Price range Vs Precise Chart Template

By admin / August 1, 2024 / No Comments / 2025

finances vs precise chart template

Associated Articles: finances vs precise chart template

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to finances vs precise chart template. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

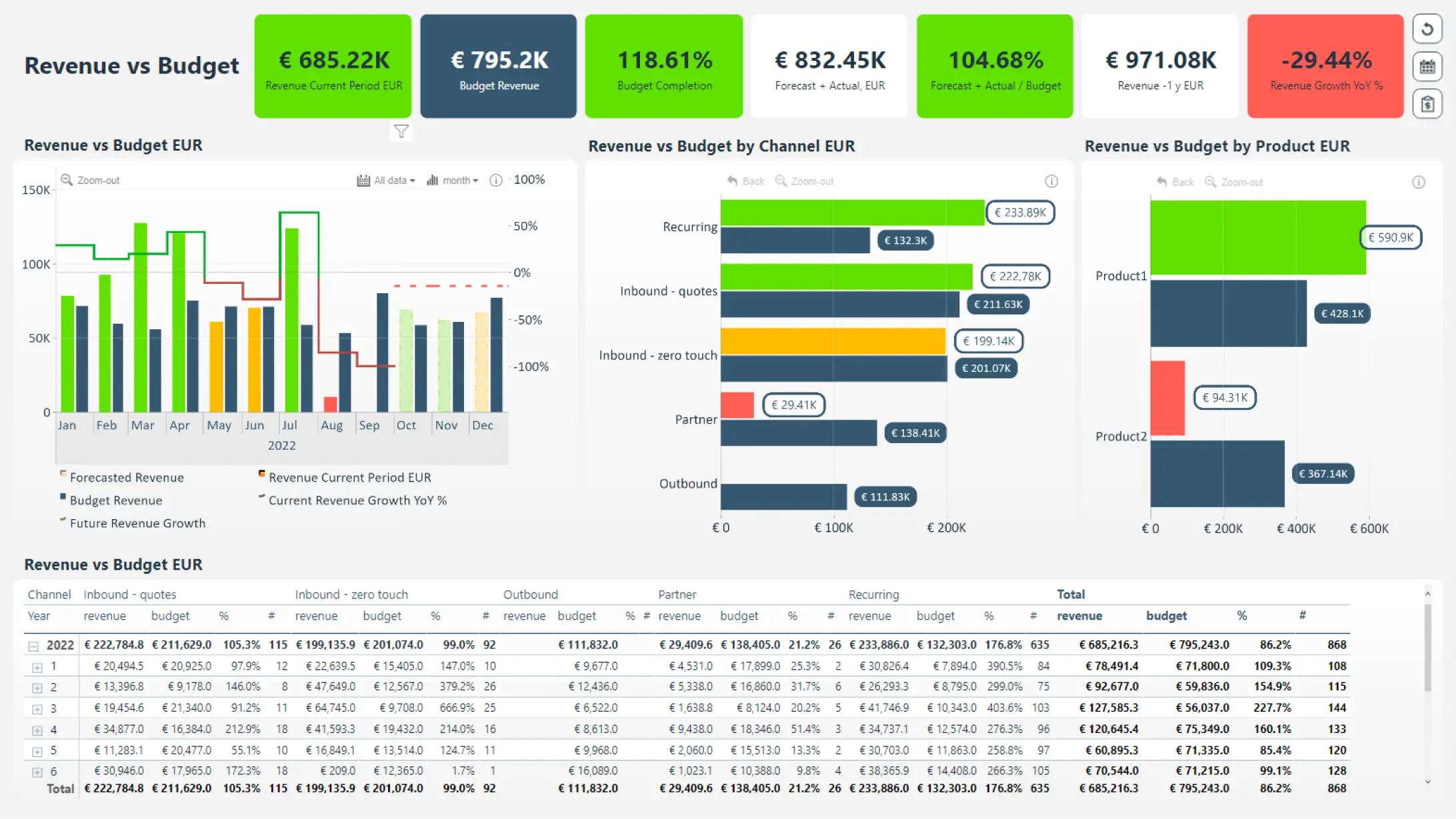

Decoding the Price range vs. Precise Chart: A Complete Information to Monetary Efficiency Monitoring

Budgeting is the cornerstone of sound monetary administration, whether or not for a small enterprise, a big company, and even private funds. Nonetheless, a finances is merely a plan; its true worth lies in its comparability to precise efficiency. That is the place the finances vs. precise chart comes into play, offering a visible illustration of variances and providing essential insights into monetary well being. This text will discover the intricacies of finances vs. precise charts, encompassing their numerous varieties, creation strategies, interpretation, and supreme contribution to efficient monetary decision-making.

Understanding the Fundamentals: What’s a Price range vs. Precise Chart?

A finances vs. precise chart, also referred to as a variance evaluation chart, is a graphical illustration that compares deliberate (budgeted) figures with the precise outcomes achieved over a selected interval. This comparability permits for the short identification of overspending, underspending, and deviations from the projected monetary efficiency. The chart usually shows information throughout time, usually month-to-month or quarterly, permitting for development evaluation and the identification of recurring points. The visible nature of the chart makes it simply comprehensible, even for these with out in depth monetary experience.

Varieties of Price range vs. Precise Charts:

A number of chart varieties can successfully signify finances vs. precise information. The most typical embody:

-

Bar Chart: That is maybe the only and most generally used methodology. Separate bars signify the budgeted and precise quantities for every class (e.g., income, bills, value of products bought). The distinction in bar lengths visually highlights the variance. Stacked bar charts can additional break down bills into subcategories.

-

Line Chart: Line charts are perfect for visualizing traits over time. Two traces, one for the finances and one for the actuals, are plotted in opposition to time. This clearly exhibits how the finances and precise efficiency change over the reporting interval. That is notably helpful for figuring out intervals of great variance and understanding the trajectory of efficiency.

-

Mixture Chart: This combines the strengths of each bar and line charts. It would use bars to signify the budgeted and precise quantities for every interval and a line to show the cumulative finances and precise values. This provides a complete view of each particular person interval efficiency and total progress.

-

Spreadsheet-based Charts: Spreadsheets like Microsoft Excel or Google Sheets supply built-in charting capabilities. Customers can simply create numerous chart varieties by inputting finances and precise information, permitting for personalization and adaptability in presentation.

Making a Price range vs. Precise Chart: A Step-by-Step Information:

Creating a sturdy finances vs. precise chart entails a number of key steps:

-

Outline the Scope: Decide the interval for the evaluation (e.g., month-to-month, quarterly, yearly) and the particular monetary classes to be included (e.g., gross sales income, value of products bought, working bills, advertising bills, and so on.). The extent of element will depend upon the group’s dimension and complexity.

-

Collect Information: Acquire each the budgeted and precise monetary information for every chosen class and interval. Guarantee information accuracy and consistency. Information sources may embody accounting software program, monetary stories, and gross sales information.

-

Calculate Variances: Decide the distinction between the budgeted and precise quantities for every class. That is the variance. A optimistic variance signifies that precise efficiency exceeded the finances (favorable), whereas a detrimental variance signifies that precise efficiency fell in need of the finances (unfavorable).

-

Select a Chart Sort: Choose the chart sort that most closely fits the information and the meant viewers. Take into account the complexity of the information and the necessity to spotlight particular traits or variances.

-

Create the Chart: Use a spreadsheet program or specialised charting software program to create the chart. Clearly label all axes, classes, and information factors. Embody a legend to distinguish between budgeted and precise values.

-

Analyze and Interpret: Fastidiously look at the chart to determine vital variances. Examine the explanations behind these variances. Had been there unexpected circumstances? Had been there errors in budgeting or execution?

Decoding the Chart: Unveiling Key Insights:

The finances vs. precise chart is greater than only a visible illustration; it is a device for evaluation and decision-making. Decoding the chart entails:

-

Figuring out Important Variances: Give attention to classes with the most important optimistic or detrimental variances. These are areas requiring additional investigation.

-

Understanding the Causes for Variances: Examine the underlying causes of great variances. This will likely contain reviewing gross sales information, expense stories, and different related info.

-

Pattern Evaluation: Study the chart for traits over time. Are variances persistently optimistic or detrimental for sure classes? This may reveal recurring points or areas for enchancment.

-

Efficiency Analysis: The chart offers a transparent image of total monetary efficiency. It helps assess whether or not the group is assembly its monetary targets and determine areas the place enhancements are wanted.

-

Forecasting: By analyzing previous traits and variances, the chart can inform future budgeting and forecasting efforts.

Bettering Budgeting Accuracy:

The finances vs. precise chart highlights areas the place the finances was inaccurate or unrealistic. This suggestions loop is essential for bettering future budgeting processes. Take into account these enhancements:

-

Extra Reasonable Assumptions: Base future budgets on extra correct and real looking assumptions about gross sales, prices, and market circumstances.

-

Common Monitoring and Changes: Recurrently monitor precise efficiency in opposition to the finances and make changes as wanted. This ensures that the finances stays related and correct all year long.

-

Improved Information Assortment: Make sure that information assortment processes are environment friendly and correct. It will present a extra dependable foundation for budgeting and variance evaluation.

-

Collaboration and Communication: Contain related stakeholders within the budgeting course of to make sure that the finances displays the views and experience of various departments.

Past the Fundamentals: Superior Functions and Concerns:

Whereas the fundamental finances vs. precise chart offers invaluable insights, its software will be expanded for extra subtle evaluation:

-

Rolling Forecasts: As a substitute of a static annual finances, make the most of rolling forecasts that always replace the finances based mostly on the newest precise efficiency.

-

Sensitivity Evaluation: Assess the affect of various situations on the finances by altering key assumptions and observing the ensuing adjustments in variances.

-

Benchmarking: Examine finances vs. precise efficiency in opposition to business benchmarks or rivals to evaluate relative efficiency.

-

Integration with different Efficiency Metrics: Mix the finances vs. precise chart with different key efficiency indicators (KPIs) to achieve a extra holistic understanding of monetary efficiency.

-

Information Visualization Instruments: Make the most of superior information visualization instruments to create interactive and dynamic charts that enable for deeper exploration of the information.

Conclusion:

The finances vs. precise chart is an indispensable device for monetary administration. By clearly visualizing the distinction between deliberate and precise efficiency, it permits efficient monitoring, evaluation, and decision-making. Understanding its creation, interpretation, and software is essential for organizations looking for to optimize their monetary efficiency and obtain their strategic targets. By means of cautious evaluation and iterative enchancment, the finances vs. precise chart turns into a robust instrument for driving monetary success.

Closure

Thus, we hope this text has supplied invaluable insights into finances vs precise chart template. We thanks for taking the time to learn this text. See you in our subsequent article!