A Decade Of Qualcomm: Deconstructing The QCOM Inventory Chart (2013-2023)

By admin / July 23, 2024 / No Comments / 2025

A Decade of Qualcomm: Deconstructing the QCOM Inventory Chart (2013-2023)

Associated Articles: A Decade of Qualcomm: Deconstructing the QCOM Inventory Chart (2013-2023)

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to A Decade of Qualcomm: Deconstructing the QCOM Inventory Chart (2013-2023). Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

A Decade of Qualcomm: Deconstructing the QCOM Inventory Chart (2013-2023)

Qualcomm Integrated (QCOM), a titan within the semiconductor business, has witnessed a rollercoaster decade in its inventory efficiency from 2013 to 2023. Analyzing its inventory chart over this era reveals a fancy narrative interwoven with technological developments, business shifts, authorized battles, and macroeconomic elements. This in-depth evaluation will dissect the important thing traits, important occasions, and underlying elements that formed QCOM’s inventory value trajectory, providing insights for traders and a broader understanding of the corporate’s journey.

2013-2015: Navigating the Smartphone Growth and Early Challenges:

The interval between 2013 and 2015 noticed QCOM driving the wave of the burgeoning smartphone market. Its dominance in cell chipsets, significantly its Snapdragon processors, fueled important income progress. The inventory chart displays this optimistic momentum, showcasing a comparatively regular upward development. Nevertheless, this era wasn’t with out its hurdles. Growing competitors from different chipmakers, significantly within the low-end market, started to emerge as a menace. Moreover, the corporate confronted rising scrutiny concerning its licensing practices, setting the stage for future authorized battles that might considerably impression investor sentiment. The inventory value, whereas usually optimistic, skilled intervals of consolidation and minor corrections, reflecting the rising challenges.

2016-2018: Authorized Battles and Market Saturation:

This era proved to be a turbulent one for QCOM. The corporate confronted main antitrust investigations and lawsuits in varied jurisdictions, together with a high-profile case with Apple. These authorized battles created important uncertainty and negatively impacted investor confidence. The inventory chart displays this volatility, with important value drops coinciding with damaging information associated to those authorized proceedings. Concurrently, the smartphone market started to point out indicators of saturation, slowing down the speedy progress QCOM had loved beforehand. This confluence of things – authorized challenges and market maturity – resulted in a interval of stagnation and underperformance in comparison with earlier years. The inventory value remained comparatively flat, struggling to interrupt by way of earlier highs, reflecting the appreciable headwinds going through the corporate. This era highlights the numerous impression of regulatory and authorized dangers on even dominant gamers in a quickly evolving business.

2019-2020: A Pivot In the direction of Diversification and the 5G Revolution:

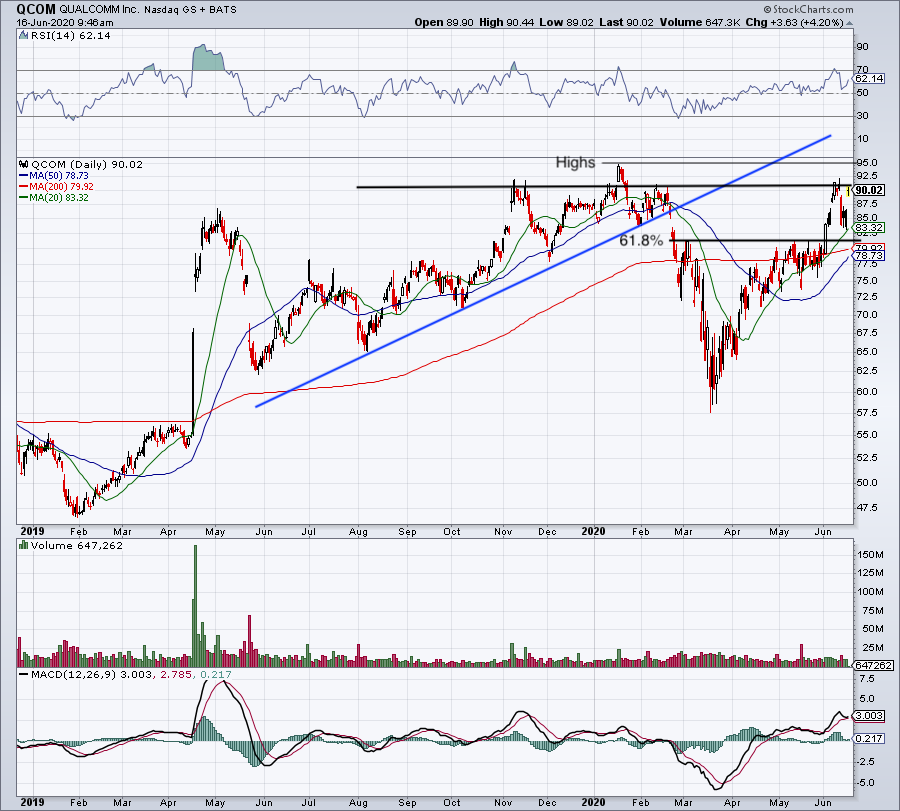

Recognizing the necessity for diversification past its reliance on the smartphone market, QCOM started to aggressively pursue alternatives in different segments. The emergence of 5G expertise introduced an important alternative. QCOM’s early investments and technological management in 5G chipsets began to repay. The inventory chart reveals a gradual restoration, reflecting renewed investor optimism fueled by the corporate’s 5G technique and the promising outlook for this transformative expertise. The COVID-19 pandemic, whereas initially inflicting market-wide uncertainty, in the end benefited QCOM, because the elevated demand for distant work and leisure boosted gross sales of gadgets incorporating its chipsets. This era marks a turning level, demonstrating QCOM’s capability to adapt and capitalize on new technological traits.

2021-2023: Consolidation and Future Outlook:

The interval from 2021 to 2023 witnessed a interval of consolidation for QCOM. Whereas the corporate continued to learn from the 5G rollout and increasing into new markets like automotive and IoT, the inventory value skilled important fluctuations. World provide chain disruptions, inflation, and macroeconomic uncertainty contributed to the volatility. The inventory chart shows a sample of ups and downs, reflecting the advanced interaction of optimistic elements (5G progress, diversification) and damaging elements (world financial headwinds). The general development, nevertheless, suggests a usually optimistic outlook, with the inventory value persistently buying and selling above its 2018 lows, indicating a rising confidence in QCOM’s long-term prospects. The corporate’s ongoing investments in R&D and its strategic enlargement into high-growth markets recommend a continued optimistic trajectory, though the extent of future progress stays topic to varied market forces.

Key Components Influencing the QCOM Inventory Chart:

A number of elements have persistently influenced QCOM’s inventory value over the previous decade:

- Smartphone Market Dynamics: The well being and progress of the smartphone market have all the time been a main driver of QCOM’s efficiency. Market saturation and competitors have periodically impacted its inventory value.

- Technological Developments: QCOM’s capability to innovate and keep forward of the curve in applied sciences like 5G, AI, and automotive has been essential in shaping its inventory efficiency.

- Authorized and Regulatory Setting: Antitrust lawsuits and regulatory scrutiny have considerably influenced investor sentiment and inventory value volatility.

- Macroeconomic Situations: World financial elements, similar to inflation, provide chain disruptions, and geopolitical occasions, have performed a job within the general market sentiment and QCOM’s inventory value.

- Diversification Technique: QCOM’s success in diversifying past smartphones into areas like automotive and IoT has contributed to a extra resilient and fewer unstable inventory efficiency.

Conclusion:

The QCOM inventory chart over the previous decade tells a narrative of resilience, adaptation, and strategic pivoting. Whereas the corporate confronted important challenges, together with authorized battles and market saturation, its capability to innovate, diversify, and capitalize on rising applied sciences like 5G has in the end pushed its long-term progress. The long run outlook for QCOM stays optimistic, pushed by its robust place within the 5G market, its increasing presence in high-growth sectors, and its continued dedication to analysis and improvement. Nevertheless, traders ought to stay conscious of the inherent dangers related to the semiconductor business, together with geopolitical uncertainties, competitors, and macroeconomic fluctuations. An intensive understanding of those elements is essential for making knowledgeable funding choices concerning QCOM inventory. The following decade guarantees to be equally thrilling and difficult for QCOM, and its inventory chart will undoubtedly proceed to mirror the dynamic interaction of technological innovation, market forces, and world occasions.

Closure

Thus, we hope this text has supplied useful insights into A Decade of Qualcomm: Deconstructing the QCOM Inventory Chart (2013-2023). We recognize your consideration to our article. See you in our subsequent article!