NVDA Inventory Chart In the present day: A Deep Dive Into Nvidia’s Market Efficiency And Future Outlook

By admin / October 19, 2024 / No Comments / 2025

NVDA Inventory Chart In the present day: A Deep Dive into Nvidia’s Market Efficiency and Future Outlook

Associated Articles: NVDA Inventory Chart In the present day: A Deep Dive into Nvidia’s Market Efficiency and Future Outlook

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to NVDA Inventory Chart In the present day: A Deep Dive into Nvidia’s Market Efficiency and Future Outlook. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

NVDA Inventory Chart In the present day: A Deep Dive into Nvidia’s Market Efficiency and Future Outlook

Nvidia (NVDA) has grow to be synonymous with the explosive development of the bogus intelligence (AI) sector. Its inventory value has mirrored this meteoric rise, making it a focus for buyers and analysts alike. Understanding the NVDA inventory chart "right this moment" requires greater than only a look on the present value; it calls for a complete evaluation of the underlying elements driving its efficiency, each short-term and long-term. This text delves deep into the intricacies of NVDA’s present market place, exploring the important thing drivers behind its fluctuations and providing insights into potential future trajectories.

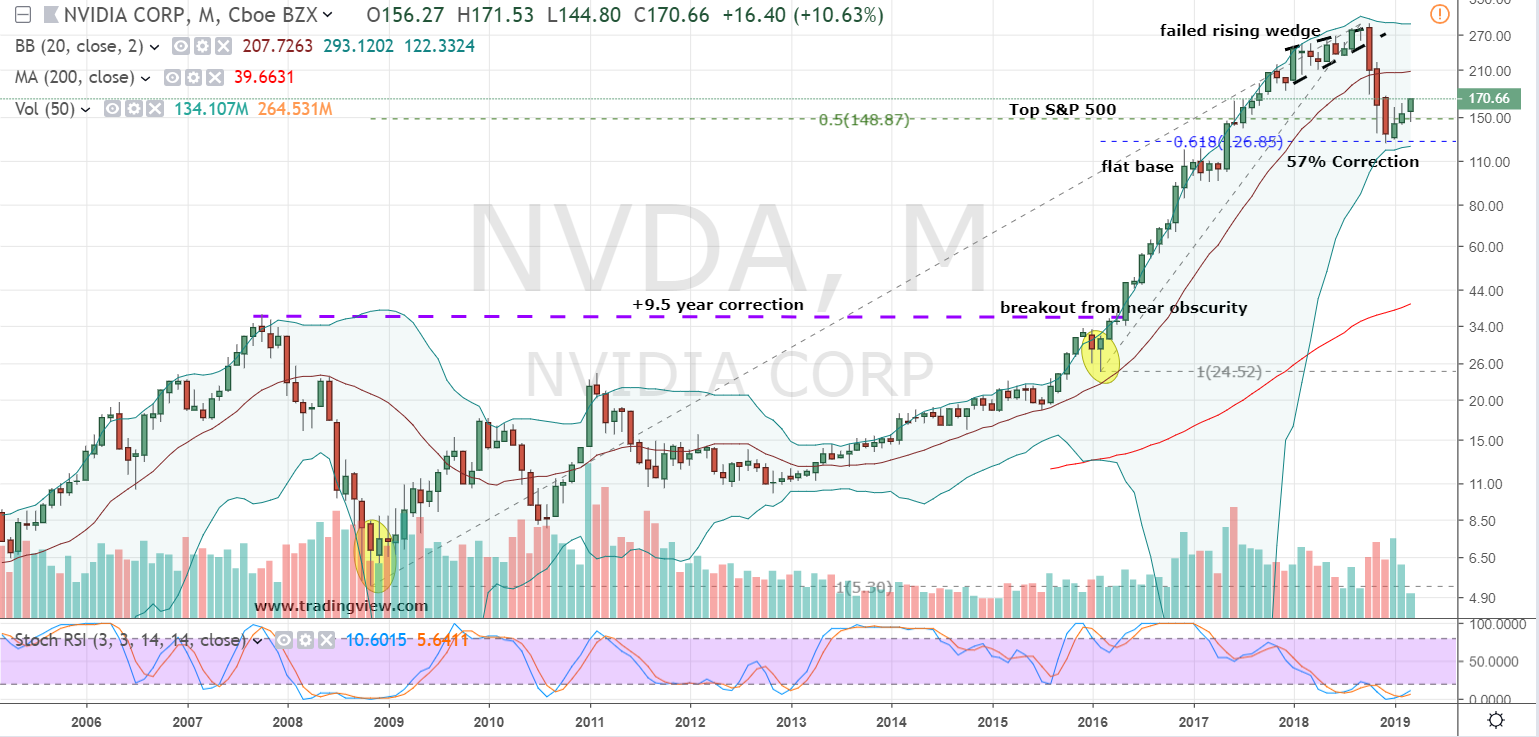

In the present day’s Snapshot: A Fast Look on the Chart

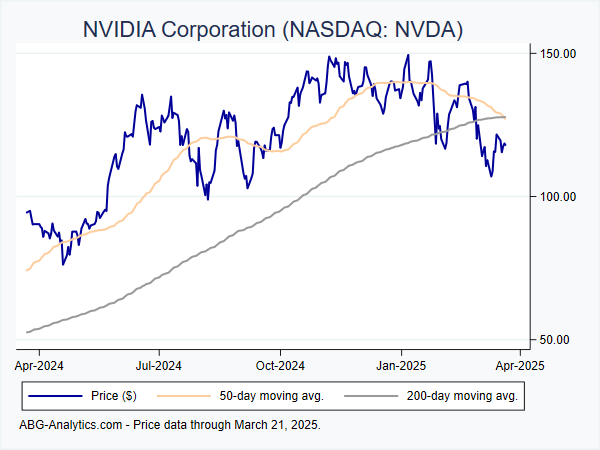

Earlier than dissecting the underlying forces, let’s acknowledge the inherent volatility of the inventory market. A snapshot of the NVDA inventory chart at any given second is just a fleeting illustration of its total efficiency. Elements comparable to information releases, earnings experiences, broader market traits, and even geopolitical occasions can considerably impression the worth inside a single buying and selling day. Subsequently, focusing solely on "right this moment’s" chart with out contextualizing it inside a broader timeframe can be deceptive.

Nevertheless, to offer a place to begin, we will study some key metrics sometimes displayed on a real-time inventory chart:

- Opening Worth: The worth at which NVDA inventory started buying and selling for the day.

- Excessive/Low: The best and lowest costs reached through the buying and selling session.

- Closing Worth: The ultimate value on the finish of the buying and selling day.

- Quantity: The variety of shares traded, indicating market exercise and investor sentiment.

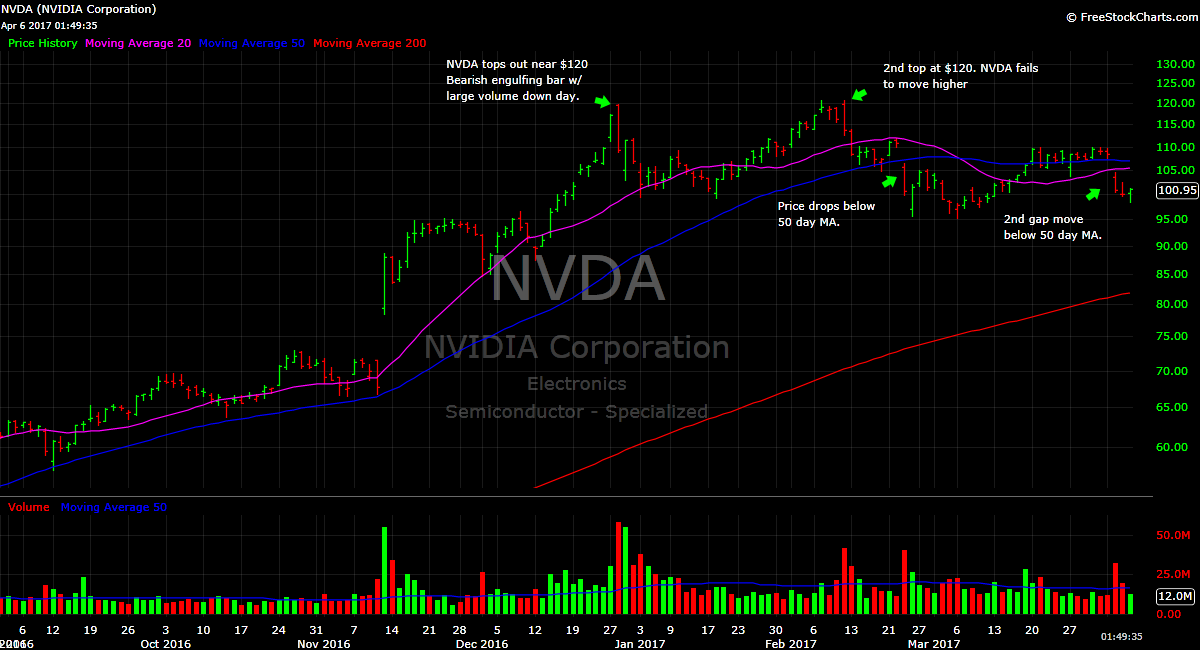

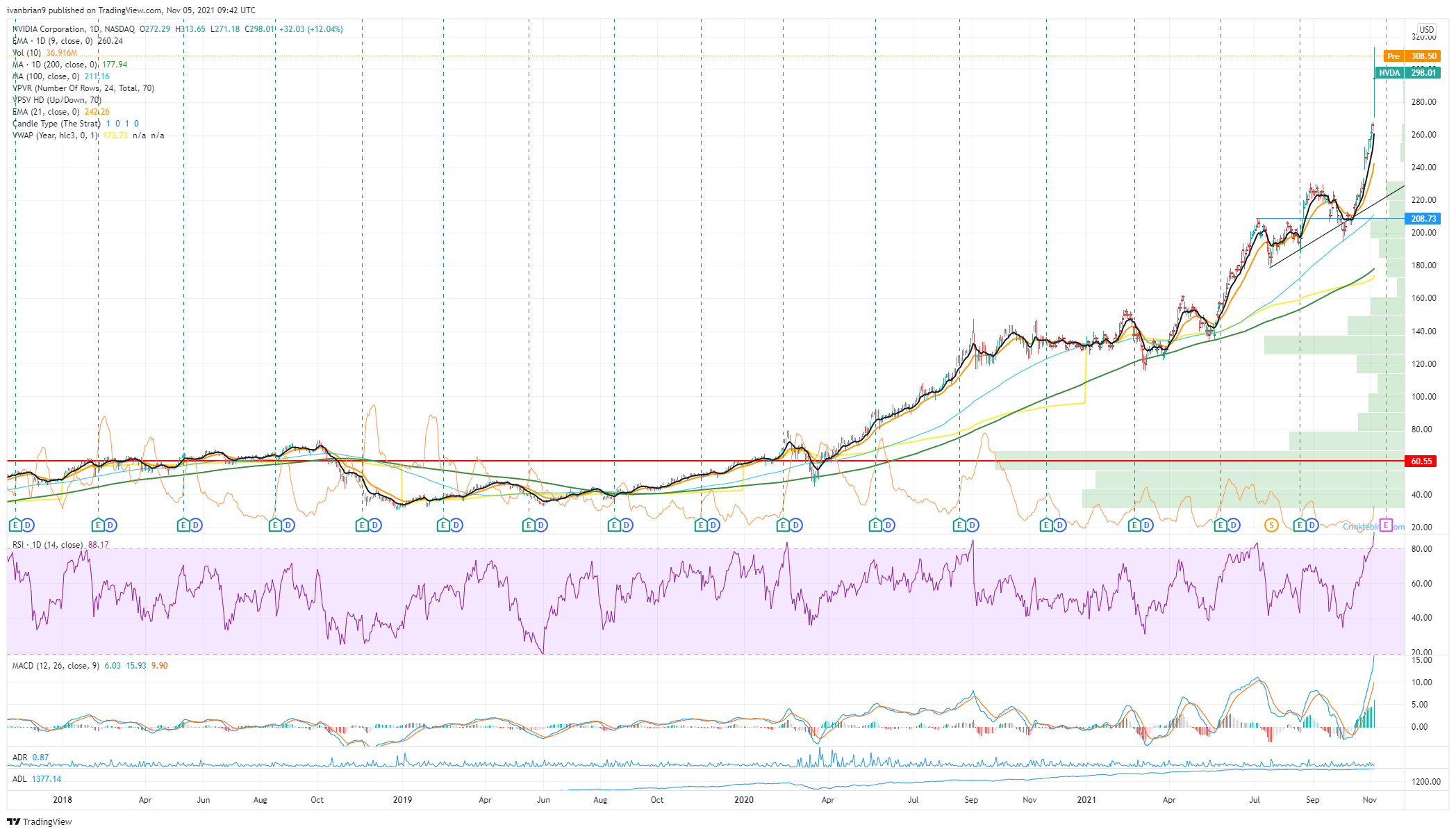

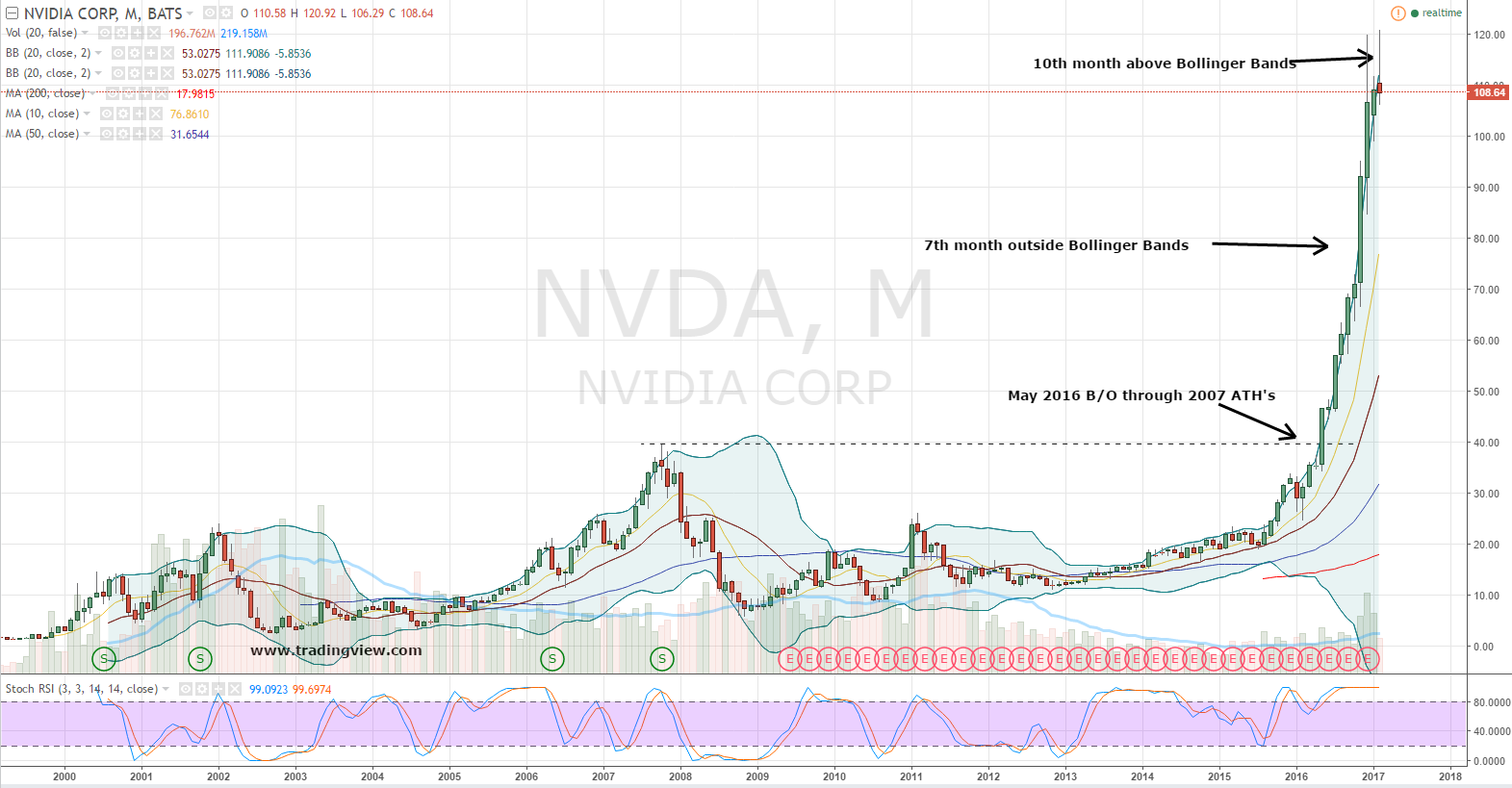

- Shifting Averages: Varied shifting averages (e.g., 50-day, 200-day) present a visible illustration of the inventory’s development over totally different durations.

- Relative Energy Index (RSI): A momentum indicator that helps assess whether or not the inventory is overbought or oversold.

- Technical Indicators: Different indicators comparable to MACD (Shifting Common Convergence Divergence) and Bollinger Bands present further insights into value momentum and volatility.

These metrics, when seen at the side of historic information and basic evaluation, supply a extra full image of NVDA’s efficiency.

The Drivers Behind NVDA’s Inventory Efficiency:

NVDA’s phenomenal development is not a random incidence; it is fueled by a confluence of things:

-

The AI Growth: Nvidia’s GPUs are the dominant power in AI processing, notably in deep studying and machine studying purposes. The explosive development of AI throughout varied sectors – from autonomous autos and robotics to cloud computing and information facilities – straight interprets into surging demand for Nvidia’s merchandise. Any information associated to AI developments, breakthroughs, or elevated funding in AI infrastructure considerably impacts NVDA’s inventory value.

-

Knowledge Middle Dominance: Nvidia’s information middle enterprise is a significant income driver. As corporations more and more depend on cloud computing and large information processing, the demand for high-performance GPUs for AI and high-performance computing (HPC) duties continues to develop exponentially. This phase’s efficiency is a vital indicator of NVDA’s total well being.

-

Gaming Market Energy: Whereas the AI phase dominates the narrative, Nvidia’s gaming enterprise stays a major contributor to its income. The continuing development of the gaming business, coupled with the discharge of latest high-performance graphics playing cards, continues to offer a secure income stream.

-

Automotive Partnerships and Autonomous Driving: Nvidia’s foray into the automotive sector, notably by way of its DRIVE platform for autonomous autos, represents a major long-term development alternative. Progress on this space, together with strategic partnerships and technological developments, can affect investor sentiment.

-

Competitors and Market Share: Whereas Nvidia presently enjoys a dominant market share in lots of its key segments, the aggressive panorama is evolving. The emergence of rivals and potential technological disruptions may impression NVDA’s future efficiency. Analyzing the aggressive dynamics is essential for understanding potential dangers.

-

Macroeconomic Elements: Broader macroeconomic circumstances, together with rates of interest, inflation, and total financial development, can affect investor habits and have an effect on NVDA’s inventory value. Intervals of financial uncertainty can result in elevated volatility available in the market.

-

Earnings Stories and Steerage: Nvidia’s quarterly earnings experiences and future steerage are vital occasions that considerably impression the inventory value. Exceeding expectations usually results in optimistic market reactions, whereas falling brief can set off sell-offs.

Analyzing the NVDA Inventory Chart: A Multi-faceted Method

Analyzing the NVDA inventory chart successfully requires a multi-faceted method:

-

Technical Evaluation: Finding out chart patterns, indicators, and historic value actions can present insights into potential value traits and help/resistance ranges. Nevertheless, technical evaluation alone should not be the only foundation for funding selections.

-

Elementary Evaluation: Inspecting Nvidia’s monetary statements, income streams, revenue margins, and aggressive panorama gives a deeper understanding of the corporate’s intrinsic worth and long-term prospects.

-

Information and Sentiment Evaluation: Staying knowledgeable about related information, business traits, and investor sentiment might help anticipate potential value actions. Monitoring information sources and social media sentiment can supply invaluable insights.

-

Lengthy-Time period vs. Brief-Time period Perspective: Traders ought to undertake a long-term perspective when contemplating investments in development shares like NVDA. Whereas short-term fluctuations are inevitable, specializing in the corporate’s long-term development potential is essential for making knowledgeable selections.

Future Outlook and Potential Dangers:

Whereas NVDA’s future seems vibrant, a number of potential dangers warrant consideration:

-

Elevated Competitors: The AI chip market is turning into more and more aggressive, with corporations like AMD and Intel making important investments on this area.

-

Provide Chain Disruptions: International provide chain points can impression Nvidia’s manufacturing and supply capabilities.

-

Regulatory Scrutiny: Elevated regulatory scrutiny of the tech business may impression Nvidia’s operations and development.

-

Overvaluation Considerations: The speedy value appreciation of NVDA has raised issues about potential overvaluation. A correction is at all times a risk.

Conclusion:

Understanding the NVDA inventory chart "right this moment" requires a nuanced understanding of the interaction between its basic energy, technical indicators, and the broader market setting. Whereas the corporate’s place within the burgeoning AI market is undeniably sturdy, buyers ought to method any funding with a balanced perspective, fastidiously contemplating each the potential rewards and the inherent dangers. A radical evaluation, combining technical and basic insights with a long-term perspective, is important for making knowledgeable funding selections relating to NVDA inventory. Common monitoring of reports, monetary experiences, and market traits is essential for staying abreast of the dynamic panorama surrounding this influential know-how firm. Bear in mind, previous efficiency will not be indicative of future outcomes, and the inventory market is inherently unpredictable. Diversification and a well-defined funding technique are at all times beneficial.

Closure

Thus, we hope this text has supplied invaluable insights into NVDA Inventory Chart In the present day: A Deep Dive into Nvidia’s Market Efficiency and Future Outlook. We thanks for taking the time to learn this text. See you in our subsequent article!