A Decade Of Volatility: Charting Bitcoin’s Value Historical past

By admin / August 3, 2024 / No Comments / 2025

A Decade of Volatility: Charting Bitcoin’s Value Historical past

Associated Articles: A Decade of Volatility: Charting Bitcoin’s Value Historical past

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to A Decade of Volatility: Charting Bitcoin’s Value Historical past. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

A Decade of Volatility: Charting Bitcoin’s Value Historical past

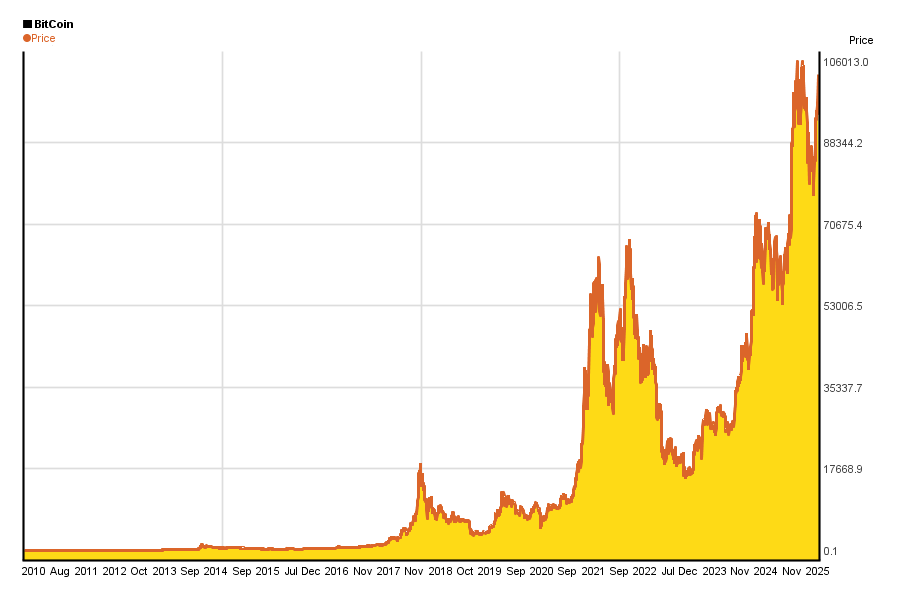

Bitcoin, the world’s first cryptocurrency, has captivated the worldwide creativeness since its inception in 2009. Its journey, nonetheless, has been removed from easy, characterised by intervals of explosive progress punctuated by dramatic crashes. Understanding Bitcoin’s worth historical past is essential to comprehending its risky nature, the forces driving its worth, and its potential for the longer term. This text will delve into the important thing worth actions, highlighting important occasions and their influence on the cryptocurrency’s trajectory.

The Early Years: Humble Beginnings and Gradual Development (2009-2012)

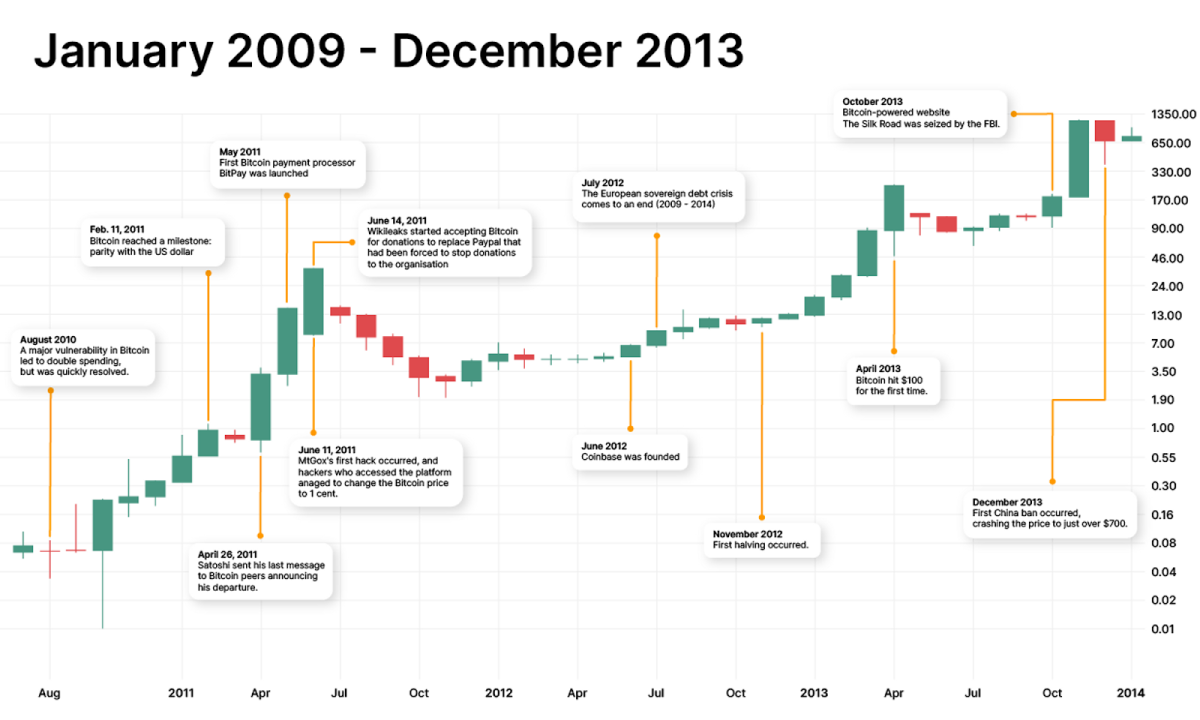

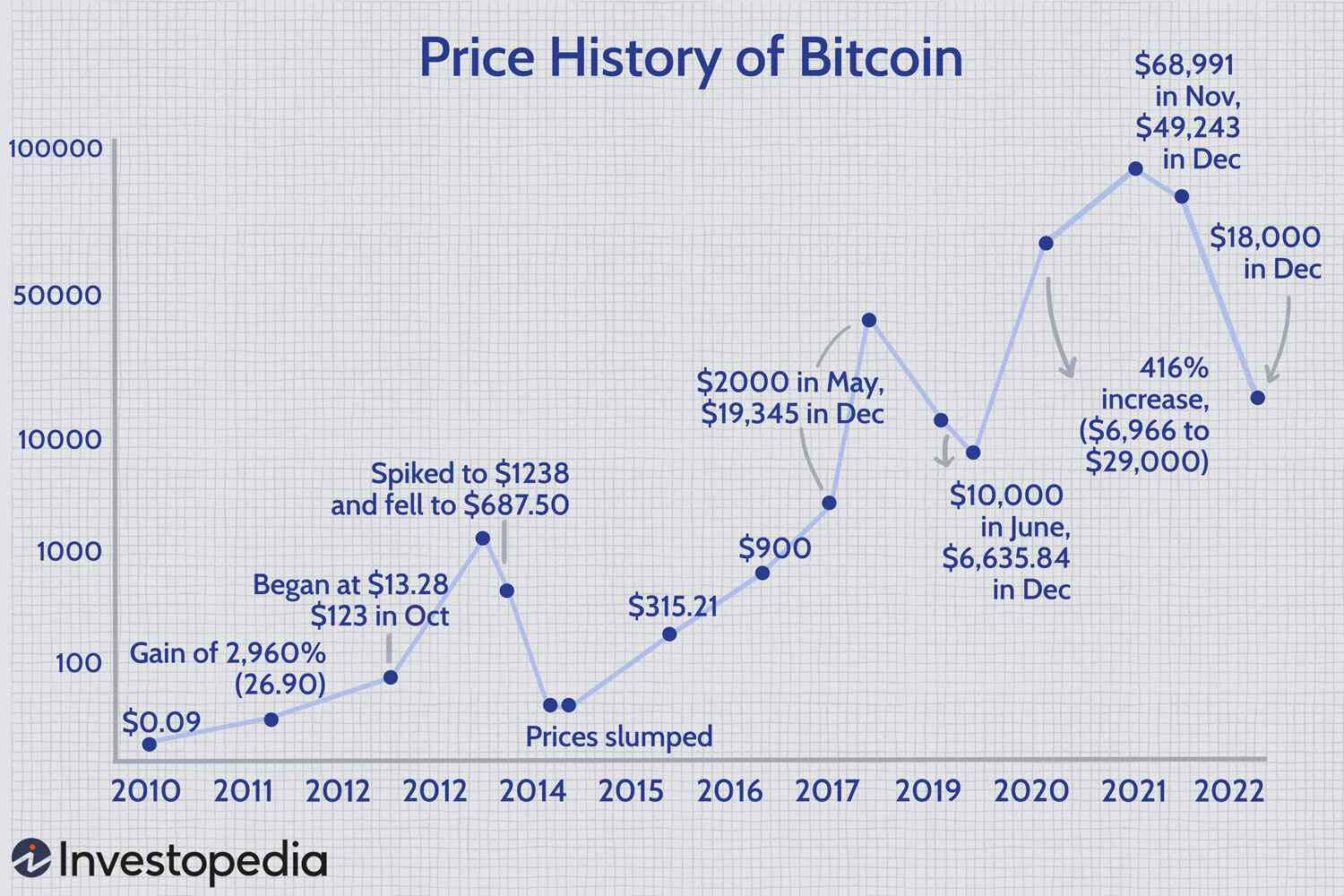

Bitcoin’s preliminary years had been marked by obscurity and gradual progress. The cryptocurrency was largely unknown outdoors of a small, devoted group of cypherpunks and early adopters. Its worth remained extraordinarily low, fluctuating within the pennies for the primary few years. The dearth of widespread adoption and restricted buying and selling quantity contributed to this worth stagnation. Nevertheless, this era laid the groundwork for future progress, establishing the core expertise and attracting early believers who would play a big position in its subsequent growth. The Mt. Gox trade, although later notorious for its collapse, emerged as a key participant, offering a platform for Bitcoin buying and selling, albeit with restricted liquidity.

The First Main Bull Run: From Pennies to 1000’s (2013-2014)

The interval between 2013 and 2014 witnessed Bitcoin’s first main bull run. A number of components contributed to this surge. Elevated media consideration, pushed by the rising curiosity in digital currencies and the potential for decentralization, attracted new buyers. The Cyprus banking disaster additionally performed a job, as some considered Bitcoin as a protected haven asset, shielded from conventional monetary system instability. The worth climbed from a number of {dollars} to over $1,000, an outstanding improve that highlighted Bitcoin’s potential for speedy appreciation. Nevertheless, this era additionally showcased the cryptocurrency’s inherent volatility. Sharp corrections and worth swings had been frequent, leaving many early buyers with important losses regardless of the general upward pattern. The Mt. Gox hack in 2014, ensuing within the lack of a considerable amount of Bitcoins, served as a stark reminder of the safety dangers related to the nascent cryptocurrency ecosystem.

Consolidation and Rising Pains (2015-2016)

Following the 2014 peak, Bitcoin’s worth skilled a interval of consolidation. The worth fluctuated inside a comparatively slim vary, failing to succeed in new highs. This era was characterised by elevated regulatory scrutiny, as governments worldwide started to grapple with the implications of cryptocurrencies. Issues about cash laundering and illicit actions led to stricter laws in some jurisdictions, impacting the expansion and adoption of Bitcoin. Regardless of the slower worth motion, this era was essential for technological growth, with the emergence of improved wallets, exchanges, and blockchain infrastructure. The inspiration was being laid for future progress, even when the worth motion did not instantly replicate it.

The Meteoric Rise and the "Bitcoin Bubble" (2017)

2017 marked Bitcoin’s most dramatic worth surge thus far. The worth exploded from beneath $1,000 originally of the yr to a staggering close to $20,000 by December. This unprecedented progress was fueled by a confluence of things: elevated institutional curiosity, the rise of Preliminary Coin Choices (ICOs), and widespread media protection that portrayed Bitcoin as the following huge funding alternative. This era noticed the emergence of a "Bitcoin bubble," with hypothesis driving the worth far past what many thought-about to be its basic worth. The speedy worth appreciation attracted a big inflow of recent buyers, a lot of whom had been pushed by FOMO (worry of lacking out). Nevertheless, this speculative frenzy additionally made the market extraordinarily weak to corrections.

The Correction and the Bear Market (2018-2019)

The inevitable correction adopted the 2017 peak. The worth plummeted from its excessive of just about $20,000 to under $3,000 in 2018, a dramatic fall that worn out billions of {dollars} in market capitalization. This bear market was characterised by widespread skepticism and damaging media protection, as many declared Bitcoin lifeless. The regulatory uncertainty continued to weigh in the marketplace, and a number of other high-profile trade hacks additional eroded investor confidence. Nevertheless, this era additionally served as a crucial correction, hunting down speculative buyers and permitting the market to consolidate earlier than the following bull run.

The Resurgence and Institutional Adoption (2020-2021)

The yr 2020 noticed a big resurgence in Bitcoin’s worth, pushed by a number of components. The COVID-19 pandemic and the ensuing financial uncertainty led some buyers to hunt different property, whereas others noticed Bitcoin as a hedge towards inflation. The rising institutional adoption of Bitcoin, with firms like MicroStrategy and Tesla investing important sums, additionally contributed to the worth improve. The worth climbed steadily all through 2020 and into 2021, reaching a brand new all-time excessive of over $60,000. This era demonstrated a shift within the notion of Bitcoin, shifting from a distinct segment asset to a extra mainstream funding choice.

The Current Volatility and the Future (2022-Current)

The interval from 2022 onwards has been marked by important volatility. The worth has skilled a number of sharp corrections, pushed by components equivalent to elevated regulatory scrutiny, macroeconomic uncertainty, and the collapse of a number of outstanding crypto tasks. Regardless of these challenges, Bitcoin has proven resilience, recovering from important worth drops. The long-term outlook for Bitcoin stays a topic of debate, with some predicting additional progress whereas others categorical issues about its sustainability. The rising integration of Bitcoin into the mainstream monetary system, alongside the continuing growth of its underlying expertise, will seemingly play a big position in shaping its future worth trajectory.

Conclusion:

Bitcoin’s worth historical past is a testomony to its volatility and its potential. From its humble beginnings to its meteoric rise and subsequent corrections, the cryptocurrency has demonstrated exceptional resilience. Whereas predicting its future worth is unimaginable, understanding its previous efficiency and the components driving its worth actions is essential for navigating this complicated and dynamic market. The continued evolution of the cryptocurrency panorama, coupled with the evolving regulatory surroundings and technological developments, will proceed to form Bitcoin’s worth chart for years to return. The story of Bitcoin is much from over, and its future stays a charming and unsure chapter within the historical past of finance. Analyzing its worth historical past supplies invaluable insights into the dangers and rewards related to this pioneering digital asset, highlighting the necessity for cautious analysis, threat administration, and a long-term perspective for anybody contemplating investing in Bitcoin.

:max_bytes(150000):strip_icc()/bitcoins-price-history-Final-2022-1ee18825fac544509c03fc3a2adfe4e9.jpg)

Closure

Thus, we hope this text has supplied invaluable insights into A Decade of Volatility: Charting Bitcoin’s Value Historical past. We thanks for taking the time to learn this text. See you in our subsequent article!