Decoding The USD/JPY Chart: A Complete Information To The Greenback-Yen Alternate Charge

By admin / July 16, 2024 / No Comments / 2025

Decoding the USD/JPY Chart: A Complete Information to the Greenback-Yen Alternate Charge

Associated Articles: Decoding the USD/JPY Chart: A Complete Information to the Greenback-Yen Alternate Charge

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the USD/JPY Chart: A Complete Information to the Greenback-Yen Alternate Charge. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the USD/JPY Chart: A Complete Information to the Greenback-Yen Alternate Charge

The USD/JPY (US greenback to Japanese yen) alternate charge is without doubt one of the most actively traded forex pairs within the foreign exchange market. Its actions are influenced by a posh interaction of macroeconomic components, geopolitical occasions, and market sentiment, making it a captivating and sometimes unstable instrument for merchants and buyers alike. Understanding the historic developments, present dynamics, and potential future actions of the USD/JPY chart requires a deep dive into the forces shaping this important forex relationship.

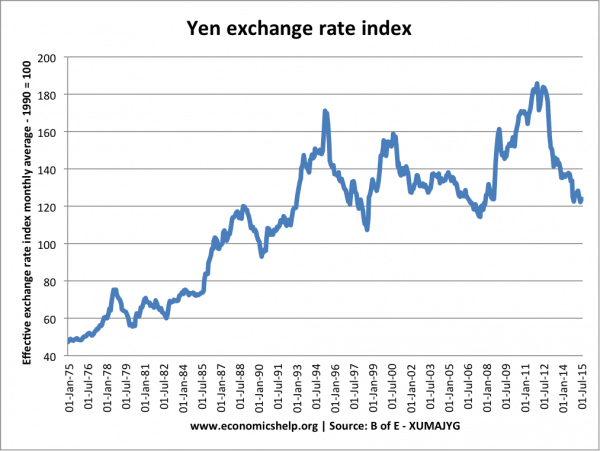

Historic Context: A Look Again on the USD/JPY Chart

The USD/JPY alternate charge has witnessed vital fluctuations all through its historical past. The post-World Warfare II period noticed a interval of relative stability, with the yen pegged to the US greenback underneath the Bretton Woods system. Nevertheless, the collapse of Bretton Woods within the early Seventies ushered in a interval of floating alternate charges, resulting in elevated volatility within the USD/JPY pair.

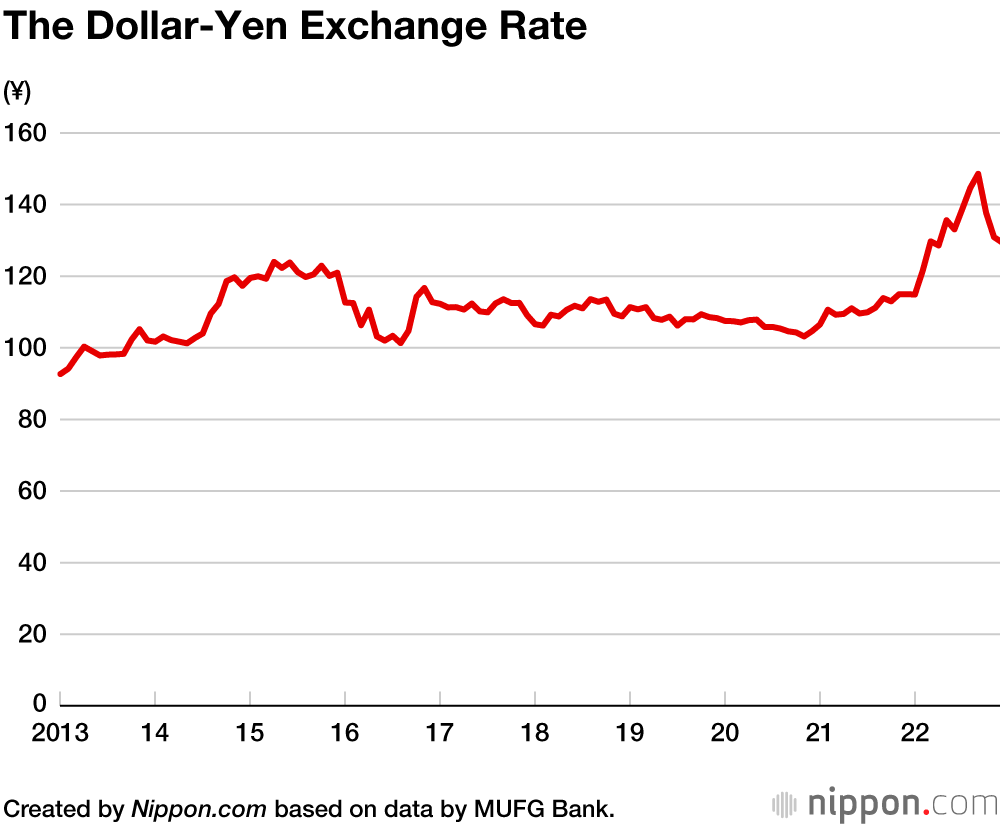

The Nineteen Eighties witnessed a dramatic appreciation of the yen in opposition to the greenback, pushed by Japan’s financial success and rising commerce surplus with the US. This era noticed the yen attain unprecedented highs in opposition to the greenback, resulting in issues in regards to the competitiveness of Japanese exports. Subsequent interventions by Japanese authorities and shifts in world financial circumstances led to a reversal of this pattern, with the yen depreciating considerably within the Nineties.

The "misplaced decade" of the Nineties in Japan, characterised by deflation and financial stagnation, additional impacted the USD/JPY alternate charge. The following interval noticed a comparatively secure vary, punctuated by occasional bursts of volatility pushed by occasions such because the Asian monetary disaster and the dot-com bubble.

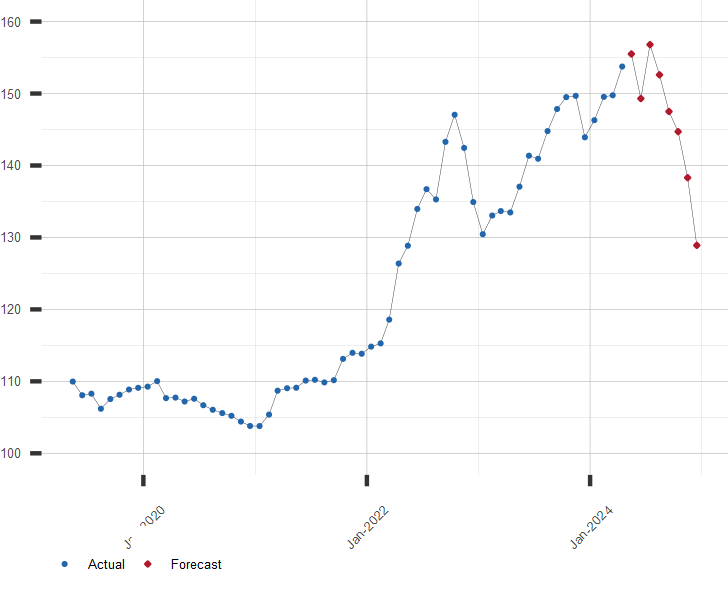

The 2000s and 2010s witnessed a posh interaction of things influencing the USD/JPY alternate charge, together with quantitative easing (QE) insurance policies in Japan and the US, world financial crises, and shifts in danger urge for food. The worldwide monetary disaster of 2008 noticed a pointy appreciation of the yen as buyers sought safe-haven belongings, whereas subsequent QE packages in each nations led to vital fluctuations. The introduction of Abenomics in Japan, aimed toward stimulating financial progress by way of financial easing and monetary stimulus, additionally performed a major position in shaping the USD/JPY chart.

Key Components Influencing the USD/JPY Alternate Charge:

A number of components contribute to the fluctuations noticed within the USD/JPY chart:

-

Curiosity Charge Differentials: The distinction in rates of interest between the US and Japan is a major driver of USD/JPY actions. Increased US rates of interest typically entice overseas funding, growing demand for the greenback and resulting in appreciation in opposition to the yen. Conversely, decrease US rates of interest or larger Japanese rates of interest can result in yen appreciation.

-

Financial Progress Differentials: Relative financial progress between the US and Japan additionally performs a vital position. Stronger US financial progress tends to draw funding, boosting the greenback, whereas sluggish US progress or stronger Japanese progress can result in yen appreciation. Indicators like GDP progress, employment information, and manufacturing PMI are carefully watched.

-

Commerce Balances: The commerce steadiness between the US and Japan considerably impacts the alternate charge. A big US commerce deficit with Japan can put downward strain on the greenback, whereas a surplus can have the other impact.

-

Protected-Haven Standing: The yen is commonly thought-about a safe-haven forex throughout instances of world uncertainty or danger aversion. During times of geopolitical instability or financial crises, buyers are likely to flock to the yen, resulting in its appreciation in opposition to the greenback.

-

Authorities Intervention: Each the US and Japanese governments have intervened within the forex market up to now to affect the USD/JPY alternate charge. These interventions, nonetheless, have gotten much less frequent in latest instances.

-

Market Sentiment and Hypothesis: Market sentiment and speculative buying and selling additionally play a job in driving USD/JPY fluctuations. Information occasions, financial information releases, and adjustments in investor confidence can result in vital short-term actions within the alternate charge.

Analyzing the USD/JPY Chart: Technical and Basic Approaches

Analyzing the USD/JPY chart requires a mixture of technical and elementary evaluation:

-

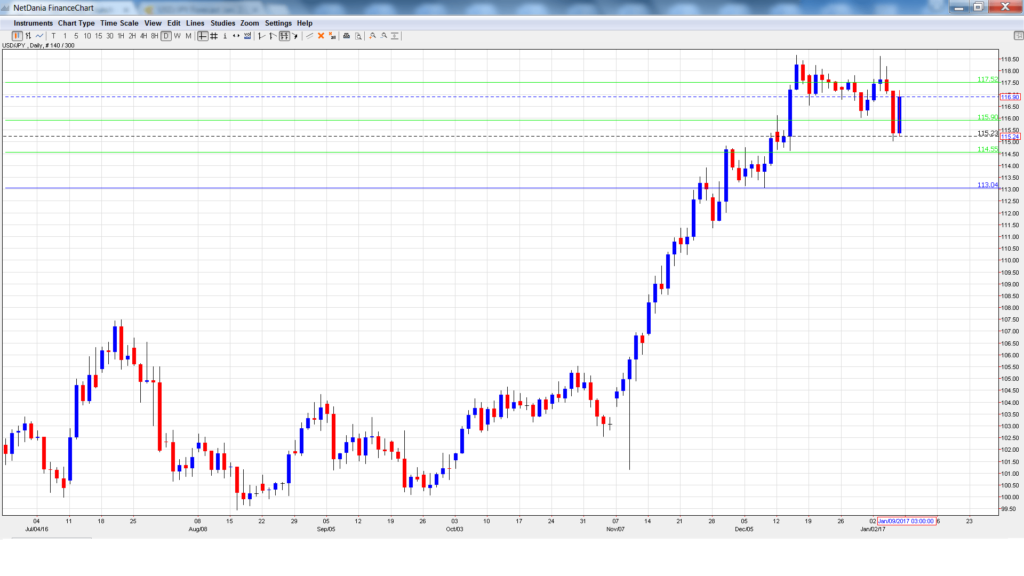

Technical Evaluation: This method focuses on chart patterns, indicators, and worth motion to foretell future worth actions. Merchants use instruments like shifting averages, relative power index (RSI), and help and resistance ranges to establish potential buying and selling alternatives. Recognizing chart patterns like head and shoulders, double tops/bottoms, and triangles can present insights into potential pattern reversals.

-

Basic Evaluation: This method entails inspecting macroeconomic components, financial information, and geopolitical occasions to evaluate the underlying forces driving the USD/JPY alternate charge. Analyzing rate of interest differentials, financial progress, commerce balances, and authorities insurance policies offers a deeper understanding of the long-term developments.

Present Market Dynamics and Future Outlook:

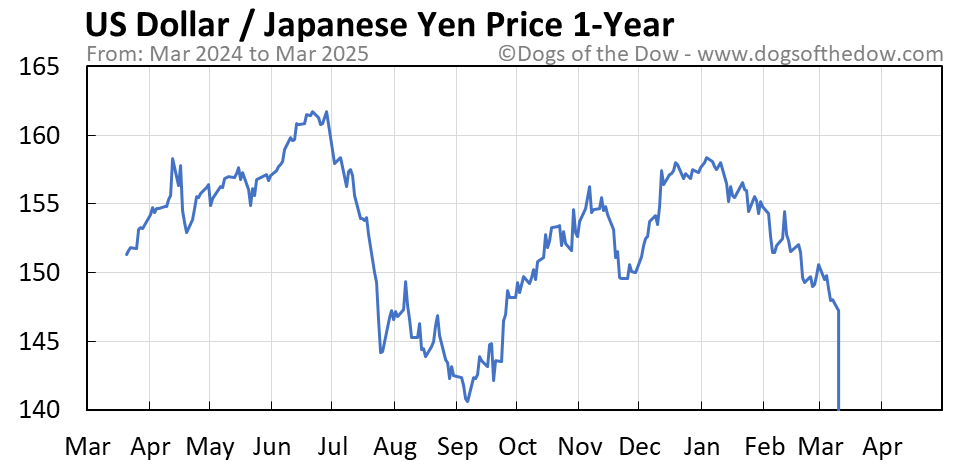

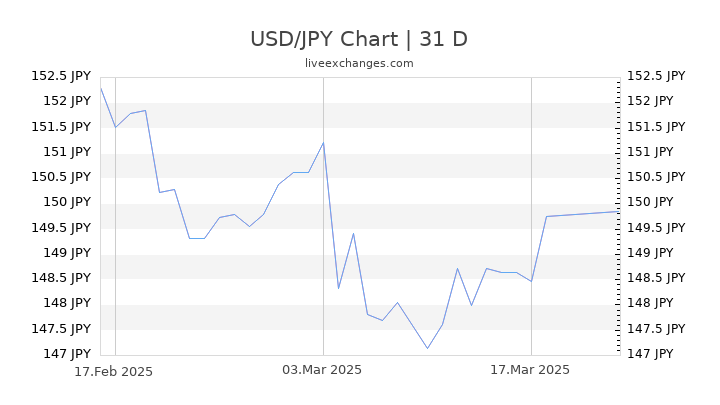

The present USD/JPY alternate charge is influenced by a lot of components, together with the continuing financial coverage divergence between the US and Japan, world inflation issues, and geopolitical dangers. The US Federal Reserve’s aggressive rate of interest hikes have strengthened the greenback, whereas the Financial institution of Japan’s dedication to yield curve management has saved Japanese rates of interest low, creating a major rate of interest differential that has supported USD power. Nevertheless, the outlook is topic to appreciable uncertainty. Adjustments in world financial progress, shifts in financial coverage, and surprising geopolitical occasions might considerably impression the USD/JPY alternate charge sooner or later.

Conclusion:

The USD/JPY chart displays a posh and dynamic relationship between two main economies. Understanding the historic context, key influencing components, and analytical approaches is essential for navigating this unstable market. Whereas predicting future actions with certainty is unattainable, combining technical and elementary evaluation, coupled with an intensive understanding of the underlying financial and geopolitical panorama, can present worthwhile insights for merchants and buyers searching for to know and probably revenue from the fluctuations of the USD/JPY alternate charge. Steady monitoring of financial indicators, central financial institution insurance policies, and geopolitical developments is important for staying knowledgeable and making knowledgeable choices on this dynamic market. The USD/JPY chart stays a compelling case examine within the interaction of world economics, politics, and market forces, providing each challenges and alternatives for individuals who dedicate themselves to understanding its intricacies.

.png)

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the USD/JPY Chart: A Complete Information to the Greenback-Yen Alternate Charge. We respect your consideration to our article. See you in our subsequent article!