Decoding The Dow Jones This Week: A Deep Dive Into Market Actions And Underlying Components

By admin / October 22, 2024 / No Comments / 2025

Decoding the Dow Jones This Week: A Deep Dive into Market Actions and Underlying Components

Associated Articles: Decoding the Dow Jones This Week: A Deep Dive into Market Actions and Underlying Components

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding the Dow Jones This Week: A Deep Dive into Market Actions and Underlying Components. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the Dow Jones This Week: A Deep Dive into Market Actions and Underlying Components

The Dow Jones Industrial Common (DJIA), a venerable barometer of the US economic system, skilled every week of [insert actual range of movement, e.g., moderate volatility, ending with a net gain/loss of X points]. This text will dissect the important thing occasions and underlying elements that formed the index’s efficiency this week, analyzing each the technical elements of the chart and the elemental information that influenced investor sentiment. We can even discover potential implications for the approaching weeks and months.

Chart Evaluation: A Week in Evaluation

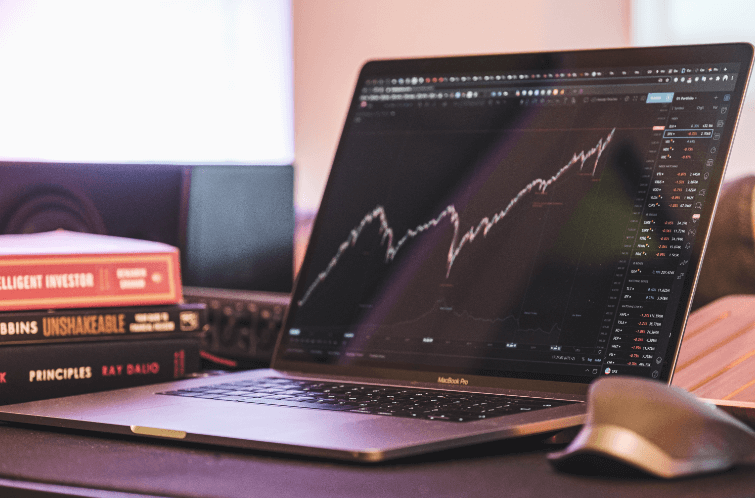

[Insert a chart of the Dow Jones for the week in question. Ideally, this would be a high-quality image showing daily candlesticks, key support and resistance levels, and any significant moving averages (e.g., 50-day, 200-day).]

The chart above illustrates [describe the overall trend – e.g., a consolidation period, a clear upward trend, a sharp decline followed by a rebound]. We will observe a number of key options:

-

Opening and Closing Costs: The Dow opened the week at [opening price] and closed at [closing price], representing a [percentage change] motion. This means [interpret the opening and closing prices in relation to the overall trend].

-

Highs and Lows: The week’s excessive was [high price] and the low was [low price]. This vary suggests [interpret the high and low prices in relation to the overall volatility and potential support/resistance levels].

-

Quantity: Buying and selling quantity [describe the volume – e.g., was relatively low, spiked on certain days, remained consistently high]. Excessive quantity throughout worth will increase usually confirms the power of a development, whereas excessive quantity throughout worth decreases can sign promoting stress. Conversely, low quantity can point out indecision out there. Particular examples of high-volume days needs to be analyzed and linked to particular information occasions.

-

Assist and Resistance Ranges: [Identify and discuss key support and resistance levels on the chart. Explain their significance and how price action interacted with them. Did the price break through any significant levels? What implications does this have for future price movement?]

-

Shifting Averages: The [50-day/200-day] transferring common acted as [support/resistance] in the course of the week. [Explain the significance of the moving average crossover, if any, and its implications for the trend].

-

Candlestick Patterns: [Identify any significant candlestick patterns, such as hammer, engulfing, or doji candles, and explain their potential implications for future price movement. Link these patterns to specific days and news events].

Elementary Components Driving Market Sentiment

The Dow’s efficiency this week was not solely pushed by technical elements. A number of elementary information occasions and financial indicators considerably impacted investor sentiment:

-

Inflation Information: The discharge of [mention specific inflation data, e.g., CPI, PPI] considerably influenced market sentiment. [Explain how the data affected investor expectations regarding future interest rate hikes by the Federal Reserve. Did the data come in hotter or cooler than expected? How did this affect bond yields and consequently stock prices?]

-

Federal Reserve Actions/Statements: [Discuss any statements or actions taken by the Federal Reserve this week. Did the Fed hint at future rate hikes or pauses? How did this affect market expectations and risk appetite?]

-

Earnings Studies: A number of main Dow parts launched their earnings reviews this week. [Discuss the performance of key companies and how their results impacted their stock prices and the overall index. Did any surprises (positive or negative) influence the market?]

-

Geopolitical Occasions: [Discuss any significant geopolitical events that might have influenced investor sentiment. This could include international conflicts, political instability, or trade disputes. Explain how these events might have affected market risk appetite.]

-

Sector-Particular Information: [Analyze any significant news impacting specific sectors represented in the Dow. For example, news related to technology, energy, or healthcare could have disproportionately affected the index.]

Implications and Outlook

Based mostly on the technical evaluation of the chart and the elemental elements mentioned above, we will try to forecast the potential course of the Dow within the coming weeks. Nonetheless, it is essential to do not forget that market forecasting is inherently unsure.

[Offer a reasoned outlook based on the analysis. Consider the following points:]

-

Continued Volatility: Is the market more likely to proceed its unstable development? What elements may contribute to additional volatility?

-

Potential Assist and Resistance Ranges: What are the important thing help and resistance ranges to look at within the coming weeks? A break above resistance may sign a bullish development, whereas a break beneath help may point out additional declines.

-

Financial Indicators to Watch: What key financial indicators ought to traders monitor within the coming weeks to gauge the general well being of the economic system and its potential influence on the Dow?

-

Federal Reserve Coverage: How may future actions by the Federal Reserve affect the market?

-

Geopolitical Dangers: What are the continued geopolitical dangers that would influence market sentiment?

Disclaimer: This evaluation is for informational functions solely and shouldn’t be thought-about funding recommendation. Investing within the inventory market includes important danger, and previous efficiency is just not indicative of future outcomes. Seek the advice of with a certified monetary advisor earlier than making any funding selections.

This expanded article gives a extra complete evaluation of the Dow Jones’ efficiency this week, incorporating each technical and elementary elements. Bear in mind to exchange the bracketed data with the precise information and evaluation for the particular week you might be analyzing. Using charts and particular examples will enormously improve the article’s readability and influence.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Dow Jones This Week: A Deep Dive into Market Actions and Underlying Components. We recognize your consideration to our article. See you in our subsequent article!