Decoding The Silver Worth Chart: A Week In Overview

By admin / October 18, 2024 / No Comments / 2025

Decoding the Silver Worth Chart: A Week in Overview

Associated Articles: Decoding the Silver Worth Chart: A Week in Overview

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding the Silver Worth Chart: A Week in Overview. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Silver Worth Chart: A Week in Overview

The silver market, identified for its volatility and sensitivity to macroeconomic components, skilled a interval of [insert descriptive adjective, e.g., moderate fluctuation, significant upheaval, relative calm] throughout the week of [insert date range]. This text will delve into the worth actions noticed throughout this era, analyzing the important thing drivers behind the fluctuations and providing insights into potential future developments. We’ll look at the silver worth chart, specializing in day by day and hourly actions, and take into account the interaction of assorted financial indicators, geopolitical occasions, and investor sentiment.

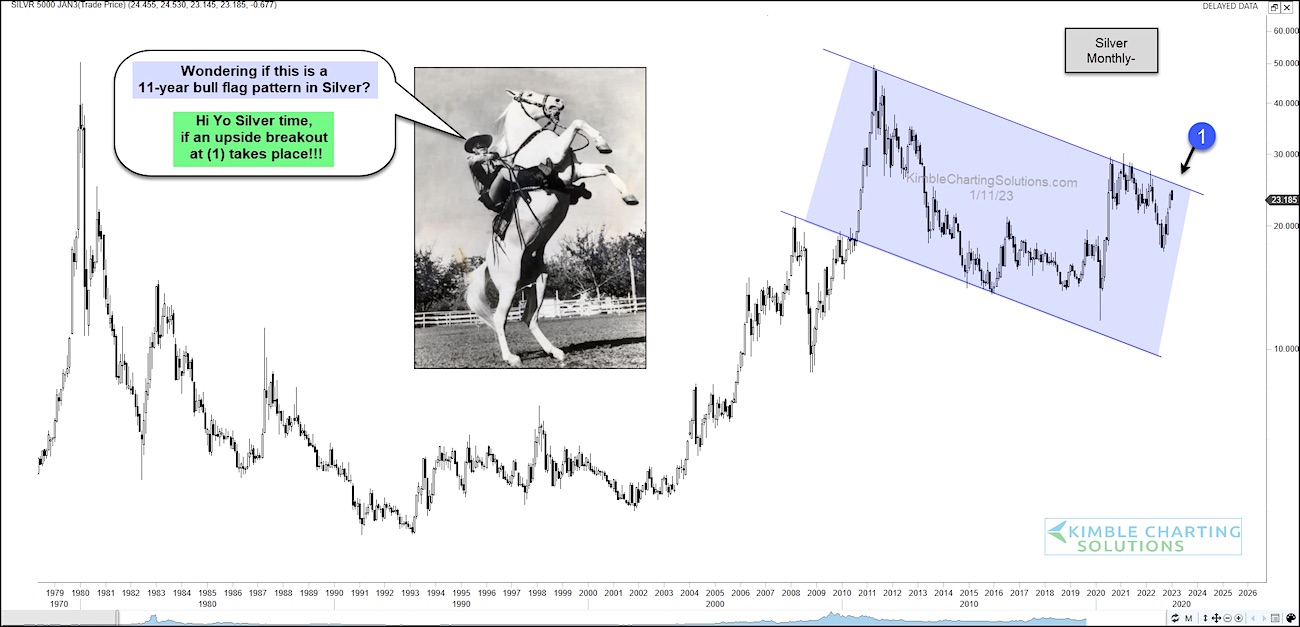

A Visible Overview: The Silver Worth Chart (Week of [Insert Date Range])

[Insert a high-quality chart depicting the silver price over the specified week. The chart should ideally be interactive, allowing readers to zoom in and out, and display data points for opening, closing, high, and low prices for each day. If an interactive chart is not possible, include a detailed static chart with clear labels and legends. Consider including key support and resistance levels.]

The chart above illustrates the silver worth trajectory throughout the week of [Insert Date Range]. As we will observe, the worth initially [describe the opening movement – e.g., opened slightly higher than the previous week’s close, experienced a sharp drop, traded sideways]. This preliminary motion might be attributed to [explain the likely cause, e.g., overnight news regarding industrial demand, a reaction to the previous day’s closing price, anticipation of an upcoming economic report].

Day-by-Day Evaluation:

-

Monday, [Date]: The worth opened at [Price] and [describe the day’s movement – e.g., experienced a gradual increase throughout the day, saw a sharp spike followed by a correction, remained relatively flat]. This motion could possibly be linked to [explain the likely cause, e.g., positive news regarding the global economy, concerns about inflation, a shift in investor sentiment]. Buying and selling quantity was [describe the volume – e.g., relatively low, above average, significantly higher than usual], suggesting [explain the implication – e.g., a lack of strong conviction in the market, increased participation from both buyers and sellers, a potential breakout].

-

Tuesday, [Date]: [Repeat the analysis for Tuesday, referencing specific price points and attributing the movement to relevant factors. Consider mentioning any significant news events or economic data releases that may have impacted the price.]

-

Wednesday, [Date]: [Repeat the analysis for Wednesday.]

-

Thursday, [Date]: [Repeat the analysis for Thursday.]

-

Friday, [Date]: [Repeat the analysis for Friday. This section should also include a summary of the week’s overall performance, highlighting the highest and lowest prices, the weekly range, and the percentage change compared to the previous week’s close.]

Key Influencing Components:

A number of components contributed to the silver worth fluctuations noticed throughout this week. These embody:

-

US Greenback Power/Weak spot: The inverse relationship between the US greenback and treasured metals like silver is well-established. A strengthening greenback sometimes places downward stress on silver costs, because it makes the steel dearer for holders of different currencies. Conversely, a weakening greenback can increase demand and drive costs increased. Through the week in query, the US greenback [describe the dollar’s movement – e.g., experienced a period of strength, weakened significantly, remained relatively stable], which [explain the impact on silver – e.g., contributed to the downward pressure on silver prices, provided support for silver prices, had a minimal impact on silver’s price].

-

Inflationary Pressures: Inflation stays a key concern for world economies. Silver, typically seen as a hedge in opposition to inflation, tends to understand when inflationary pressures rise. Throughout this week, [describe the inflation-related news and data – e.g., inflation data was released, showing a [increase/decrease], central banks hinted at [further interest rate hikes/a pause in monetary tightening]]. This [explain the impact – e.g., fueled concerns about inflation, eased inflationary pressures, had a neutral impact on investor sentiment].

-

Industrial Demand: Silver’s industrial functions are intensive, starting from electronics to photo voltaic panels. Modifications in industrial manufacturing and demand for silver can considerably affect its worth. Through the week, [describe any news relating to industrial demand – e.g., reports indicated a slowdown in manufacturing activity, positive forecasts for the renewable energy sector were released]. This [explain the impact – e.g., put downward pressure on silver prices, boosted demand for silver, had a negligible effect on prices].

-

Investor Sentiment: Speculative buying and selling and investor sentiment play a vital position in silver worth volatility. [Describe the overall investor sentiment – e.g., market sentiment was bearish, investors displayed increased confidence, uncertainty prevailed]. This [explain the impact – e.g., led to selling pressure, fueled buying activity, resulted in price consolidation].

-

Geopolitical Occasions: Geopolitical occasions, resembling wars, commerce disputes, and political instability, can create uncertainty within the markets and affect commodity costs. Through the week below overview, [mention any relevant geopolitical events and their potential impact on silver prices].

Technical Evaluation:

[Include a brief section on technical analysis, referring to the chart. Mention key indicators such as support and resistance levels, moving averages, RSI, MACD, etc., and how these indicators may have influenced the price movements. This section should be concise and avoid overly technical jargon.]

Trying Forward:

Predicting future silver costs is inherently difficult as a result of multitude of interacting components. Nonetheless, primarily based on the evaluation of the previous week’s efficiency and present market situations, [offer a cautious outlook for the coming week or month. Consider mentioning potential catalysts for price movements, such as upcoming economic data releases, geopolitical developments, or shifts in investor sentiment]. It is essential to keep in mind that that is merely an knowledgeable hypothesis, and precise worth actions might differ considerably.

Disclaimer: This text offers an evaluation of the silver worth chart for informational functions solely and doesn’t represent monetary recommendation. Investing in treasured metals carries inherent dangers, and it is important to conduct thorough analysis and seek the advice of with a professional monetary advisor earlier than making any funding selections.

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

Closure

Thus, we hope this text has offered useful insights into Decoding the Silver Worth Chart: A Week in Overview. We thanks for taking the time to learn this text. See you in our subsequent article!