A Gilded Historical past: Deciphering The Historic Gold Value Chart

By admin / October 30, 2024 / No Comments / 2025

A Gilded Historical past: Deciphering the Historic Gold Value Chart

Associated Articles: A Gilded Historical past: Deciphering the Historic Gold Value Chart

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to A Gilded Historical past: Deciphering the Historic Gold Value Chart. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

A Gilded Historical past: Deciphering the Historic Gold Value Chart

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

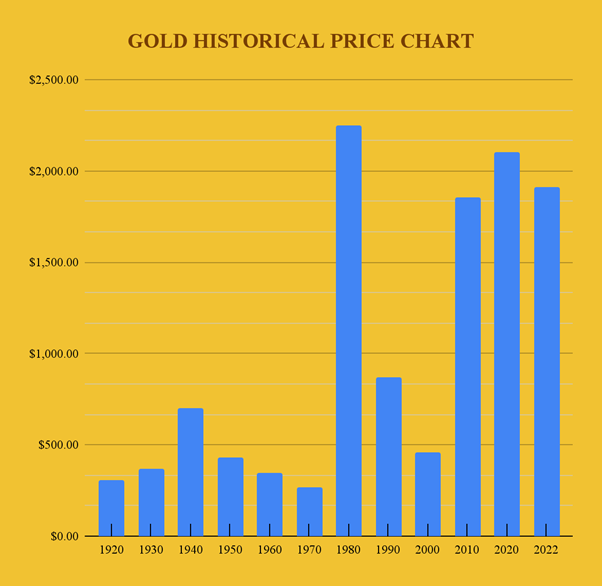

Gold. The shimmering metallic has captivated humanity for millennia, its attract transcending cultures and eras. Its worth, nonetheless, has been removed from static. A journey by means of the historic gold worth chart reveals a posh narrative interwoven with financial shifts, geopolitical upheavals, and technological developments. Understanding this historical past is essential for buyers, economists, and anybody within the interaction between finance and world occasions.

Historic Occasions: A Commodity Past Value

Earlier than the arrival of fiat currencies, gold’s worth wasn’t expressed in numerical phrases towards different commodities or currencies. As a substitute, its value was intrinsically tied to its rarity, sturdiness, and perceived aesthetic worth. Historic civilizations just like the Egyptians, Greeks, and Romans used gold as a type of foreign money, typically within the type of cash or bars. Its weight and purity decided its worth in transactions, a system that lacked the standardized pricing mechanisms we see immediately. Historic information, although fragmentary, recommend that gold’s relative worth fluctuated based mostly on provide and demand, influenced by components like profitable mining expeditions or wars that plundered current reserves. The absence of a centralized market makes exact worth charting unattainable for this period, but it units the stage for the later improvement of a extra formalized system.

The Gold Commonplace Period: A Mounted Value, a Fragile System

The nineteenth and early twentieth centuries witnessed the rise of the gold customary, a financial system the place a rustic’s foreign money was instantly convertible to gold at a hard and fast price. This era supplies a extra concrete foundation for charting gold costs, albeit with limitations. The worth of gold was basically mounted, sometimes pegged to a selected weight of gold per foreign money unit. For instance, the US greenback was pegged to a certain quantity of gold below the Bretton Woods system (1944-1971). Whereas the worth of gold remained comparatively steady by way of its pegged foreign money, fluctuations occurred within the relative worth of various currencies towards one another. This period, nonetheless, wasn’t devoid of worth actions. The restricted provide of gold and shifts in world demand sometimes led to stress on the system, revealing the inherent fragility of a fixed-price regime. For instance, the Nice Melancholy noticed a surge in demand for gold as buyers sought a secure haven asset, placing pressure on the gold customary.

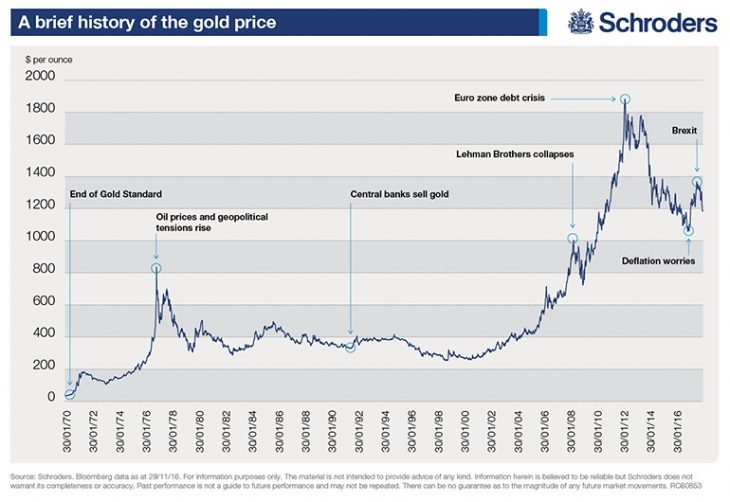

The Submit-Bretton Woods Period: Floating Costs and Market Volatility

The collapse of the Bretton Woods system in 1971 marked a pivotal second in gold’s historical past. The US greenback was decoupled from gold, permitting the worth of gold to drift freely available in the market, decided by provide and demand. This ushered in an period of unprecedented volatility. The chart from 1971 onwards displays a dramatic surge in gold costs, largely fueled by inflation, geopolitical uncertainty (e.g., the Vietnam Conflict, the oil crises), and a lack of confidence in fiat currencies. The Nineteen Seventies noticed gold costs skyrocket, reaching a historic excessive in 1980 earlier than present process a major correction within the subsequent years.

Components Influencing the Submit-1971 Gold Value Chart:

A number of key components have formed the gold worth chart since 1971:

- Inflation: Gold has traditionally served as a hedge towards inflation. Intervals of excessive inflation are inclined to drive up gold costs as buyers search to guard their buying energy.

- Curiosity Charges: Inversely associated to gold costs, larger rates of interest make holding non-interest-bearing property like gold much less engaging, typically resulting in decrease costs.

- US Greenback: The US greenback and gold costs typically exhibit an inverse relationship. A weakening greenback often boosts gold costs, whereas a strengthening greenback tends to suppress them.

- Geopolitical Occasions: International conflicts, political instability, and financial crises typically result in elevated demand for gold as a secure haven asset, pushing costs larger.

- Provide and Demand: The interaction between gold mining manufacturing and world demand considerably impacts costs. Elevated mining output can exert downward stress, whereas robust demand from buyers and central banks can drive costs up.

- Funding Demand: The rise of gold exchange-traded funds (ETFs) and different funding autos has considerably elevated the demand for gold, contributing to cost fluctuations.

- Technological Developments: Enhancements in mining expertise can improve gold provide, influencing costs.

Analyzing the Gold Value Chart: Developments and Patterns

A cautious examination of the gold worth chart reveals a number of recurring developments and patterns:

- Lengthy-Time period Uptrends: Regardless of durations of volatility, the long-term pattern of gold costs has usually been upward, reflecting its enduring enchantment as a retailer of worth and secure haven asset.

- Cycles and Corrections: Gold costs typically exhibit cyclical patterns, with durations of fast progress adopted by corrections or consolidations. These cycles are influenced by the interaction of the components talked about above.

- Correlation with Different Belongings: The gold worth chart typically reveals correlations with different property, significantly the US greenback and different valuable metals. Understanding these correlations can present useful insights into market dynamics.

The Gold Value Chart As we speak and Past:

The gold worth chart continues to evolve, reflecting the continued interaction of worldwide financial and geopolitical components. Predicting future gold costs is inherently difficult, because it will depend on quite a few interconnected variables. Nonetheless, understanding the historic context, the assorted components that affect costs, and the recurring patterns supplies a useful framework for navigating the complexities of the gold market. The chart stays a strong software for buyers and analysts alike, providing a window into the previous and a possible glimpse into the way forward for this enduringly valuable metallic.

Conclusion:

The historic gold worth chart is greater than only a document of numerical values; it is a chronicle of human historical past, reflecting the ebb and movement of economies, the rise and fall of empires, and the enduring human want for safety and stability. By finding out this chart, we acquire a deeper understanding of the forces that form world finance and the enduring attract of gold, a metallic whose worth continues to fascinate and intrigue. Whereas predicting the longer term is unattainable, understanding the previous supplies a vital basis for navigating the complexities of the gold market and making knowledgeable selections on this dynamic and ever-evolving panorama.

Closure

Thus, we hope this text has supplied useful insights into A Gilded Historical past: Deciphering the Historic Gold Value Chart. We thanks for taking the time to learn this text. See you in our subsequent article!