Deciphering The US30 Chart On TradingView: A Complete Information

By admin / June 1, 2024 / No Comments / 2025

Deciphering the US30 Chart on TradingView: A Complete Information

Associated Articles: Deciphering the US30 Chart on TradingView: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deciphering the US30 Chart on TradingView: A Complete Information. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Deciphering the US30 Chart on TradingView: A Complete Information

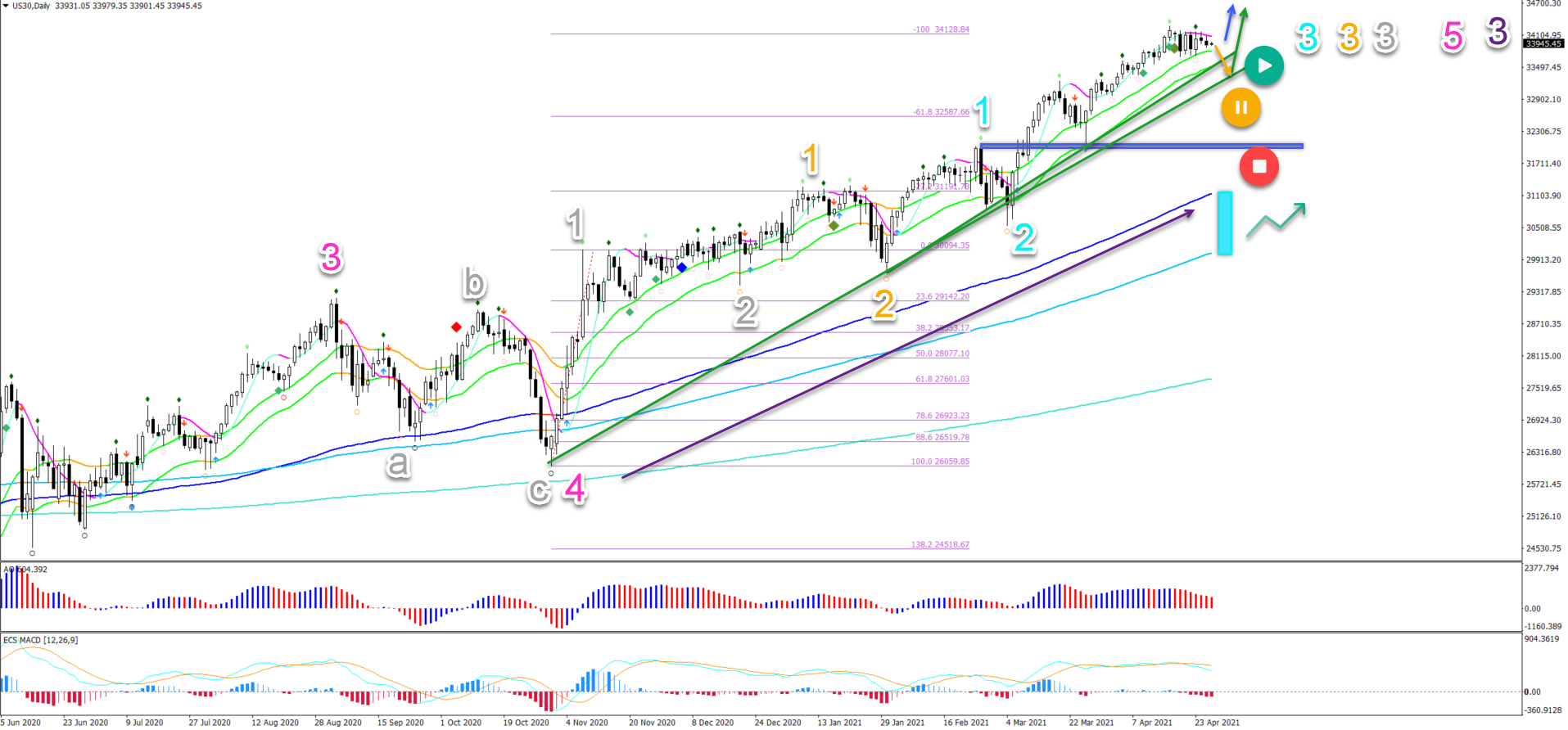

The US30, or Dow Jones Industrial Common, is a globally acknowledged benchmark for the American financial system. Its chart on TradingView, a preferred buying and selling platform, offers a wealthy tapestry of data for merchants of all expertise ranges. Understanding easy methods to interpret this chart successfully is essential for profitable buying and selling. This text delves into the assorted features of analyzing the US30 chart on TradingView, protecting technical evaluation, elementary concerns, and threat administration methods.

I. Navigating the TradingView US30 Chart Interface:

Earlier than diving into evaluation, familiarity with the TradingView interface is paramount. The platform gives a customizable charting expertise. Key parts embrace:

-

Chart Kind: Select between candlestick, bar, line, Heikin Ashi, and Renko charts. Candlestick charts are probably the most generally used, offering a visible illustration of worth motion over a selected interval.

-

Timeframe: Choose the timeframe (e.g., 1-minute, 5-minute, each day, weekly, month-to-month) to research worth actions at completely different scales. Longer timeframes reveal broader traits, whereas shorter timeframes spotlight intraday volatility.

-

Indicators: TradingView gives an unlimited library of technical indicators (e.g., shifting averages, RSI, MACD, Bollinger Bands). These instruments assist determine traits, momentum, and potential reversal factors. Experiment with completely different indicators to seek out the mixture that most accurately fits your buying and selling fashion.

-

Drawing Instruments: Make the most of drawing instruments like pattern traces, Fibonacci retracements, assist/resistance ranges, and channels to determine patterns and potential worth targets. These instruments assist visualize market construction and potential future worth actions.

-

Research: TradingView’s "Research" part lets you add customized indicators and scripts to reinforce your evaluation. This opens up a world of superior methods and customized methods.

II. Technical Evaluation of the US30 Chart:

Technical evaluation focuses on previous worth motion and quantity to foretell future worth actions. A number of key methods are relevant to the US30 chart:

-

Development Identification: Establish the prevailing pattern (uptrend, downtrend, or sideways). Uptrends are characterised by larger highs and better lows, whereas downtrends present decrease highs and decrease lows. Sideways traits, or ranges, exhibit worth consolidation between assist and resistance ranges. Shifting averages, such because the 200-day shifting common, can assist verify the general pattern.

-

Help and Resistance Ranges: These are worth ranges the place the worth has traditionally struggled to interrupt by way of. Help ranges signify potential shopping for alternatives, whereas resistance ranges point out potential promoting alternatives. Breaks above resistance or beneath assist can sign important pattern adjustments.

-

Shifting Averages: Shifting averages clean out worth fluctuations and assist determine traits. Generally used shifting averages embrace the 50-day and 200-day shifting averages. Crossovers between completely different shifting averages can generate purchase or promote alerts.

-

Relative Power Index (RSI): The RSI measures the magnitude of latest worth adjustments to guage overbought or oversold situations. Readings above 70 typically counsel an overbought market, whereas readings beneath 30 point out an oversold market. These ranges can sign potential pattern reversals.

-

MACD (Shifting Common Convergence Divergence): The MACD identifies momentum adjustments by evaluating two shifting averages. Crossovers of the MACD line above the sign line can counsel bullish momentum, whereas crossovers beneath the sign line point out bearish momentum.

-

Bollinger Bands: Bollinger Bands measure worth volatility by plotting commonplace deviations round a shifting common. Value bounces off the bands can sign potential reversal factors. Widening bands point out elevated volatility, whereas narrowing bands counsel decreased volatility.

-

Candlestick Patterns: Recognizing candlestick patterns, resembling hammer, hanging man, engulfing patterns, and doji, can present useful insights into potential worth reversals or continuations.

III. Elementary Evaluation and its Affect on the US30:

Whereas technical evaluation focuses on worth motion, elementary evaluation considers financial elements that affect the US30. These elements embrace:

-

Financial Knowledge: Key financial indicators like GDP development, inflation charges, unemployment figures, and shopper confidence considerably affect the US30. Constructive financial knowledge typically results in larger costs, whereas detrimental knowledge can set off worth declines.

-

Curiosity Charges: Adjustments in rates of interest by the Federal Reserve affect borrowing prices for companies and shoppers, influencing company earnings and general market sentiment. Larger rates of interest can result in decrease inventory costs, whereas decrease charges can stimulate financial development and push costs larger.

-

Geopolitical Occasions: International occasions, resembling political instability, commerce wars, and worldwide conflicts, can considerably affect market sentiment and the US30’s efficiency.

-

Firm Efficiency: The US30 contains 30 giant, publicly traded firms. Particular person firm efficiency, earnings experiences, and bulletins instantly affect the general index. Constructive information from particular person firms typically helps the index, whereas detrimental information can weigh it down.

IV. Danger Administration Methods for US30 Buying and selling:

Buying and selling the US30 includes important threat. Implementing efficient threat administration methods is essential for preserving capital and attaining long-term success:

-

Place Sizing: Decide the suitable place measurement based mostly in your threat tolerance and account steadiness. By no means threat greater than a small proportion of your capital on a single commerce.

-

Cease-Loss Orders: Place stop-loss orders to restrict potential losses. These orders routinely promote your place when the worth reaches a predetermined stage.

-

Take-Revenue Orders: Set take-profit orders to safe earnings when the worth reaches a goal stage. This helps lock in good points and keep away from giving again earnings attributable to market reversals.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your investments throughout completely different asset lessons to cut back general threat.

-

Backtesting: Earlier than implementing any buying and selling technique, backtest it on historic knowledge to guage its efficiency and determine potential weaknesses.

V. Conclusion:

Buying and selling the US30 on TradingView requires a holistic method combining technical and elementary evaluation, coupled with disciplined threat administration. Mastering the platform’s options, understanding key technical indicators, and staying knowledgeable about related financial and geopolitical occasions are important for profitable buying and selling. Do not forget that no buying and selling technique ensures earnings, and losses are an inevitable a part of the method. Steady studying, adaptation, and disciplined threat administration are key to navigating the complexities of the US30 market and attaining your buying and selling objectives. At all times observe accountable buying and selling and contemplate in search of recommendation from a professional monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered useful insights into Deciphering the US30 Chart on TradingView: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!