Mastering The Chart Of Accounts In QuickBooks: A Complete Information

By admin / July 27, 2024 / No Comments / 2025

Mastering the Chart of Accounts in QuickBooks: A Complete Information

Associated Articles: Mastering the Chart of Accounts in QuickBooks: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Mastering the Chart of Accounts in QuickBooks: A Complete Information. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Mastering the Chart of Accounts in QuickBooks: A Complete Information

The Chart of Accounts is the spine of your QuickBooks accounting system. It is a meticulously organized record of each account your enterprise makes use of to trace monetary transactions. A well-structured chart of accounts is essential for correct monetary reporting, environment friendly bookkeeping, and knowledgeable decision-making. This complete information will stroll you thru creating and managing your Chart of Accounts in QuickBooks, protecting every part from basic ideas to superior methods.

Understanding the Significance of a Properly-Structured Chart of Accounts

Earlier than diving into the specifics of QuickBooks, let’s perceive why a sturdy Chart of Accounts is paramount. Consider it because the organizational framework for all of your monetary information. Every transaction you document – from gross sales invoices to expense funds – is categorized inside a selected account on this chart. A poorly designed chart can result in:

- Inaccurate Monetary Statements: Miscategorized transactions will distort your revenue assertion, steadiness sheet, and money circulate assertion, making it tough to evaluate your enterprise’s true monetary well being.

- Inefficient Bookkeeping: Trying to find particular transactions turns into a nightmare when accounts are vaguely named or improperly organized.

- Poor Choice-Making: Incorrect monetary information results in flawed enterprise choices, impacting profitability and progress.

- Auditing Challenges: A disorganized chart of accounts makes auditing considerably extra advanced and time-consuming.

Creating Your Chart of Accounts in QuickBooks: A Step-by-Step Information

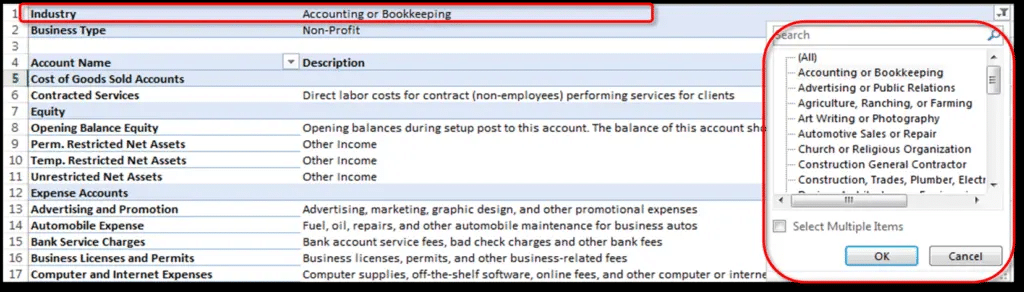

QuickBooks provides a user-friendly interface for managing your Chart of Accounts. The particular steps may range barely relying in your QuickBooks model (On-line vs. Desktop), however the core ideas stay the identical.

1. Selecting the Proper Account Sorts:

QuickBooks makes use of a standardized account construction based mostly on usually accepted accounting ideas (GAAP). Understanding these account varieties is important:

- Property: What your enterprise owns (e.g., Money, Accounts Receivable, Stock, Gear).

- Liabilities: What your enterprise owes (e.g., Accounts Payable, Loans Payable, Credit score Card Liabilities).

- Fairness: The proprietor’s stake within the enterprise (e.g., Proprietor’s Fairness, Retained Earnings).

- Income: Earnings generated from enterprise operations (e.g., Gross sales, Service Income, Curiosity Earnings).

- Bills: Prices incurred in working the enterprise (e.g., Lease Expense, Salaries Expense, Utilities Expense).

2. Setting Up Your Accounts in QuickBooks:

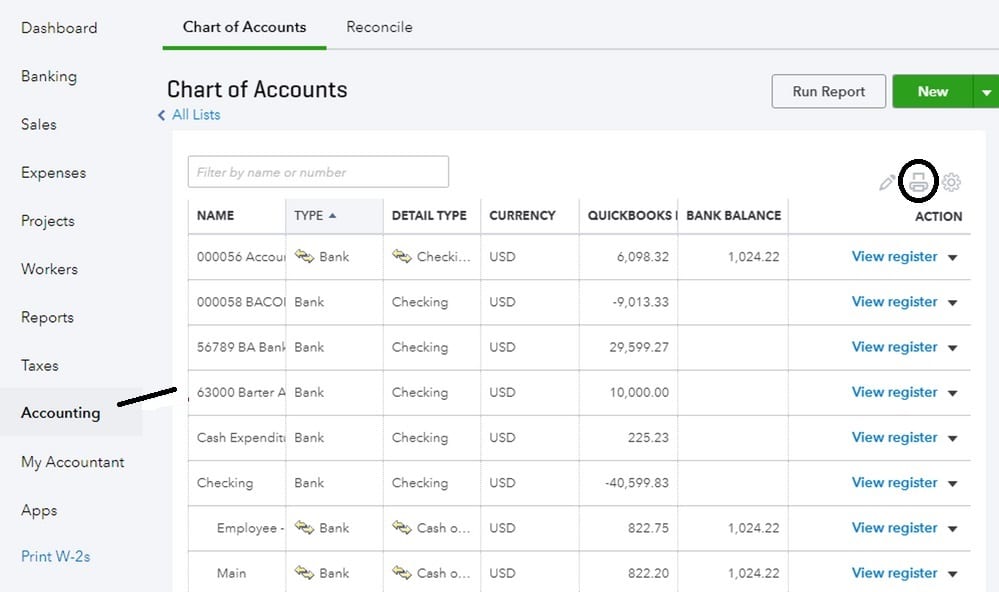

The method sometimes includes navigating to the Chart of Accounts part inside your QuickBooks software program. This is a normal define:

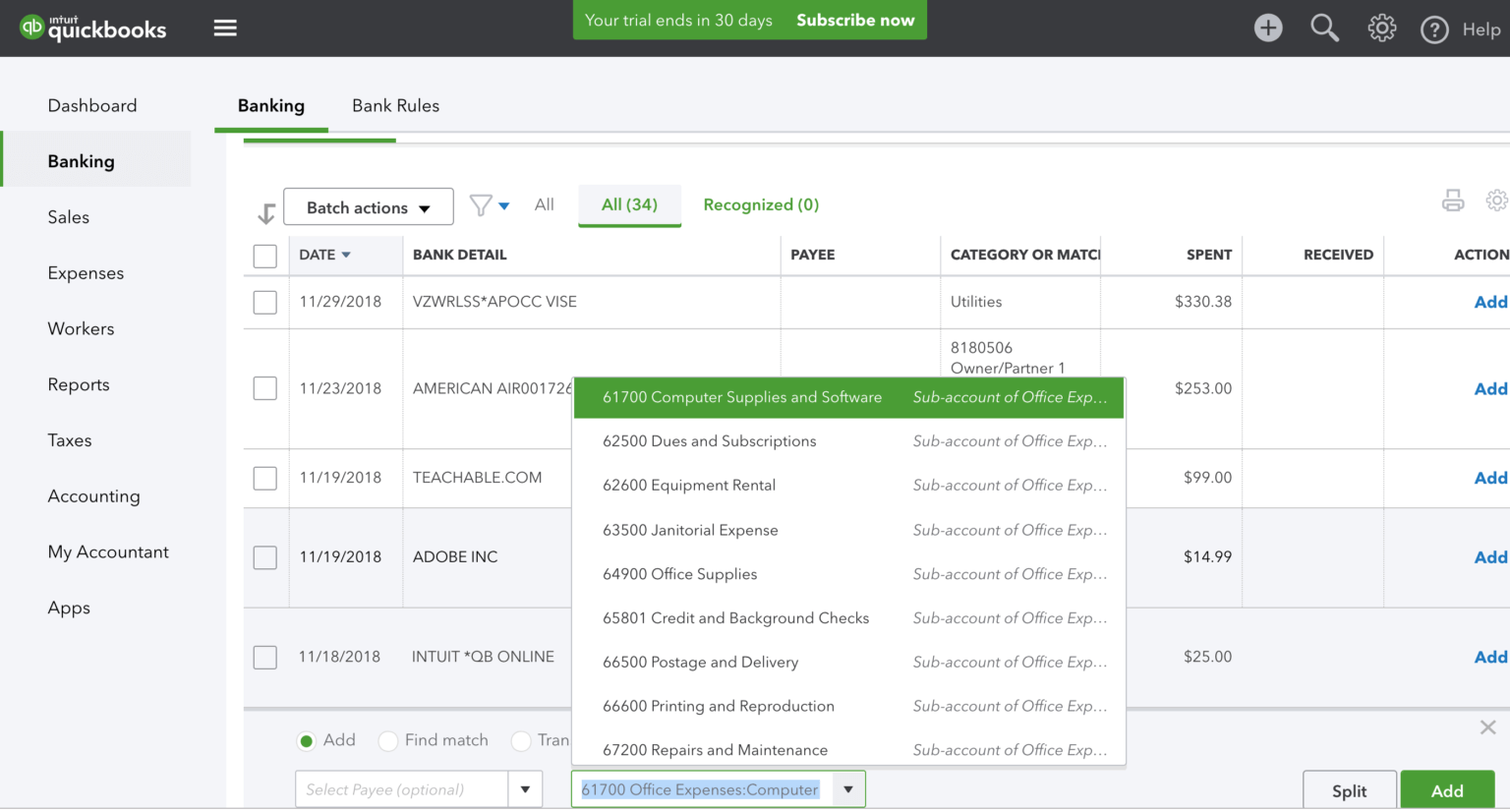

- Add New Account: Search for an choice so as to add a brand new account. This normally includes choosing the account kind (Asset, Legal responsibility, Fairness, Income, Expense) from a dropdown menu.

- Account Title: Assign a transparent, concise, and descriptive identify to every account. Keep away from utilizing abbreviations or ambiguous phrases. For instance, as an alternative of "Exp," use "Lease Expense."

- Account Quantity: QuickBooks usually assigns account numbers robotically, however you’ll be able to customise them for a extra organized construction (e.g., utilizing a hierarchical system like 1000 for Property, 2000 for Liabilities, and many others.). Consistency is vital.

- Element Sort: For some accounts, you may must specify a element kind. For instance, inside the "Bills" class, you might need "Price of Items Bought" as a element kind.

- Subaccounts: Manage your accounts into subaccounts for higher categorization. As an illustration, beneath "Bills," you could possibly have subaccounts for "Lease Expense," "Utilities Expense," and "Salaries Expense." This granular stage of element is essential for detailed monetary reporting.

- Tax Classification: Specify how every account is handled for tax functions (e.g., taxable, non-taxable, and many others.). That is particularly essential for correct tax reporting.

3. Organizing Your Chart of Accounts:

A well-organized chart of accounts is essential for effectivity. Take into account these methods:

- Numbering System: Use a constant numbering system to create a hierarchical construction. This enables for simple identification of account relationships.

- Account Grouping: Group comparable accounts collectively logically. This improves readability and simplifies reporting.

- Common Evaluation: Periodically overview and replace your chart of accounts to make sure it precisely displays your enterprise’s present operations. As your enterprise grows and evolves, so ought to your chart of accounts.

4. Examples of Widespread Accounts:

Listed here are some examples of frequent accounts you may embody in your Chart of Accounts:

- Property: Money, Checking Account, Financial savings Account, Accounts Receivable, Stock, Pay as you go Bills, Gear, Automobiles.

- Liabilities: Accounts Payable, Loans Payable, Credit score Card Payable, Gross sales Tax Payable.

- Fairness: Proprietor’s Fairness, Retained Earnings.

- Income: Gross sales, Service Income, Curiosity Earnings, Rental Earnings.

- Bills: Price of Items Bought, Lease Expense, Utilities Expense, Salaries Expense, Advertising and marketing Expense, Insurance coverage Expense, Depreciation Expense.

5. Superior Chart of Accounts Strategies:

As your enterprise grows, you may want extra refined methods:

- Utilizing Courses: QuickBooks means that you can assign "lessons" to your accounts, enabling you to categorize transactions based mostly on varied standards (e.g., venture, division, buyer). This offers extra layers of research and reporting.

- Customizing Studies: Leverage the facility of QuickBooks reporting to generate personalized monetary statements tailor-made to your particular wants. Your well-organized chart of accounts will make this course of considerably simpler.

- Reconciling Accounts: Frequently reconcile your financial institution accounts and bank card accounts together with your QuickBooks information to make sure accuracy and determine any discrepancies.

Troubleshooting Widespread Chart of Accounts Points:

- Duplicate Accounts: Keep away from creating duplicate accounts. This may result in inaccurate monetary reporting.

- Obscure Account Names: Use clear and descriptive account names to keep away from confusion.

- Inconsistent Numbering: Keep a constant numbering system for simple navigation and reporting.

- Lacking Accounts: Guarantee you’ve accounts for all elements of your enterprise operations.

Conclusion:

Creating and sustaining a well-structured Chart of Accounts in QuickBooks is a basic side of sound monetary administration. By following the steps outlined on this information and dedicating time to cautious planning and group, you’ll be able to make sure that your QuickBooks system offers correct, dependable, and insightful monetary information to help your enterprise choices. Keep in mind that that is an ongoing course of. Frequently overview and replace your chart of accounts to replicate the evolving wants of your enterprise. Investing the time upfront in creating a sturdy Chart of Accounts can pay dividends by way of effectivity, accuracy, and knowledgeable decision-making for years to return.

Closure

Thus, we hope this text has supplied beneficial insights into Mastering the Chart of Accounts in QuickBooks: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!