Wyckoff Buying and selling Chart Patterns: A Complete Information (PDF Obtain Assets)

By admin / July 12, 2024 / No Comments / 2025

Wyckoff Buying and selling Chart Patterns: A Complete Information (PDF Obtain Assets)

Associated Articles: Wyckoff Buying and selling Chart Patterns: A Complete Information (PDF Obtain Assets)

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Wyckoff Buying and selling Chart Patterns: A Complete Information (PDF Obtain Assets). Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Wyckoff Buying and selling Chart Patterns: A Complete Information (PDF Obtain Assets)

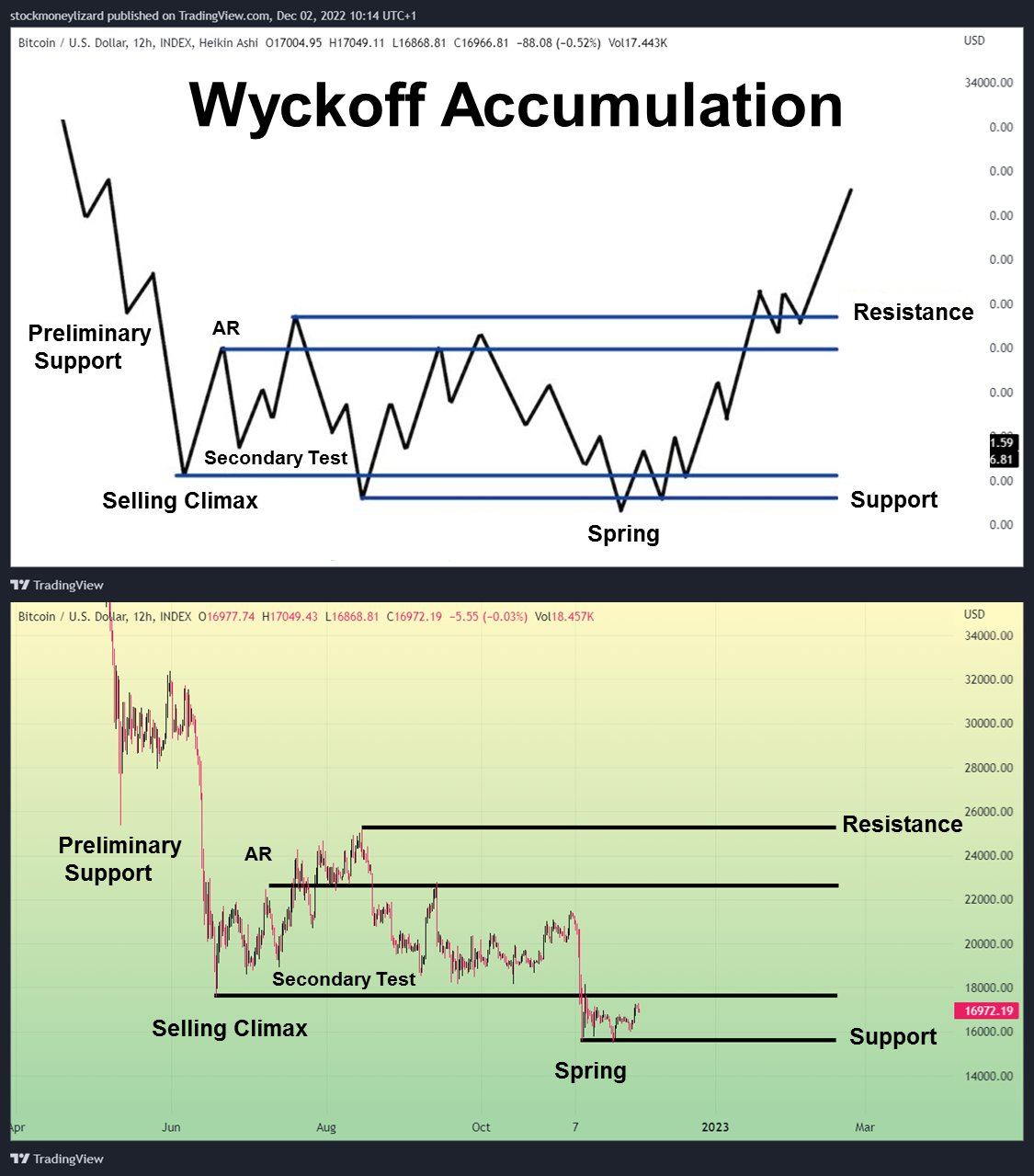

Wyckoff buying and selling, a technique developed by Richard Wyckoff within the early twentieth century, focuses on figuring out market accumulation and distribution phases to capitalize on vital value actions. Not like many technical evaluation approaches that rely solely on value motion, Wyckoff incorporates quantity, value, and time to know the underlying market psychology and the intentions of enormous gamers. An important side of Wyckoff evaluation is the identification of particular chart patterns, which offer visible clues about these accumulation and distribution phases. Whereas there is not a single, universally accepted "Wysetrade chart patterns PDF" freely out there on-line, this text will discover the important thing Wyckoff patterns, their traits, and the place to seek out dependable studying sources, together with potential PDF downloads from respected sources.

Understanding the Core Rules of Wyckoff:

Earlier than delving into the chart patterns, it is important to know the basic ideas of Wyckoff methodology. The core idea revolves across the "Composite Operator" – a time period representing massive institutional traders and market makers who manipulate value to build up or distribute their holdings. Wyckoff’s methodology goals to determine their actions by means of cautious commentary of value and quantity conduct.

The market phases in response to Wyckoff are:

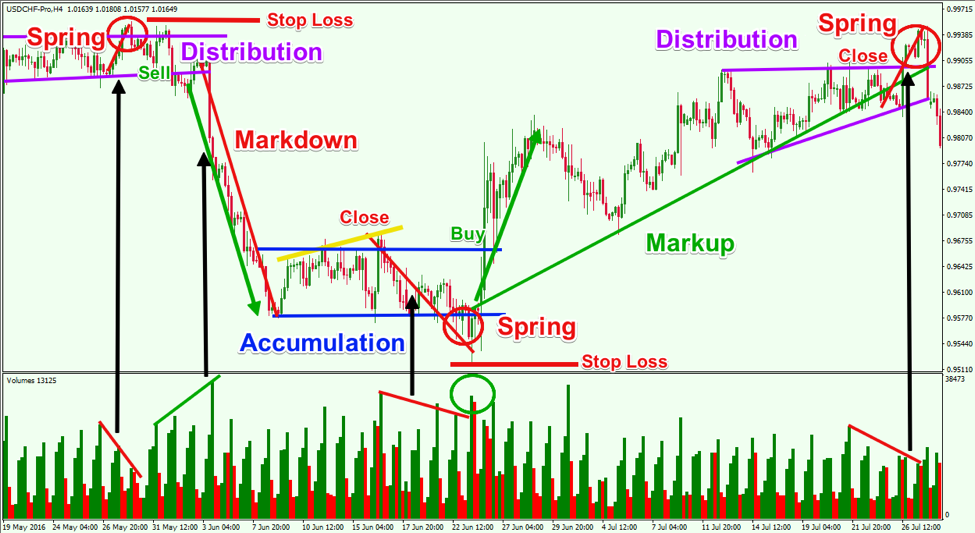

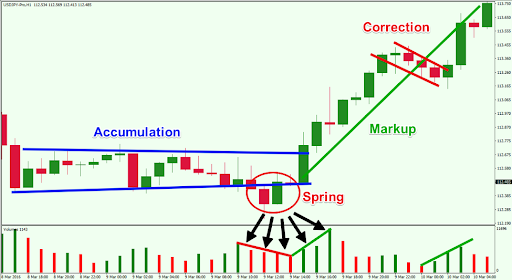

- Accumulation: This part sees massive gamers quietly shopping for a safety at comparatively low costs, usually consolidating value inside a variety. The purpose is to build up a major place earlier than initiating a value upswing.

- Mark-Up: Following accumulation, the value considerably will increase because the Composite Operator distributes a part of their holdings at greater costs.

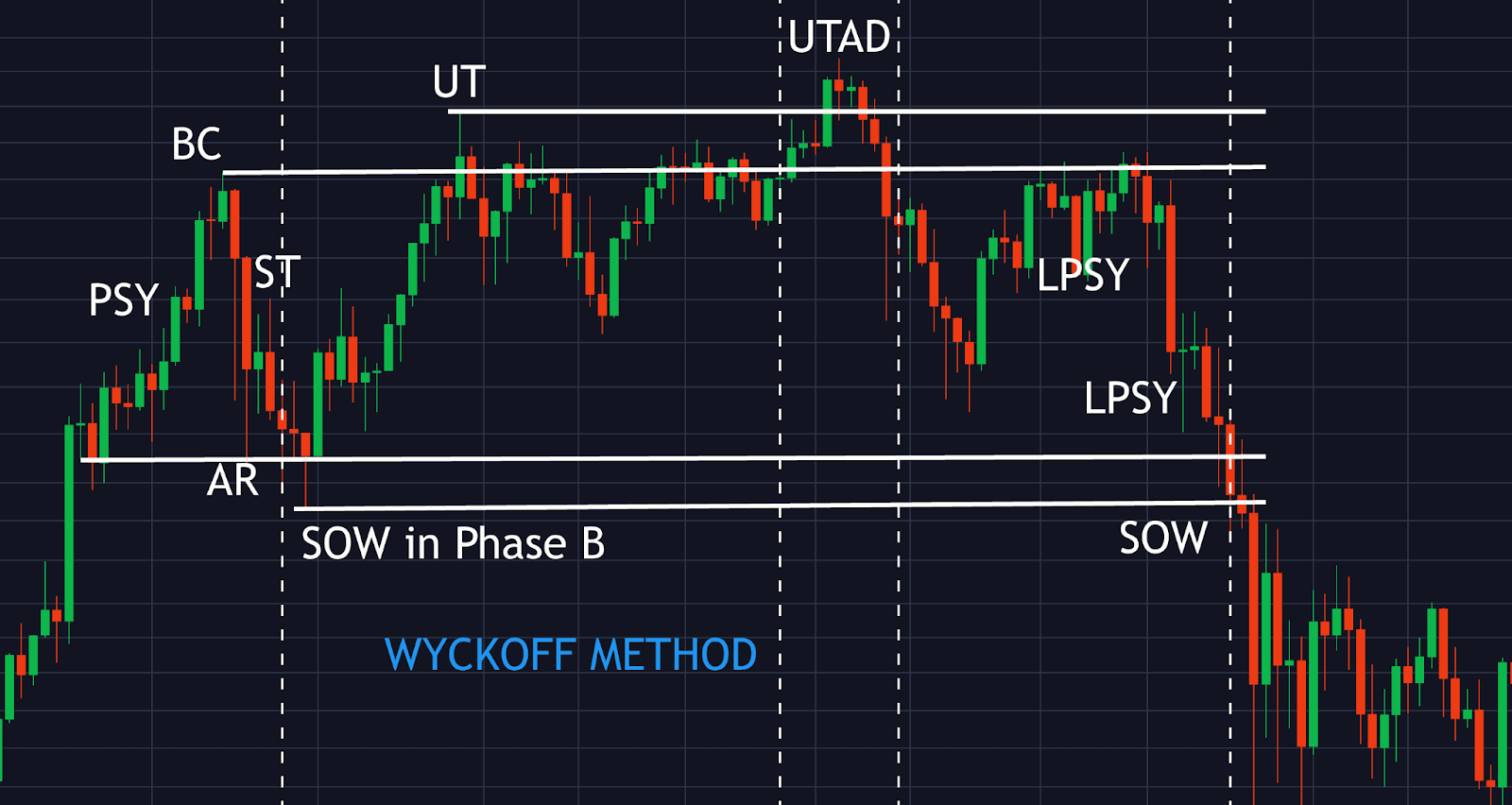

- Distribution: That is the other of accumulation. Giant gamers distribute their holdings at comparatively excessive costs, usually making a false sense of continued upward momentum.

- Mark-Down: After distribution, the value declines considerably because the Composite Operator completes their distribution and the promoting strain overwhelms shopping for strain.

Key Wyckoff Chart Patterns:

A number of chart patterns are essential for figuring out these phases. Whereas exact definitions can fluctuate barely relying on the supply, the core traits stay constant. Do not forget that these patterns are best when analyzed together with quantity and different Wyckoff ideas.

-

Spring: A pointy value drop adopted by a fast restoration. That is usually a check of help, designed to shake out weak holders earlier than the value begins its upward development. Quantity is usually low through the drop and will increase through the restoration.

-

Signal of Weak point (SOW): A decline in value accompanied by elevated quantity. This signifies a possible shift from accumulation to distribution or a weakening of the uptrend.

-

Signal of Energy (SOS): A rise in value accompanied by elevated quantity. This means potential energy and a attainable shift from distribution to accumulation or a strengthening of the uptrend.

-

Upthrust After Distribution (UTAD): A pointy upward transfer adopted by a major drop in value. This can be a traditional distribution sample the place the Composite Operator creates a false sense of energy to lure consumers earlier than initiating a value decline.

-

Secondary Check: A retest of a earlier help or resistance stage. These exams are essential for confirming the energy of the help or resistance and might present glorious entry or exit factors.

-

Final Level of Help (LPS): The ultimate low earlier than a major value enhance throughout accumulation. It represents the purpose the place the Composite Operator has accomplished their accumulation.

-

Final Level of Provide (LPSY): The ultimate excessive earlier than a major value lower throughout distribution. It represents the purpose the place the Composite Operator has accomplished their distribution.

-

Schematics: These should not particular patterns however moderately visible representations of the varied phases of the market cycle, exhibiting the interaction between value, quantity, and time. Understanding schematics helps in contextualizing particular person patterns.

Discovering Wyckoff Chart Patterns PDFs and Studying Assets:

Sadly, a complete and freely out there "Wysetrade chart patterns PDF" is uncommon. Many sources providing Wyckoff coaching are paid programs or books. Nonetheless, a number of avenues can assist you find out about these patterns:

-

On-line Programs: Platforms like Udemy, Coursera, and TradingView supply programs on Wyckoff buying and selling. These programs usually embody video classes, charts, and downloadable supplies, although they normally come at a value.

-

Books: A number of books delve into Wyckoff methodology, offering detailed explanations and examples of chart patterns. Looking for "Wyckoff buying and selling" on Amazon or different ebook retailers will yield quite a lot of choices.

-

TradingView and Different Charting Platforms: These platforms permit you to draw and analyze charts, enabling you to determine Wyckoff patterns on real-time knowledge. Many merchants share their analyses and concepts on these platforms, providing additional studying alternatives.

-

Blogs and Articles: Many web sites and blogs devoted to technical evaluation focus on Wyckoff methodology and chart patterns. Whilst you could not discover a single PDF encompassing all patterns, you may collect info from varied sources.

-

Buying and selling Communities and Boards: Becoming a member of on-line buying and selling communities and boards permits you to work together with different merchants, study from their experiences, and focus on Wyckoff patterns and their software.

Necessary Concerns:

-

Observe: Mastering Wyckoff evaluation requires vital observe. Begin by analyzing historic charts and regularly transition to dwell buying and selling.

-

Danger Administration: All the time use correct threat administration strategies, together with stop-loss orders and place sizing, to guard your capital.

-

Affirmation: Do not rely solely on chart patterns. Affirm your evaluation with different indicators and elementary components.

-

Endurance: Figuring out Wyckoff patterns takes time and persistence. Do not count on to grow to be an skilled in a single day.

Conclusion:

Whereas a free, complete "Wysetrade chart patterns PDF" is perhaps tough to seek out, the data and sources mentioned above present a stable basis for studying about Wyckoff buying and selling and its attribute chart patterns. Do not forget that constant studying, observe, and threat administration are essential for achievement on this advanced however probably rewarding buying and selling methodology. By combining your data from varied sources and diligently making use of the ideas of Wyckoff evaluation, you may considerably improve your buying and selling expertise and enhance your probabilities of figuring out worthwhile buying and selling alternatives. All the time prioritize respected sources and be cautious of overly simplified or deceptive info. Profitable Wyckoff buying and selling requires a deep understanding of market psychology and diligent chart evaluation.

Closure

Thus, we hope this text has supplied helpful insights into Wyckoff Buying and selling Chart Patterns: A Complete Information (PDF Obtain Assets). We admire your consideration to our article. See you in our subsequent article!