Decoding The Gold Buying and selling Chart Reside: A Complete Information

By admin / July 21, 2024 / No Comments / 2025

Decoding the Gold Buying and selling Chart Reside: A Complete Information

Associated Articles: Decoding the Gold Buying and selling Chart Reside: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Gold Buying and selling Chart Reside: A Complete Information. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the Gold Buying and selling Chart Reside: A Complete Information

Gold, a timeless image of wealth and stability, has captivated traders for hundreds of years. Its worth, nevertheless, is something however static. Understanding the dwell gold buying and selling chart is essential for anybody navigating this dynamic market, whether or not you are a seasoned dealer or simply starting your journey. This text delves deep into the intricacies of dwell gold charts, exploring the varied indicators, patterns, and elements that affect its worth actions. We’ll equip you with the data to interpret these charts successfully and make knowledgeable buying and selling choices.

Understanding the Fundamentals of a Reside Gold Chart

A dwell gold buying and selling chart shows the value of gold over time, sometimes in real-time. The commonest chart varieties are:

- Line Chart: The only sort, displaying the closing worth of gold for every interval (e.g., day by day, hourly, or minutely). Preferrred for figuring out general traits.

- Bar Chart: Supplies extra info than a line chart, displaying the open, excessive, low, and shutting costs for every interval. The "physique" of the bar represents the value vary between the open and shut, whereas the "wicks" lengthen to the excessive and low costs.

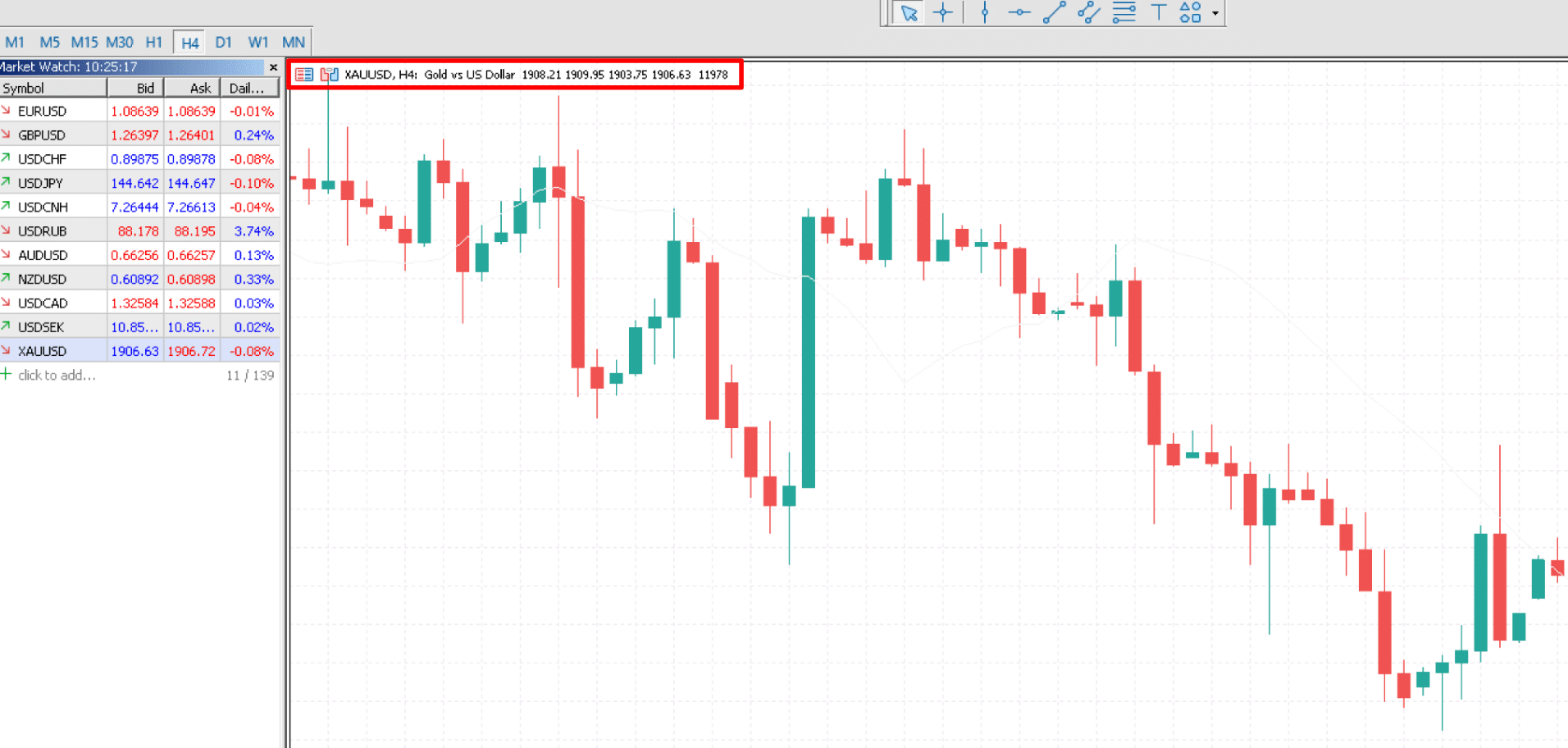

- Candlestick Chart: Much like bar charts, however visually richer. The physique is stuffed (normally inexperienced or white for bullish, purple or black for bearish) and the wicks symbolize the highs and lows. Candlestick patterns supply worthwhile insights into market sentiment.

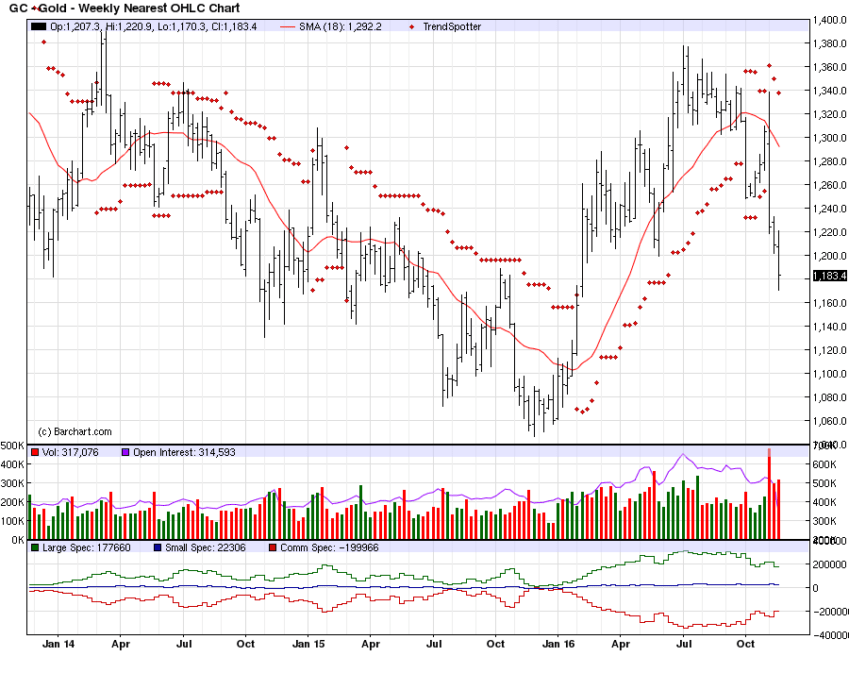

Most dwell gold charts assist you to customise the timeframe, from intraday (minutes, hours) to long-term (day by day, weekly, month-to-month). This flexibility permits merchants to investigate gold’s worth motion at numerous scales, figuring out short-term buying and selling alternatives or long-term funding methods. The chart sometimes additionally shows quantity, which represents the quantity of gold traded throughout every interval. Excessive quantity typically accompanies vital worth actions.

Key Indicators Utilized in Gold Chart Evaluation

Whereas the uncooked worth knowledge is key, technical indicators improve the chart’s analytical energy. These indicators present indicators primarily based on mathematical calculations utilized to historic worth knowledge. Some generally used indicators embrace:

- Transferring Averages (MA): Calculate the typical worth over a particular interval (e.g., 50-day MA, 200-day MA). They easy out worth fluctuations and assist determine traits. Crossovers between completely different MAs (e.g., a 50-day MA crossing above a 200-day MA) can sign potential pattern modifications.

- Relative Power Index (RSI): Measures the pace and alter of worth actions. It oscillates between 0 and 100. Readings above 70 are typically thought-about overbought, suggesting a possible worth reversal, whereas readings beneath 30 are thought-about oversold, suggesting a possible worth bounce.

- MACD (Transferring Common Convergence Divergence): Compares two transferring averages to determine momentum modifications. A bullish crossover (MACD line crossing above the sign line) can point out a possible uptrend, whereas a bearish crossover can sign a possible downtrend.

- Bollinger Bands: Plot normal deviations round a transferring common. They present worth volatility. Costs touching or breaking the bands can recommend potential reversals or breakouts.

- Fibonacci Retracement: Primarily based on the Fibonacci sequence, this device identifies potential help and resistance ranges primarily based on previous worth actions.

Deciphering Chart Patterns

Technical evaluation entails figuring out recurring chart patterns that usually precede particular worth actions. Some widespread patterns embrace:

- Head and Shoulders: A reversal sample suggesting a possible downtrend after an uptrend.

- Inverse Head and Shoulders: A reversal sample suggesting a possible uptrend after a downtrend.

- Double High/Backside: Reversal patterns indicating potential pattern modifications.

- Triangles: Consolidation patterns that may precede a breakout in both path.

- Flags and Pennants: Continuation patterns suggesting the continuation of the prevailing pattern.

Components Influencing Gold Costs

Understanding the elements influencing gold costs is essential for decoding dwell gold charts successfully. These elements embrace:

- US Greenback Power: Gold is inversely correlated with the US greenback. A stronger greenback sometimes results in decrease gold costs, and vice versa.

- Curiosity Charges: Larger rates of interest typically improve the chance value of holding gold (which does not pay curiosity), resulting in decrease gold costs.

- Inflation: Gold is commonly seen as a hedge towards inflation. Larger inflation sometimes results in larger gold costs.

- Geopolitical Occasions: Political instability, wars, and different geopolitical occasions can considerably influence gold costs, typically driving them larger as traders search protected haven property.

- Provide and Demand: Like all commodity, the availability and demand dynamics of gold affect its worth. Elevated demand or decreased provide sometimes results in larger costs.

- Central Financial institution Exercise: Central banks’ shopping for and promoting of gold can considerably influence the market.

- Market Sentiment: Investor sentiment performs an important function. Optimistic sentiment can drive costs larger, whereas pessimistic sentiment can result in decrease costs.

Utilizing Reside Gold Charts for Buying and selling Methods

Reside gold charts are indispensable instruments for numerous buying and selling methods:

- Day Buying and selling: Focuses on short-term worth actions inside a single day. Requires shut monitoring of the chart and fast decision-making.

- Swing Buying and selling: Holds positions for a number of days or perhaps weeks, aiming to capitalize on short-to-medium-term worth swings.

- Place Buying and selling: Holds positions for longer intervals, typically months and even years, aiming to revenue from long-term traits.

- Scalping: A really short-term buying and selling technique aiming to revenue from small worth fluctuations.

Danger Administration and Accountable Buying and selling

Buying and selling gold, like all monetary market, entails threat. Efficient threat administration is essential:

- Set Cease-Loss Orders: These orders mechanically promote your gold place if the value falls to a predetermined degree, limiting potential losses.

- Diversify Your Portfolio: Do not put all of your eggs in a single basket. Diversify your investments to cut back general threat.

- Use Leverage Correctly: Leverage can amplify each earnings and losses. Use it cautiously and provided that you totally perceive the dangers.

- Repeatedly Study and Adapt: The gold market is dynamic. Keep up to date on market traits and refine your buying and selling methods accordingly.

Conclusion:

Mastering the dwell gold buying and selling chart is a journey, not a vacation spot. It requires constant studying, apply, and self-discipline. By understanding the fundamentals of chart varieties, technical indicators, chart patterns, and the elements influencing gold costs, you’ll be able to considerably enhance your capability to interpret market indicators and make knowledgeable buying and selling choices. Keep in mind that accountable buying and selling entails managing threat successfully and repeatedly studying to adapt to the ever-changing market dynamics. All the time conduct thorough analysis and take into account in search of recommendation from a professional monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Gold Buying and selling Chart Reside: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!