Navigating The Chart Of Accounts: Understanding And Managing Unhealthy Debt Expense

By admin / September 8, 2024 / No Comments / 2025

Navigating the Chart of Accounts: Understanding and Managing Unhealthy Debt Expense

Associated Articles: Navigating the Chart of Accounts: Understanding and Managing Unhealthy Debt Expense

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Navigating the Chart of Accounts: Understanding and Managing Unhealthy Debt Expense. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Navigating the Chart of Accounts: Understanding and Managing Unhealthy Debt Expense

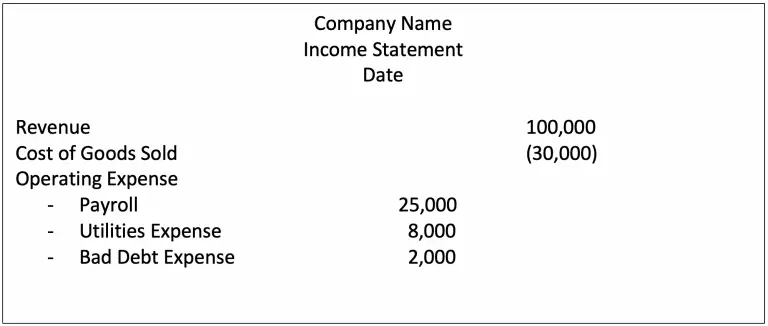

The chart of accounts, the spine of any accounting system, meticulously organizes an organization’s monetary transactions. Inside this structured framework lies a vital account that displays the inherent threat of extending credit score: the unhealthy debt expense account. Understanding this account, its implications, and efficient administration methods is paramount for sustaining correct monetary reporting and preserving an organization’s monetary well being. This text delves deep into the intricacies of the unhealthy debt expense account, exploring its goal, accounting strategies, evaluation, and the general impression on a enterprise’s backside line.

What’s Unhealthy Debt Expense?

Unhealthy debt expense represents the anticipated losses an organization will incur resulting from uncollectible accounts receivable. In essence, it is the price of doing enterprise on credit score. When an organization extends credit score to prospects, there’s at all times a threat that some prospects will not pay their excellent invoices. Unhealthy debt expense accounts for this inherent threat, recognizing the potential loss earlier than it truly happens. It is a essential ingredient in matching revenues with bills, making certain a real reflection of profitability. With out accounting for unhealthy debt, an organization’s monetary statements would overstate its internet earnings and belongings.

The Significance of Correct Unhealthy Debt Estimation

Precisely estimating unhealthy debt expense is important for a number of causes:

-

Monetary Assertion Accuracy: Overestimating or underestimating unhealthy debt immediately impacts the accuracy of the earnings assertion and stability sheet. An overestimation results in an understated internet earnings, whereas an underestimation inflates internet earnings, making a deceptive image of the corporate’s monetary efficiency.

-

Compliance with Accounting Requirements: Usually Accepted Accounting Ideas (GAAP) require firms to acknowledge unhealthy debt expense within the interval the credit score sale is made, making use of the matching precept. Failure to take action may end up in non-compliance and potential penalties.

-

Credit score Coverage Analysis: Analyzing unhealthy debt expense can reveal inefficiencies in an organization’s credit score insurance policies. A constantly excessive unhealthy debt expense may point out a must tighten credit score phrases, enhance buyer screening processes, or implement extra aggressive assortment methods.

-

Tax Implications: Unhealthy debt expense is a deductible expense for tax functions, decreasing the corporate’s taxable earnings. Correct estimation is essential to maximizing tax advantages.

Strategies for Estimating Unhealthy Debt Expense

Two major strategies are generally used to estimate unhealthy debt expense:

-

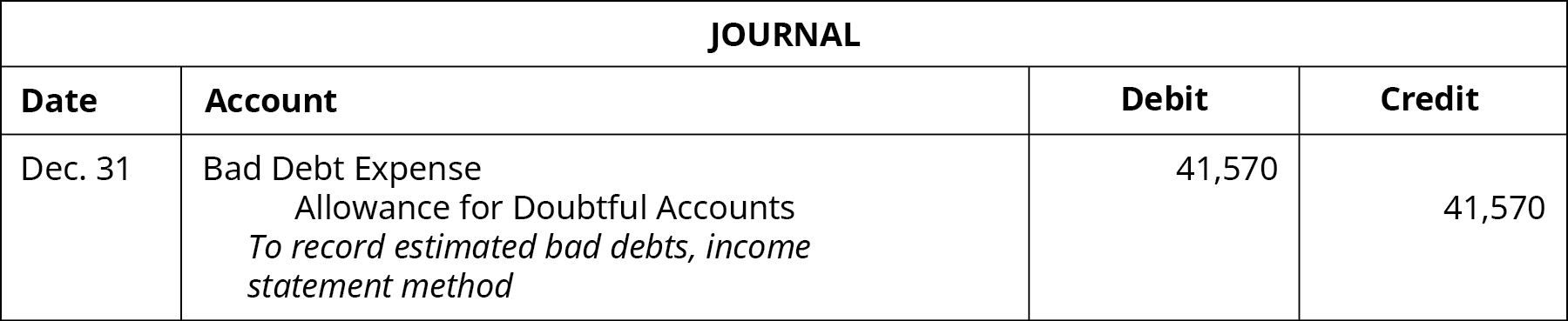

Share of Gross sales Methodology: This technique estimates unhealthy debt expense as a share of internet credit score gross sales. The share is set primarily based on historic information, business benchmarks, and administration’s judgment. It is a easy technique, notably appropriate for firms with comparatively secure credit score gross sales and a constant historical past of unhealthy money owed. The system is:

Unhealthy Debt Expense = Web Credit score Gross sales x Share of Gross sales -

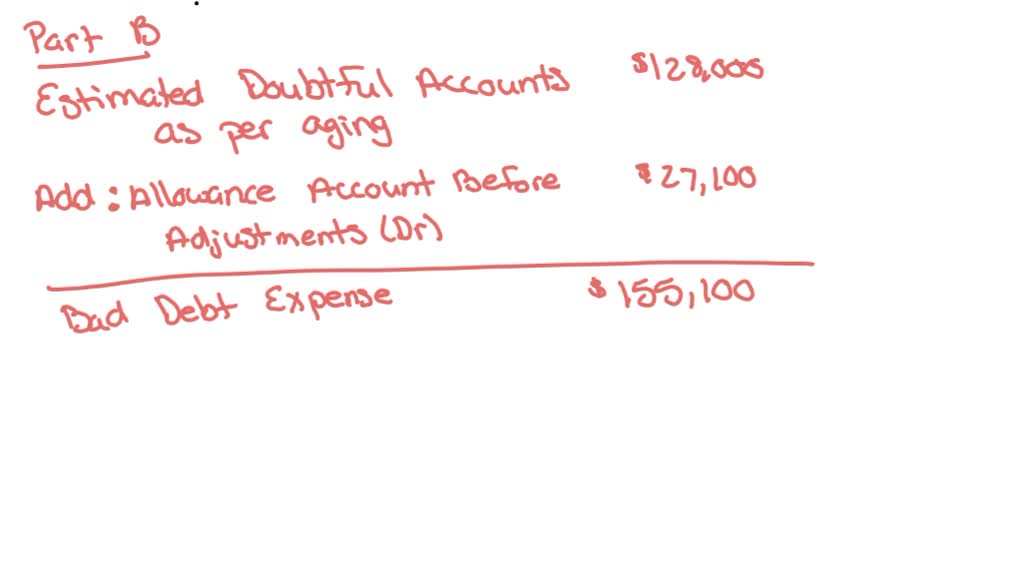

Share of Accounts Receivable Methodology: This technique estimates unhealthy debt expense primarily based on the prevailing accounts receivable stability. It is notably helpful for firms with fluctuating credit score gross sales however a comparatively secure ageing of receivables. The share is utilized to the accounts receivable stability, usually categorized by age (e.g., 0-30 days, 31-60 days, 60+ days), reflecting the growing chance of non-payment with time. The system is:

Unhealthy Debt Expense = Accounts Receivable x Share of Receivables

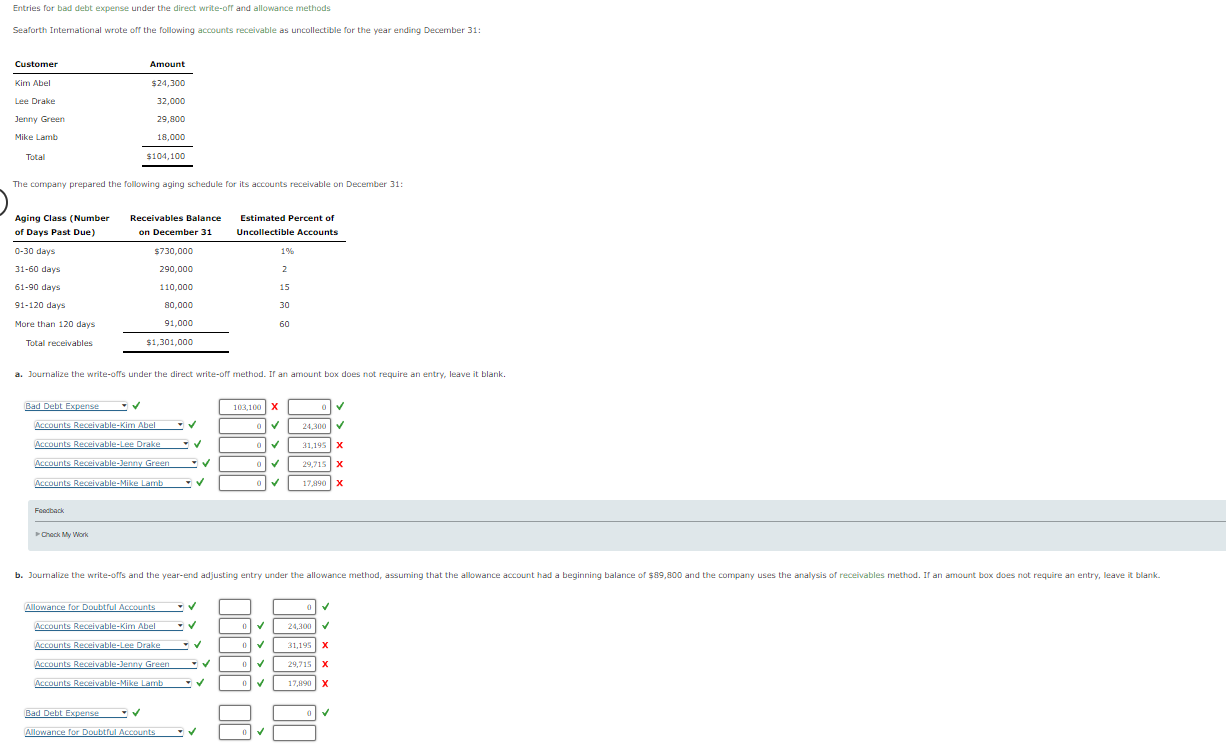

The Growing older of Accounts Receivable Methodology

The ageing of accounts receivable is a vital refinement of the proportion of accounts receivable technique. It acknowledges that the likelihood of accumulating an bill diminishes because it ages. By categorizing receivables by age, an organization can assign completely different percentages to every class, reflecting the various threat of non-collection. This method offers a extra correct estimate than a blanket share utilized to all the receivables stability.

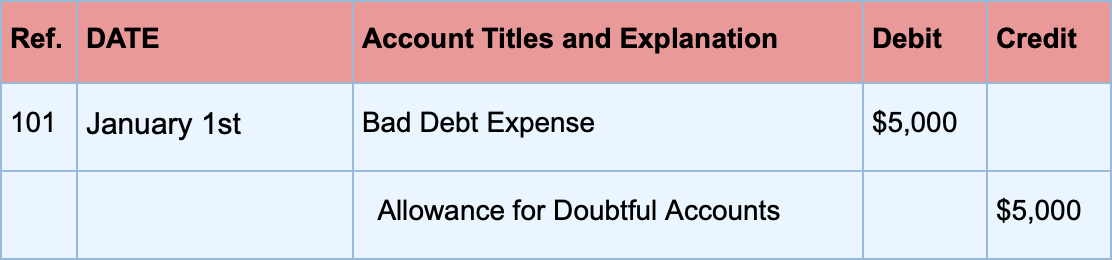

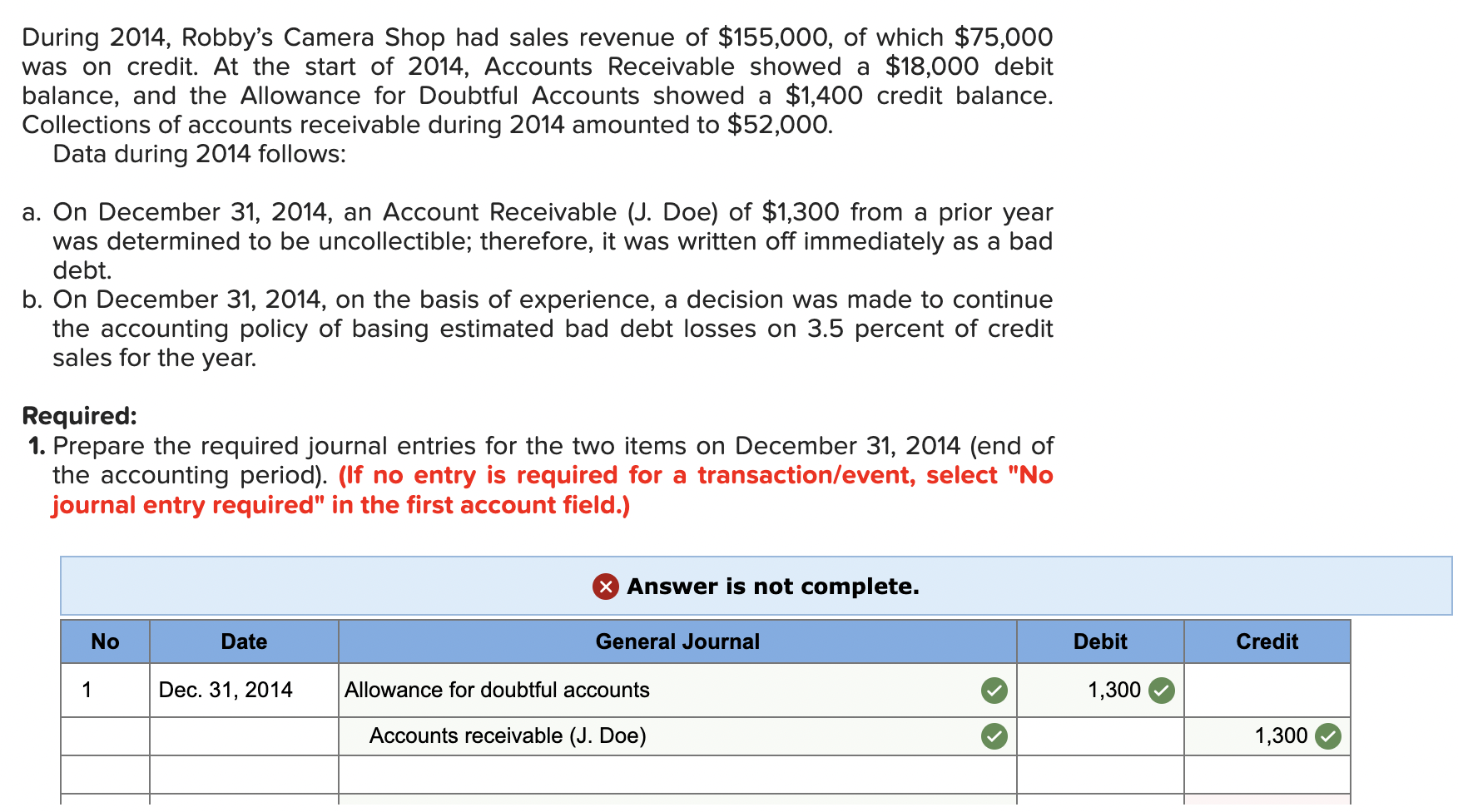

Writing Off Unhealthy Money owed

As soon as it is decided that an account is uncollectible, the corporate should write it off. This entails eradicating the account from the accounts receivable and recording the loss. The journal entry entails debiting the unhealthy debt expense account (if not already estimated) and crediting the accounts receivable account. This reduces each the expense and the asset accounts, reflecting the fact of the loss.

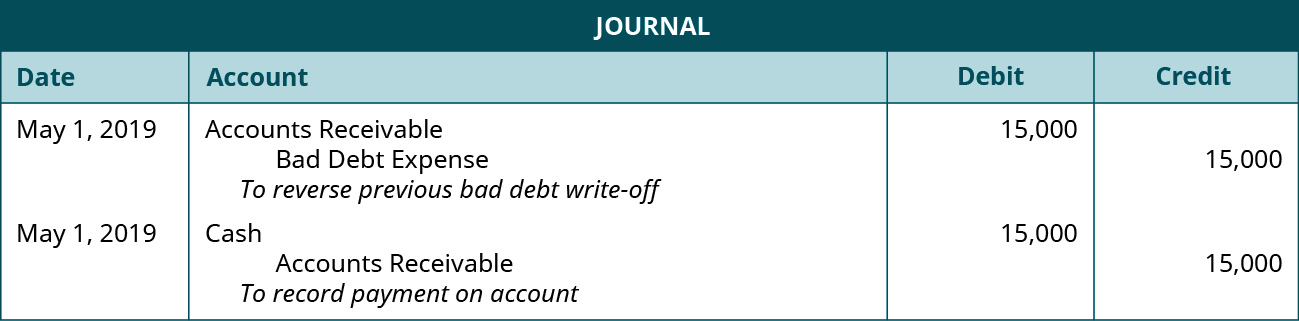

Recovering Written-Off Accounts

Often, a beforehand written-off account could also be recovered. When this occurs, the corporate should reverse the unique write-off entry and document the gathering. This entails debiting the accounts receivable account, crediting the unhealthy debt restoration account (a contra-expense account), and doubtlessly crediting money or one other receivable account for the precise cost acquired.

Analyzing Unhealthy Debt Expense

Analyzing unhealthy debt expense is essential for evaluating the effectiveness of an organization’s credit score and assortment insurance policies. Key metrics embrace:

-

Unhealthy Debt Ratio: This ratio compares unhealthy debt expense to internet credit score gross sales, offering perception into the proportion of credit score gross sales leading to uncollectible accounts. A excessive ratio signifies potential issues with credit score insurance policies or assortment efforts.

-

Days Gross sales Excellent (DSO): This metric measures the common variety of days it takes to gather accounts receivable. A excessive DSO suggests potential points with collections and the next threat of unhealthy money owed.

-

Growing older of Receivables: Analyzing the ageing schedule reveals the proportion of receivables in every age class, highlighting potential assortment issues and the necessity for proactive intervention.

Bettering Unhealthy Debt Administration

A number of methods can enhance unhealthy debt administration and cut back losses:

-

Strengthening Credit score Insurance policies: Implementing stricter credit score checks, requiring collateral, or limiting credit score limits can cut back the chance of extending credit score to high-risk prospects.

-

Bettering Assortment Procedures: Establishing clear cost phrases, sending well timed reminders, and using aggressive assortment strategies (when needed) can enhance assortment charges.

-

Investing in Credit score Scoring Methods: Using credit score scoring fashions may also help establish high-risk prospects earlier than extending credit score.

-

Common Monitoring and Assessment: Constantly monitoring unhealthy debt expense, DSO, and the ageing of receivables permits for well timed identification of potential issues and proactive changes to credit score and assortment insurance policies.

Conclusion

The unhealthy debt expense account is an integral a part of the chart of accounts, reflecting the inherent threat of extending credit score. Correct estimation and efficient administration of unhealthy debt are essential for sustaining correct monetary reporting, optimizing profitability, and making certain compliance with accounting requirements. By understanding the varied strategies for estimating unhealthy debt, analyzing key metrics, and implementing proactive methods, companies can decrease losses and strengthen their monetary place. Common assessment and adaptation of credit score and assortment insurance policies are important for navigating the complexities of unhealthy debt and sustaining a wholesome monetary outlook. The continual monitoring and evaluation of unhealthy debt expense must be a key element of any profitable enterprise technique.

Closure

Thus, we hope this text has offered beneficial insights into Navigating the Chart of Accounts: Understanding and Managing Unhealthy Debt Expense. We hope you discover this text informative and useful. See you in our subsequent article!