The Intertwined Destiny Of Oil And Fuel Costs: A Chart-Pushed Evaluation

By admin / September 28, 2024 / No Comments / 2025

The Intertwined Destiny of Oil and Fuel Costs: A Chart-Pushed Evaluation

Associated Articles: The Intertwined Destiny of Oil and Fuel Costs: A Chart-Pushed Evaluation

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to The Intertwined Destiny of Oil and Fuel Costs: A Chart-Pushed Evaluation. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

The Intertwined Destiny of Oil and Fuel Costs: A Chart-Pushed Evaluation

The value of oil and the value of pure gasoline, whereas distinct commodities, are inextricably linked. Their relationship is complicated, influenced by a mess of things starting from world provide and demand dynamics to geopolitical occasions and technological developments. Understanding this relationship is essential for companies, traders, policymakers, and shoppers alike, as fluctuations in both commodity can have cascading results throughout the worldwide economic system. This text will delve into the historic relationship between oil and gasoline costs, analyzing key tendencies illustrated via charts and analyzing the underlying drivers that form their correlated, but usually divergent, trajectories.

Visualizing the Relationship: A Historic Perspective

[Insert Chart 1 here: A long-term chart (e.g., 20 years) showing the price of crude oil (e.g., Brent or WTI) and natural gas (e.g., Henry Hub) plotted on the same graph. The chart should clearly label axes and include a legend.]

Chart 1 offers a visible illustration of the historic interaction between oil and gasoline costs. Whereas a transparent correlation exists – usually exhibiting durations of simultaneous value will increase or decreases – the connection is way from completely linear. There are situations the place oil costs surge whereas gasoline costs stay comparatively stagnant, and vice versa. This divergence highlights the affect of things particular to every commodity’s market.

Components Driving Oil Value Fluctuations:

Oil value actions are notoriously unstable and influenced by a confluence of things:

-

OPEC and International Provide: The Group of the Petroleum Exporting International locations (OPEC) performs a major function in setting world oil manufacturing ranges. OPEC’s selections relating to manufacturing quotas instantly impression the provision of crude oil, influencing costs. Geopolitical instability in main oil-producing areas, such because the Center East, also can disrupt provide chains and result in value spikes.

-

International Demand: International financial progress is a significant driver of oil demand. Intervals of sturdy financial enlargement sometimes result in elevated industrial exercise and transportation, boosting oil consumption and costs. Conversely, financial downturns can suppress demand and put downward stress on costs.

-

Technological Developments: The event and adoption of other vitality sources, corresponding to photo voltaic and wind energy, can progressively cut back the reliance on oil, doubtlessly dampening value will increase in the long run. Technological developments in oil extraction, corresponding to fracking, can enhance provide, main to cost decreases.

-

Hypothesis and Funding: Oil futures markets are inclined to hypothesis, the place merchants guess on future value actions. This may amplify value volatility, resulting in each sharp will increase and reduces impartial of elementary provide and demand elements.

-

Geopolitical Dangers: Political instability, sanctions, and conflicts in oil-producing areas can create uncertainty and disrupt provide, main to cost spikes. That is significantly related in areas with vital oil reserves and manufacturing capability.

Components Driving Pure Fuel Value Fluctuations:

Pure gasoline costs, whereas usually correlated with oil costs, are topic to their very own set of distinct influences:

-

Climate Patterns: Pure gasoline demand is extremely delicate to climate situations. Chilly winters enhance heating demand, driving up costs, whereas delicate winters can result in decrease costs. Equally, scorching summers can enhance electrical energy demand for air con, additionally boosting gasoline costs.

-

Storage Ranges: The quantity of pure gasoline saved in underground reservoirs considerably impacts costs. Low storage ranges point out restricted provide, doubtlessly main to cost will increase, whereas excessive storage ranges can put downward stress on costs.

-

Competitors from Different Vitality Sources: Pure gasoline competes with different vitality sources, corresponding to coal and renewables, for electrical energy technology and industrial functions. Adjustments within the relative prices and availability of those alternate options can affect pure gasoline demand and costs.

-

Pipeline Infrastructure: The capability and effectivity of pure gasoline pipelines play a vital function in transporting gasoline from manufacturing websites to shoppers. Bottlenecks or disruptions in pipeline infrastructure can result in regional value variations.

-

Authorities Laws: Authorities insurance policies, corresponding to environmental rules and subsidies for renewable vitality, can impression the demand and provide of pure gasoline, thereby influencing costs.

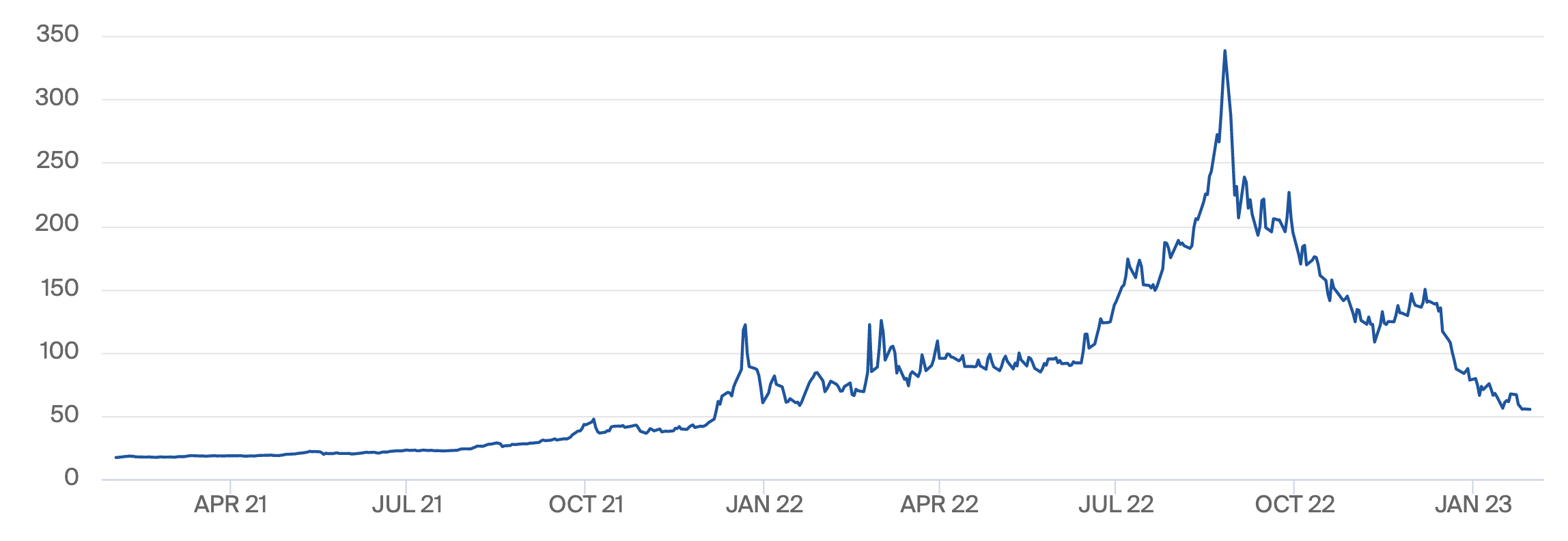

[Insert Chart 2 here: A shorter-term chart (e.g., 5 years) showing the price of crude oil and natural gas, highlighting periods of divergence. Include annotations to point out specific events or periods that caused divergence.]

Chart 2 illustrates durations the place oil and gasoline costs diverge. For instance, a interval of unusually delicate winters might result in decrease pure gasoline costs regardless of rising oil costs because of geopolitical tensions. Conversely, a surge in pure gasoline demand because of a chronic chilly snap may drive gasoline costs larger whereas oil costs stay comparatively steady. These divergences spotlight the impartial elements influencing every commodity’s market.

The Interaction: Correlation vs. Causation

Whereas oil and gasoline costs usually transfer in tandem, it is essential to tell apart between correlation and causation. The correlation usually arises from their shared function in vitality markets and their susceptibility to comparable macroeconomic elements. Nevertheless, the particular drivers behind value fluctuations can differ considerably, as demonstrated by the examples above.

For example, a surge in world financial progress may concurrently enhance demand for each oil and gasoline, main to cost will increase in each markets. Nevertheless, a selected occasion, corresponding to a pipeline disruption affecting pure gasoline provide, would primarily impression pure gasoline costs, whereas oil costs may stay comparatively unaffected.

Implications for Companies, Traders, and Policymakers:

Understanding the dynamic relationship between oil and gasoline costs is essential for numerous stakeholders:

-

Companies: Vitality-intensive industries are significantly weak to cost fluctuations in each oil and gasoline. Correct forecasting of those costs is essential for efficient price administration and strategic planning.

-

Traders: Traders in vitality corporations want to think about the correlation and divergence between oil and gasoline costs when making funding selections. Diversification throughout vitality sectors will help mitigate threat.

-

Policymakers: Authorities insurance policies associated to vitality safety, environmental safety, and financial stability want to think about the complicated interaction between oil and gasoline markets. Efficient insurance policies require a nuanced understanding of the elements driving value fluctuations.

Conclusion:

The connection between oil and gasoline costs is multifaceted and dynamic. Whereas usually correlated, their value actions are influenced by a variety of distinct elements, resulting in durations of convergence and divergence. Analyzing historic value tendencies, as illustrated within the charts above, alongside a complete understanding of the underlying market drivers, is important for companies, traders, and policymakers to navigate the complexities of the worldwide vitality panorama. Future analysis ought to deal with refining forecasting fashions that account for the more and more complicated interaction of things influencing these essential commodities, together with the rising function of renewable vitality and evolving geopolitical dynamics. The persevering with evolution of the vitality sector guarantees additional fascinating developments within the dynamic relationship between oil and gasoline costs within the years to return.

Closure

Thus, we hope this text has offered priceless insights into The Intertwined Destiny of Oil and Fuel Costs: A Chart-Pushed Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!