Decoding The 30-12 months Mortgage Price Chart: A Complete Information

By admin / June 18, 2024 / No Comments / 2025

Decoding the 30-12 months Mortgage Price Chart: A Complete Information

Associated Articles: Decoding the 30-12 months Mortgage Price Chart: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the 30-12 months Mortgage Price Chart: A Complete Information. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the 30-12 months Mortgage Price Chart: A Complete Information

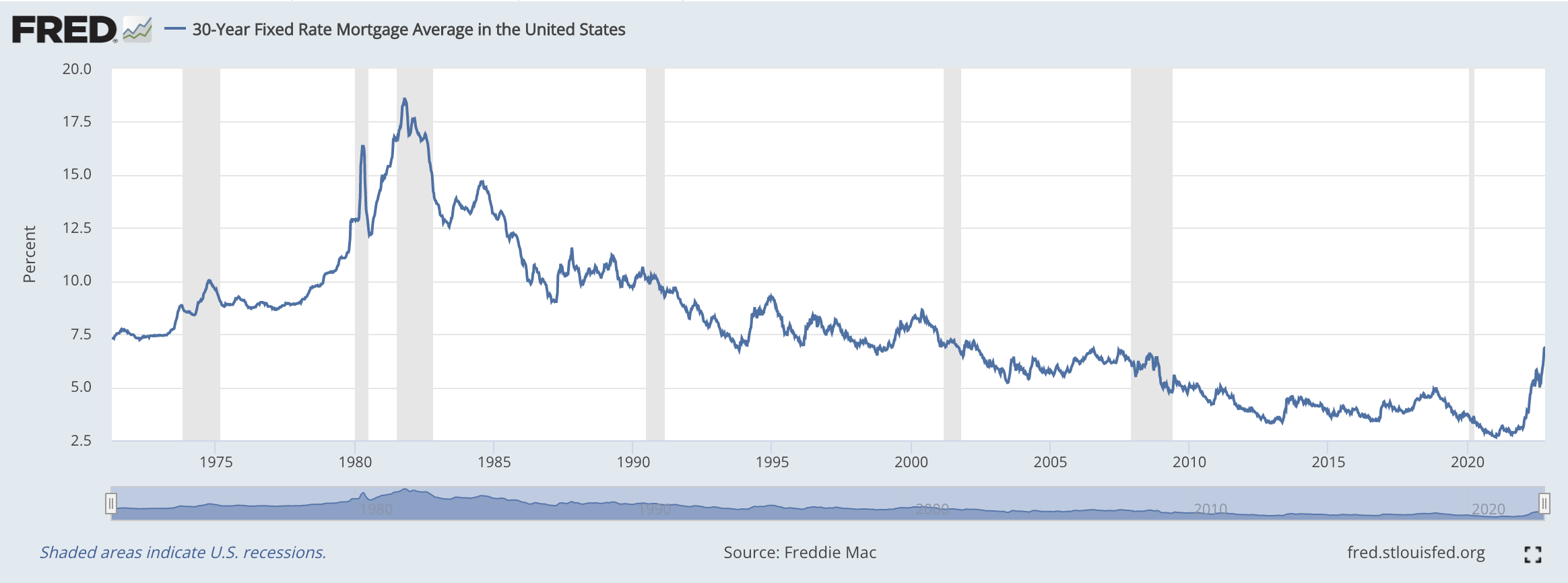

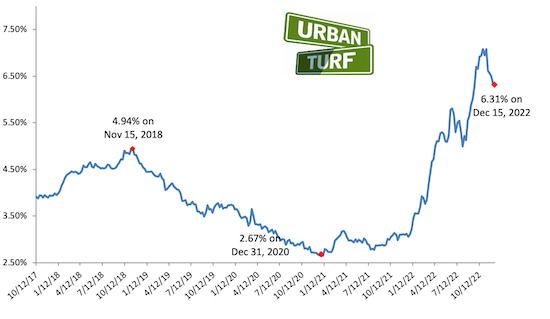

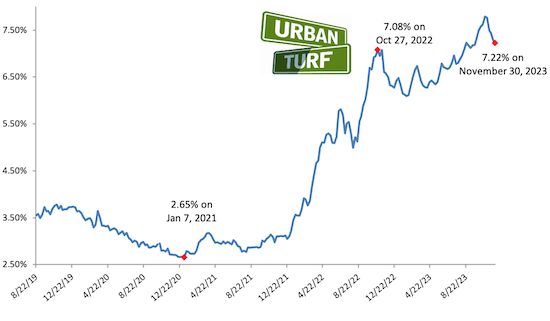

The 30-year fixed-rate mortgage is a cornerstone of the American dream, providing householders a predictable, long-term cost plan for his or her greatest funding. Understanding the dynamics of 30-year mortgage rates of interest, nevertheless, is essential for making knowledgeable monetary choices. This text will delve deep into the intricacies of 30-year mortgage fee charts, exploring their historic developments, influencing components, and implications for potential homebuyers.

Understanding the Chart:

A typical 30-year mortgage fee chart shows the historic and/or projected rates of interest for 30-year fixed-rate mortgages over a specified interval, typically starting from a number of months to a number of a long time. The chart usually makes use of a line graph, with the horizontal axis representing time (often in months or years) and the vertical axis representing the rate of interest (often expressed as a share). The road itself reveals the fluctuation of charges over time. Some charts may embody further knowledge factors, reminiscent of common charges, median charges, and even projections based mostly on financial fashions.

Decoding the Knowledge:

Analyzing a 30-year mortgage fee chart requires understanding a number of key components:

-

Price Fluctuations: The chart visually demonstrates the volatility of rates of interest. Intervals of financial development typically correlate with larger charges, whereas recessions or financial uncertainty can result in decrease charges. Understanding these fluctuations permits debtors to anticipate potential fee adjustments and plan accordingly.

-

Tendencies: Lengthy-term developments reveal broader financial patterns. For example, a persistently upward-sloping line signifies a usually rising rate of interest surroundings, whereas a downward pattern suggests falling charges. Figuring out these developments will help predict future fee actions, though it is essential to keep in mind that these are predictions, not ensures.

-

Historic Context: Evaluating present charges to historic charges supplies priceless perspective. A seemingly excessive fee right this moment may be thought of low in comparison with charges seen in earlier a long time. This context helps keep away from emotional reactions to short-term fluctuations.

-

Exterior Components: Whereas the chart focuses on charges, understanding the exterior components influencing these charges is significant. Financial indicators like inflation, unemployment, and authorities insurance policies all play a major position. A chart alone can’t absolutely clarify the "why" behind fee adjustments; supplementary financial evaluation is required.

Components Influencing 30-12 months Mortgage Charges:

A number of interconnected components affect the rates of interest displayed on a 30-year mortgage fee chart:

-

Federal Reserve Coverage: The Federal Reserve (the Fed), the central financial institution of america, performs a dominant position. The Fed’s financial coverage, significantly its federal funds fee (the goal fee for in a single day lending between banks), considerably impacts mortgage charges. Elevating the federal funds fee usually results in larger mortgage charges, and vice versa.

-

Inflation: Excessive inflation erodes the buying energy of cash, prompting the Fed to boost rates of interest to chill down the economic system. This, in flip, will increase mortgage charges. Conversely, low inflation permits for decrease charges.

-

Financial Development: Robust financial development typically results in larger rates of interest as demand for loans will increase. Conversely, financial slowdowns or recessions can push charges decrease.

-

Authorities Rules: Authorities laws, reminiscent of these associated to housing finance and banking, can influence the provision of mortgage capital and affect charges.

-

Investor Demand: The demand for mortgage-backed securities (MBS) within the secondary market influences charges. Larger demand usually pushes charges down, whereas decrease demand pushes them up.

-

International Financial Circumstances: Worldwide financial occasions may have an effect on US mortgage charges. International financial uncertainty or crises can result in elevated threat aversion, doubtlessly impacting borrowing prices.

Utilizing the Chart to Make Knowledgeable Selections:

A 30-year mortgage fee chart is a strong device for potential homebuyers, however it’s not a crystal ball. It ought to be used together with different monetary planning instruments {and professional} recommendation. This is find out how to leverage the chart successfully:

-

Lengthy-Time period Perspective: Deal with the long-term developments reasonably than short-term fluctuations. Quick-term dips may be tempting, however long-term developments supply a extra dependable image.

-

Affordability: Decide your inexpensive month-to-month cost based mostly in your revenue and monetary state of affairs. The chart helps you perceive the potential vary of month-to-month funds based mostly on completely different rates of interest.

-

Danger Tolerance: Larger charges imply larger month-to-month funds, however decrease charges won’t all the time be sustainable in the long term. Assess your threat tolerance and select a fee and mortgage time period that aligns together with your consolation stage.

-

Seek the advice of Professionals: Work with a mortgage dealer or monetary advisor to debate your particular person circumstances and discover completely different mortgage choices. They’ll present customized steerage based mostly in your particular wants and the present market circumstances.

-

Contemplate Different Mortgage Varieties: The chart focuses on 30-year fixed-rate mortgages, however different choices exist, reminiscent of adjustable-rate mortgages (ARMs) or 15-year fixed-rate mortgages. Discover these options to search out the perfect match to your state of affairs.

Past the Chart: Taking a look at Different Key Metrics:

Whereas the speed chart is crucial, it is not the one issue to think about. Pay shut consideration to:

-

Mortgage Charges: Closing prices, origination charges, and different prices can considerably influence the general value of the mortgage. Evaluate these charges throughout completely different lenders.

-

Credit score Rating: Your credit score rating straight influences the rate of interest you qualify for. The next credit score rating usually interprets to a decrease fee.

-

Down Fee: A bigger down cost can cut back the mortgage quantity and doubtlessly safe a greater rate of interest.

-

Mortgage-to-Worth Ratio (LTV): This ratio compares the mortgage quantity to the property’s worth. A decrease LTV typically leads to extra favorable phrases.

Conclusion:

A 30-year mortgage fee chart is a priceless useful resource for understanding the historic and potential future actions of rates of interest. Nevertheless, it is essential to make use of it as one piece of a bigger monetary puzzle. By combining chart evaluation with an understanding of influencing components, cautious monetary planning, {and professional} recommendation, potential homebuyers could make knowledgeable choices that align with their long-term monetary objectives. Keep in mind that the chart displays market developments, however your particular person circumstances and monetary planning ought to finally information your mortgage alternative. Do not solely depend on the chart; have interaction with specialists and completely analysis your choices to search out the perfect mortgage to your particular wants and monetary state of affairs.

:max_bytes(150000):strip_icc()/BgXcd-average-mortgage-rates-over-the-last-year-feb-29-2024-0875eb9980bb4ece94169bb78b670b86.png)

Closure

Thus, we hope this text has supplied priceless insights into Decoding the 30-12 months Mortgage Price Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!