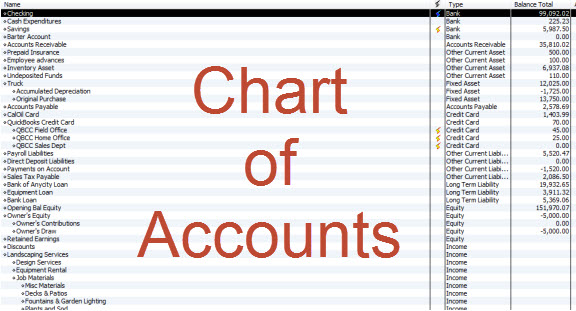

A well-structured chart of accounts is the cornerstone of any profitable enterprise’s monetary administration system. It is greater than only a listing of accounts; it is a meticulously organized framework that categorizes all monetary transactions, offering a transparent and concise image of the corporate’s monetary well being. This text delves deep into the intricacies of making and sustaining a strong chart of accounts, appropriate for companies of all sizes, specializing in the sensible elements and greatest practices.

What’s a Chart of Accounts?

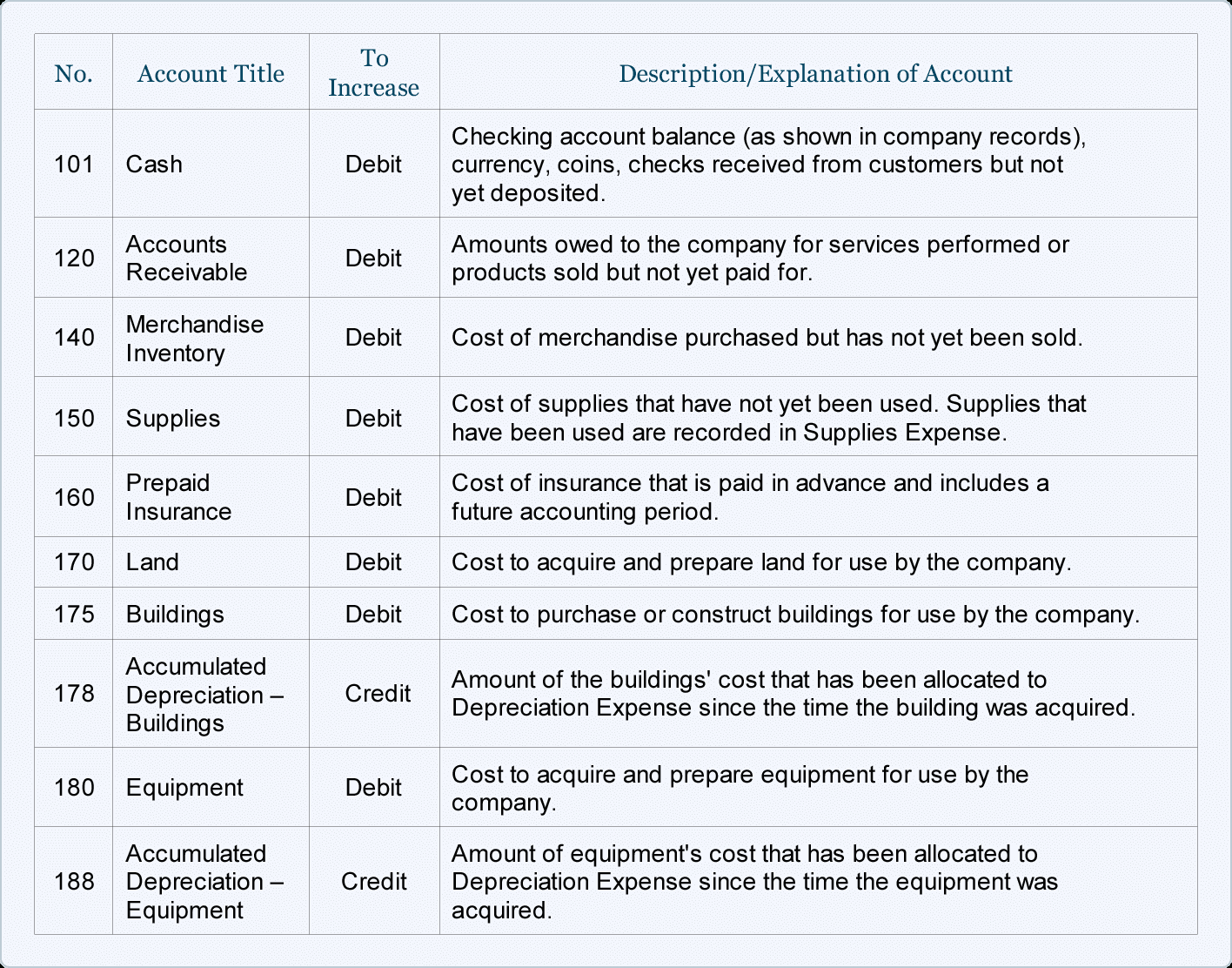

A chart of accounts (COA) is a complete itemizing of all of the accounts utilized by a enterprise to document its monetary transactions. Every account represents a particular ingredient of the corporate’s monetary exercise, akin to property, liabilities, fairness, revenues, and bills. Consider it as an in depth index in your firm’s monetary data. The COA permits for correct monitoring of earnings, bills, property, and liabilities, facilitating knowledgeable decision-making and compliance with accounting requirements.

The Significance of a Properly-Structured Chart of Accounts:

A well-designed COA gives quite a few advantages:

-

Correct Monetary Reporting: A correctly structured COA ensures that each one transactions are recorded within the right accounts, resulting in correct monetary statements (steadiness sheet, earnings assertion, money move assertion). This accuracy is essential for inner administration, exterior reporting to buyers and lenders, and tax compliance.

-

Improved Monetary Evaluation: By categorizing transactions successfully, the COA simplifies monetary evaluation. Managers can simply establish developments, pinpoint areas of power and weak spot, and make data-driven choices relating to useful resource allocation, value management, and profitability enchancment.

-

Streamlined Accounting Processes: A well-organized COA simplifies the accounting course of, lowering errors and enhancing effectivity. It streamlines information entry, reconciliation, and report era.

-

Enhanced Inner Management: A sturdy COA contributes to a powerful inner management system by offering a transparent framework for authorization, segregation of duties, and monitoring of transactions. This minimizes the danger of fraud and errors.

-

Simplified Auditing: A well-structured COA makes the audit course of smoother and extra environment friendly, as auditors can simply hint transactions and confirm the accuracy of monetary data.

Designing Your Chart of Accounts: A Step-by-Step Information

Making a COA requires cautious planning and consideration of what you are promoting’s particular wants. Here is a step-by-step information:

-

Select an Accounting System: Choose an accounting software program or system that most accurately fits what you are promoting dimension and complexity. Many software program packages supply pre-built COA templates, which may be personalized.

-

Outline Your Account Construction: Most COAs observe a standardized construction primarily based on the accounting equation: Property = Liabilities + Fairness. This construction varieties the muse for categorizing all accounts.

-

Develop a Detailed Account Listing: This includes making a complete listing of accounts, together with:

- Property: Present property (money, accounts receivable, stock), fastened property (property, plant, and gear), and different property (pay as you go bills, investments).

- Liabilities: Present liabilities (accounts payable, short-term loans), long-term liabilities (mortgages, bonds payable).

- Fairness: Proprietor’s fairness (capital contributions, retained earnings).

- Revenues: Gross sales income, service income, curiosity income, different income streams.

- Bills: Price of products bought, salaries, lease, utilities, advertising and marketing bills, depreciation, and many others.

-

Implement a Constant Chart of Accounts Numbering System: A numerical coding system helps set up and categorize accounts. A typical method makes use of a hierarchical system, with every digit representing a particular class or sub-category. For instance, 1000-1999 would possibly characterize property, 2000-2999 liabilities, and so forth. This technique simplifies looking and reporting.

-

Think about Sub-Accounts: For bigger companies, utilizing sub-accounts inside main classes offers larger element and permits for extra granular evaluation. For instance, inside the "Bills" class, you can have sub-accounts for "Salaries – Gross sales," "Salaries – Administration," and "Salaries – Manufacturing."

-

Common Assessment and Updates: Your COA just isn’t static. As what you are promoting grows and evolves, you may must assessment and replace it usually to make sure it precisely displays your present operations. This would possibly contain including new accounts, eradicating out of date ones, or reorganizing current accounts.

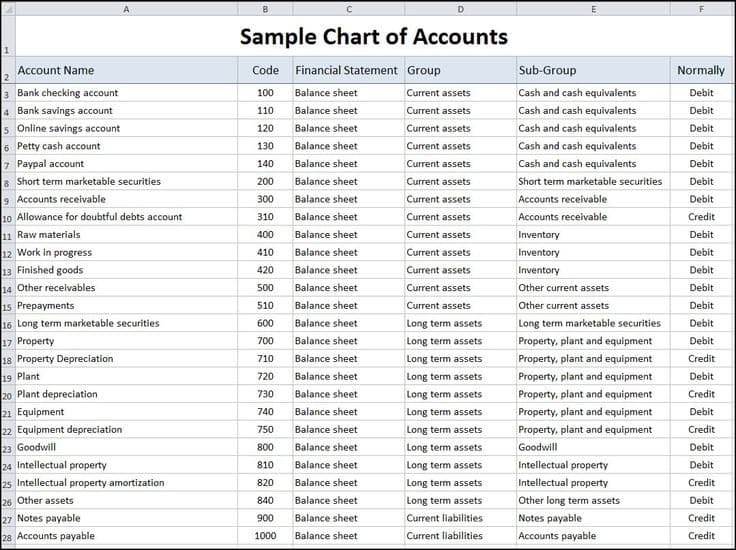

Instance Chart of Accounts Construction:

It is a simplified instance, and the extent of element will differ relying on what you are promoting:

| Account Quantity | Account Title | Account Kind |

|---|---|---|

| 1000 | Money | Asset |

| 1100 | Accounts Receivable | Asset |

| 1200 | Stock | Asset |

| 2000 | Accounts Payable | Legal responsibility |

| 2100 | Salaries Payable | Legal responsibility |

| 3000 | Proprietor’s Fairness | Fairness |

| 4000 | Gross sales Income | Income |

| 5000 | Price of Items Bought | Expense |

| 5100 | Salaries Expense | Expense |

| 5200 | Lease Expense | Expense |

| 5300 | Utilities Expense | Expense |

Greatest Practices for Chart of Accounts Administration:

- Hold it Easy: Keep away from extreme complexity. A transparent and concise COA is less complicated to handle and perceive.

- Use Constant Terminology: Keep constant terminology all through the COA to keep away from confusion.

- Doc Your COA: Create an in depth documentation explaining every account and its goal. That is essential for coaching new workers and for future reference.

- Often Reconcile Accounts: Often reconcile your accounts to make sure accuracy and establish any discrepancies.

- Keep Compliant: Guarantee your COA complies with related accounting requirements and rules.

Conclusion:

The chart of accounts is a basic ingredient of monetary administration for any enterprise. A well-designed and maintained COA offers a strong basis for correct monetary reporting, environment friendly accounting processes, and knowledgeable decision-making. By following the steps outlined on this article and adhering to greatest practices, companies can create a strong COA that helps their development and success. Keep in mind that the secret’s to create a system that’s tailor-made to your particular wants and usually reviewed and up to date to mirror the evolving nature of what you are promoting. Investing the effort and time in making a well-structured chart of accounts can pay dividends in the long term, guaranteeing correct monetary insights and supporting sound enterprise choices.

Closure

Thus, we hope this text has supplied worthwhile insights into The Chart of Accounts: Spine of Monetary Administration for Your Enterprise. We thanks for taking the time to learn this text. See you in our subsequent article!