A Century Of Peaks And Valleys: Charting The Dow Jones Industrial Common’s Journey

By admin / June 27, 2024 / No Comments / 2025

A Century of Peaks and Valleys: Charting the Dow Jones Industrial Common’s Journey

Associated Articles: A Century of Peaks and Valleys: Charting the Dow Jones Industrial Common’s Journey

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to A Century of Peaks and Valleys: Charting the Dow Jones Industrial Common’s Journey. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

A Century of Peaks and Valleys: Charting the Dow Jones Industrial Common’s Journey

The Dow Jones Industrial Common (DJIA), typically merely referred to as the "Dow," is greater than only a assortment of 30 massive, publicly owned firms. It is a barometer of the American financial system, a mirrored image of investor sentiment, and a historic report of unprecedented progress, devastating crashes, and all the pieces in between. Charting its journey over time reveals not solely the fluctuations of the market but in addition the broader societal and geopolitical forces which have formed its trajectory.

The Early Years: Humble Beginnings and Regular Ascent (1896-1929)

The Dow’s inception in 1896, with Charles Dow’s preliminary index of 12 industrial shares, marked a nascent stage in monetary market monitoring. The early years noticed sluggish, however usually upward, motion, reflecting the burgeoning industrialization of the US. The chart throughout this era would present a gradual incline punctuated by occasional dips, reflecting financial cycles and localized crises. Technological improvements, westward enlargement, and rising industrial output fueled this progress. Nonetheless, the size of the chart throughout this period can be comparatively modest in comparison with the dramatic swings witnessed later. The absence of refined monetary devices and the smaller scale of the market contributed to this gentler trajectory. Analyzing this early part of the Dow’s chart highlights the foundational interval of American capitalism and its gradual, albeit uneven, progress.

The Roaring Twenties and the Nice Crash (Nineteen Twenties-Thirties): A Paradigm Shift

The Nineteen Twenties witnessed a interval of unprecedented prosperity, mirrored in a dramatic surge on the Dow chart. The "Roaring Twenties" noticed speculative funding attain fever pitch, driving inventory costs to unsustainable ranges. This era showcases the hazards of unchecked optimism and the inherent volatility of the market. The chart would show a steep, nearly vertical climb, culminating within the notorious peak of September 1929. The following crash, nevertheless, is arguably probably the most important occasion within the Dow’s historical past. The chart would dramatically plummet, illustrating the devastating impression of the Nice Despair. This era serves as a stark reminder of the potential for catastrophic market failures and the fragility of financial prosperity. The sluggish and painful restoration that adopted, depicted by a protracted trough within the chart, underlines the long-term penalties of speculative bubbles and the challenges of financial restoration. Analyzing this era emphasizes the significance of regulation and the necessity for a balanced method to funding.

Submit-Warfare Growth and the Rise of the Conglomerates (Forties-Nineteen Seventies): A New Period of Progress

World Warfare II introduced a interval of financial mobilization, adopted by a post-war growth that’s clearly seen within the Dow’s upward trajectory. The chart demonstrates a sustained interval of progress, fueled by pent-up shopper demand, authorities spending, and technological developments. The Nineteen Fifties and Nineteen Sixties noticed the rise of the American shopper financial system, mirrored within the steadily rising worth of the index. Nonetheless, the Nineteen Seventies introduced financial challenges, together with stagflation (a mixture of excessive inflation and sluggish financial progress), which is mirrored in a interval of relative stagnation and even decline within the Dow chart. This era showcases the advanced interaction between financial coverage, geopolitical occasions, and market efficiency. The shift from a manufacturing-based financial system to a extra service-oriented one additionally began to develop into evident within the composition of the Dow’s constituent firms.

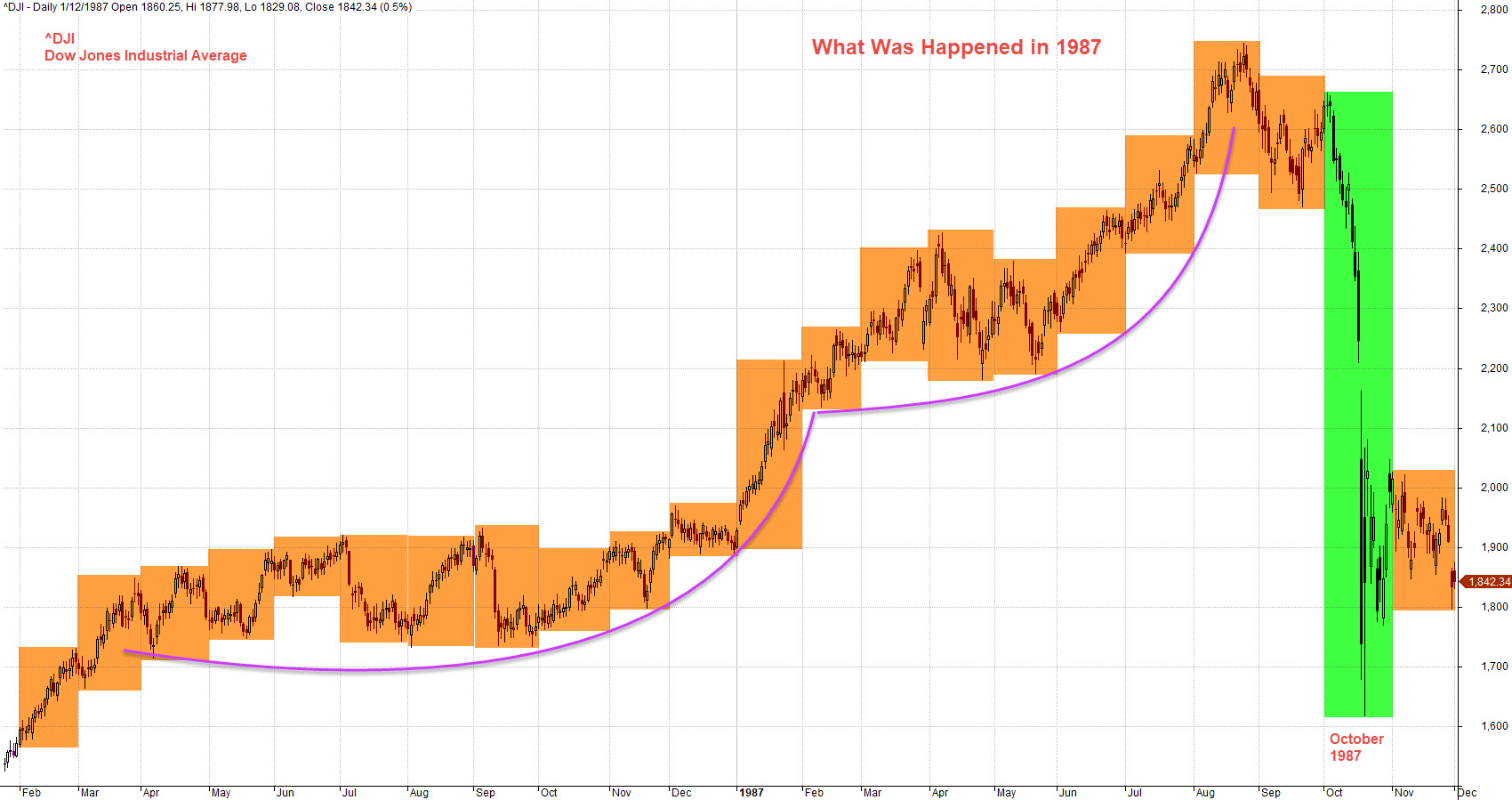

The Period of Deregulation and Technological Innovation (Eighties-2000s): A Rollercoaster Experience

The Eighties and Nineties noticed important deregulation, resulting in elevated market exercise and volatility. The chart from this era showcases a collection of sharp peaks and troughs, reflecting the boom-and-bust cycles attribute of this period. The rise of know-how firms, notably within the late Nineties, contributed to the dot-com bubble, a interval of speedy progress adopted by a dramatic collapse, clearly seen as a pointy peak and subsequent plunge on the Dow chart. This era highlights the impression of technological innovation in the marketplace, in addition to the inherent dangers related to speculative funding in rising sectors. The aftermath of the dot-com bust, adopted by the 9/11 terrorist assaults and subsequent financial downturn, additional emphasizes the vulnerability of the market to exterior shocks.

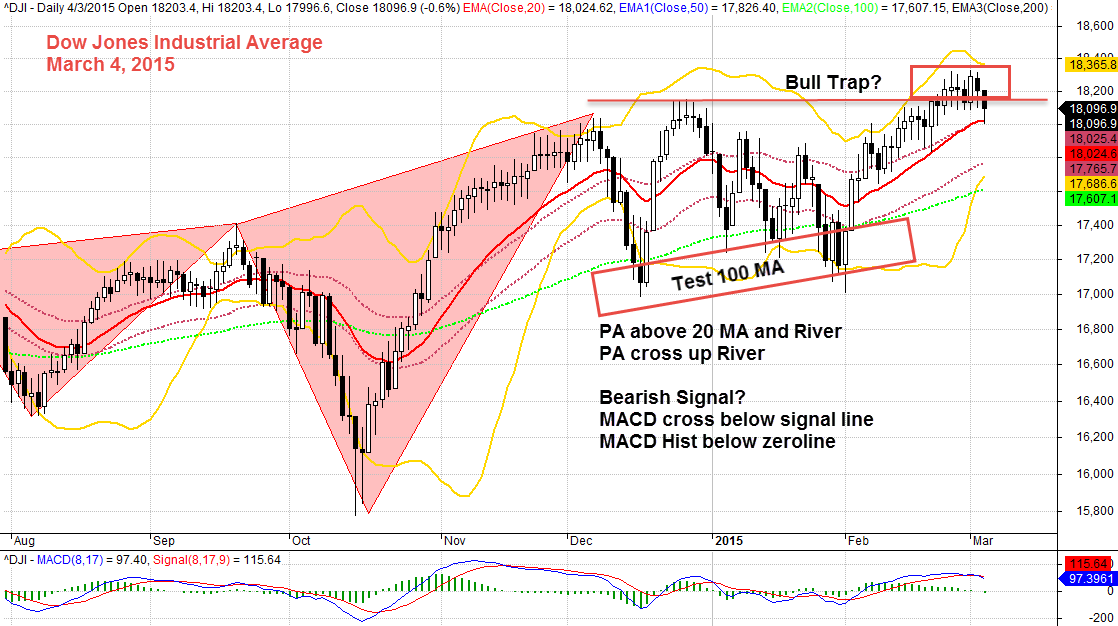

The twenty first Century: World Interdependence and Unprecedented Volatility (2000s-Current): Navigating a New Panorama

The twenty first century has been characterised by unprecedented globalization and interconnectedness, resulting in elevated market volatility. The chart from this era exhibits a collection of serious occasions, together with the 2008 monetary disaster, which resulted in probably the most important drop within the Dow because the Nice Despair. The restoration from this disaster was sluggish and uneven, reflecting the worldwide nature of the monetary system and the challenges of managing systemic danger. The following years have seen durations of each important progress and substantial corrections, highlighting the continued affect of geopolitical occasions, financial insurance policies, and technological disruptions. The rise of quantitative easing, the impression of the COVID-19 pandemic, and ongoing geopolitical tensions are all clearly seen within the chart’s fluctuations. This period underscores the complexities of the trendy monetary panorama and the challenges of predicting future market actions.

Analyzing the Dow Jones Chart: Key Takeaways

A complete evaluation of the Dow Jones chart over time reveals a number of key takeaways:

- Cyclical Nature of Markets: The chart clearly demonstrates the cyclical nature of market efficiency, with durations of progress invariably adopted by durations of decline. Understanding these cycles is essential for long-term funding methods.

- Impression of Exterior Elements: Geopolitical occasions, financial insurance policies, technological improvements, and societal shifts all considerably affect the Dow’s trajectory. This underscores the significance of contemplating broader macroeconomic and geopolitical components when analyzing market tendencies.

- Danger and Reward: The chart highlights the inherent dangers related to investing within the inventory market, but in addition the potential for important rewards over the long run. A balanced method to danger administration is essential for profitable investing.

- Significance of Diversification: The Dow, whereas a big indicator, represents solely a small phase of the general market. Diversification throughout completely different asset lessons and sectors is crucial to mitigate danger.

- Lengthy-Time period Perspective: Whereas short-term fluctuations will be dramatic, a long-term perspective is commonly vital to understand the general upward development of the Dow, reflecting the long-term progress of the American financial system.

The Dow Jones Industrial Common is greater than only a quantity; it is a dwelling testomony to the dynamism and volatility of the American financial system and the worldwide monetary system. By learning its chart over time, we achieve priceless insights into the forces that form markets, the significance of understanding danger, and the enduring energy of long-term funding methods. The journey continues, and the following chapter within the Dow’s story stays to be written.

:max_bytes(150000):strip_icc()/GettyImages-1425998005-e1275c6270264d329851d71bb2df65aa.jpg)

Closure

Thus, we hope this text has supplied priceless insights into A Century of Peaks and Valleys: Charting the Dow Jones Industrial Common’s Journey. We hope you discover this text informative and helpful. See you in our subsequent article!