A Decade Of Gold: Analyzing The Worth Per Ounce Over The Previous 10 Years

By admin / August 30, 2024 / No Comments / 2025

A Decade of Gold: Analyzing the Worth Per Ounce Over the Previous 10 Years

Associated Articles: A Decade of Gold: Analyzing the Worth Per Ounce Over the Previous 10 Years

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to A Decade of Gold: Analyzing the Worth Per Ounce Over the Previous 10 Years. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

A Decade of Gold: Analyzing the Worth Per Ounce Over the Previous 10 Years

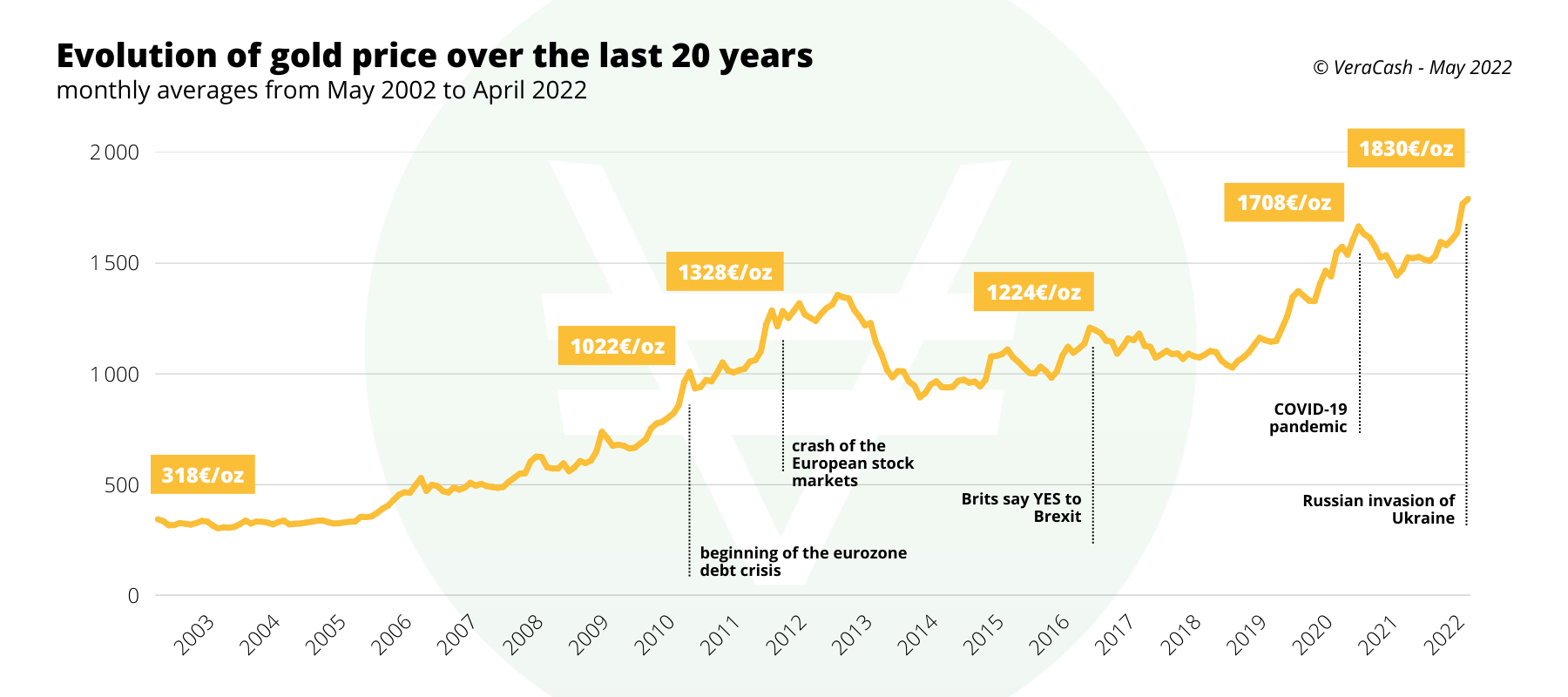

Gold, a timeless image of wealth and stability, has captivated buyers and collectors for millennia. Its value, nevertheless, is something however static, fluctuating wildly primarily based on a posh interaction of macroeconomic components, geopolitical occasions, and market sentiment. Analyzing a 10-year chart of gold’s value per ounce reveals an enchanting narrative, providing insights into international financial developments and highlighting the inherent volatility of this valuable steel. This text delves into the value actions of gold over the previous decade, exploring the important thing drivers behind its fluctuations and providing views on potential future developments.

The 2013-2023 Gold Worth Trajectory: A Rollercoaster Experience

To actually perceive the last decade’s gold value actions, we should study the particular intervals and the components that formed them. Whereas a exact numerical chart is past the scope of this textual evaluation, we are able to focus on the key developments noticed over the previous 10 years (assuming the evaluation begins in 2013 and ends in 2023):

2013-2015: A Interval of Decline and Consolidation: The start of the last decade noticed a big decline in gold costs. This downturn was largely attributed to the tapering of quantitative easing by the Federal Reserve, signaling a possible shift in direction of larger rates of interest. Greater rates of interest make non-interest-bearing property like gold much less enticing, as buyers search larger returns in interest-bearing devices. Moreover, a strengthening US greenback, towards which gold is often priced, additional contributed to the value drop. This era noticed a consolidation of costs across the $1,200-$1,300 per ounce vary.

2016-2019: A Gradual Restoration and Vary-Sure Buying and selling: The years following the preliminary decline noticed a gradual restoration in gold costs. A number of components contributed to this upward pattern. Geopolitical uncertainty, together with the Brexit vote and escalating commerce tensions between the US and China, fueled safe-haven demand for gold. Considerations about international financial progress and the potential for deflation additionally boosted gold’s enchantment as a hedge towards financial uncertainty. Nonetheless, the restoration was comparatively gradual and characterised by range-bound buying and selling, with costs fluctuating inside an outlined vary with out vital breakouts.

2020-2023: The Pandemic Surge and Subsequent Volatility: The COVID-19 pandemic dramatically reshaped the gold market. The unprecedented uncertainty surrounding the pandemic, coupled with huge authorities stimulus packages and considerations about inflation, propelled gold costs to report highs. Buyers flocked to gold as a secure haven, driving costs above $2,000 per ounce. Nonetheless, this surge was not sustained. As economies started to get well and central banks began tightening financial coverage to fight inflation, gold costs skilled a interval of correction and consolidation. The following years noticed a fluctuating market influenced by inflation fears, rate of interest hikes, and the continued geopolitical panorama.

Key Components Influencing Gold Costs:

A number of interconnected components drive gold value fluctuations. Understanding these components is essential for decoding the 10-year chart:

-

US Greenback Energy: The US greenback is the first forex used to cost gold. A stronger greenback usually results in decrease gold costs, because it turns into dearer for holders of different currencies to purchase gold. Conversely, a weaker greenback tends to push gold costs larger.

-

Curiosity Charges: Greater rates of interest make holding non-interest-bearing property like gold much less enticing. Buyers might shift their investments in direction of interest-bearing devices, lowering demand for gold and placing downward strain on its value.

-

Inflation: Gold is commonly thought-about a hedge towards inflation. When inflation rises, the buying energy of fiat currencies decreases, making gold a extra enticing funding. This elevated demand can push gold costs larger.

-

Geopolitical Uncertainty: Intervals of geopolitical instability and uncertainty typically result in elevated demand for gold as a secure haven asset. Buyers search refuge in gold throughout occasions of disaster, driving up costs.

-

Provide and Demand: Like several commodity, the interaction of provide and demand considerably influences gold costs. Modifications in mining manufacturing, jewellery demand, and funding demand all have an effect on the general stability and affect costs.

-

Central Financial institution Actions: Central banks all over the world maintain vital gold reserves. Their shopping for and promoting actions can affect the general market dynamics and value ranges.

-

Market Sentiment: Investor sentiment and hypothesis play an important function in gold value fluctuations. Optimistic sentiment can result in elevated shopping for, pushing costs larger, whereas destructive sentiment can set off promoting and value declines.

Decoding the 10-12 months Chart: Past the Numbers

A visible illustration of the 10-year gold value chart would reveal a number of key insights:

-

Volatility: The chart would undoubtedly spotlight the inherent volatility of gold costs. The worth has skilled vital swings each upward and downward, reflecting the affect of the assorted components mentioned above.

-

Development Reversals: The chart would present intervals of upward and downward developments, illustrating how these developments are sometimes influenced by shifts in macroeconomic situations and investor sentiment.

-

Help and Resistance Ranges: The chart would determine key assist and resistance ranges, representing value factors the place shopping for or promoting strain is especially robust. These ranges can present insights into potential future value actions.

-

Correlation with Different Property: The chart may very well be analyzed along side charts of different property, such because the US greenback index, rates of interest, and inventory market indices, to determine correlations and perceive the interaction between gold and different market forces.

Future Outlook: Predicting the Unpredictable

Predicting future gold costs is inherently difficult. The quite a few interconnected components influencing gold costs make correct forecasting extraordinarily tough. Nonetheless, by analyzing present financial situations, geopolitical dangers, and market sentiment, we are able to speculate on potential future developments.

Components to think about for the longer term embody:

-

Inflationary Pressures: Persistent inflationary pressures may proceed to assist gold costs as buyers search safety towards eroding buying energy.

-

Financial Coverage: The actions of central banks, significantly the Federal Reserve, will considerably affect gold costs. Additional rate of interest hikes may put downward strain on gold, whereas a shift in direction of extra accommodative financial coverage may assist larger costs.

-

Geopolitical Dangers: Ongoing geopolitical tensions and uncertainties may proceed to drive safe-haven demand for gold.

-

Technological Developments: Developments in gold mining know-how may affect provide and probably affect costs.

Conclusion:

The ten-year gold value chart provides a compelling narrative of financial and geopolitical occasions. Whereas predicting the longer term stays elusive, understanding the historic context and the important thing drivers of gold value fluctuations offers invaluable insights for buyers and market analysts. The inherent volatility of gold necessitates a cautious and nuanced strategy to funding methods, recognizing that gold’s worth lies not solely in its financial price but additionally in its function as a secure haven and a hedge towards uncertainty in a always evolving international panorama. Cautious consideration of the components outlined above, mixed with ongoing market evaluation, is essential for navigating the complexities of the gold market and making knowledgeable funding selections.

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

Closure

Thus, we hope this text has supplied invaluable insights into A Decade of Gold: Analyzing the Worth Per Ounce Over the Previous 10 Years. We hope you discover this text informative and useful. See you in our subsequent article!