Decoding The Nifty 50 Dwell Graph Chart: A Complete Information For Traders

By admin / November 13, 2024 / No Comments / 2025

Decoding the Nifty 50 Dwell Graph Chart: A Complete Information for Traders

Associated Articles: Decoding the Nifty 50 Dwell Graph Chart: A Complete Information for Traders

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Nifty 50 Dwell Graph Chart: A Complete Information for Traders. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Nifty 50 Dwell Graph Chart: A Complete Information for Traders

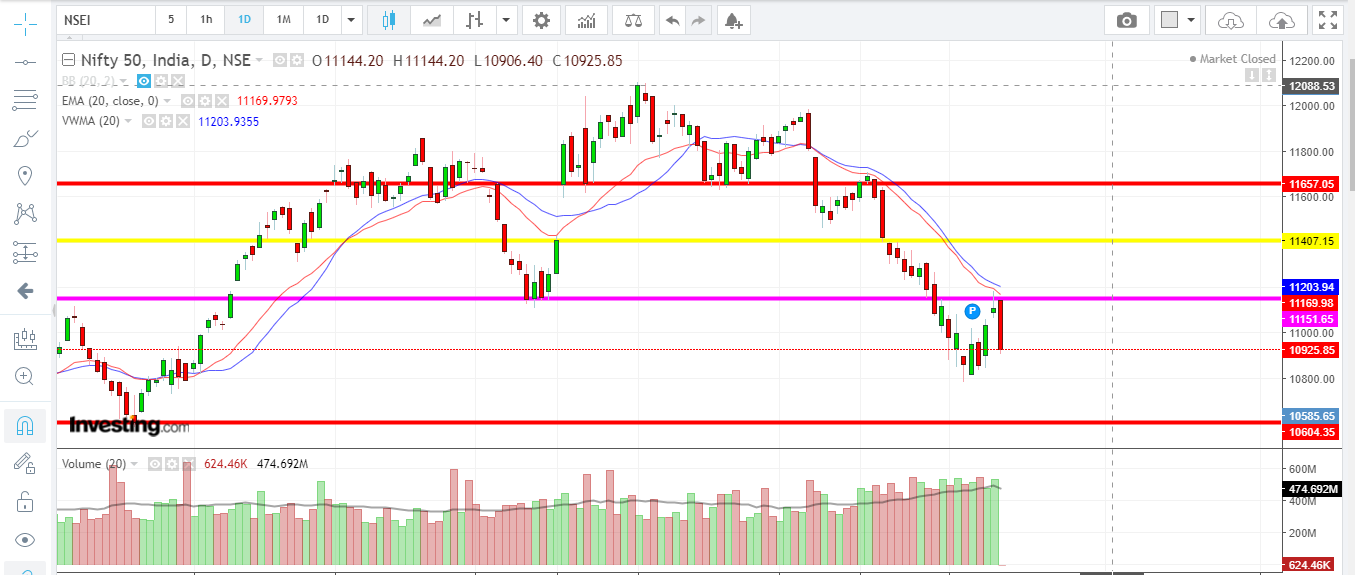

The Nifty 50 index, a benchmark for the Indian inventory market, represents the 50 largest and most liquid firms listed on the Nationwide Inventory Alternate of India (NSE). Understanding its stay graph chart is essential for each seasoned buyers and newcomers navigating the dynamic world of Indian equities. This text delves deep into the intricacies of the Nifty 50 stay graph, exploring its parts, interpretation, and sensible purposes.

Understanding the Parts of the Nifty 50 Dwell Graph

A typical Nifty 50 stay graph shows a wealth of data in a visually accessible format. Key parts embrace:

-

Value Axis (Y-axis): This vertical axis represents the index worth of the Nifty 50 at any given cut-off date. The size usually adjusts dynamically to accommodate worth fluctuations all through the buying and selling day.

-

Time Axis (X-axis): This horizontal axis represents the time, often displayed in minutes, hours, or days, relying on the chosen timeframe. This permits buyers to trace worth actions over totally different intervals, from intraday fluctuations to long-term traits.

-

Value Line (Candlestick or Line Chart): The core of the graph is the value line, which visually represents the index’s motion. Two frequent chart varieties are used:

-

Candlestick Charts: These present detailed info for every time interval (e.g., one minute, one hour). Every candlestick represents the open, excessive, low, and shutting costs. The physique of the candlestick exhibits the vary between the open and shut, whereas the wicks (higher and decrease shadows) point out the excessive and low costs reached throughout that interval. Inexperienced (or white) candlesticks usually point out a worth enhance, whereas purple (or black) candlesticks sign a worth lower.

-

Line Charts: These show a steady line connecting the closing costs of every time interval. Whereas easier than candlestick charts, they successfully illustrate the general development of the index.

-

-

Quantity Indicator: Many stay graphs embrace a separate quantity indicator, usually displayed under the value chart. This exhibits the buying and selling quantity (variety of shares traded) for every time interval. Excessive quantity usually accompanies vital worth actions, suggesting robust market sentiment.

-

Technical Indicators: Refined stay graphs usually incorporate technical indicators, overlayed on the value chart. These indicators, derived from worth and quantity knowledge, present alerts about potential future worth actions. Frequent indicators embrace:

-

Shifting Averages (MA): These clean out worth fluctuations and assist establish traits. Widespread MAs embrace the 50-day and 200-day transferring averages.

-

Relative Power Index (RSI): This indicator measures the magnitude of latest worth adjustments to judge overbought or oversold situations.

-

MACD (Shifting Common Convergence Divergence): This indicator identifies adjustments in momentum by evaluating two transferring averages.

-

Bollinger Bands: These bands show worth volatility and potential reversal factors.

-

-

Annotations and Alerts: Some platforms permit customers so as to add annotations to the chart, marking vital occasions or worth ranges. Alert options can notify customers when the index reaches particular worth thresholds or technical indicator alerts.

Deciphering the Nifty 50 Dwell Graph Chart

Deciphering the stay graph requires understanding numerous elements:

-

Pattern Identification: Observe the general path of the value line. An upward development suggests a bullish market, whereas a downward development suggests a bearish market. Determine assist and resistance ranges, that are worth factors the place the index has traditionally struggled to interrupt by means of.

-

Volatility Evaluation: Study the value fluctuations and quantity. Excessive volatility signifies vital worth swings, probably signifying elevated danger and alternative. Low volatility suggests a extra steady market.

-

Technical Indicator Evaluation: Use technical indicators to substantiate traits and establish potential buying and selling alerts. For instance, a bullish crossover of transferring averages may recommend a purchase sign, whereas an RSI above 70 may point out an overbought situation.

-

Information and Occasions Correlation: Contemplate the affect of reports occasions and financial knowledge releases on the Nifty 50’s worth actions. Vital financial bulletins or geopolitical occasions can set off sharp worth fluctuations.

-

Timeframe Choice: The selection of timeframe (e.g., 1-minute, 1-hour, 1-day) considerably influences the interpretation. Intraday charts reveal short-term fluctuations, whereas longer-term charts present broader traits.

Sensible Purposes of the Nifty 50 Dwell Graph Chart

The Nifty 50 stay graph serves numerous sensible functions for buyers:

-

Actual-time Market Monitoring: Observe the index’s efficiency all through the buying and selling day, gaining insights into market sentiment and potential alternatives.

-

Pattern Following: Determine prevailing traits and modify funding methods accordingly. A powerful uptrend may encourage shopping for, whereas a downtrend may immediate promoting or hedging.

-

Danger Administration: Assess market volatility and handle danger successfully. Excessive volatility intervals may necessitate decreasing publicity to the market.

-

Entry and Exit Level Identification: Use technical indicators and chart patterns to establish potential entry and exit factors for trades.

-

Portfolio Efficiency Monitoring: Examine the efficiency of particular person investments in opposition to the Nifty 50 index to gauge their relative efficiency.

-

Academic Software: The stay graph gives a precious studying device for understanding market dynamics and worth actions.

Limitations and Cautions

Whereas the Nifty 50 stay graph affords precious insights, it is essential to acknowledge its limitations:

-

Previous Efficiency is Not Indicative of Future Outcomes: Previous worth actions don’t assure future efficiency. Market situations are consistently evolving.

-

Technical Indicators are Not Excellent: Technical indicators present alerts, not ensures. They need to be used along side basic evaluation and different components.

-

Emotional Bias: It is important to keep away from emotional decision-making based mostly solely on chart patterns. Concern and greed can result in poor funding decisions.

-

Market Manipulation: The market might be manipulated, probably affecting the accuracy of the stay graph.

Conclusion

The Nifty 50 stay graph chart is a useful device for buyers in search of to know and navigate the Indian inventory market. By mastering its parts, interpretation, and sensible purposes, buyers could make extra knowledgeable selections, handle danger successfully, and probably improve their funding outcomes. Nevertheless, it’s essential to keep in mind that the graph is only one piece of the puzzle. Combining chart evaluation with basic analysis, danger administration methods, and a disciplined strategy is crucial for long-term success within the dynamic world of investing. All the time bear in mind to seek the advice of with a monetary advisor earlier than making any vital funding selections.

Closure

Thus, we hope this text has supplied precious insights into Decoding the Nifty 50 Dwell Graph Chart: A Complete Information for Traders. We hope you discover this text informative and helpful. See you in our subsequent article!