Chart Patterns: A Dance Of Greed And Concern In The Market

By admin / October 22, 2024 / No Comments / 2025

Chart Patterns: A Dance of Greed and Concern within the Market

Associated Articles: Chart Patterns: A Dance of Greed and Concern within the Market

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Chart Patterns: A Dance of Greed and Concern within the Market. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Chart Patterns: A Dance of Greed and Concern within the Market

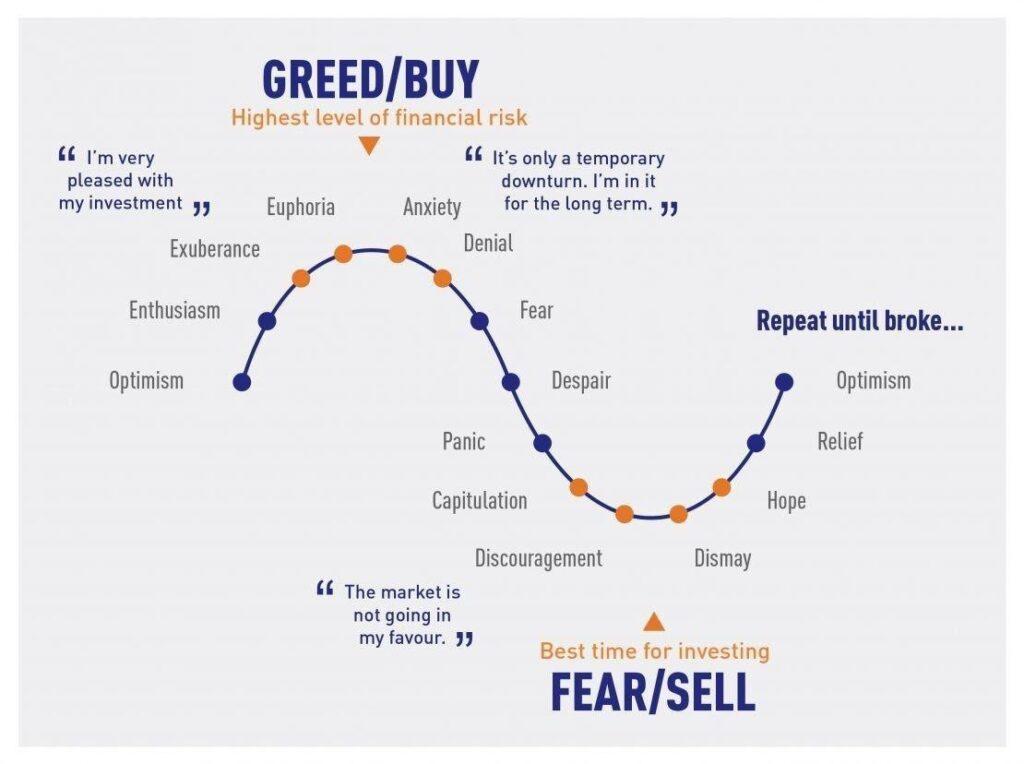

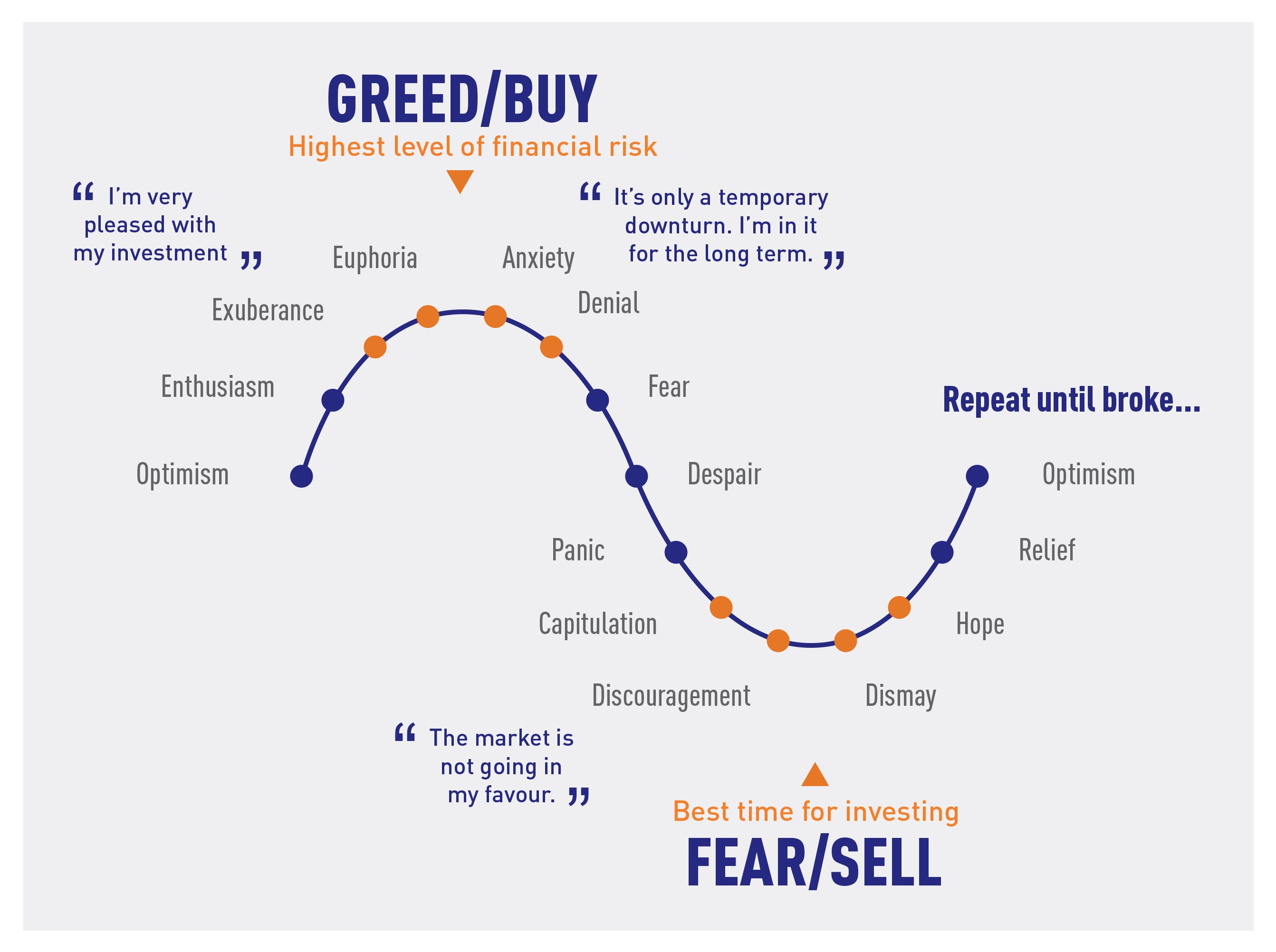

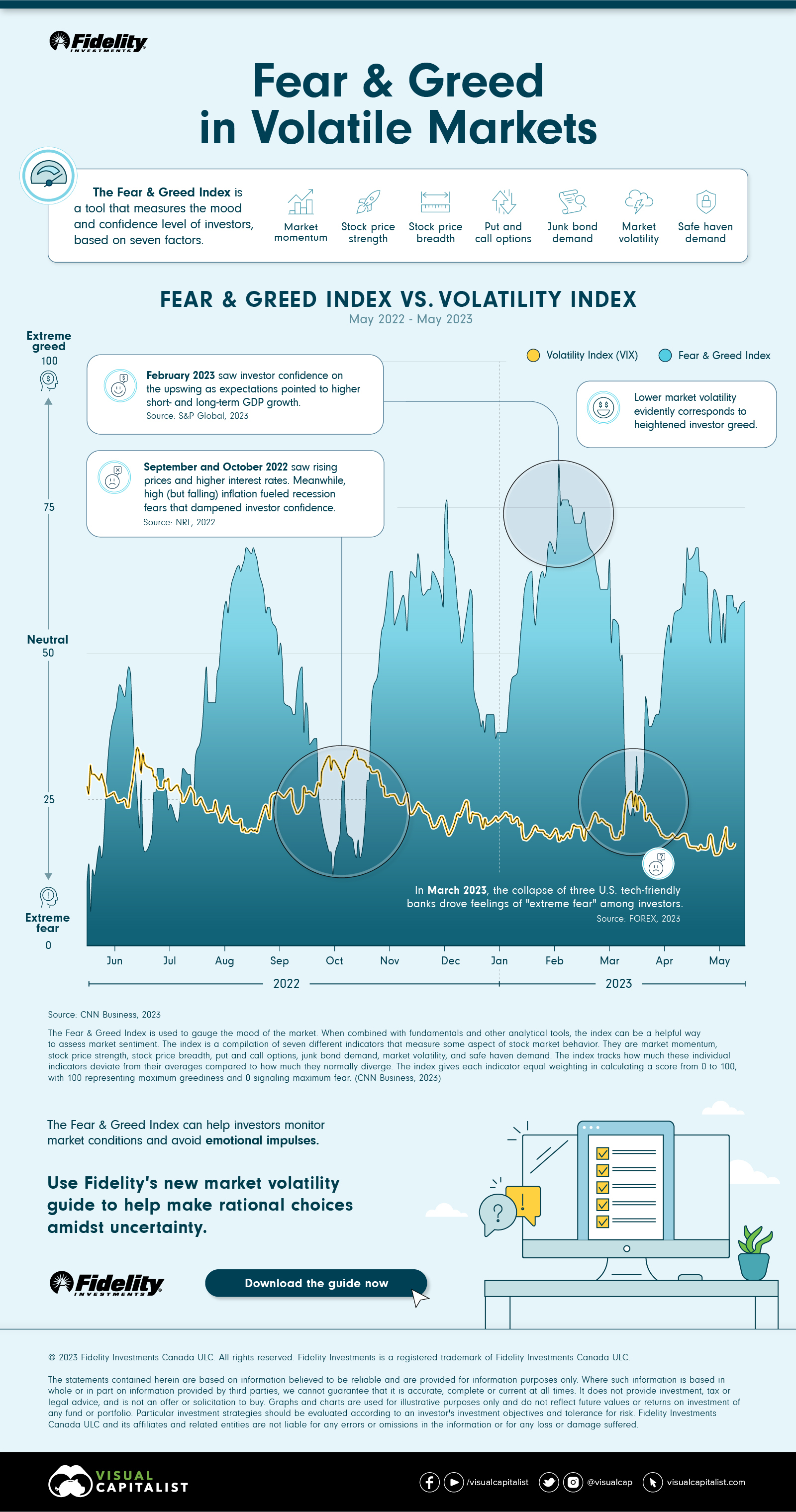

The monetary markets are an interesting microcosm of human psychology. Whereas complicated algorithms and macroeconomic indicators play a big position, the underlying driver of worth actions usually boils down to 2 basic feelings: greed and worry. These feelings, amplified by herd mentality and knowledge asymmetry, manifest in predictable patterns on worth charts, providing savvy merchants potential insights into future market route. Understanding these chart patterns, and the psychological forces that create them, is essential for navigating the turbulent waters of buying and selling and investing.

This text explores a number of frequent chart patterns, illustrating how greed and worry contribute to their formation and providing potential buying and selling methods primarily based on their interpretation.

1. Head and Shoulders (H&S): A Story of Two Extremes

The Head and Shoulders sample is a traditional bearish reversal sample. It is characterised by three distinct peaks, with the center peak ("the pinnacle") considerably increased than the 2 outer peaks ("the shoulders"). The sample’s formation displays a battle between greed and worry.

- The Left Shoulder: Initially, market individuals pushed by greed push costs increased. Constructive information, optimistic forecasts, or just a basic sense of bullishness gas the ascent.

- The Head: As costs climb, some traders, sensing overvaluation, start to take earnings, resulting in a brief pullback. Nevertheless, the bullish sentiment persists, fueled by additional constructive information or hypothesis, driving costs to a brand new excessive – the pinnacle. This represents the height of greed.

- The Proper Shoulder: As the pinnacle kinds, extra traders acknowledge the potential for a reversal. Concern begins to creep in, outweighing greed. Revenue-taking accelerates, and the worth retraces, forming the precise shoulder. This shoulder is normally decrease than the pinnacle, indicating waning bullish conviction.

- The Neckline: A trendline connecting the troughs between the pinnacle and shoulders kinds the neckline. A decisive break beneath this neckline confirms the sample and alerts a possible bearish development reversal. This break represents the capitulation of greed, overwhelmed by worry.

Buying and selling the H&S sample entails figuring out the neckline break as a promote sign. Cease-loss orders might be positioned above the pinnacle to restrict potential losses if the sample fails to materialize. Revenue targets might be set primarily based on the peak of the pinnacle above the neckline, projected downwards from the break level.

2. Inverse Head and Shoulders: A Resurrection of Hope

The Inverse Head and Shoulders sample is the mirror picture of the H&S, a bullish reversal sample. It displays a shift from worry to greed.

- The Left Shoulder: Initially, worry dominates. Unfavorable information, financial uncertainty, or basic pessimism drives costs down.

- The Head: As costs fall, some traders, recognizing the potential undervaluation, begin shopping for, resulting in a brief rally. Nevertheless, worry continues to prevail, pushing costs again down. This represents the nadir of worry.

- The Proper Shoulder: As the pinnacle kinds, extra traders, emboldened by the short-term rally, begin accumulating, lowering the promoting stress. This results in a second trough, adopted by one other rally, forming the precise shoulder.

- The Neckline: A trendline connecting the peaks between the pinnacle and shoulders kinds the neckline. A decisive break above this neckline confirms the sample and alerts a possible bullish development reversal. This break represents the triumph of greed over worry.

Buying and selling the Inverse H&S sample entails figuring out the neckline break as a purchase sign. Cease-loss orders might be positioned beneath the pinnacle, and revenue targets might be set primarily based on the peak of the pinnacle above the neckline, projected upwards from the break level.

3. Double Tops and Double Bottoms: Oscillations of Sentiment

Double Tops and Double Bottoms are patterns reflecting the cyclical nature of market sentiment. They signify a tug-of-war between greed and worry, with neither emotion decisively profitable.

- Double High: A double high kinds when the worth reaches an analogous excessive twice, adopted by a big decline. The primary peak represents the preliminary surge of greed, adopted by a pullback as worry units in. The second peak exhibits a renewed try to push costs increased, however worry finally prevails, resulting in a breakdown.

- Double Backside: A double backside kinds when the worth reaches an analogous low twice, adopted by a big rally. The primary trough represents the height of worry, adopted by a brief restoration as greed emerges. The second trough exhibits a renewed dip, however greed finally triumphs, resulting in a breakout.

Buying and selling these patterns entails figuring out the neckline break (for double tops, a break beneath; for double bottoms, a break above) as a sign to enter a brief (double high) or lengthy (double backside) place.

4. Triangles: A Gradual Decision of Uncertainty

Triangles signify a interval of consolidation the place neither greed nor worry dominates decisively. They’re characterised by converging trendlines, indicating a narrowing vary of worth fluctuations. This consolidation usually precedes a big breakout, reflecting the eventual decision of uncertainty. There are a number of forms of triangles, together with symmetrical, ascending, and descending triangles, every with barely totally different implications.

- Symmetrical Triangle: This sample signifies a steadiness between patrons and sellers, with neither facet gaining a transparent benefit. The eventual breakout, both upwards or downwards, might be important.

- Ascending Triangle: This sample means that patrons are steadily gaining energy, indicating a bullish bias. A breakout above the higher trendline is extra probably.

- Descending Triangle: This sample means that sellers are steadily gaining energy, indicating a bearish bias. A breakout beneath the decrease trendline is extra probably.

Buying and selling triangles entails ready for a decisive breakout from the sample. Cease-loss orders might be positioned simply outdoors the triangle, and revenue targets might be set primarily based on the triangle’s peak projected past the breakout level.

5. Flags and Pennants: Quick-Time period Consolidations

Flags and pennants are short-term continuation patterns, indicating a brief pause in a prevailing development. They signify a short interval of consolidation after a pointy worth motion, pushed by a brief shift in sentiment.

- Flags: Flags are characterised by parallel trendlines, normally showing after a steep worth transfer. They recommend a brief exhaustion of the prevailing development, with a subsequent continuation anticipated.

- Pennants: Pennants are just like flags, however with converging trendlines, forming a triangular form. Additionally they recommend a brief pause earlier than the development resumes.

Buying and selling these patterns entails figuring out the breakout from the flag or pennant as a sign to proceed buying and selling within the route of the prevailing development.

Conclusion:

Chart patterns should not foolproof predictors of future worth actions. They’re instruments that may improve a dealer’s understanding of market dynamics, providing potential insights primarily based on the interaction of greed and worry. Efficient use of chart patterns requires a mix of technical evaluation, danger administration, and a deep understanding of the psychological forces that drive market behaviour. Do not forget that profitable buying and selling requires self-discipline, endurance, and a willingness to adapt to altering market situations. By no means rely solely on chart patterns; at all times incorporate basic evaluation and different components into your buying and selling technique. The markets are complicated, and mastering them requires a holistic strategy that acknowledges each the technical and emotional dimensions of buying and selling.

Closure

Thus, we hope this text has supplied invaluable insights into Chart Patterns: A Dance of Greed and Concern within the Market. We hope you discover this text informative and useful. See you in our subsequent article!