A Decade Of Glittering Uncertainty: Analyzing The Gold Worth Chart (2014-2024)

By admin / June 13, 2024 / No Comments / 2025

A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024)

Associated Articles: A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024). Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024)

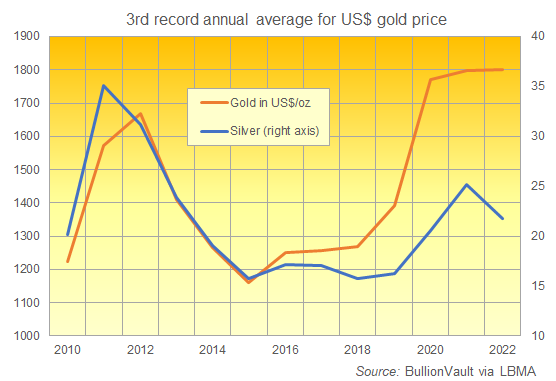

Gold, a timeless image of wealth and stability, has skilled an enchanting decade of value fluctuations since 2014. Understanding this journey requires a deep dive into the financial, geopolitical, and market forces that formed its trajectory. This text analyzes the gold value chart from 2014 to 2024 (projected), exploring key traits, influential elements, and potential implications for traders. Whereas exact future projections are unimaginable, we will use previous information and present traits to color a extra knowledgeable image.

The 2014-2019 Interval: A Descent from the Peaks

The last decade started with gold costs retreating from their 2011 highs. The interval between 2014 and 2019 witnessed a usually downward development, albeit with intervals of volatility. A number of elements contributed to this decline:

-

Strengthening US Greenback: A strengthening US greenback negatively impacted gold costs. Gold is priced in US {dollars}, and a stronger greenback makes it costlier for holders of different currencies, lowering demand. The Federal Reserve’s gradual tightening of financial coverage throughout this era contributed considerably to the greenback’s energy.

-

Rising Curiosity Charges: Larger rates of interest improve the chance value of holding non-yielding property like gold. Buyers usually shift their funds in direction of interest-bearing devices when charges rise, lowering the enchantment of gold.

-

Bettering World Financial Outlook: A comparatively optimistic world financial outlook throughout elements of this era lessened the safe-haven demand for gold. Buyers felt much less must hedge towards financial uncertainty, resulting in diminished gold purchases.

-

Technological Developments in Gold Mining: Improved mining applied sciences and exploration strategies elevated gold provide, placing downward strain on costs.

Nonetheless, this downward development wasn’t linear. Important geopolitical occasions, such because the Greek debt disaster and Brexit, triggered short-term spikes in gold costs as traders sought refuge within the valuable metallic. These occasions highlighted gold’s function as a safe-haven asset throughout occasions of uncertainty. The chart for this era would present a gradual decline punctuated by sharp, albeit short-term, upward actions.

The 2020-2024 Interval: A Resurgence Pushed by Uncertainty

The interval from 2020 onwards offered a stark distinction to the earlier 5 years. Gold costs skilled a exceptional surge, pushed by a confluence of unprecedented occasions:

-

COVID-19 Pandemic: The COVID-19 pandemic triggered a world financial downturn and widespread uncertainty, sending traders flocking to gold as a safe-haven asset. The unprecedented ranges of presidency stimulus and quantitative easing additional fueled inflation fears, boosting gold’s enchantment as an inflation hedge.

-

Inflationary Pressures: The pandemic, coupled with provide chain disruptions and elevated authorities spending, led to vital inflationary pressures globally. Gold, traditionally considered as an inflation hedge, noticed a major improve in demand.

-

Geopolitical Tensions: Rising geopolitical tensions, together with the US-China commerce conflict and ongoing conflicts in numerous elements of the world, additional enhanced gold’s safe-haven standing. Buyers sought safety from geopolitical dangers by investing in gold.

-

Detrimental Actual Curiosity Charges: In lots of developed economies, actual rates of interest (nominal rates of interest minus inflation) turned unfavourable. This made holding money much less enticing, additional boosting gold’s enchantment as a retailer of worth.

The gold value chart for this era would present a dramatic upward development, with intervals of consolidation interspersed with sharp value will increase. The influence of those elements assorted over time, leading to a posh, but finally upward-trending, value sample.

Analyzing the Chart: Key Indicators and Interpretations

A complete evaluation of the gold value chart over the last decade requires contemplating numerous indicators:

-

Shifting Averages: Utilizing transferring averages (e.g., 50-day, 200-day) helps determine traits and potential assist and resistance ranges. A break above a long-term transferring common might sign a bullish development, whereas a break beneath might point out a bearish development.

-

Relative Power Index (RSI): The RSI is a momentum indicator that helps determine overbought and oversold circumstances. Excessive RSI values counsel potential value corrections, whereas low values might point out shopping for alternatives.

-

Bollinger Bands: Bollinger Bands measure value volatility and will help determine potential breakouts or reversals. Costs transferring outdoors the bands usually sign sturdy momentum.

-

Correlation with different property: Analyzing the correlation between gold costs and different property, such because the US greenback, inventory indices, and oil costs, can present invaluable insights into market dynamics.

By combining these technical indicators with basic evaluation (contemplating macroeconomic elements, geopolitical occasions, and market sentiment), traders can acquire a extra nuanced understanding of the gold value chart and make knowledgeable funding selections.

Projected Developments (2024 and Past): A Cautious Outlook

Predicting future gold costs is inherently difficult, however contemplating present traits and potential future situations permits for educated hypothesis. A number of elements might affect gold costs within the coming years:

-

Inflationary Surroundings: Persistent inflation might proceed to assist gold costs, particularly if central banks battle to manage inflation successfully.

-

Curiosity Charge Insurance policies: Central financial institution insurance policies will play an important function. Continued rate of interest hikes might put downward strain on gold costs, whereas a pivot in direction of decrease charges might increase demand.

-

Geopolitical Dangers: Ongoing geopolitical uncertainties and potential future conflicts might drive safe-haven demand for gold.

-

Technological Developments: Continued developments in gold mining know-how might affect provide and probably average value will increase.

-

Funding Demand: The extent of investor curiosity in gold, each from particular person traders and institutional traders, will considerably affect costs.

The projected gold value chart for 2024 and past might present a continuation of the upward development, albeit at a probably slower tempo than within the current previous. Nonetheless, vital financial shifts or sudden geopolitical occasions might result in substantial value volatility. A cautious method, incorporating danger administration methods, is essential for traders navigating the gold market.

Conclusion:

The gold value chart over the previous decade displays a posh interaction of financial, geopolitical, and market forces. Whereas the interval from 2014 to 2019 witnessed a common decline, the following surge from 2020 onward highlights gold’s enduring enchantment as a safe-haven asset and inflation hedge. Understanding the elements driving these value fluctuations is essential for traders in search of to navigate the complexities of the gold market. Whereas predicting future costs stays difficult, analyzing historic traits and present market dynamics permits for a extra knowledgeable method to funding selections. A diversified funding technique, incorporating danger administration rules, stays essentially the most prudent method to capitalizing on the alternatives and mitigating the dangers related to gold funding.

Closure

Thus, we hope this text has supplied invaluable insights into A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024). We thanks for taking the time to learn this text. See you in our subsequent article!