Understanding T-Chart Accounting: A Complete Information With Examples

By admin / November 10, 2024 / No Comments / 2025

Understanding T-Chart Accounting: A Complete Information with Examples

Associated Articles: Understanding T-Chart Accounting: A Complete Information with Examples

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Understanding T-Chart Accounting: A Complete Information with Examples. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Understanding T-Chart Accounting: A Complete Information with Examples

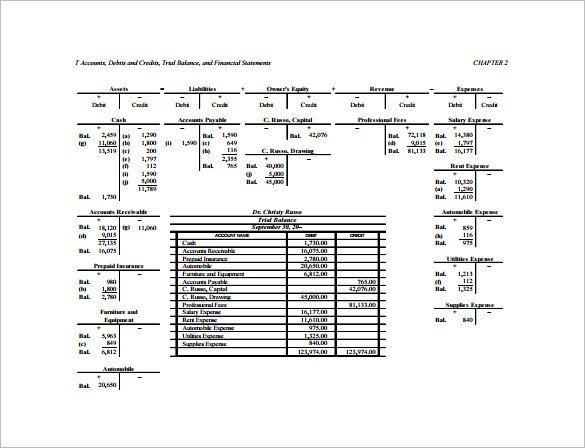

The T-chart, a elementary instrument in accounting, offers a easy but efficient technique to visualize and report monetary transactions. Its easy construction makes it supreme for learners studying accounting rules and in addition serves as a helpful instrument for knowledgeable accountants to shortly analyze particular person transactions earlier than formal bookkeeping. This text will delve into the intricacies of T-chart accounting, exploring its functions, advantages, and limitations by detailed examples.

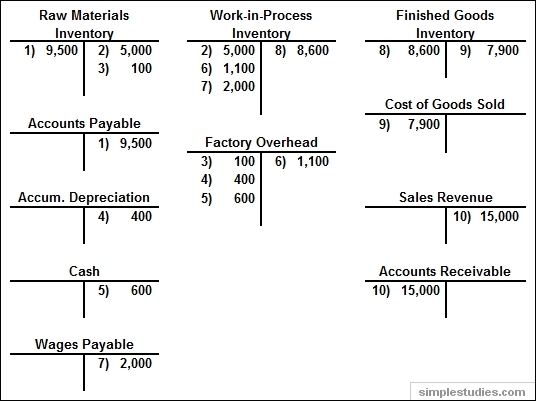

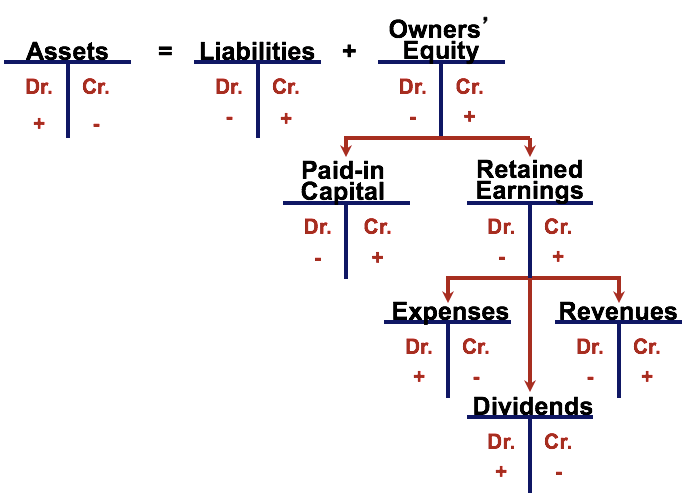

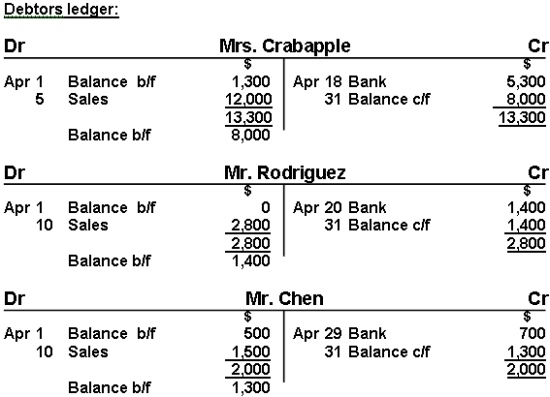

The Construction of a T-Chart

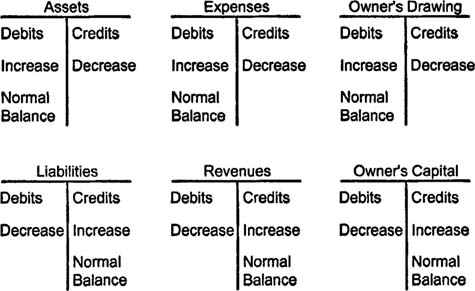

As its identify suggests, a T-chart resembles the letter "T," divided into two columns by a vertical line. The left column represents the debit facet, whereas the correct column represents the credit score facet. The elemental accounting equation, Belongings = Liabilities + Fairness, is implicitly represented within the T-chart. Debits improve asset accounts and reduce legal responsibility and fairness accounts. Credit improve legal responsibility and fairness accounts and reduce asset accounts. This seemingly easy rule is the cornerstone of double-entry bookkeeping, which ensures the accounting equation stays balanced after each transaction.

Key Accounts Utilized in T-Charts:

Earlier than diving into examples, it is essential to know the frequent accounts utilized in T-charts. These are broadly categorized as:

- Belongings: These symbolize what an organization owns, reminiscent of money, accounts receivable (cash owed to the corporate), stock, gear, and buildings.

- Liabilities: These symbolize what an organization owes to others, together with accounts payable (cash owed to suppliers), loans payable, and salaries payable.

- Fairness: This represents the proprietor’s stake within the firm. It consists of capital contributions, retained earnings (income reinvested within the enterprise), and withdrawals by the proprietor.

- Income: This represents earnings generated from the corporate’s operations, reminiscent of gross sales income and repair income.

- Bills: These symbolize the prices incurred in working the enterprise, reminiscent of lease, salaries, utilities, and value of products offered.

Instance 1: Easy Money Transaction

Let’s think about a easy state of affairs: a enterprise receives $5,000 money from a buyer for companies rendered.

| Account Identify | Debit | Credit score |

|---|---|---|

| Money | $5,000 | |

| Service Income | $5,000 |

On this transaction, the money account will increase (debit), reflecting the influx of money. Concurrently, the service income account will increase (credit score), representing the earnings generated. The debit and credit score quantities are equal, sustaining the basic accounting equation steadiness.

Instance 2: Buy of Gear on Credit score

Think about the enterprise purchases gear price $10,000 on credit score from a provider.

| Account Identify | Debit | Credit score |

|---|---|---|

| Gear | $10,000 | |

| Accounts Payable | $10,000 |

The gear account will increase (debit) as a result of the enterprise now owns the gear. Conversely, the accounts payable account will increase (credit score) as a result of the enterprise owes cash to the provider. Once more, the equation stays balanced.

Instance 3: Fee of Hire Expense

The enterprise pays $1,000 lease for the month.

| Account Identify | Debit | Credit score |

|---|---|---|

| Hire Expense | $1,000 | |

| Money | $1,000 |

Hire expense will increase (debit) as it is a value incurred. Concurrently, the money account decreases (credit score) as money is paid out.

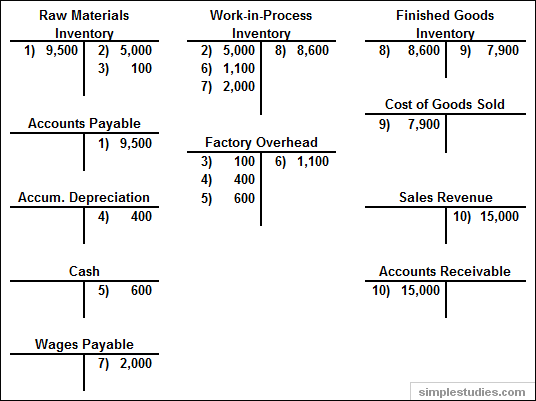

Instance 4: Extra Advanced Transaction – Gross sales with Price of Items Bought

Let’s think about a extra advanced state of affairs: the enterprise sells items price $20,000 (value of products offered is $12,000) and receives money for the sale.

This transaction entails a number of accounts:

- Money: Will increase (debit) as money is obtained.

- Gross sales Income: Will increase (credit score) to report the earnings.

- Price of Items Bought: Will increase (debit) representing the price of the products offered.

- Stock: Decreases (credit score) as the products are not in inventory.

The T-chart would appear like this:

| Account Identify | Debit | Credit score |

|---|---|---|

| Money | $20,000 | |

| Price of Items Bought | $12,000 | |

| Stock | $12,000 | |

| Gross sales Income | $20,000 |

Notice that the whole debits ($32,000) equal the whole credit ($32,000), sustaining the accounting equation steadiness. This demonstrates how a number of accounts are impacted by a single transaction.

Instance 5: Proprietor’s Funding

The proprietor invests $25,000 within the enterprise.

| Account Identify | Debit | Credit score |

|---|---|---|

| Money | $25,000 | |

| Proprietor’s Fairness | $25,000 |

Money will increase (debit) because the enterprise receives the funding, and the proprietor’s fairness will increase (credit score) reflecting the elevated possession stake.

Limitations of T-Charts

Whereas T-charts are extremely helpful for illustrating particular person transactions, they’ve limitations:

- Restricted Scope: They’re greatest suited to single transactions or small units of transactions. For giant and sophisticated companies, a extra complete accounting system is critical.

- No Operating Stability: T-charts do not routinely present working balances for every account. This data must be calculated individually.

- Lack of Element: They lack the detailed data usually required for complete monetary reporting. This necessitates using normal ledgers and different accounting software program.

Transition to Formal Accounting Techniques

T-charts function a stepping stone to extra refined accounting techniques. As soon as a radical understanding of debits and credit is achieved, companies sometimes transition to normal ledgers, which give a extra structured and complete record-keeping system. Accounting software program packages additional automate the method, dealing with advanced calculations and producing monetary studies.

Conclusion:

T-chart accounting provides a helpful introduction to the basic rules of double-entry bookkeeping. Its simplicity permits learners to know the core ideas of debits and credit and the way they affect the accounting equation. Whereas restricted in scope for advanced companies, it stays a vital instrument for visualizing particular person transactions and reinforcing the basic rules that underpin all accounting practices. Mastering the T-chart is step one in the direction of a deeper understanding of monetary accounting and efficient enterprise administration. By understanding the examples offered, readers can start to use these rules to their very own monetary conditions or achieve a firmer grasp of accounting fundamentals. The secret’s constant observe and a focus to element in guaranteeing debits at all times equal credit, sustaining the integrity of the accounting equation.

Closure

Thus, we hope this text has offered helpful insights into Understanding T-Chart Accounting: A Complete Information with Examples. We thanks for taking the time to learn this text. See you in our subsequent article!