Deciphering The Dance: Foreign exchange And Bitcoin Chart Evaluation

By admin / June 25, 2024 / No Comments / 2025

Deciphering the Dance: Foreign exchange and Bitcoin Chart Evaluation

Associated Articles: Deciphering the Dance: Foreign exchange and Bitcoin Chart Evaluation

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Deciphering the Dance: Foreign exchange and Bitcoin Chart Evaluation. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Deciphering the Dance: Foreign exchange and Bitcoin Chart Evaluation

The world of finance is a dynamic panorama, continually shifting and evolving. Two distinguished gamers on this area – the international trade market (foreign exchange) and Bitcoin – supply distinctive alternatives and challenges for traders and merchants. Whereas seemingly disparate, analyzing their respective charts reveals intriguing parallels and important variations that form buying and selling methods. This text delves into the intricacies of foreign exchange and Bitcoin chart evaluation, exploring their similarities, contrasting their traits, and offering insights into efficient buying and selling approaches.

Understanding the Charts: A Basis for Evaluation

Earlier than diving into the specifics of foreign exchange and Bitcoin charts, it is essential to grasp the elemental ideas underpinning their interpretation. Each make the most of numerous chart sorts, primarily candlestick charts and bar charts, to visually signify worth actions over time. These charts show key knowledge factors:

- Open: The worth at first of the interval (e.g., a day, hour, or minute).

- Excessive: The very best worth reached through the interval.

- Low: The bottom worth reached through the interval.

- Shut: The worth on the finish of the interval.

Candlestick charts use distinct visible representations – "candles" – as an instance these knowledge factors, with the physique of the candle representing the vary between the open and shut costs, and the wicks extending upwards to the excessive and downwards to the low. Bar charts use vertical strains to signify the excessive and low costs, with horizontal strains marking the open and shut.

Each chart sorts, when mixed with applicable technical indicators, enable merchants to establish tendencies, assist and resistance ranges, and potential reversal factors. Nevertheless, the applying and interpretation of those instruments differ considerably between foreign exchange and Bitcoin markets.

Foreign exchange Chart Evaluation: A Mature Market’s Stability

The foreign exchange market, the biggest and most liquid monetary market globally, boasts a historical past spanning centuries. This maturity contributes to its relative stability and predictability, though volatility definitely exists. Foreign exchange charts usually show smoother, extra gradual worth actions in comparison with Bitcoin. This permits for the efficient software of classical technical evaluation instruments:

- Transferring Averages: These indicators, similar to easy transferring averages (SMA) and exponential transferring averages (EMA), successfully clean out worth fluctuations and establish tendencies in foreign exchange. Crossovers between totally different transferring averages can sign potential purchase or promote alerts.

- Relative Power Index (RSI): This momentum oscillator helps establish overbought and oversold circumstances, signaling potential pattern reversals. In foreign exchange, RSI can successfully pinpoint intervals of market exhaustion and potential corrections.

- Fibonacci Retracements: Based mostly on the Fibonacci sequence, these retracements establish potential assist and resistance ranges throughout worth corrections, providing merchants entry and exit factors. The predictability of foreign exchange worth actions usually makes Fibonacci retracements a invaluable software.

- Help and Resistance Ranges: These ranges signify worth factors the place the market has traditionally struggled to interrupt by way of, offering potential entry and exit factors for merchants. In foreign exchange, these ranges are sometimes extra clearly outlined as a result of market’s higher liquidity and established patterns.

- Chart Patterns: Head and shoulders, double tops/bottoms, triangles, and flags are frequent chart patterns noticed in foreign exchange, providing insights into potential pattern reversals or continuations. The established nature of the market makes these patterns extra dependable in foreign exchange than in Bitcoin.

The liquidity and established regulatory frameworks within the foreign exchange market make it comparatively simpler to execute trades with minimal slippage and worth manipulation. This contributes to a extra predictable buying and selling setting, making technical evaluation simpler.

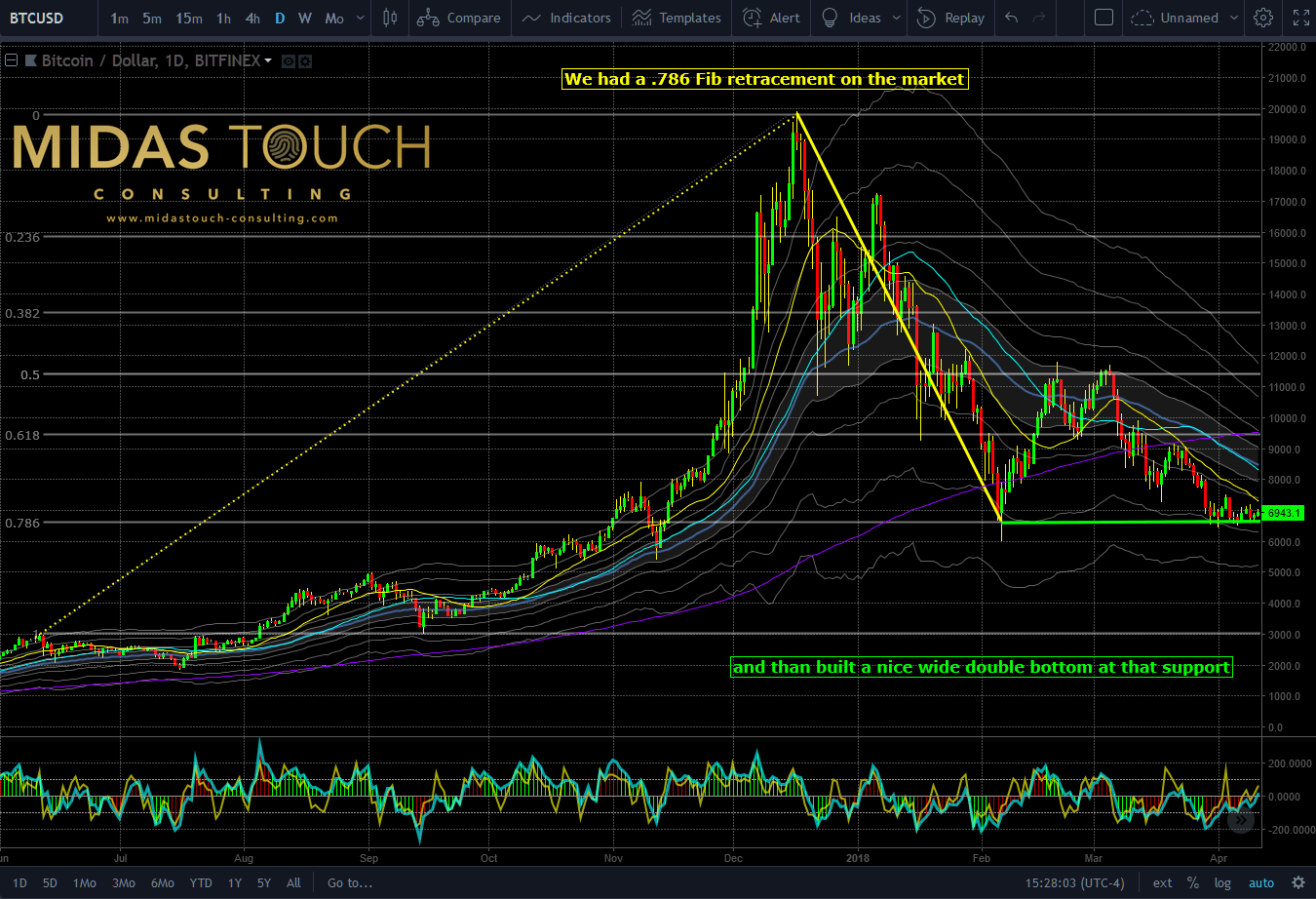

Bitcoin Chart Evaluation: Navigating Volatility in a Nascent Market

Bitcoin, alternatively, represents a comparatively new asset class with a considerably shorter historical past. Its worth volatility is dramatically larger than that of most foreign exchange pairs. Whereas technical evaluation can nonetheless be utilized, its effectiveness is usually challenged by the market’s susceptibility to:

- Information Occasions and Sentiment: Bitcoin’s worth is closely influenced by information occasions, regulatory bulletins, and general market sentiment. A single tweet from a distinguished determine could cause important worth swings, making technical evaluation much less dependable.

- Whale Manipulation: Giant holders ("whales") can considerably affect Bitcoin’s worth by way of their buying and selling actions, creating synthetic worth actions that defy conventional technical evaluation patterns.

- Excessive Volatility: The acute worth swings make it difficult to establish clear assist and resistance ranges and precisely predict worth actions utilizing conventional indicators. Transferring averages, for instance, might lag considerably behind speedy worth modifications.

- Lack of Established Patterns: The comparatively quick historical past of Bitcoin implies that established chart patterns are much less prevalent and dependable than in foreign exchange. This necessitates a extra cautious and adaptive strategy to technical evaluation.

Regardless of these challenges, technical evaluation stays a invaluable software for Bitcoin merchants. Nevertheless, it needs to be used along with basic evaluation, contemplating information occasions, regulatory developments, and general market sentiment. Indicators like RSI and MACD can nonetheless supply insights into momentum and potential reversals, however merchants should train higher warning and modify their methods based mostly available on the market’s distinctive volatility.

Evaluating and Contrasting: Key Variations

The next desk summarizes the important thing variations between foreign exchange and Bitcoin chart evaluation:

| Characteristic | Foreign exchange | Bitcoin |

|---|---|---|

| Volatility | Comparatively low | Extraordinarily excessive |

| Liquidity | Extraordinarily excessive | Excessive, however topic to fluctuations |

| Regulatory Framework | Properly-established and controlled | Much less regulated, topic to various guidelines globally |

| Chart Patterns | Extra established and dependable | Much less established, much less dependable |

| Technical Evaluation | Extremely efficient, usually utilized in isolation | Efficient, however requires basic evaluation |

| Sentiment Impression | Much less impactful | Extremely impactful |

| Manipulation | Much less prevalent | Extra prevalent (whale manipulation) |

Methods and Issues

Profitable buying and selling in each foreign exchange and Bitcoin requires a holistic strategy that mixes technical and basic evaluation. For foreign exchange, a deal with traditional technical indicators and chart patterns, coupled with threat administration methods, will be extremely efficient. For Bitcoin, a extra nuanced strategy is required, incorporating information evaluation, sentiment monitoring, and the next tolerance for threat.

Diversification is essential in each markets. Do not put all of your eggs in a single basket. Unfold your investments throughout totally different foreign money pairs in foreign exchange and take into account diversifying past Bitcoin into different cryptocurrencies.

Danger administration is paramount. At all times use stop-loss orders to restrict potential losses and by no means make investments greater than you may afford to lose. Backtesting buying and selling methods on historic knowledge is important to refine your strategy and assess its effectiveness.

Conclusion: Navigating the Chart’s Narrative

Foreign exchange and Bitcoin charts, whereas sharing some basic analytical instruments, current distinct challenges and alternatives. Foreign exchange gives a comparatively steady and predictable market, amenable to traditional technical evaluation. Bitcoin, alternatively, calls for a extra dynamic and adaptive strategy, integrating basic evaluation with technical instruments to navigate its inherent volatility. Understanding these variations, using applicable methods, and rigorously managing threat are essential for achievement in each these thrilling and dynamic markets. The important thing lies in studying to decipher the distinctive narrative every chart unfolds, adapting your strategy to the precise traits of every market, and continually evolving your methods based mostly on market dynamics.

Closure

Thus, we hope this text has offered invaluable insights into Deciphering the Dance: Foreign exchange and Bitcoin Chart Evaluation. We admire your consideration to our article. See you in our subsequent article!