Deciphering The Candlestick Chart: A Complete Information

By admin / September 13, 2024 / No Comments / 2025

Deciphering the Candlestick Chart: A Complete Information

Associated Articles: Deciphering the Candlestick Chart: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Deciphering the Candlestick Chart: A Complete Information. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Deciphering the Candlestick Chart: A Complete Information

Candlestick charts, ubiquitous in monetary markets, supply a visually wealthy and insightful technique to analyze value actions over time. In contrast to easy line charts that solely present closing costs, candlestick charts incorporate the open, excessive, low, and shut (OHLC) costs of an asset inside a selected timeframe, revealing a wealth of details about market sentiment and potential future value motion. This text will delve deep into the intricacies of candlestick charts, explaining their building, interpretation, and sensible purposes for merchants and traders.

Understanding the Anatomy of a Candlestick:

Every candlestick represents the worth motion of an asset over a selected interval, which might vary from one minute to at least one month and even longer. The core elements are:

-

Physique: The oblong a part of the candlestick represents the worth vary between the open and shut costs.

- Bullish (Inexperienced/White): When the closing value is larger than the opening value, the physique is usually coloured inexperienced or white, indicating a optimistic value motion and bullish sentiment.

- Bearish (Purple/Black): When the closing value is decrease than the opening value, the physique is often coloured crimson or black, signifying a adverse value motion and bearish sentiment. The size of the physique signifies the magnitude of the worth change. An extended physique suggests a stronger transfer in both route.

-

Wicks (Shadows/Tails): The skinny traces extending above and beneath the physique are the wicks (also called shadows or tails).

- Higher Wick (Shadow): The wick extending above the physique exhibits the very best value reached in the course of the interval. A protracted higher wick signifies that the worth encountered important promoting strain at larger ranges, even when the closing value was optimistic.

- Decrease Wick (Shadow): The wick extending beneath the physique exhibits the bottom value reached in the course of the interval. A protracted decrease wick suggests sturdy shopping for strain at decrease ranges, even when the closing value was adverse.

Deciphering Candlestick Patterns:

The true energy of candlestick charts lies of their skill to disclose patterns that present clues about potential future value actions. These patterns are shaped by combining particular person candlesticks and observing their relationships to one another. Whereas deciphering patterns requires expertise and context, some frequent and important patterns embody:

-

Doji: A Doji candlestick has its open and shut costs nearly the identical, leading to a small or non-existent physique with comparatively lengthy higher and decrease wicks. Dojis typically sign indecision or a possible reversal available in the market pattern. Various kinds of Dojis, akin to Dragonfly Doji, Headstone Doji, and Lengthy-Legged Doji, supply additional nuances in interpretation.

-

Hammer and Hanging Man: These are single-candlestick reversal patterns. A hammer is a bullish reversal sample characterised by a small physique close to the underside of the buying and selling vary with an extended decrease wick. It suggests patrons stepped in to help the worth close to the lows. A dangling man is the bearish equal, showing close to a peak with an extended decrease wick, indicating potential promoting strain.

-

Engulfing Sample: This sample consists of two candlesticks. A bullish engulfing sample happens when a small bearish candlestick is adopted by a bigger bullish candlestick that utterly engulfs the earlier one. This implies a possible shift from bearish to bullish sentiment. The bearish engulfing sample is the other, with a big bearish candlestick engulfing a smaller bullish one, indicating a possible shift from bullish to bearish.

-

Piercing Sample and Darkish Cloud Cowl: These are two-candlestick reversal patterns. A piercing sample is a bullish reversal sample the place a bearish candlestick is adopted by a bullish candlestick that opens decrease however closes above the midpoint of the earlier candlestick’s physique. A darkish cloud cowl is a bearish reversal sample, the reverse of the piercing sample.

-

Morning Star and Night Star: These three-candlestick patterns are sturdy reversal alerts. A morning star is a bullish reversal sample showing after a downtrend, often consisting of a bearish candlestick, a small physique (doji or small physique), and a bullish candlestick that gaps larger. A night star is the bearish counterpart, signaling a possible reversal from an uptrend.

-

Three White Troopers and Three Black Crows: These are three-candlestick continuation patterns. Three white troopers are a bullish continuation sample characterised by three consecutive bullish candlesticks with every candlestick’s open value being above the earlier candlestick’s shut value. Three black crows are the bearish equal.

Combining Candlestick Patterns with Different Indicators:

Whereas candlestick patterns supply invaluable insights, it is essential to not rely solely on them. Combining candlestick evaluation with different technical indicators, akin to transferring averages, Relative Energy Index (RSI), MACD, and quantity evaluation, can present a extra complete and strong buying and selling technique. For instance, confirming a candlestick reversal sample with a corresponding shift within the RSI from overbought to oversold territory strengthens the sign.

Timeframe Concerns:

The timeframe chosen for candlestick charts considerably impacts the interpretation. Quick-term charts (e.g., 1-minute, 5-minute) reveal short-term value fluctuations and are sometimes utilized by day merchants. Longer-term charts (e.g., every day, weekly, month-to-month) supply a broader perspective on the general pattern and are most well-liked by swing merchants and long-term traders. The identical candlestick sample may need totally different implications relying on the timeframe.

Limitations of Candlestick Evaluation:

It is important to acknowledge the constraints of candlestick evaluation. Patterns may be subjective, and their interpretation can differ amongst merchants. False alerts can happen, and no sample ensures future value actions. Market circumstances, information occasions, and basic components can override technical alerts. Due to this fact, relying solely on candlestick patterns for buying and selling selections is dangerous. It is essential to make use of them along with different types of evaluation and danger administration methods.

Sensible Purposes:

Candlestick charts are invaluable instruments for numerous buying and selling and funding methods:

-

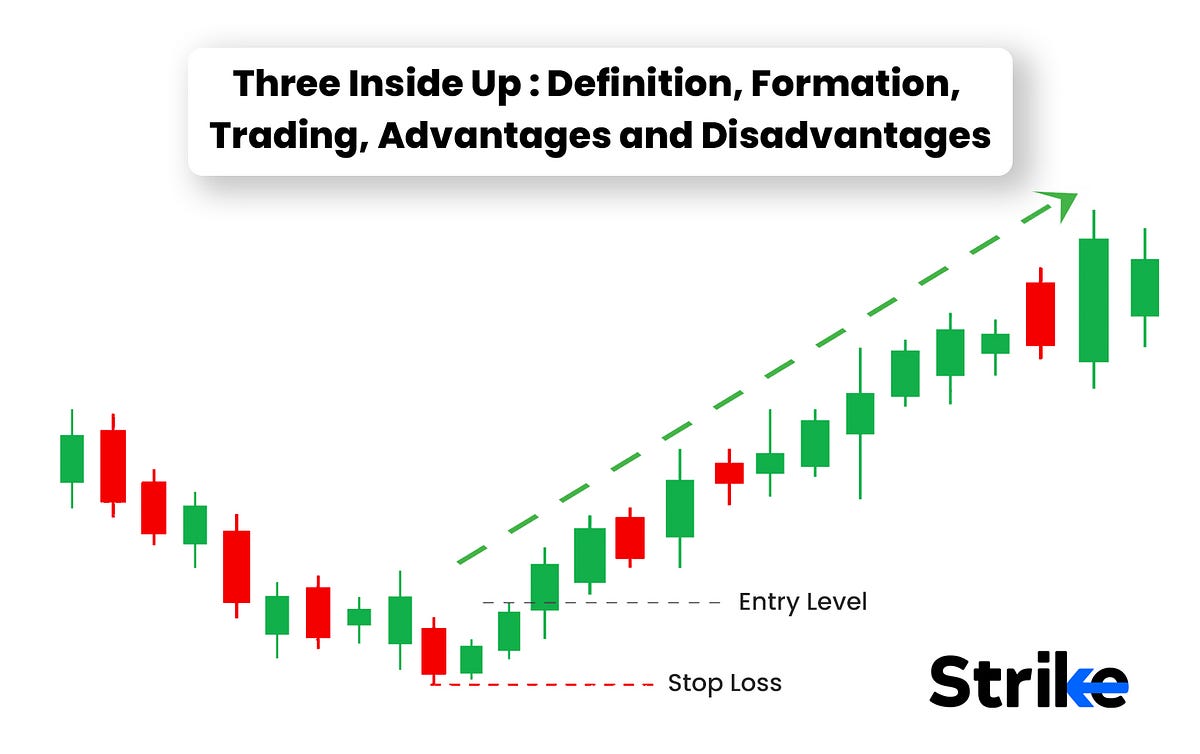

Figuring out potential entry and exit factors: Merchants can use candlestick patterns to establish potential reversal or continuation factors, serving to them time their trades successfully.

-

Confirming pattern route: Candlestick patterns might help verify whether or not the market is trending up, down, or consolidating.

-

Gauging market sentiment: The scale and colour of the candlestick our bodies, together with the size of the wicks, present insights into the power of shopping for and promoting strain.

-

Setting stop-loss and take-profit ranges: Understanding candlestick patterns might help merchants decide acceptable ranges for his or her stop-loss and take-profit orders.

-

Bettering danger administration: By incorporating candlestick evaluation right into a complete buying and selling plan, merchants can improve their danger administration methods and reduce potential losses.

Conclusion:

Candlestick charts are a robust visible instrument for analyzing value actions and understanding market sentiment. By mastering the artwork of deciphering candlestick patterns and mixing them with different technical indicators, merchants and traders can acquire a deeper understanding of market dynamics and make extra knowledgeable buying and selling selections. Nevertheless, it is essential to keep in mind that candlestick evaluation is only one piece of the puzzle, and profitable buying and selling requires a holistic strategy that comes with basic evaluation, danger administration, and disciplined execution. Steady studying and follow are important to creating experience in candlestick chart evaluation and maximizing its potential for worthwhile buying and selling.

Closure

Thus, we hope this text has offered invaluable insights into Deciphering the Candlestick Chart: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!