Chart Patterns: A Free Information To Mastering Technical Evaluation

By admin / August 6, 2024 / No Comments / 2025

Chart Patterns: A Free Information to Mastering Technical Evaluation

Associated Articles: Chart Patterns: A Free Information to Mastering Technical Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Chart Patterns: A Free Information to Mastering Technical Evaluation. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Chart Patterns: A Free Information to Mastering Technical Evaluation

The world of finance can really feel daunting, particularly for newcomers. Understanding market actions and predicting future worth actions looks like a ability reserved for seasoned professionals. Nevertheless, a good portion of profitable buying and selling depends on recognizing and deciphering recurring worth patterns, often known as chart patterns. Whereas costly programs and proprietary software program promise to unlock these secrets and techniques, a substantial quantity of information about chart patterns might be acquired totally free by diligent analysis and the appliance of available sources. This text serves as a complete, free information to understanding and using varied chart patterns in your technical evaluation.

What are Chart Patterns?

Chart patterns are visually identifiable formations on worth charts that symbolize the collective habits of patrons and sellers. These patterns, fashioned over various timeframes (from minutes to years), typically sign potential modifications in worth course, momentum, or volatility. They aren’t foolproof predictors, however quite worthwhile instruments that, when used at the side of different types of evaluation, can considerably enhance buying and selling selections. Understanding these patterns permits merchants to anticipate potential breakouts, reversals, and consolidations, offering alternatives for strategic entry and exit factors.

Forms of Chart Patterns: A Free Overview

Chart patterns are broadly categorized into two essential teams: continuation patterns and reversal patterns.

1. Continuation Patterns: These patterns recommend that the present development will doubtless proceed after a interval of consolidation. They symbolize a short lived pause within the prevailing momentum earlier than the value resumes its earlier course.

-

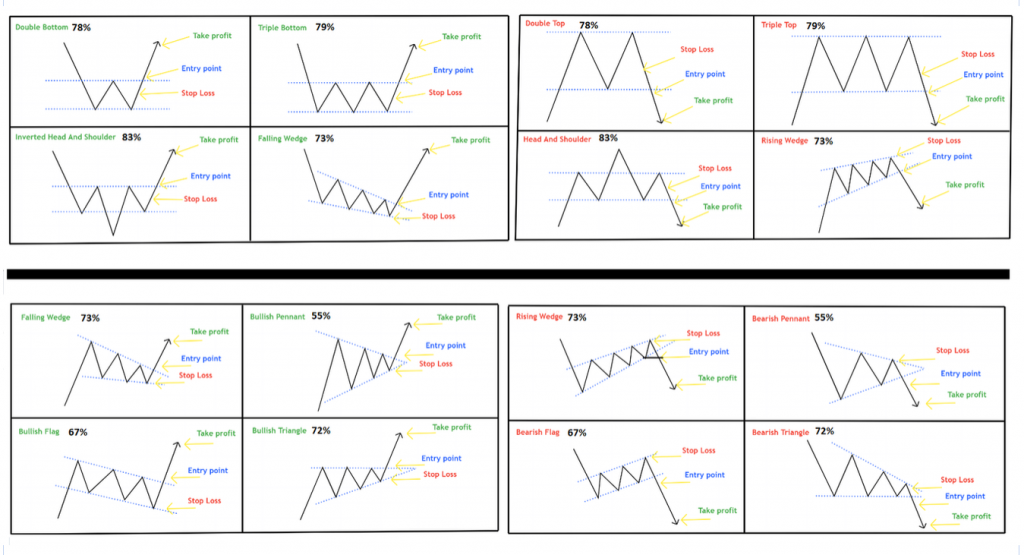

Triangles: Triangles are characterised by converging trendlines, making a triangular form on the chart. There are three essential sorts: symmetrical, ascending, and descending. Symmetrical triangles point out a interval of indecision, with neither patrons nor sellers dominating. Ascending triangles recommend bullish stress, whereas descending triangles recommend bearish stress. The breakout sometimes happens on the apex of the triangle.

-

Rectangles: Rectangles present a interval of sideways consolidation between two horizontal help and resistance ranges. The value fluctuates inside this vary earlier than ultimately breaking out, normally within the course of the previous development.

-

Flags and Pennants: These patterns resemble flags or pennants connected to a flagpole (the previous development). They’re characterised by a short interval of consolidation, typically with parallel trendlines, adopted by a breakout within the course of the unique development. Pennants are usually extra symmetrical than flags.

-

Wedges: Wedges are just like triangles however have converging trendlines which might be each sloping, both upward (bullish wedge) or downward (bearish wedge). Bullish wedges are usually thought of bearish patterns, suggesting a possible reversal, whereas bearish wedges are thought of bullish patterns.

2. Reversal Patterns: These patterns recommend a possible change within the prevailing development. They point out a shift in market sentiment, from bullish to bearish or vice versa.

-

Head and Shoulders: This can be a basic reversal sample, characterised by three peaks resembling a head and two shoulders. The “head” is the very best peak, and the 2 “shoulders” are decrease peaks on both facet. A neckline connects the troughs between the peaks. A break beneath the neckline confirms the bearish reversal. An inverse head and shoulders sample indicators a bullish reversal.

-

Double Tops and Double Bottoms: These patterns encompass two comparable peaks (double prime) or troughs (double backside) at roughly the identical worth stage. A break beneath the neckline of a double prime or above the neckline of a double backside indicators a possible reversal.

-

Triple Tops and Triple Bottoms: Much like double tops and bottoms, however with three peaks or troughs. These patterns usually sign stronger reversals as a result of elevated affirmation.

-

Rounding Tops and Bottoms: These patterns are characterised by a gradual curve within the worth motion, forming a rounded form. Rounding tops recommend a bearish reversal, whereas rounding bottoms recommend a bullish reversal.

Free Sources for Studying Chart Patterns:

Whereas this text supplies a foundational understanding, quite a few free sources can improve your data:

-

On-line Charting Platforms: Many brokerage companies provide free charting platforms with fundamental technical evaluation instruments, together with the power to attract trendlines and establish chart patterns. Discover platforms like TradingView (free tier accessible) to observe figuring out patterns on historic information.

-

YouTube Tutorials: Quite a few YouTube channels devoted to technical evaluation present free tutorials on varied chart patterns, typically together with sensible examples and buying and selling methods. Seek for phrases like "chart patterns tutorial," "technical evaluation for rookies," or particular sample names (e.g., "head and shoulders sample defined").

-

Free On-line Programs: A number of web sites provide free introductory programs on technical evaluation, overlaying chart patterns and different related matters. Search for programs supplied by academic platforms or respected monetary web sites.

-

Blogs and Articles: Quite a few monetary blogs and web sites publish articles on technical evaluation, typically together with discussions of particular chart patterns and their functions. Nevertheless, at all times critically consider the supply’s credibility and potential biases.

-

Books (Free E-books and Public Libraries): Whereas many books on technical evaluation are costly, you’ll be able to typically discover free e-books on-line or entry related books by your native public library. Seek for titles specializing in chart patterns or technical evaluation for rookies.

Vital Issues:

-

Affirmation is Key: By no means rely solely on chart patterns to make buying and selling selections. At all times corroborate your findings with different types of evaluation, reminiscent of basic evaluation, quantity evaluation, and indicators like transferring averages and RSI.

-

Context Issues: The interpretation of chart patterns relies upon closely on the context of the broader market and the particular asset being traded. What is perhaps a bullish sign in a single market is perhaps meaningless and even bearish in one other.

-

Apply Makes Excellent: Mastering chart sample recognition requires observe and expertise. Begin by analyzing historic charts and figuring out patterns. Progressively enhance the complexity of your evaluation and refine your expertise over time.

-

Threat Administration: At all times use correct threat administration methods, reminiscent of stop-loss orders, to guard your capital. No buying and selling technique is foolproof, and losses are inevitable.

Conclusion:

Chart patterns symbolize a strong software in a dealer’s arsenal. Whereas mastering them requires dedication and observe, the foundational data is available by free sources. By combining diligent research with sensible software, you’ll be able to considerably enhance your understanding of market dynamics and make extra knowledgeable buying and selling selections. Keep in mind to at all times method buying and selling with warning, handle your threat successfully, and constantly refine your expertise. The journey to changing into a proficient dealer is a marathon, not a dash, and free sources can present a stable basis to your success.

Closure

Thus, we hope this text has supplied worthwhile insights into Chart Patterns: A Free Information to Mastering Technical Evaluation. We admire your consideration to our article. See you in our subsequent article!