Decoding The LIC House Mortgage Amortization Chart: Your Information To Understanding Mortgage Compensation

By admin / July 23, 2024 / No Comments / 2025

Decoding the LIC House Mortgage Amortization Chart: Your Information to Understanding Mortgage Compensation

Associated Articles: Decoding the LIC House Mortgage Amortization Chart: Your Information to Understanding Mortgage Compensation

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the LIC House Mortgage Amortization Chart: Your Information to Understanding Mortgage Compensation. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the LIC House Mortgage Amortization Chart: Your Information to Understanding Mortgage Compensation

Life Insurance coverage Company of India (LIC) gives residence loans, a major monetary dedication for most people. Understanding the compensation schedule is essential for efficient monetary planning. That is the place the LIC residence mortgage amortization chart is available in. This text delves deep into the intricacies of this chart, explaining its parts, methods to interpret it, and its significance in managing your house mortgage successfully.

What’s an Amortization Chart?

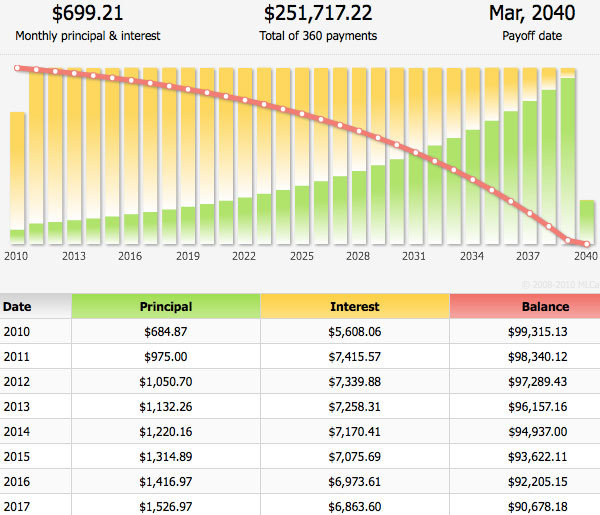

An amortization chart, often known as a mortgage amortization schedule, is an in depth desk that outlines your month-to-month cost schedule for a mortgage. Particularly for an LIC residence mortgage, it breaks down every month-to-month cost into its principal and curiosity parts. This gives a transparent image of how your mortgage stability decreases over time as you make common funds. It is a highly effective instrument for visualizing your compensation journey and understanding the monetary implications of your mortgage.

Elements of an LIC House Mortgage Amortization Chart:

A typical LIC residence mortgage amortization chart contains the next key components:

- Mortgage Quantity (Principal): That is the preliminary quantity borrowed from LIC to buy your house.

- Curiosity Price: The annual rate of interest charged by LIC in your mortgage. This fee may be fastened or floating, impacting your month-to-month funds and the general price of the mortgage.

- Mortgage Tenure: The full compensation interval of the mortgage, often expressed in years or months. An extended tenure means decrease month-to-month funds however larger total curiosity paid.

- Month-to-month Cost: The fastened quantity you pay to LIC every month. This cost covers each the principal and curiosity parts.

- Principal Paid: The portion of your month-to-month cost that goes in direction of lowering the excellent mortgage quantity. This will increase over time.

- Curiosity Paid: The portion of your month-to-month cost that goes in direction of paying the curiosity on the excellent mortgage quantity. This decreases over time.

- Excellent Mortgage Stability: The remaining quantity you owe LIC after every month-to-month cost. This regularly decreases till it reaches zero on the finish of the mortgage tenure.

- Whole Curiosity Paid: The cumulative curiosity paid over your complete mortgage tenure. It is a essential issue to think about when evaluating completely different mortgage choices.

The best way to Interpret an LIC House Mortgage Amortization Chart:

The chart presents knowledge in a tabular format, often organized chronologically, exhibiting the adjustments in every part over the mortgage’s lifetime. Every row represents a month-to-month installment. By inspecting the chart, you may:

- Observe your progress: Observe how the excellent mortgage stability decreases with every cost.

- Perceive curiosity and principal allocation: See the proportion of your month-to-month cost allotted to curiosity versus principal compensation. Within the preliminary phases, a bigger portion goes in direction of curiosity, whereas the principal part regularly will increase.

- Plan your funds: Predict future money stream necessities based mostly on the constant month-to-month cost quantity.

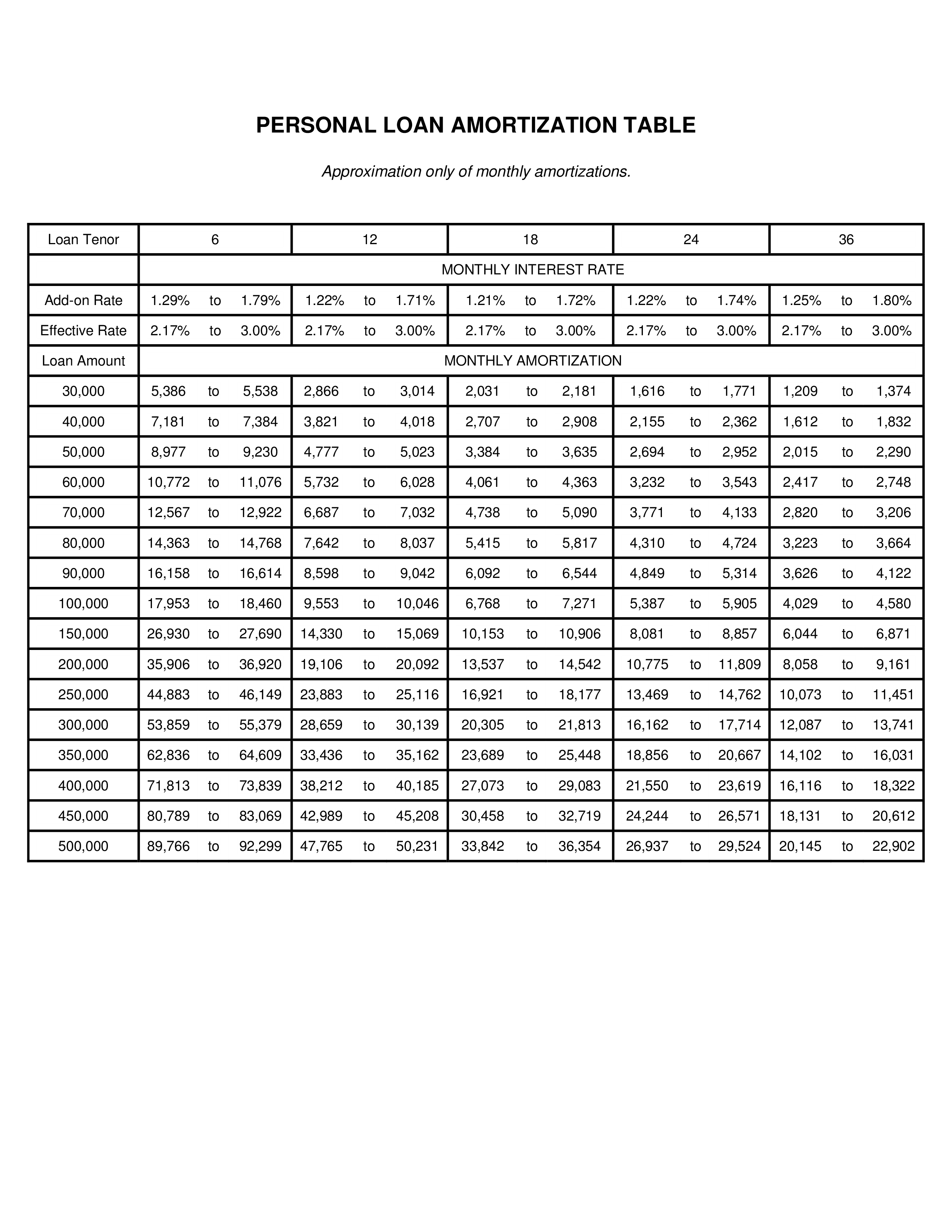

- Examine mortgage choices: In case you are contemplating completely different mortgage choices from LIC or different lenders, evaluating their amortization charts helps in making an knowledgeable determination based mostly on whole curiosity paid and month-to-month cost quantities.

- Establish potential financial savings: The chart can spotlight alternatives to prepay parts of the mortgage to cut back the general curiosity burden. Prepayment methods can considerably cut back the full curiosity paid and shorten the mortgage tenure.

Significance of the Amortization Chart:

The LIC residence mortgage amortization chart serves a number of crucial functions:

- Monetary Planning: It gives a transparent roadmap for managing your funds, permitting you to funds successfully in your month-to-month funds.

- Debt Administration: It aids in understanding your debt compensation journey, serving to you keep on monitor and keep away from potential defaults.

- Knowledgeable Determination Making: It empowers you to make knowledgeable selections relating to mortgage choices, contemplating elements like rates of interest, mortgage tenure, and whole curiosity payable.

- Transparency: It gives transparency within the mortgage compensation course of, guaranteeing you perceive how your funds are being utilized.

- Early Mortgage Closure: By analyzing the chart, you may strategically plan for early mortgage closure by making additional funds to cut back the principal quantity and thereby the curiosity payable.

Acquiring your LIC House Mortgage Amortization Chart:

You possibly can sometimes receive your amortization chart from LIC in a number of methods:

- On the time of mortgage disbursement: LIC often gives a duplicate of the amortization chart whenever you finalize your house mortgage.

- By your LIC mortgage account portal: Many lenders supply on-line entry to your mortgage account particulars, together with the amortization chart.

- By contacting your LIC mortgage officer: For those who can’t discover your chart, contacting your mortgage officer will offer you a duplicate.

Components Affecting the Amortization Chart:

A number of elements affect the small print displayed in your LIC residence mortgage amortization chart:

- Mortgage Quantity: A bigger mortgage quantity will end in larger month-to-month funds and an extended compensation interval, assuming the rate of interest and mortgage tenure stay fixed.

- Curiosity Price: The next rate of interest results in larger month-to-month funds and a better whole curiosity payable over the mortgage tenure.

- Mortgage Tenure: An extended mortgage tenure ends in decrease month-to-month funds however the next whole curiosity payable. Conversely, a shorter tenure results in larger month-to-month funds however decrease total curiosity.

- Prepayments: Making prepayments reduces the excellent mortgage stability, thereby reducing the curiosity payable and doubtlessly shortening the mortgage tenure. This can considerably alter the amortization schedule.

Utilizing the Amortization Chart for Efficient Mortgage Administration:

The amortization chart is not only a static doc; it’s a dynamic instrument for efficient mortgage administration. You should use it to:

- Monitor your progress: Usually assessment your chart to make sure you are on monitor along with your funds.

- Plan for prepayments: Establish alternatives to make prepayments, doubtlessly saving vital curiosity over the mortgage’s lifetime.

- Discover refinancing choices: If rates of interest fall considerably, you should use the chart to evaluate the potential advantages of refinancing your mortgage at a decrease fee.

- Funds successfully: The constant month-to-month cost determine permits for correct budgeting and monetary planning.

Conclusion:

The LIC residence mortgage amortization chart is a useful instrument for understanding and managing your house mortgage successfully. By understanding its parts and deciphering the info precisely, you can also make knowledgeable monetary selections, plan your funds meticulously, and guarantee a easy and environment friendly residence mortgage compensation journey. Do not underestimate the ability of this seemingly easy chart; it is the important thing to unlocking monetary readability and profitable homeownership. Keep in mind to at all times make a copy of your amortization chart and check with it frequently to remain knowledgeable and answerable for your LIC residence mortgage.

Closure

Thus, we hope this text has offered helpful insights into Decoding the LIC House Mortgage Amortization Chart: Your Information to Understanding Mortgage Compensation. We thanks for taking the time to learn this text. See you in our subsequent article!